Are you looking to streamline your investment account management? Crafting a clear and concise authorization letter can make all the difference in ensuring your investment strategies are executed smoothly. In this article, we'll guide you through the essential elements of a solid investment account management authorization letter, helping you understand what to include for maximum effectiveness. Ready to enhance your financial future? Dive in to discover more!

Account Holder Information

In the realm of investment account management, the authorization process is crucial for individuals and institutions overseeing significant financial assets. The account holder information section typically includes essential identifiers such as full name, date of birth, and social security number (or tax identification number). Additionally, details regarding the investment account itself like account number and financial institution name are vital to ensure precise permissions are granted. Contact information such as email and phone number can facilitate communication between the account holder and the management entity. Furthermore, specifying the scope of authorization--whether it encompasses full investment discretion or limited actions--provides clarity for both parties involved in the investment management process.

Authorized Representative Details

Investment account management involves assigning an authorized representative to oversee financial decisions. An authorized representative's responsibilities may include executing trades, accessing account information, and managing overall investment strategies for clients. Investors should provide detailed identification information, including full name, contact number, email address, and associated identification numbers like Social Security or Tax Identification Numbers. Clear documentation is essential to ensure compliance with financial regulations and protect client interests. Establishing communication protocols between the investor and the authorized representative is vital for effective management.

Scope of Authority

Investment account management authorization empowers designated individuals to make decisions regarding portfolio management. This includes buying or selling securities, reallocating assets, and accessing account information through financial institutions such as brokerages or banks. The scope of authority varies based on agreements structured, ranging from limited to discretionary powers. Documentation often specifies the types of investments permissible, restrictions on certain transactions, and reporting requirements. By stipulating these details, both the investor and the management entity can ensure clarity about expectations and responsibilities, fostering a trusting relationship essential for effective investment strategies. Key entities involved typically include investment firms, financial advisors, and relevant compliance bodies, which enforce regulations like the Securities Exchange Act to protect shareholders.

Effective Date and Duration

Investment account management authorization outlines the permissions granted to a financial advisor or firm concerning the management of assets within an investment account. This document identifies the effective date, marking the formal commencement of authority (commonly stated as the date of signature), and specifies the duration of the agreement, typically ranging from one year to ongoing; this duration defines how long the advisor can execute trades, make investment decisions, and handle account transactions on behalf of the account holder. Certain conditions may lead to termination, such as written notice by either party, commonly required to be a minimum of 30 days. Such agreements are crucial for ensuring clarity in the responsibilities and expectations of both investors and advisors.

Signature and Authentication

Investment account management authorization requires specific documentation and signature verification to ensure secure handling of sensitive financial information. Clients must provide a signed authorization form which includes pertinent details such as full name, account number, and the date of authorization. In addition, authentication methods like notarization or digital signatures may be mandated to prevent fraud and confirm the identity of the client. This process not only complies with regulatory requirements but also safeguards the financial assets managed by professional investment firms like Smith & Sons Investments in New York City. Proper handling of these formalities is crucial for efficient account management and client trust.

Letter Template For Investment Account Management Authorization Samples

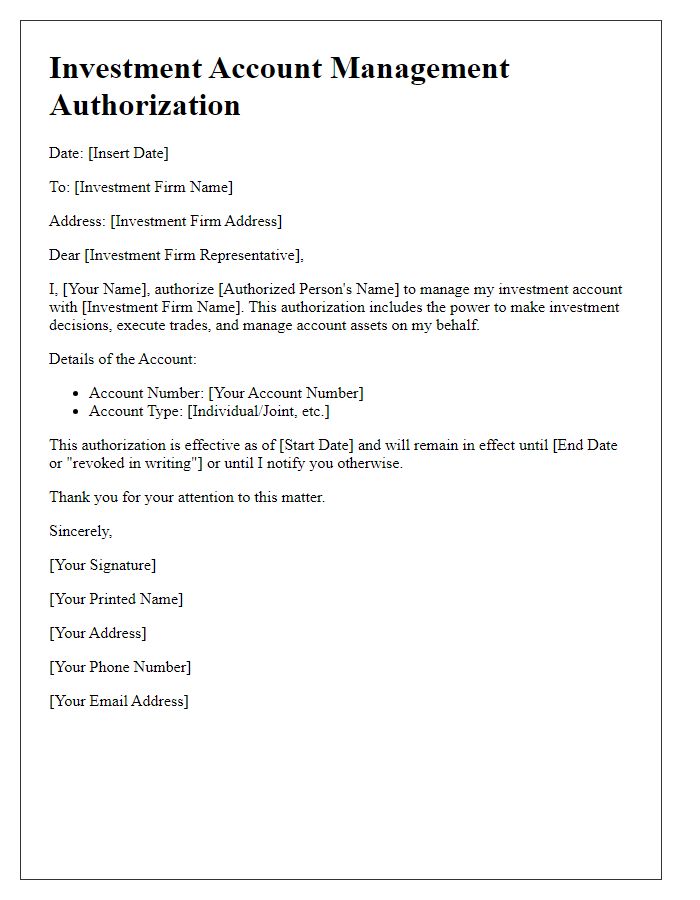

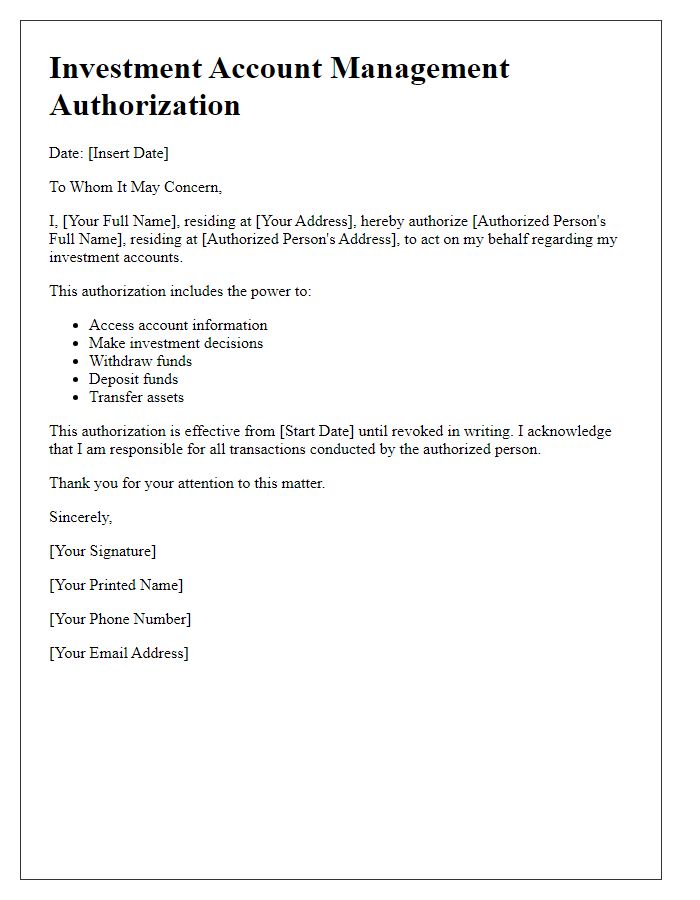

Letter template of investment account management authorization for individual investors

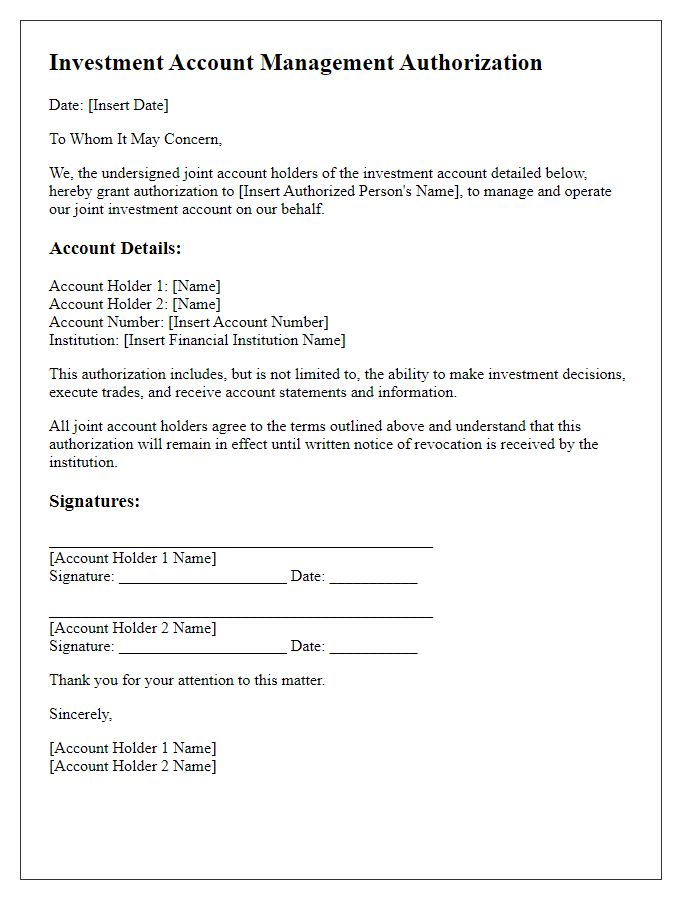

Letter template of investment account management authorization for joint account holders

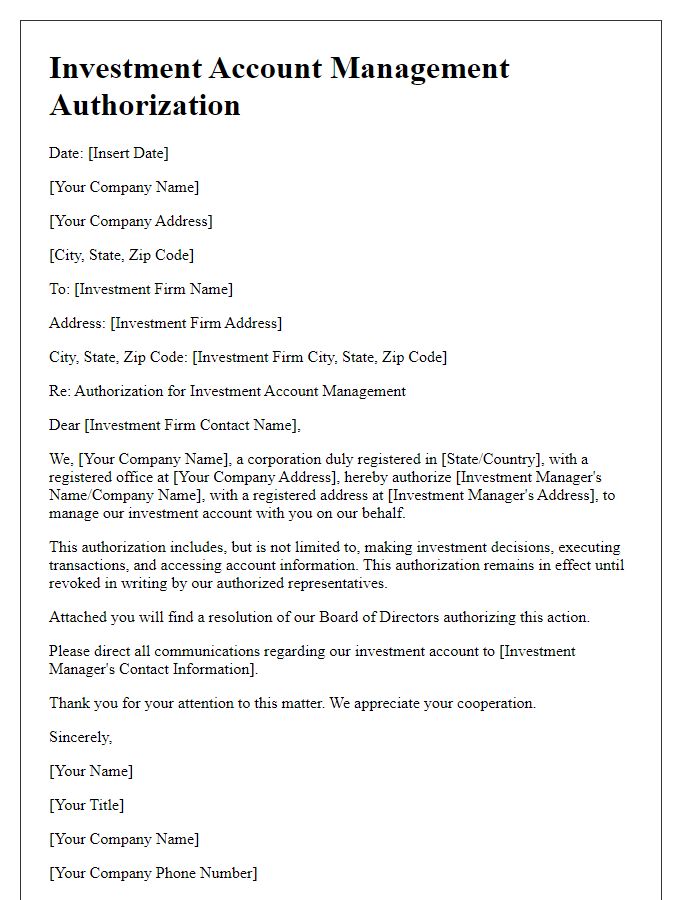

Letter template of investment account management authorization for corporate entities

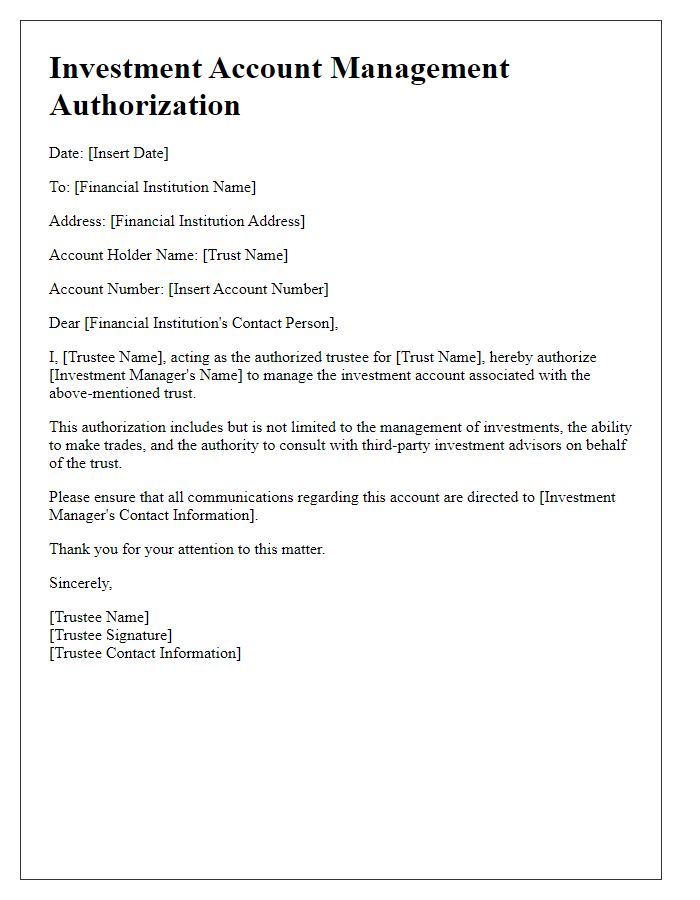

Letter template of investment account management authorization for trust accounts

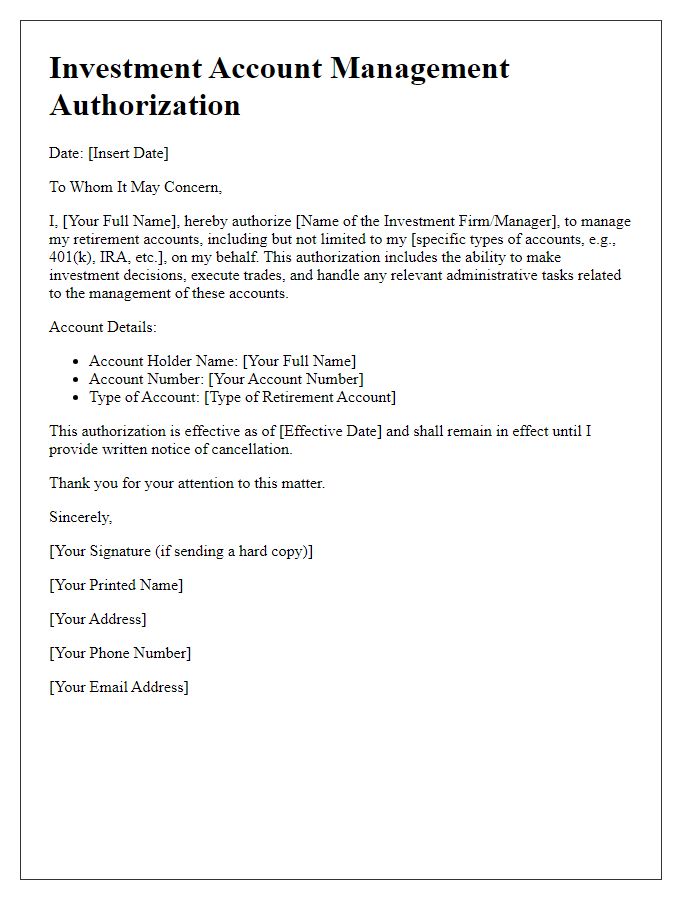

Letter template of investment account management authorization for retirement accounts

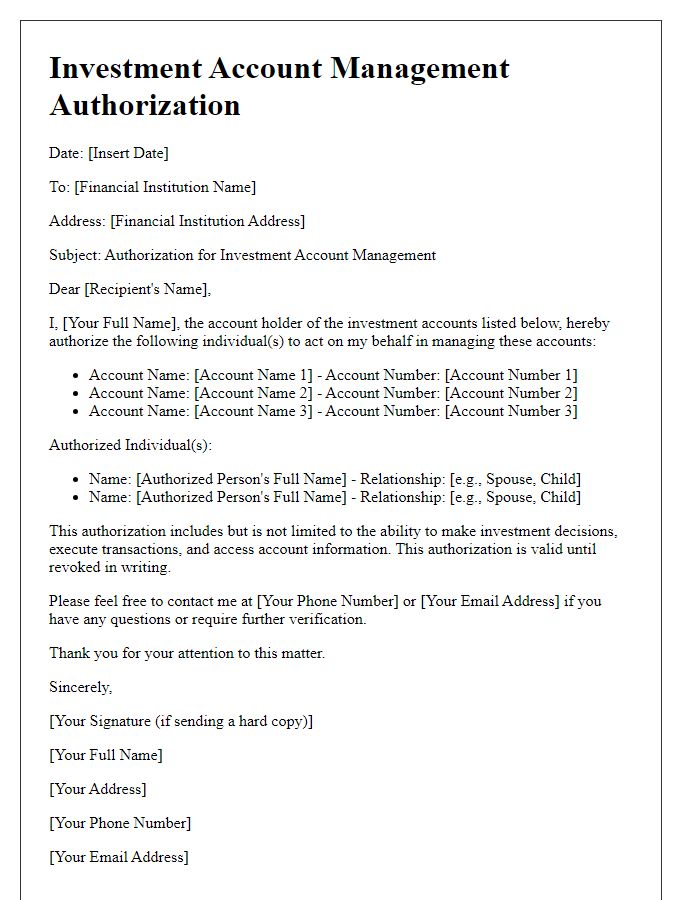

Letter template of investment account management authorization for family accounts

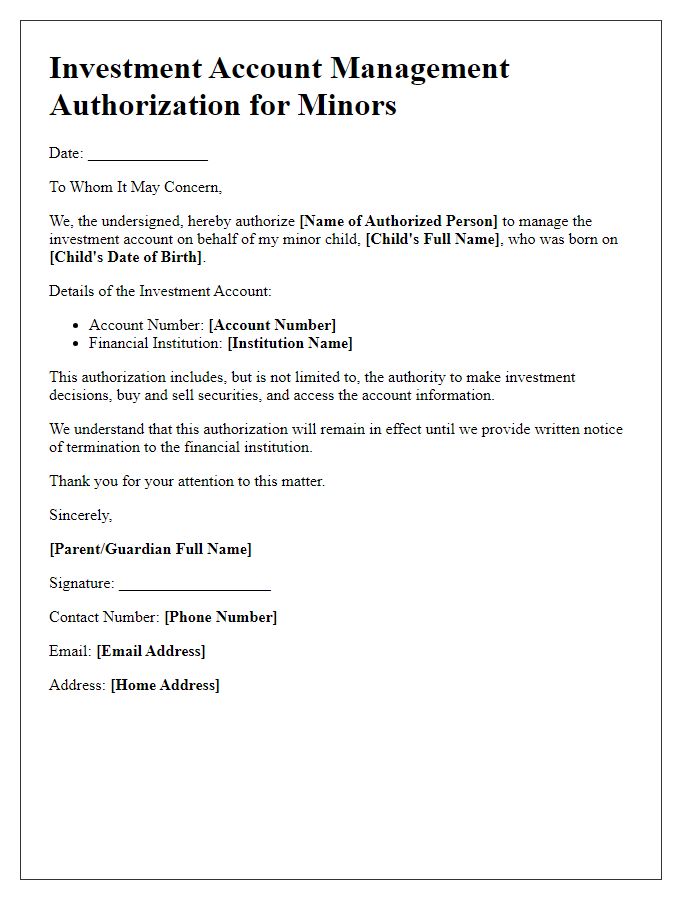

Letter template of investment account management authorization for minors

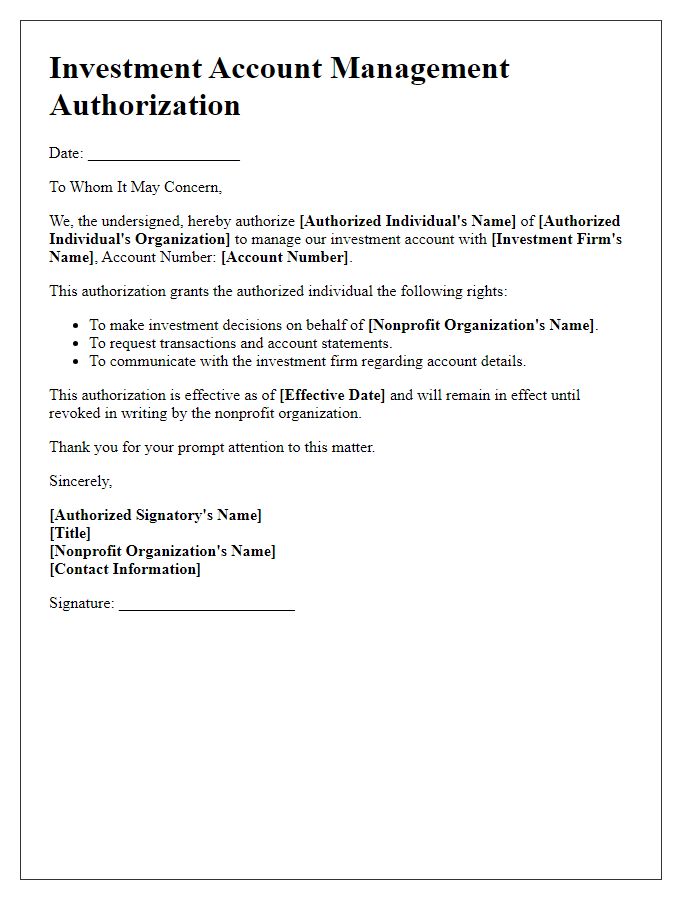

Letter template of investment account management authorization for nonprofit organizations

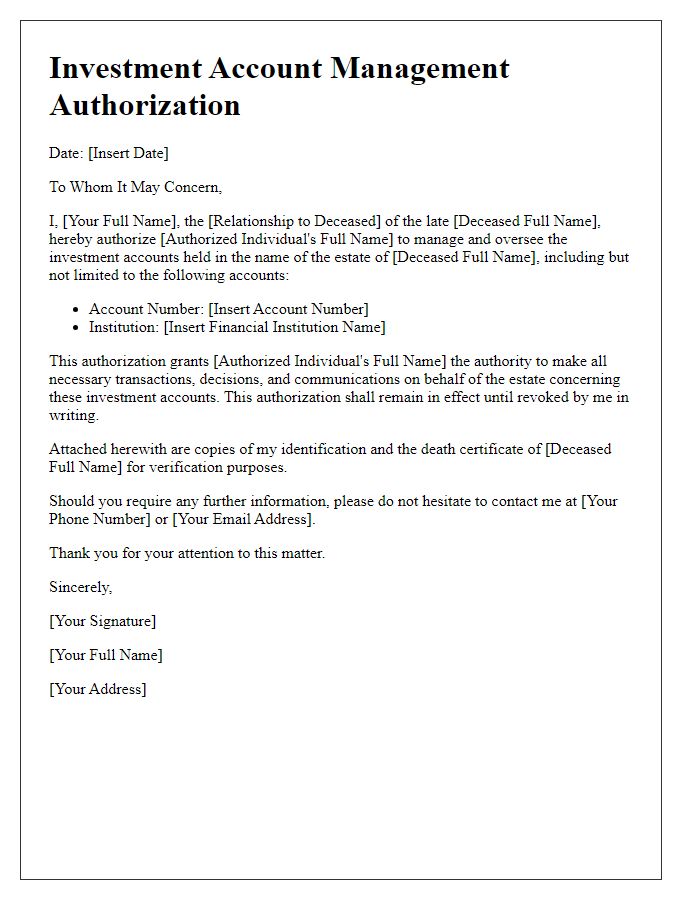

Letter template of investment account management authorization for power of attorney

Comments