Applying for a mortgage can feel overwhelming, but it doesn't have to be! In this guide, we'll walk you through a simple letter template that grants authorization for your mortgage application, making the process smoother. Understanding what to include in your letter ensures that your lender can efficiently access the necessary information to move forward. Ready to simplify your mortgage journey? Let's dive in and explore the details!

Borrower Information

The mortgage application process requires detailed borrower information to assess financial eligibility. Key details include the full legal name (for identification), Social Security Number (for credit history verification), current address (to confirm residence), date of birth (to establish age), and employment history (to evaluate income stability). Financial information such as annual income, assets (like bank account balances), and liabilities (existing debts) form the basis of a comprehensive financial profile. Additionally, lending institutions often require details about the property involved in the mortgage application, including its address, estimated value, and the intended use of the property (primary residence, investment, or secondary home). Accurate and complete information accelerates the approval process and improves communication with the lender.

Lender Details

A mortgage application authorization requires detailed contact information for lenders, essential for processing loan requests. Names such as Bank of America, Wells Fargo, and Quicken Loans represent prominent mortgage lenders in the U.S. Each lender has specific branches with unique routing numbers critical for transactions. Additionally, contact addresses for local offices (e.g., 100 N Tryon St, Charlotte, NC 28202 for Bank of America) should be included for correspondence. Phone numbers, like Wells Fargo's national mortgage service line (1-800-357-6675), facilitate immediate communication. Including precise email addresses for underwriting teams ensures efficient document submissions, enhancing the overall mortgage process. Such meticulous detailing aligns with standard mortgage industry practices for seamless transaction authorization.

Loan Purpose

Mortgage applications often require specific details regarding the loan purpose to guide lenders in decision-making. A mortgage for home purchase generally involves financing the acquisition of residential property, while a refinance aims to replace an existing mortgage with better terms. Home equity loans leverage the borrower's existing equity for purposes such as renovations, debt consolidation, or tuition payments. Understanding these categories helps lenders assess risk and determine eligibility based on the intended use of funds. Detailed documentation supporting the stated loan purpose strengthens the application process and enhances approval chances.

Authorization Statement

Mortgage application processes often require an authorization statement to confirm the borrower's consent for the lender to obtain necessary financial information. This statement ensures that crucial data, including credit reports and employment verification, can be accessed by financial institutions, facilitating smoother processing of mortgage applications. Proper authorization typically includes details such as the borrower's full name, social security number, and the specific purpose of obtaining the information. Additionally, it may outline the duration of the authorization validity and what entities are allowed to access the information. Essential for compliance, this document serves as a legal safeguard, protecting both the lender and the borrower throughout the application journey.

Contact Information

When applying for a mortgage, it is essential to provide accurate and detailed contact information for all parties involved in the transaction to facilitate communication and ensure a smooth process. This typically includes the applicant's full name (first, middle, last), social security number, current residential address with ZIP code, phone number (home and mobile), and email address for correspondence. Additionally, it may be necessary to include the contact information of co-applicants or guarantors, as well as the contact details for the lender or mortgage broker handling the application, which should comprise their company name, specific representative's name, office phone number, email address, and mailing address. Providing comprehensive contact information helps to streamline the mortgage approval process and ensures timely updates from all involved parties.

Letter Template For Mortgage Application Authorization Samples

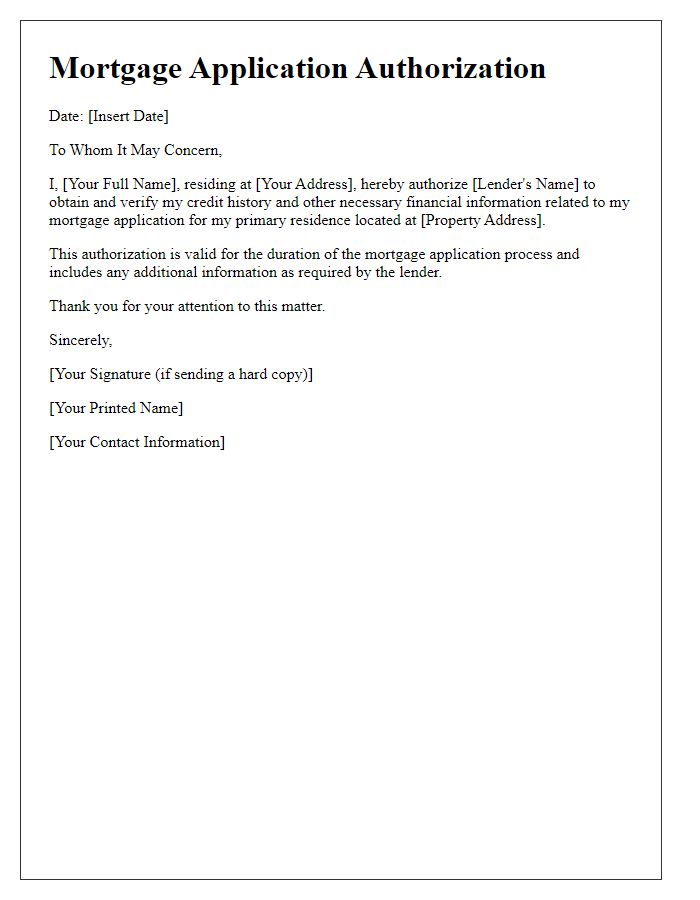

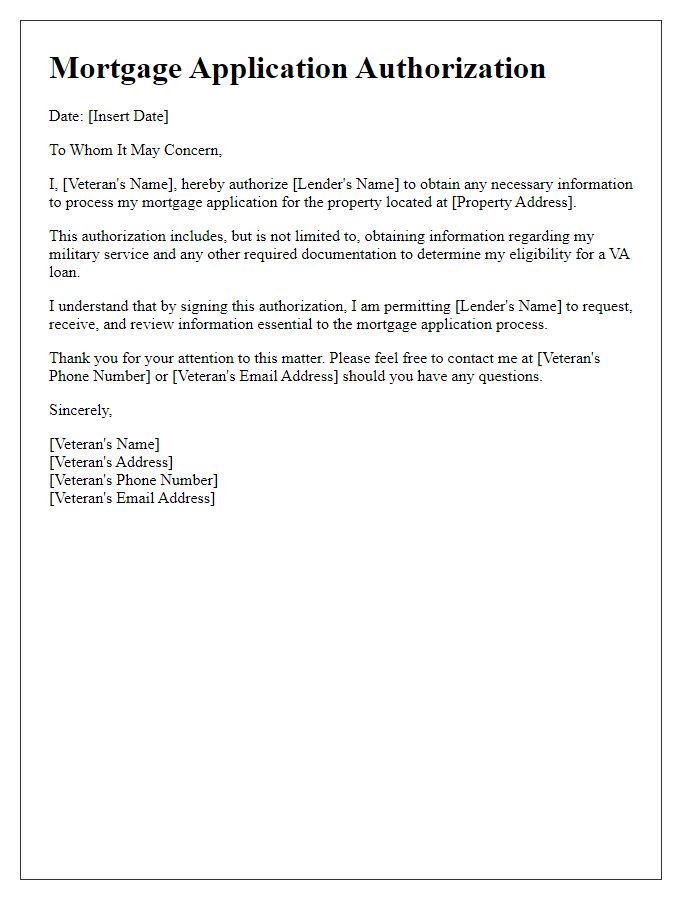

Letter template of mortgage application authorization for primary residence.

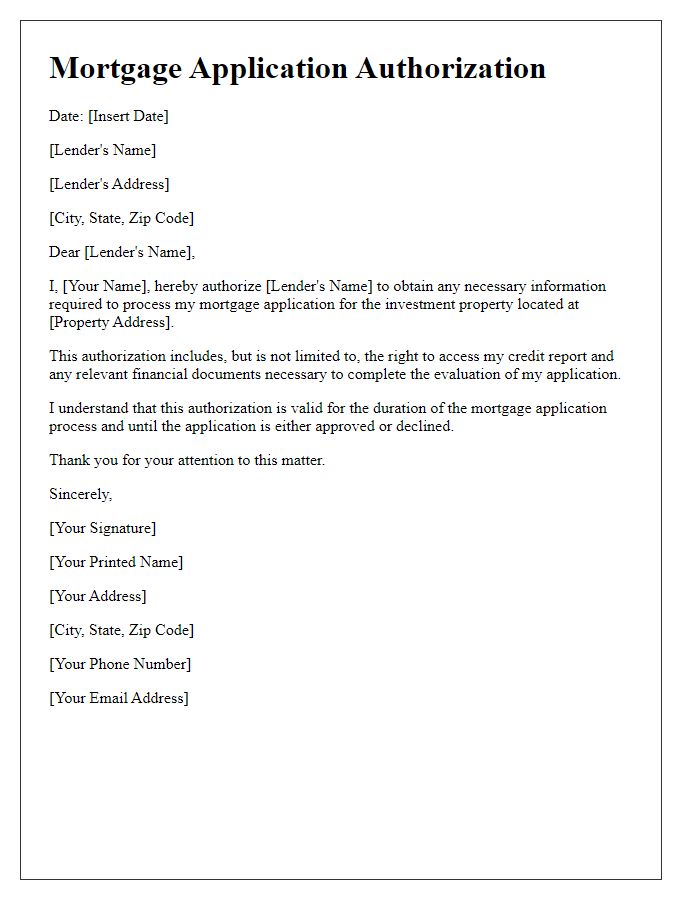

Letter template of mortgage application authorization for investment property.

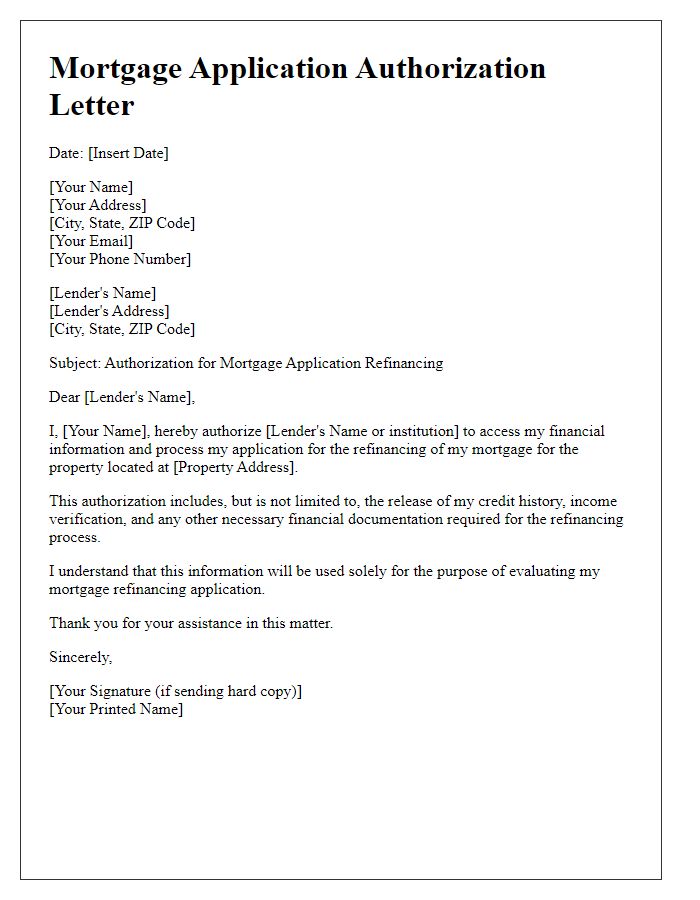

Letter template of mortgage application authorization for refinancing purposes.

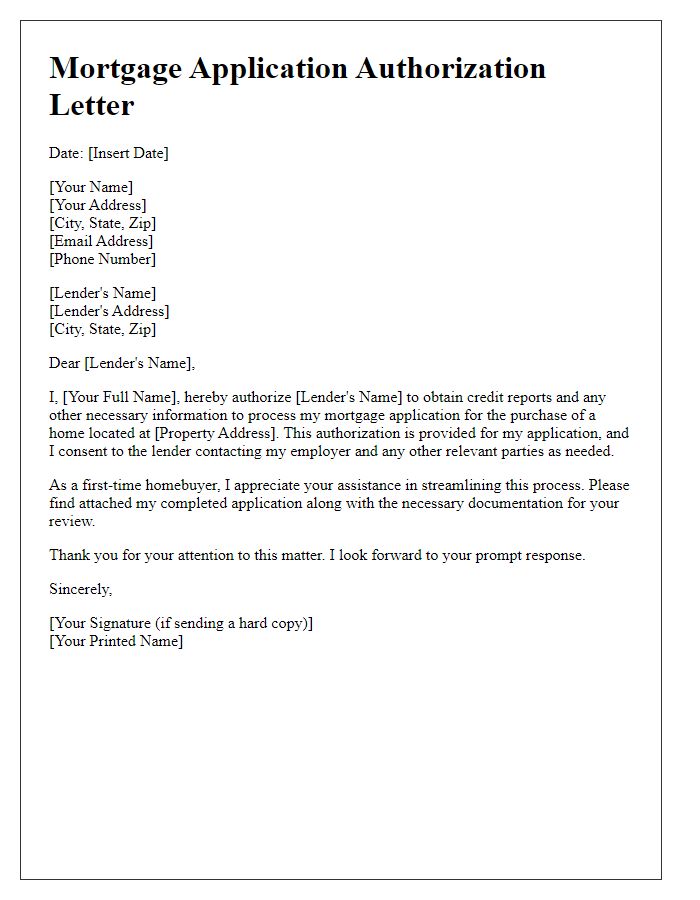

Letter template of mortgage application authorization for first-time homebuyers.

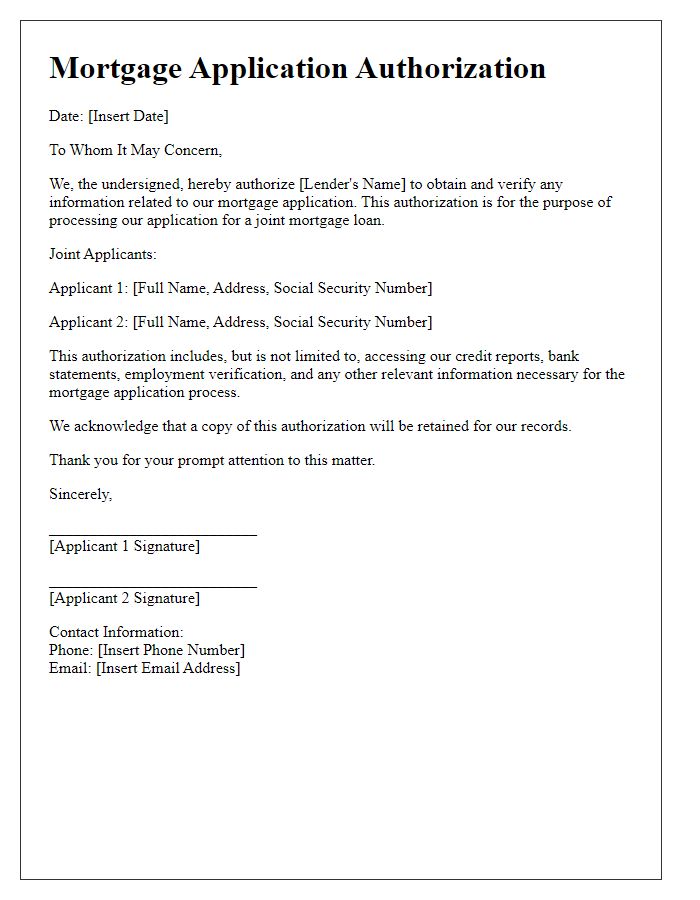

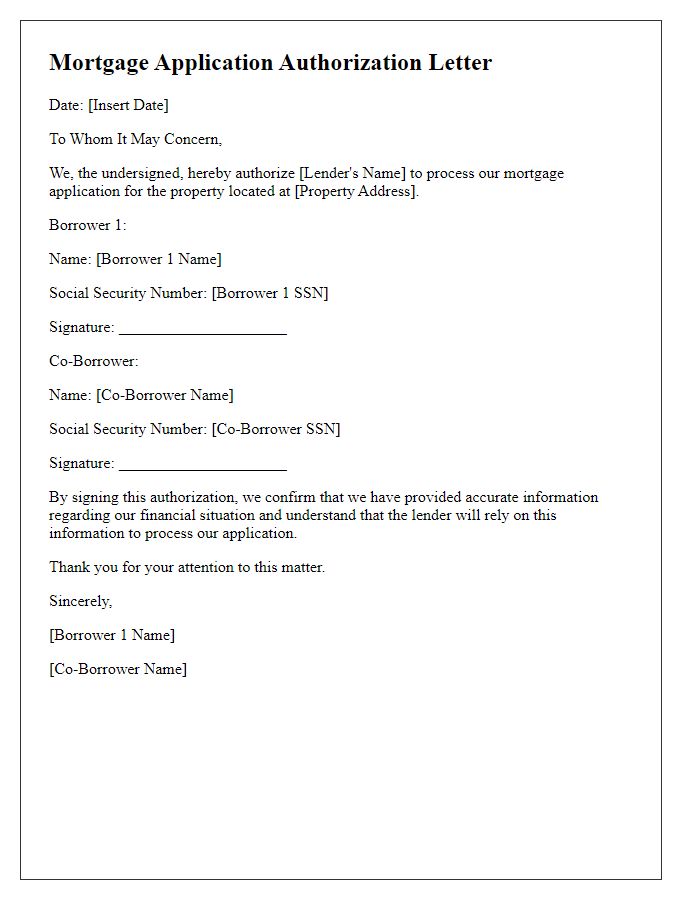

Letter template of mortgage application authorization for joint applications.

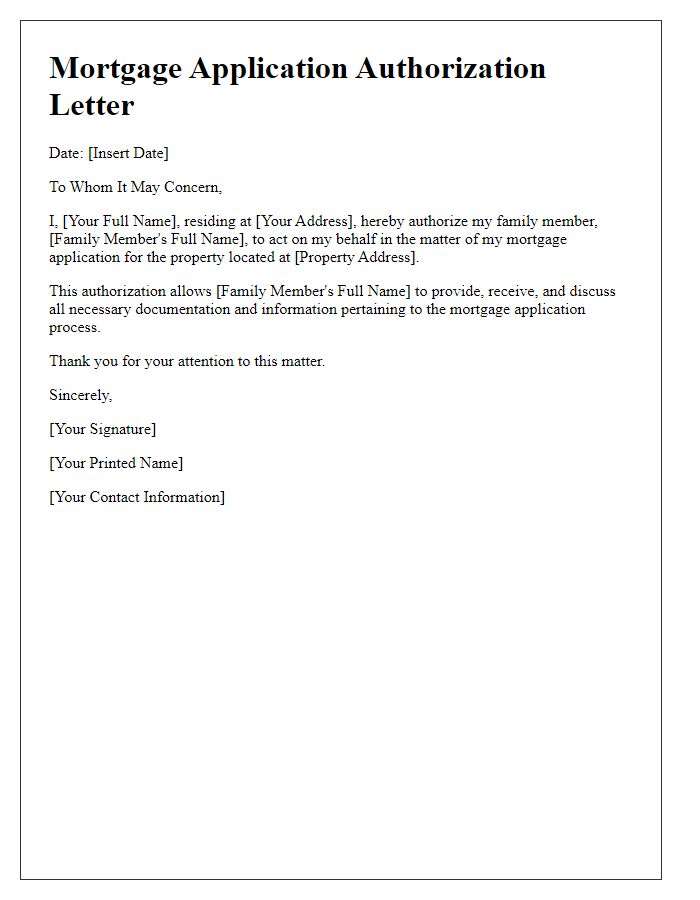

Letter template of mortgage application authorization for family members.

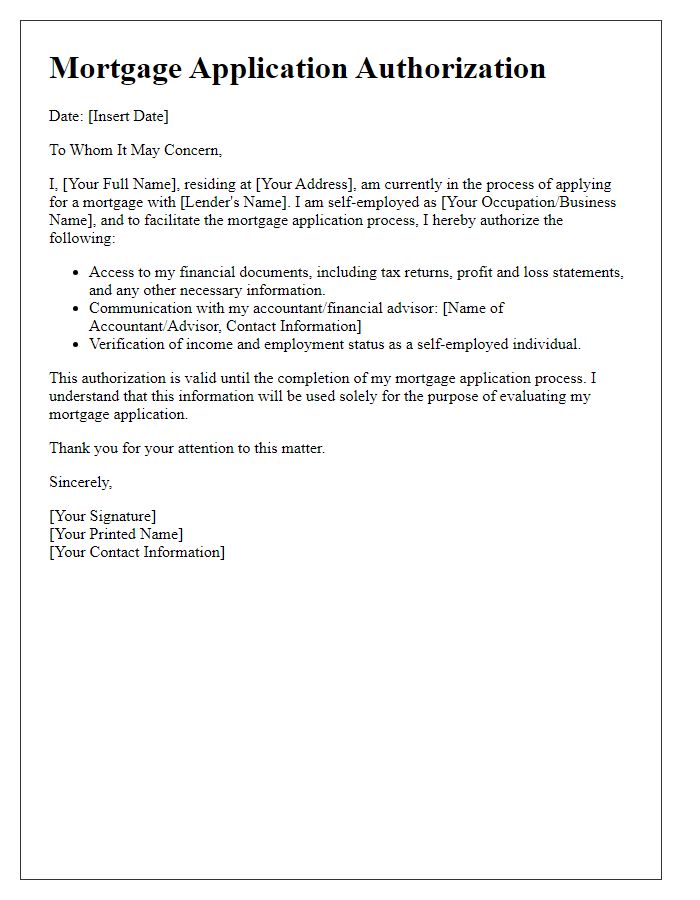

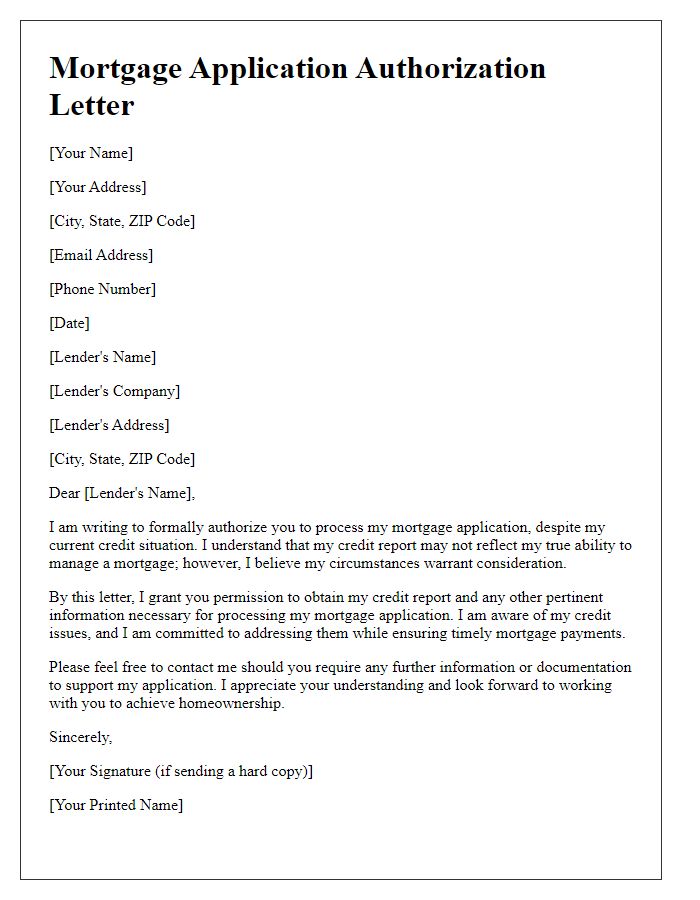

Letter template of mortgage application authorization for self-employed individuals.

Comments