Are you tired of waiting for checks to arrive in the mail or making trips to the bank? Setting up direct deposit can streamline your finances and give you peace of mind knowing your paycheck is securely deposited into your account. In this article, we'll walk you through how to complete a direct deposit authorization letter that ensures a smooth, hassle-free transition. So, let's dive in and get your direct deposit set up today!

Employee Information

Direct deposit authorization forms are essential for streamlining payroll processes in organizations. Employee information includes personal details such as full name, employee identification number (EIN), bank name (for instance, Chase Bank), bank account number, routing number (usually a nine-digit numeric code), and contact information (email and phone number). These details ensure that payments are efficiently deposited into the correct account, enhancing financial management for both the employee and employer. Accuracy in the provided information minimizes the risk of payment delays or errors, thereby fostering trust in the payroll system. Proper handling of sensitive information is crucial for maintaining privacy and compliance with financial regulations.

Employer Information

Direct deposit authorization entails providing employers with essential banking information for seamless employee salary deposits. Employers, such as XYZ Corporation located in New York City, must collect employee details including full name, Social Security Number (SSN), and bank account information. Typically, a voided check or a direct deposit form from the bank, specifying the routing number (a nine-digit code), account number, and account type (checking or savings), is required. This process ensures timely payroll disbursement, enhances convenience for employees, and reduces paper checks used. Direct deposit not only minimizes the risk of lost or stolen checks but also streamlines the payroll process, contributing to efficient cash flow management.

Bank Details

Direct deposit authorization allows for seamless electronic transfer of funds into bank accounts. Essential bank details include the account holder's name, which must match the bank records to prevent any discrepancies. The bank name, such as JPMorgan Chase or Bank of America, indicates the financial institution involved. The account number, typically a series of 10-12 digits, is vital for identifying the correct account for deposit. The routing number, a nine-digit identifier assigned to each bank, ensures the funds are directed to the correct branch. Providing these details facilitates direct payments, such as payroll deposits, government benefits, or investment distributions, enhancing convenience and security for all parties involved.

Authorization Statement

Direct deposit authorization is a process that allows individuals to have their salary payments electronically transferred to their bank accounts instead of receiving a physical paycheck. This service is commonly used by employers in the United States, significantly simplifying payroll management. Individuals must complete a direct deposit authorization form containing essential information such as bank account number, routing number, and employee identification details. Benefits include faster access to funds, reduced risk of lost or stolen checks, and greater convenience for employees. Financial institutions often provide resources and support for setting up this seamless payment method.

Employee Signature and Date

Direct deposit authorization allows employees to receive their wages electronically, streamlining the payroll process. This method eliminates the need for physical checks, enhancing convenience and security. Upon completion, employees must provide their signature (a handwritten mark indicating agreement) to authenticate the authorization form. Dates (typically in the MM/DD/YYYY format) must accompany the signature to demonstrate when the authorization was executed, ensuring clarity and compliance with employment regulations. Moreover, accurate bank information, including routing numbers (nine-digit numbers identifying financial institutions) and account numbers, is essential for successful processing of deposits.

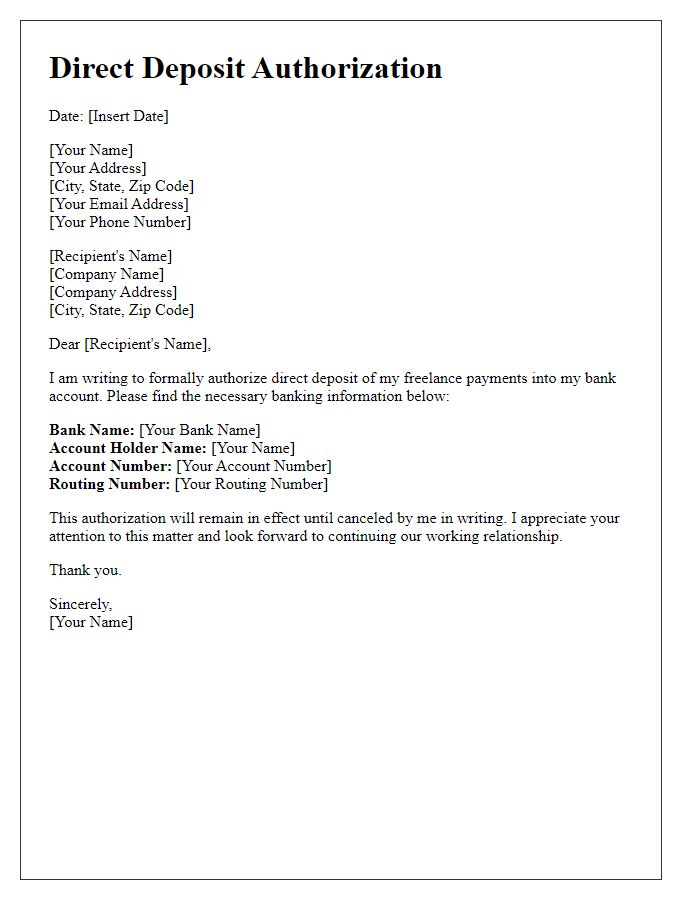

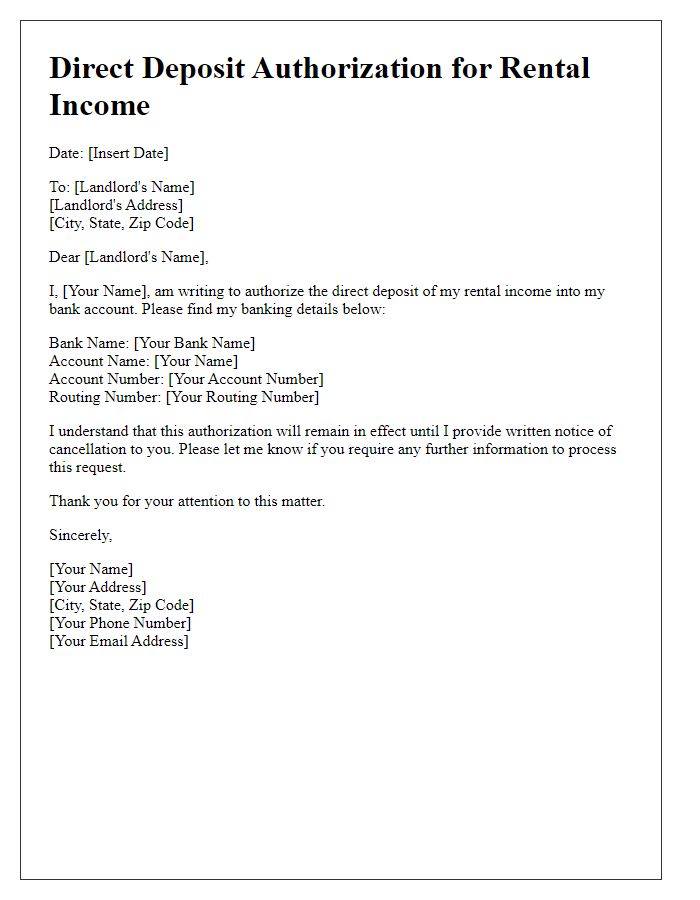

Letter Template For Direct Deposit Authorization Samples

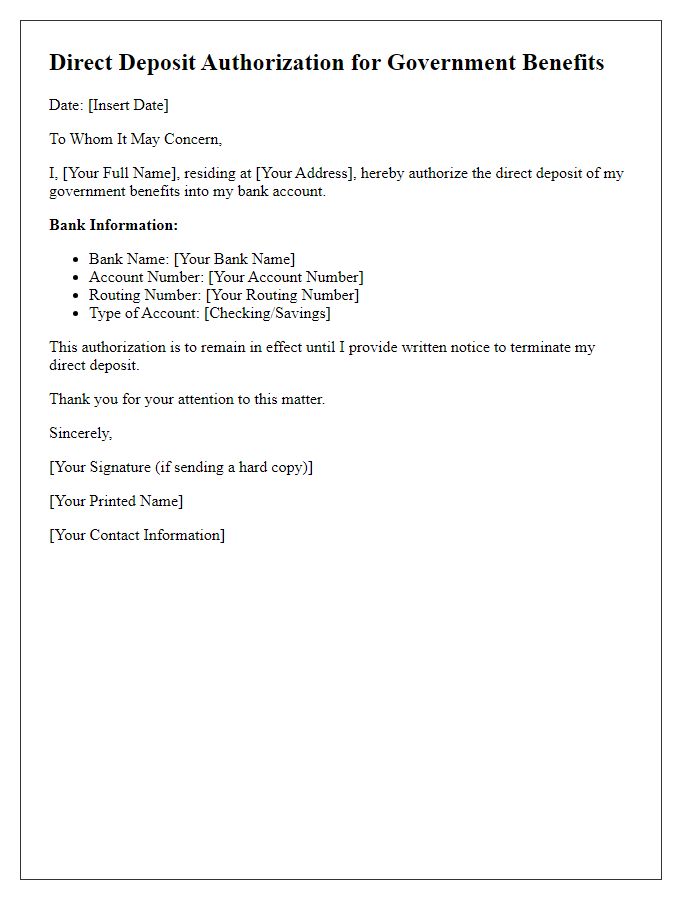

Letter template of direct deposit authorization for government benefits.

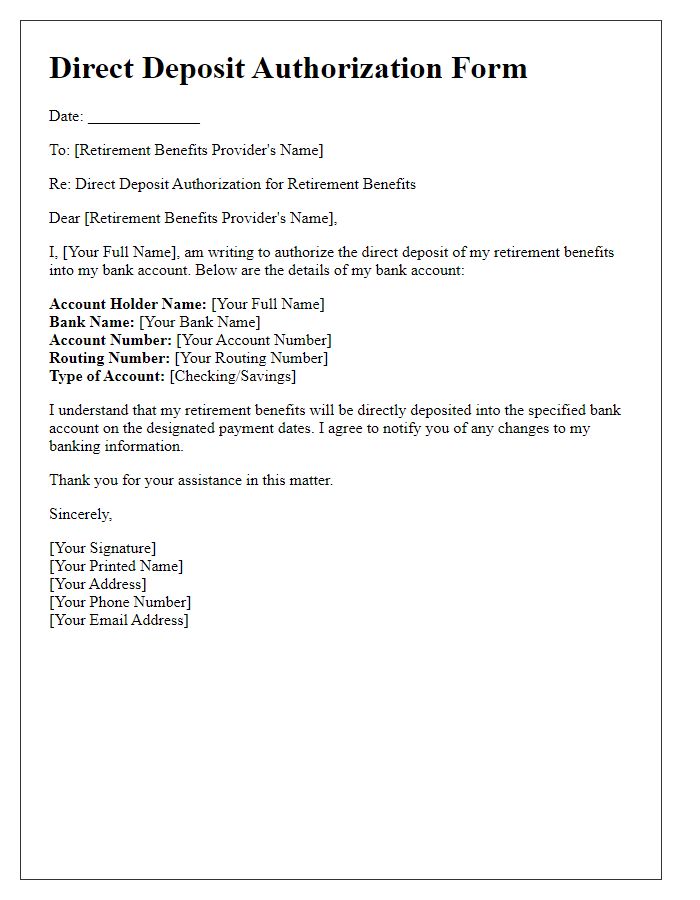

Letter template of direct deposit authorization for retirement benefits.

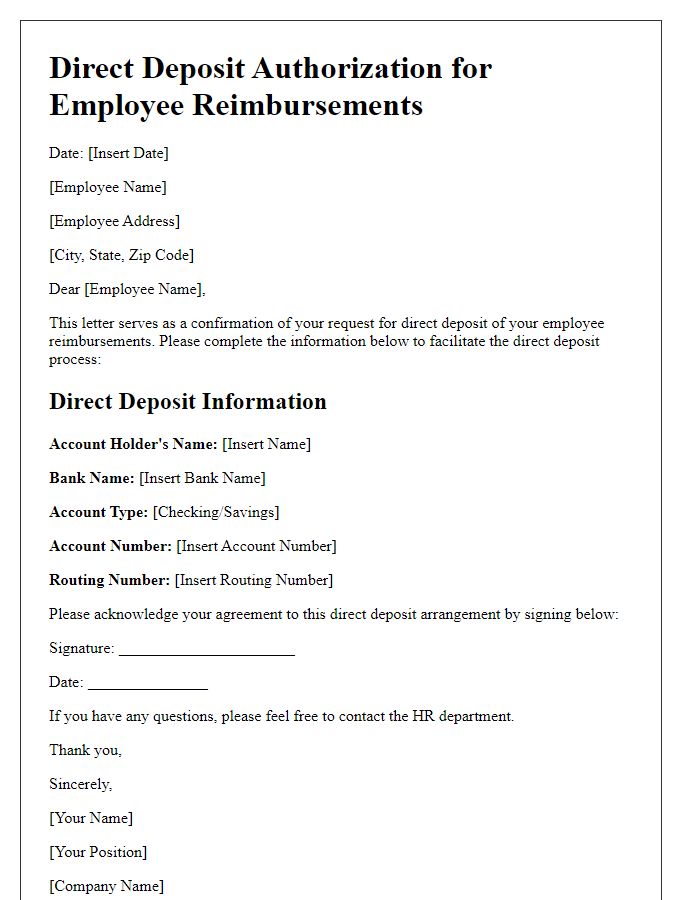

Letter template of direct deposit authorization for employee reimbursements.

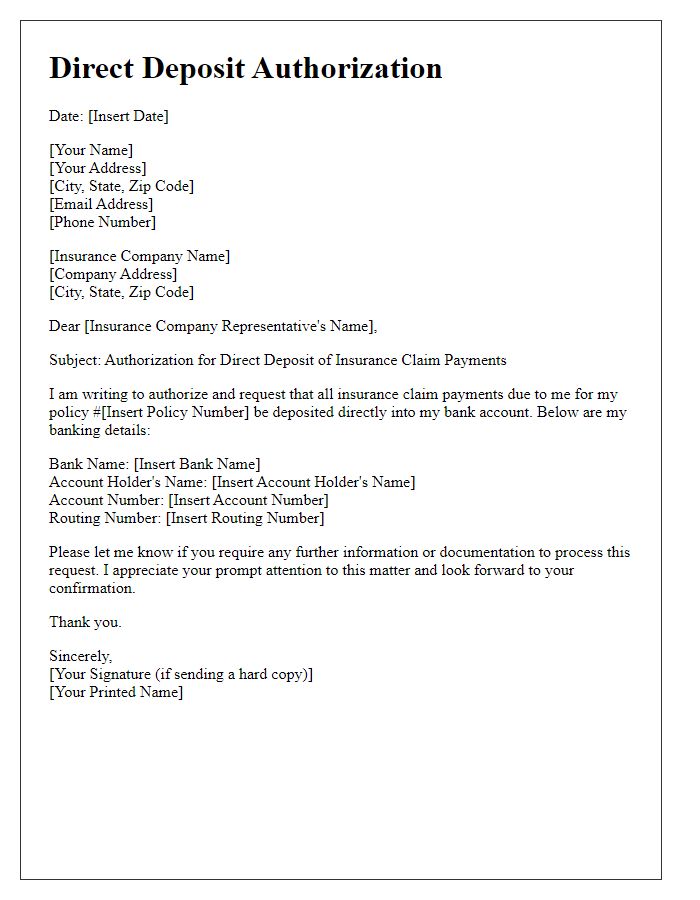

Letter template of direct deposit authorization for insurance claim payments.

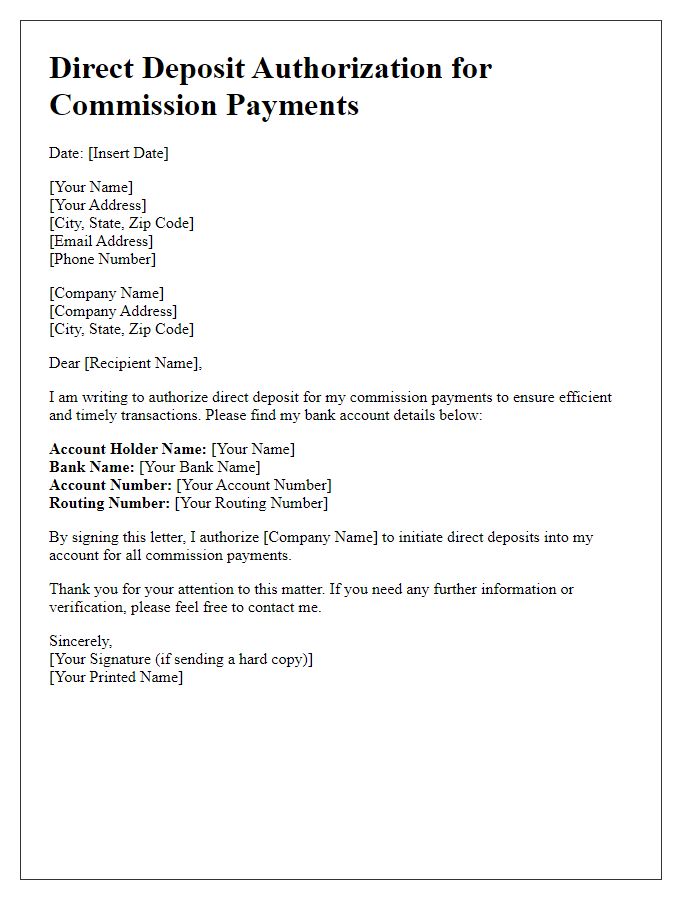

Letter template of direct deposit authorization for commission payments.

Comments