Are you looking to streamline your policy application process? Writing a well-structured authorization letter can make all the difference in ensuring your request is processed smoothly. In this article, we'll guide you on how to craft a compelling policy application authorization letter with all the essential elements included. So, grab a cup of coffee and dive in to learn more about creating an effective template!

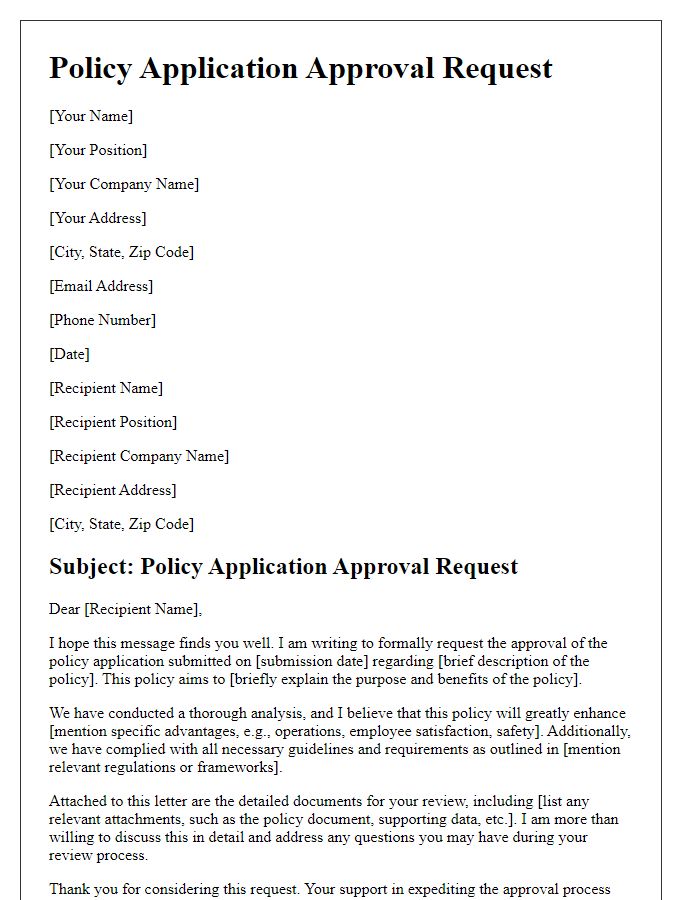

Applicant's Personal Information

The applicant's personal information is a crucial aspect of policy application authorization, encompassing full legal name (as per government-issued identification), contact number (including area code), residential address (providing city, state, and zip code), date of birth (ensuring compliance with age requirements), and social security number (for identity verification). Additional identifiers such as email address (for communication purposes), employment details (including employer's name and address), and any relevant identification numbers (linked to specific policies) enrich the context of the applicant. Accurate and detailed personal information aids in swift processing of the application while ensuring adherence to regulatory standards and privacy protocols.

Policy Details and Coverage

The application for policy authorization requires specific details regarding the insurance coverage selected. Policy details include essential information such as the policy number, which acts as a unique identifier for the coverage issued by the insurance provider, coupled with the policyholder's name and contact information, ensuring timely communication. The coverage section outlines the extent of protection against various risks, detailing the sum insured, which is the maximum amount payable upon a claim, and specific inclusions and exclusions that clarify circumstances under which coverage applies. Additionally, the effective date indicates when the policy becomes active, while the premium amount specifies the costs associated with maintaining the policy throughout its duration. Understanding these elements is crucial for effective policy management and claims processing.

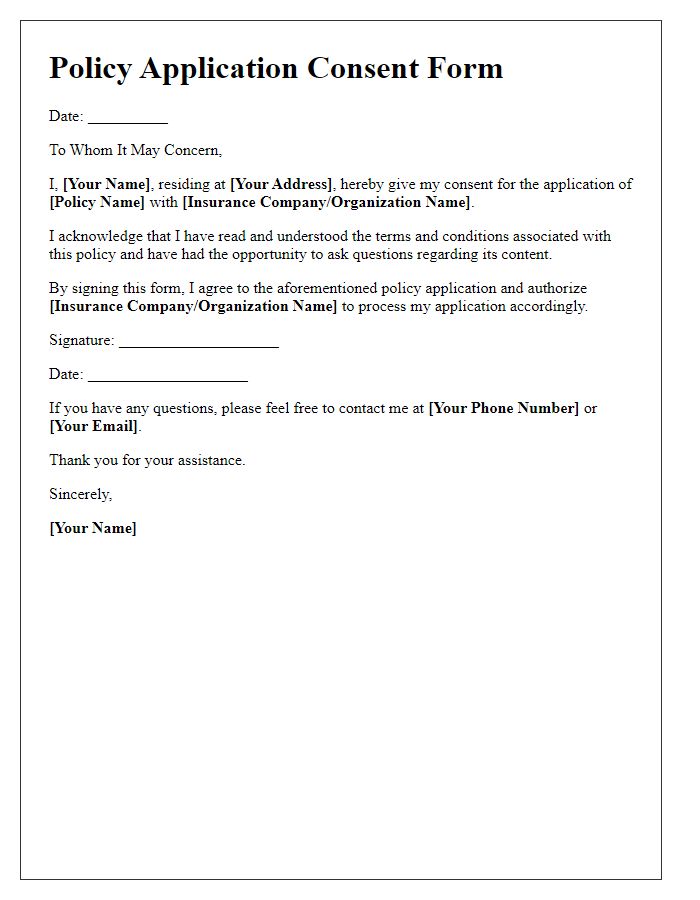

Authorization Statement

Authorization statements establish consent for specific actions or access related to sensitive information or decisions. These statements often require identification of the individual granting authority, such as a name, title, and organization, and the type of policy or application involved, like health insurance or financial services. Additionally, details like the effective date and duration of the authorization could be included, with a clear outline of any limitations placed on the authorized party, such as sharing confidential data or making decisions on behalf of the individual. Often, such documents are used in contexts requiring regulatory compliance, emphasizing privacy protection and responsibility.

Consent for Information Sharing

The consent for information sharing authorization allows organizations to exchange personal data, ensuring compliance with regulations such as the General Data Protection Regulation (GDPR). This authorization often includes specific details regarding the types of data shared, such as financial information, health records, or employment history. The consent form typically outlines the parties involved, the purpose of sharing the information, and the duration for which the consent remains valid, often defined to a particular event or period, such as the duration of employment or specific project completion. Signatures from all relevant parties must be obtained, reinforcing accountability and transparency in the data sharing process.

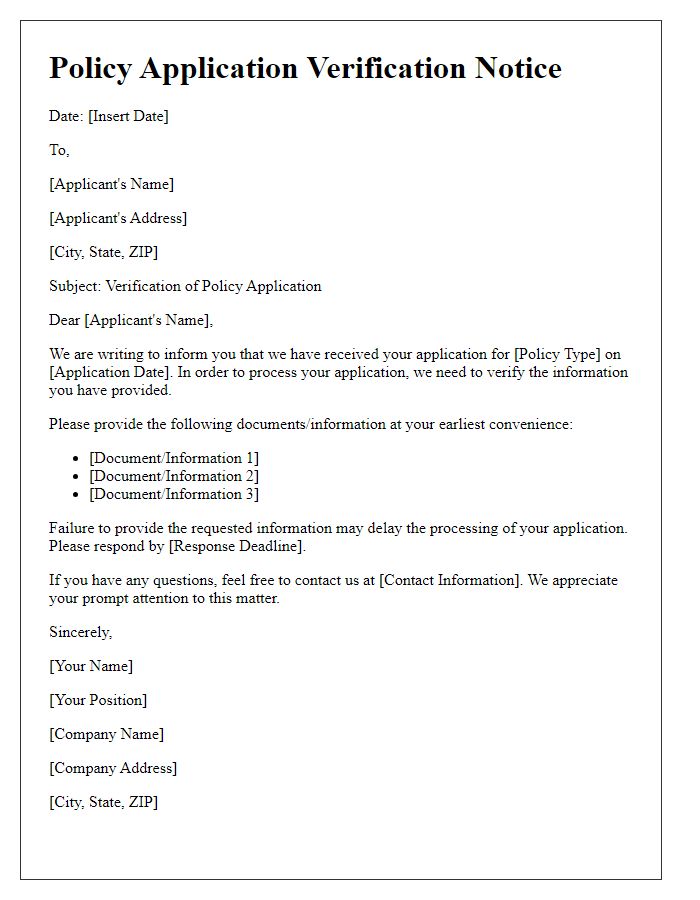

Contact Information for Queries

In business endeavors, maintaining clear communication channels is essential for efficient operations. Providing a designated contact point for queries related to policy application authorization fosters transparency and responsiveness. Prospective applicants should be informed of a specific contact person, often designated by an authoritative title such as Policy Manager or Compliance Officer. This individual, typically located in the company's headquarters (for example, New York City), should possess direct email contact (e.g. policyqueries@company.com) and a dedicated phone number (such as +1-800-555-0199) for inquiries. Furthermore, an organized response time frame, often within 48 hours, can enhance applicant confidence and streamline the authorization process.

Comments