Are you looking to secure business credit but unsure about the application process? Understanding the necessary steps and documentation is crucial for a smooth experience. This article will break down the essential elements of a business credit application authorization letter, guiding you through each requirement along the way. So, let's dive in and explore how you can streamline your application process!

Business Information

When applying for business credit, it's essential to provide detailed business information to support the application. Essential components include the company's legal name (as registered with the Secretary of State), the physical address (including city, state, and zip code) where the business operates, the incorporation date (indicating how long the business has been established), and the Employer Identification Number (EIN) assigned by the IRS. Business ownership details, including the names of the owners and their percentages of ownership, are also crucial. Furthermore, it's beneficial to include the business's annual revenue, business bank account information, and references from suppliers or other credit sources to strengthen the application.

Credit Limit Request

A business credit application authorization typically includes crucial information regarding the financial credibility and operational capacity of the requesting business. Through this formal process, a company seeks to establish a credit limit with a financial institution or supplier, facilitating necessary purchases or services. Essential components may encompass the legal business name, federal tax identification number, desired credit limit amount, and a detailed description of the nature of the business operations. Additionally, personal guarantees from business owners or directors might be required to enhance the application's strength. The evaluation period may vary, depending on the lender or supplier's policies, and includes background checks and credit history reviews to assess the risk involved in extending credit to the business.

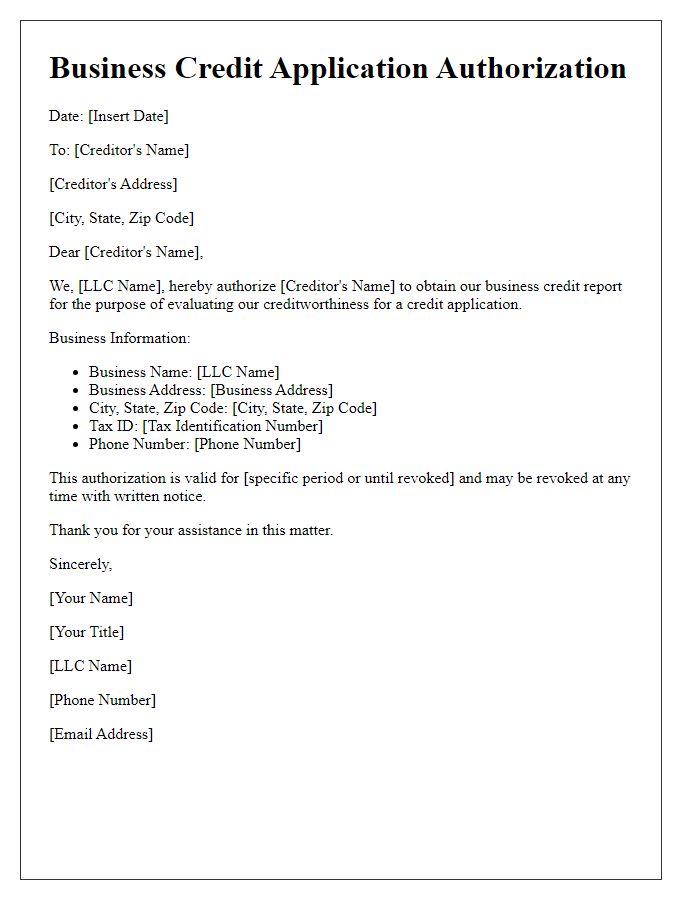

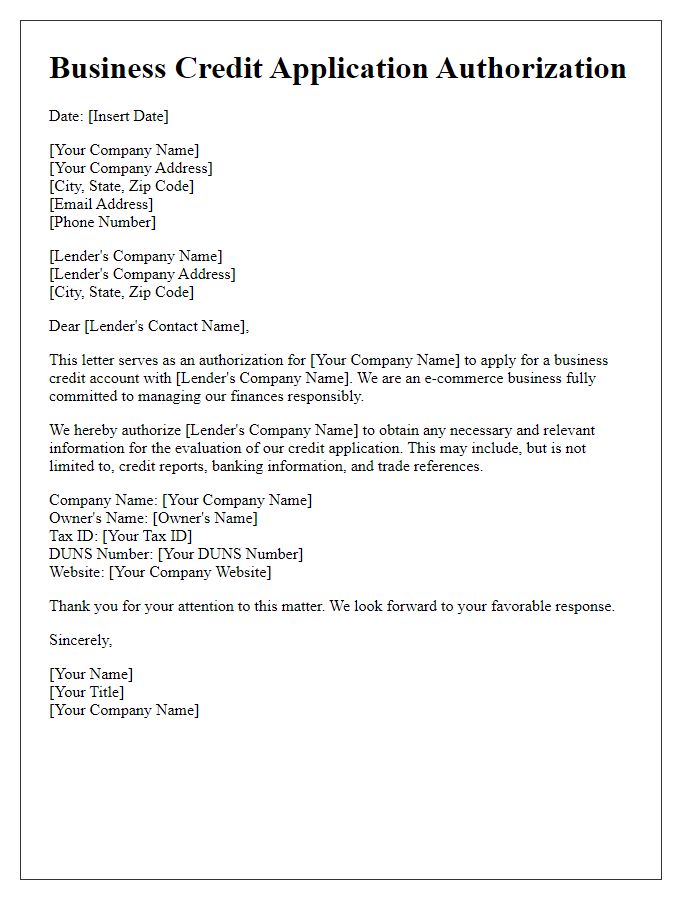

Authorization Statement

A business credit application authorization statement provides necessary consent for financial institutions to access relevant company information. Essential elements include the business name, tax identification number (TIN), and authorized signatory details. The statement often verifies the role of the signatory, typically an owner or executive. Financial institutions require this authorization to assess creditworthiness by checking business credit reports, including accounts payable and outstanding debts. This process ensures transparency in evaluating the financial health of the company. Accurate completion of the authorization statement is crucial for timely processing and approval of the credit application.

Signatures and Contact Information

A business credit application authorization form requires accurate signatures and contact information to ensure proper processing. Essential details include the business name, registered address, and the date of the application. Signatures should be provided by authorized personnel, such as the CEO or CFO, confirming the legitimacy of the request for credit. Additionally, contact information must include direct phone numbers and email addresses to facilitate communication regarding the application status. Attention to this information is crucial for maintaining compliance with financial institutions and streamlining approval processes.

Legal Terms and Conditions

A business credit application authorization form often includes important legal terms and conditions that establish the guidelines between the creditor and the applicant. This document typically outlines obligations concerning repayment terms, interest rates, and the consequences of default. It may specify the duration of the credit agreement, usually ranging from one to five years, and the limits on credit amounts, potentially reaching thousands of dollars depending on the business's creditworthiness. Essential clauses may cover the right of the creditor to report payment history to credit bureaus, affecting the applicant's credit score and future borrowing capabilities. Additionally, it may include terms regarding collateral, ensuring that the creditor has claims over specified assets, such as property or equipment, in case of non-payment. Finally, disclosure of fees associated with late payments or early termination of the agreement are crucial to avoid misunderstandings and ensure compliance.

Letter Template For Business Credit Application Authorization Samples

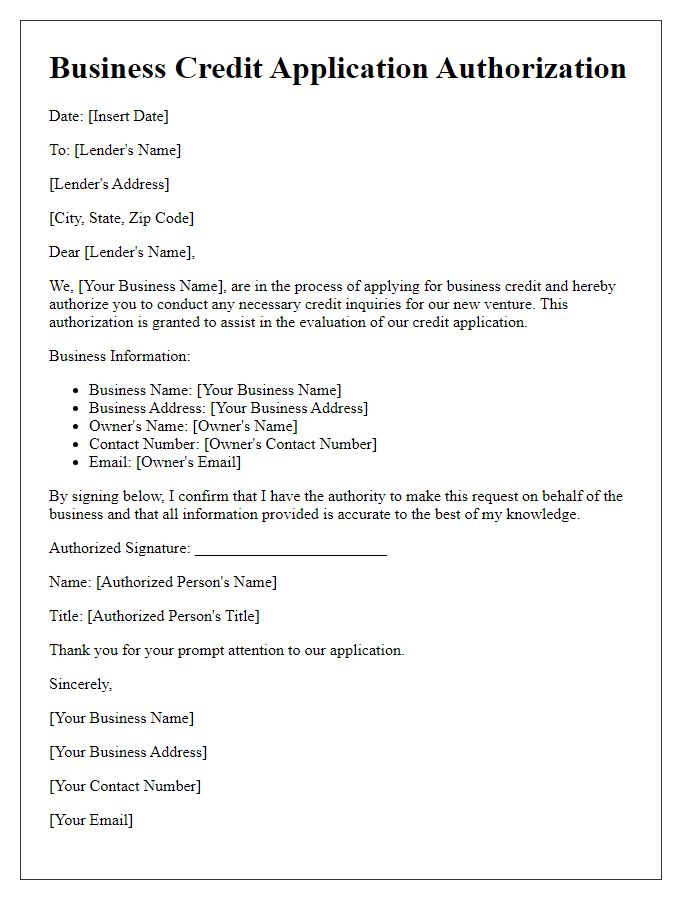

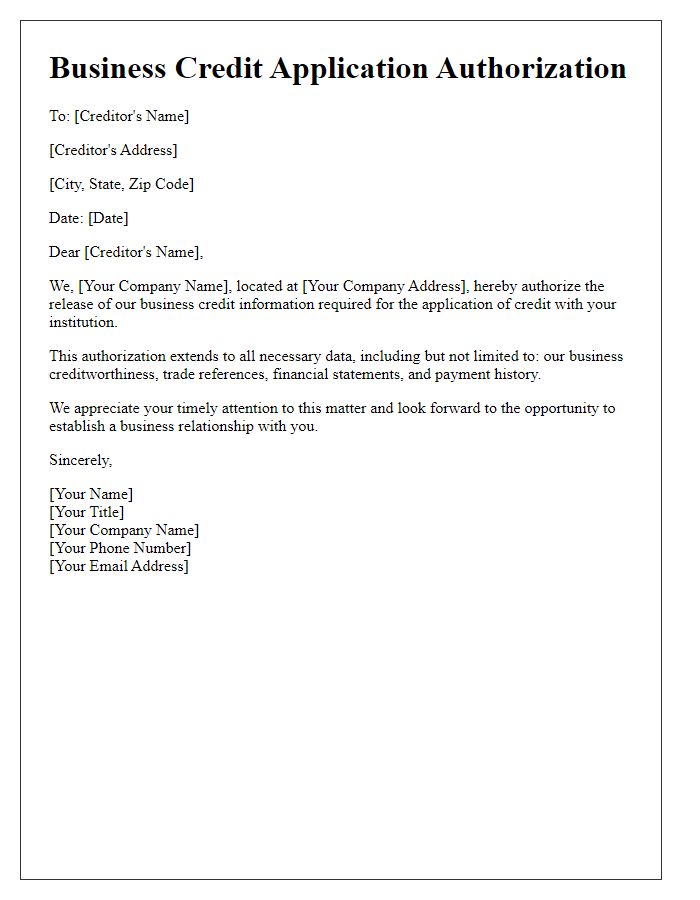

Letter template of business credit application authorization for new ventures

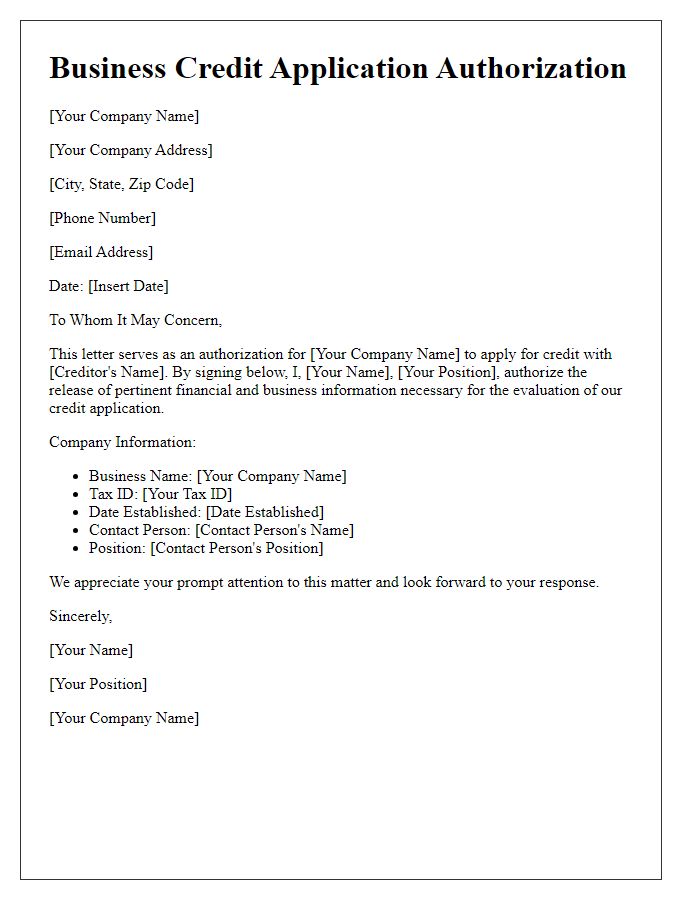

Letter template of business credit application authorization for established companies

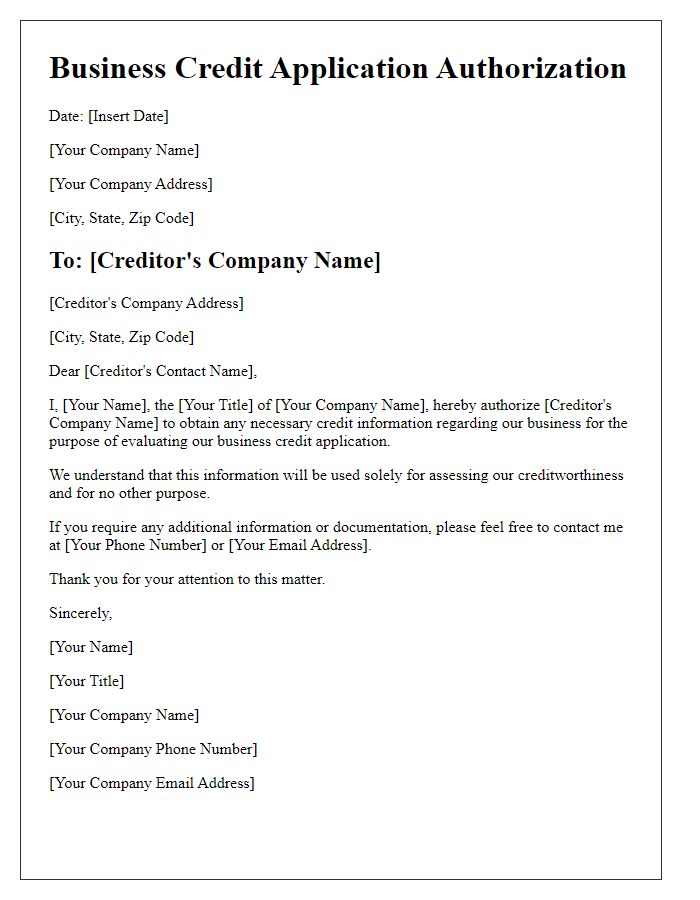

Letter template of business credit application authorization for small businesses

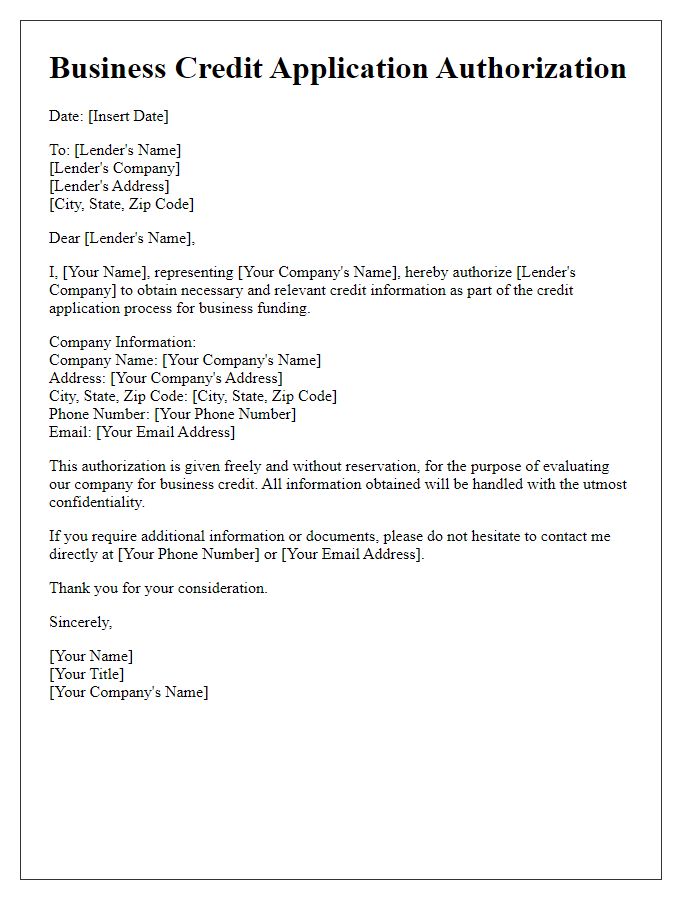

Letter template of business credit application authorization for startups seeking funding

Letter template of business credit application authorization for corporate partnerships

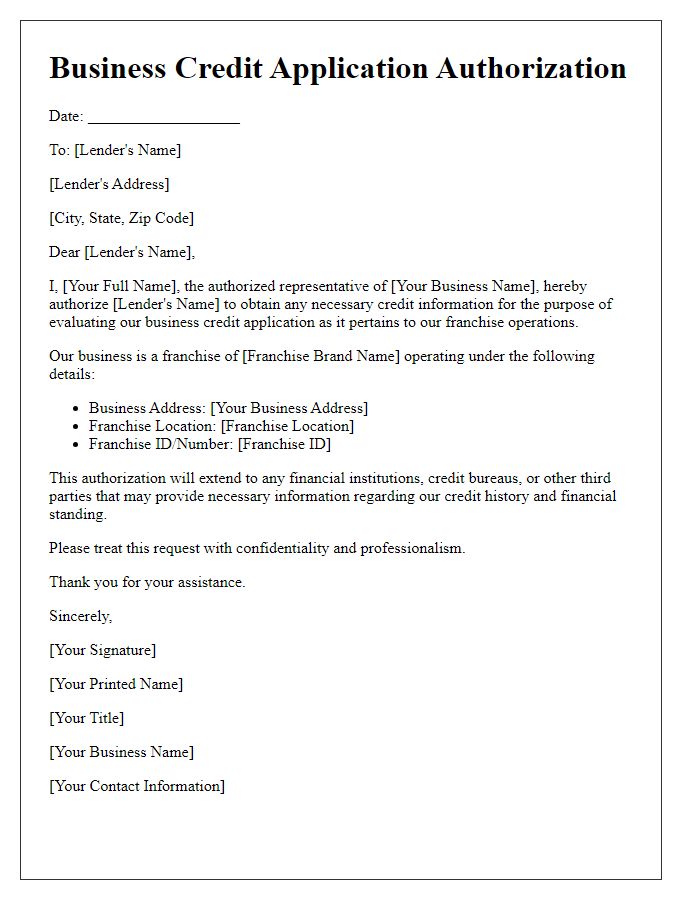

Letter template of business credit application authorization for franchise operations

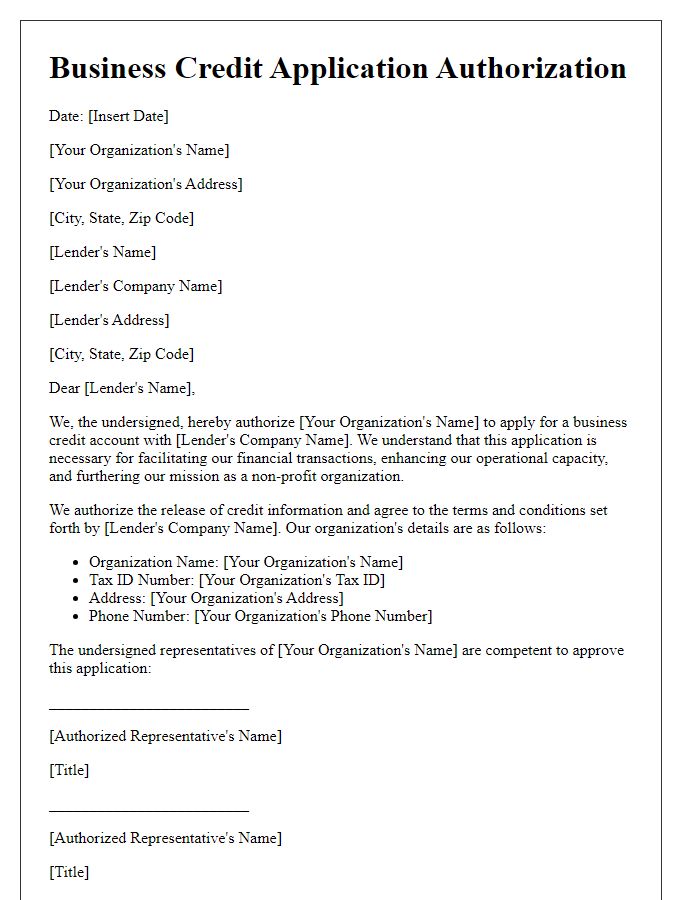

Letter template of business credit application authorization for non-profit organizations

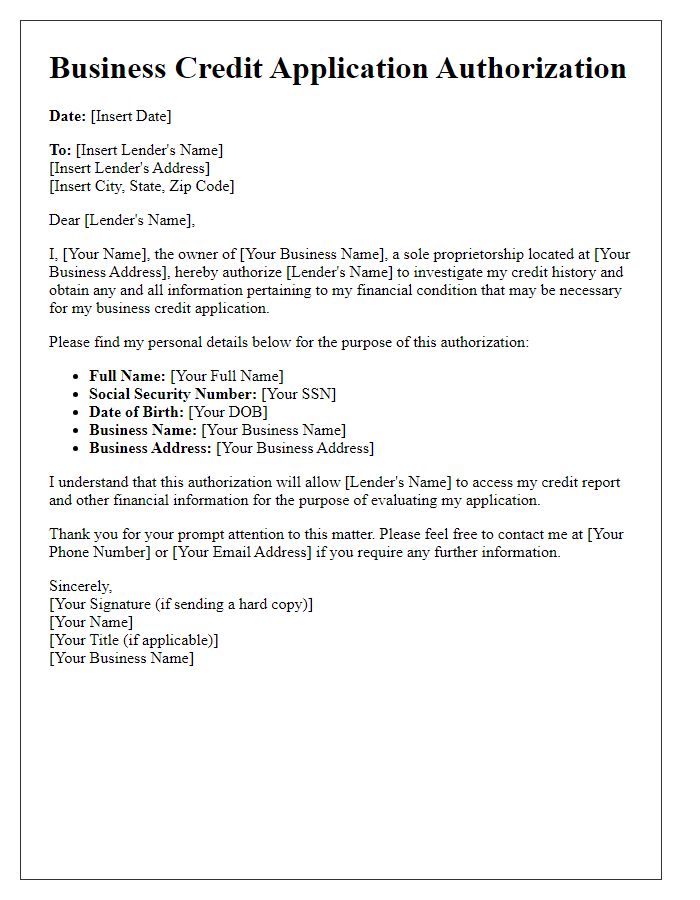

Letter template of business credit application authorization for sole proprietorships

Comments