In the world of business, clear communication and proper authorization are key to successful transactions. Crafting a well-structured business transaction authorization letter not only ensures that everyone is on the same page but also protects all parties involved. This template serves as a guiding framework, simplifying the process and making it more efficient. Ready to elevate your transaction game? Read on for practical tips and insights!

Contact Information

Business transaction authorization requires precise contact information to facilitate effective communication. Essential details include the company's name, registered address (for legal identification), primary contact person's name (indicating responsibility), phone number (for immediate inquiries), email address (for documentation), and business identification number (like a tax ID). Accurate data ensures smooth approvals, expedites transaction timelines, and fosters transparent interactions in the context of corporate compliance and record-keeping. Clear connections between parties can enhance trust and clarify obligations during the transaction process.

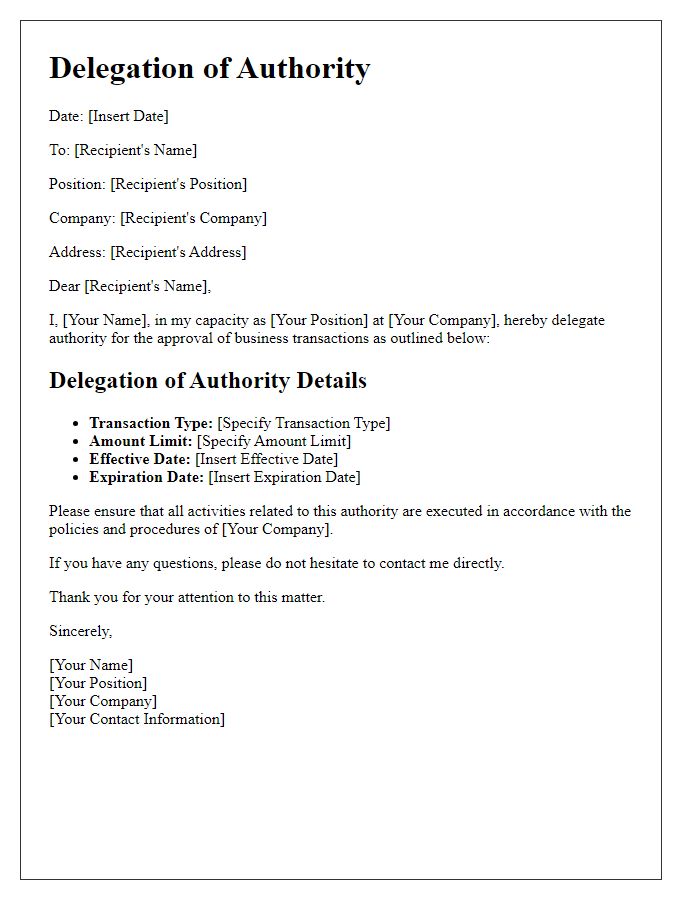

Authorization Statement

A business transaction authorization statement is crucial for ensuring clarity and accountability in financial dealings. This document outlines the specific transaction details, including the transaction amount, date, and purpose. It typically requires signatures from authorized individuals within the organization to validate the transaction. For instance, in a company like ABC Corporation, a transaction amounting to $50,000 to a vendor for office supplies could necessitate signatures from both the Finance Director and the CEO. Clear identification of the parties involved, including their roles and contact information, enhances transparency. Furthermore, the statement often includes a declaration affirming compliance with company policies and the lawful use of funds. Effective communication within this document fosters trust and mitigates the risk of fraud or mismanagement.

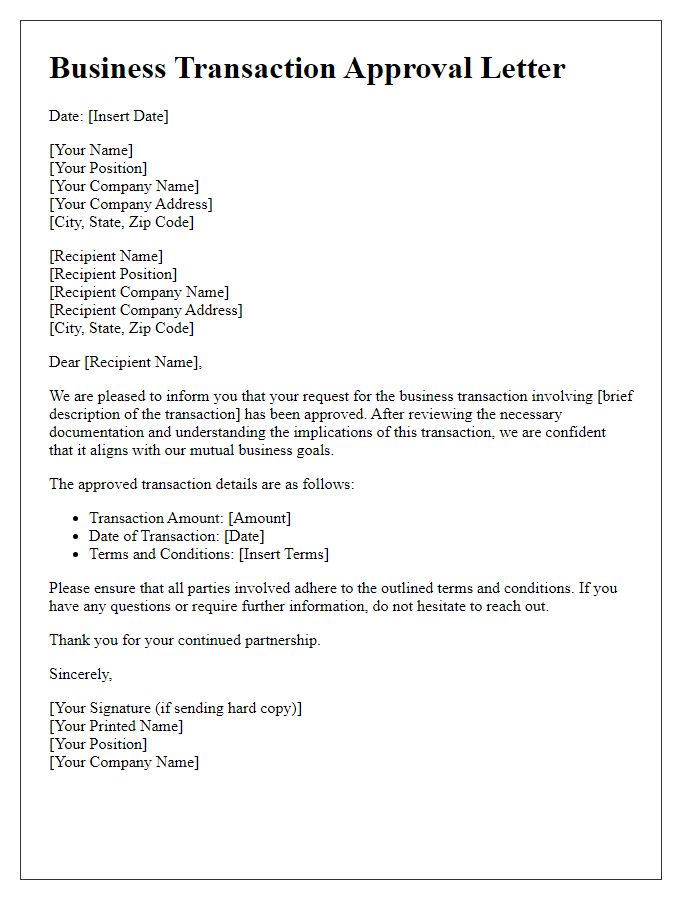

Transaction Details

Transaction authorization is a critical process for businesses to ensure secure and reliable operations. Documenting transaction details, such as amounts, participant entities like company names and accounts, and transaction dates, is essential. For example, a transaction involving $50,000 between Company A and Company B on October 15, 2023, must include unique identifiers such as invoice numbers or purchase orders to link the financial action to its purpose. Additionally, proper authorization signatures from designated officers, such as CFOs or Account Managers, can enhance accountability. This thorough documentation prevents fraud and ensures compliance with financial regulations.

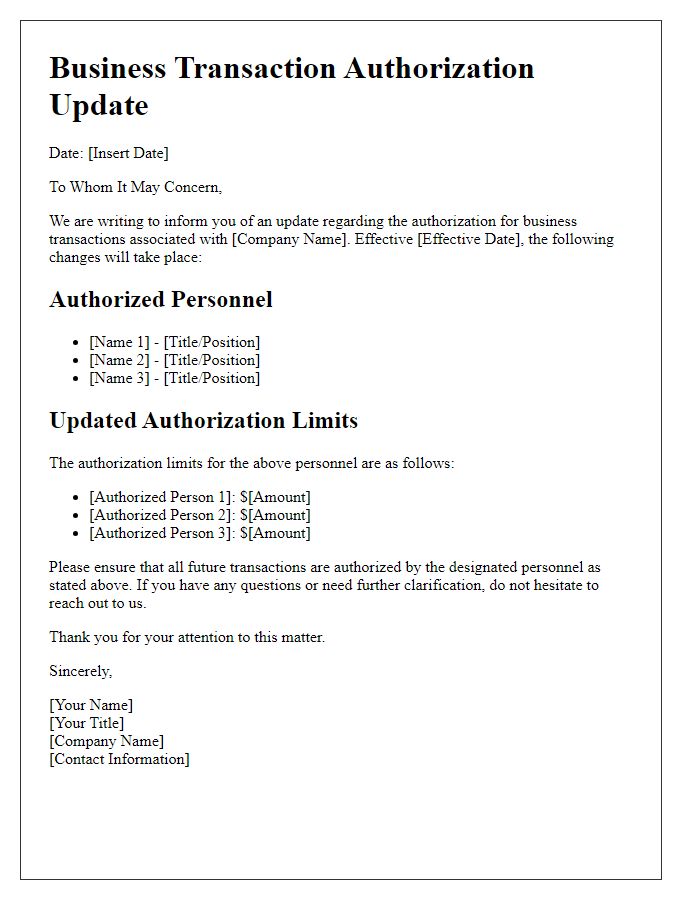

Duration and Validity

Duration and validity of business transaction authorizations are crucial elements that govern the integrity and effectiveness of financial agreements. Typically, the authorization period may range from 30 days to one year, depending on the nature of the transaction or contract. For instance, service agreements often specify a validity period, allowing businesses such as logistics companies or suppliers to fulfill obligations seamlessly. Extensions may be negotiated, ensuring continued compliance with terms. Clear documentation of expiration dates is vital to prevent misunderstandings, particularly in high-stakes industries like finance or real estate. Specific milestones or deadlines within the agreement may also determine validity, impacting both parties' responsibilities and risks. Failure to adhere to these durations can lead to unauthorized transactions, potentially resulting in financial losses or legal disputes.

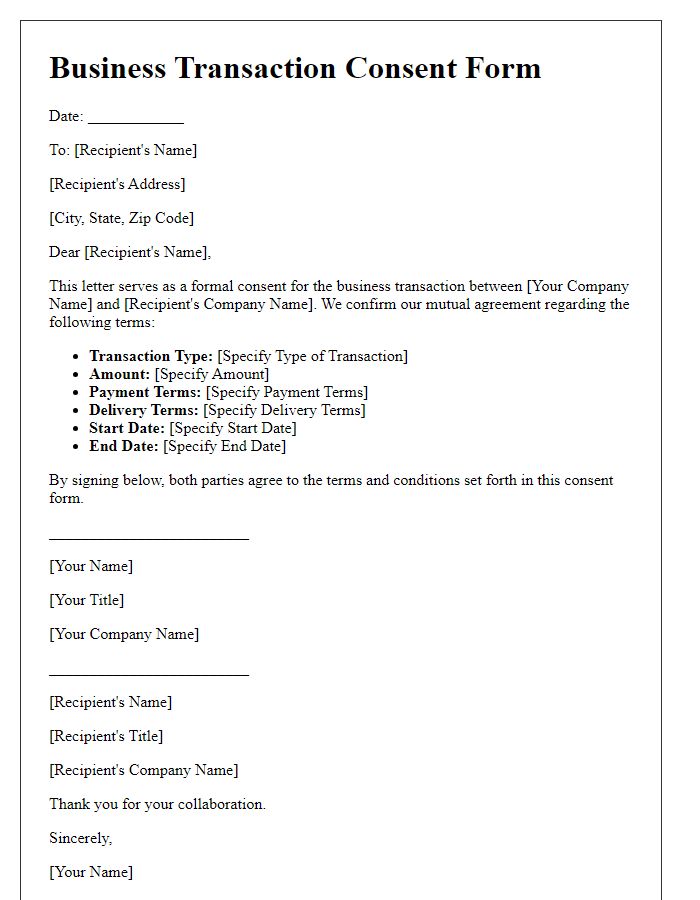

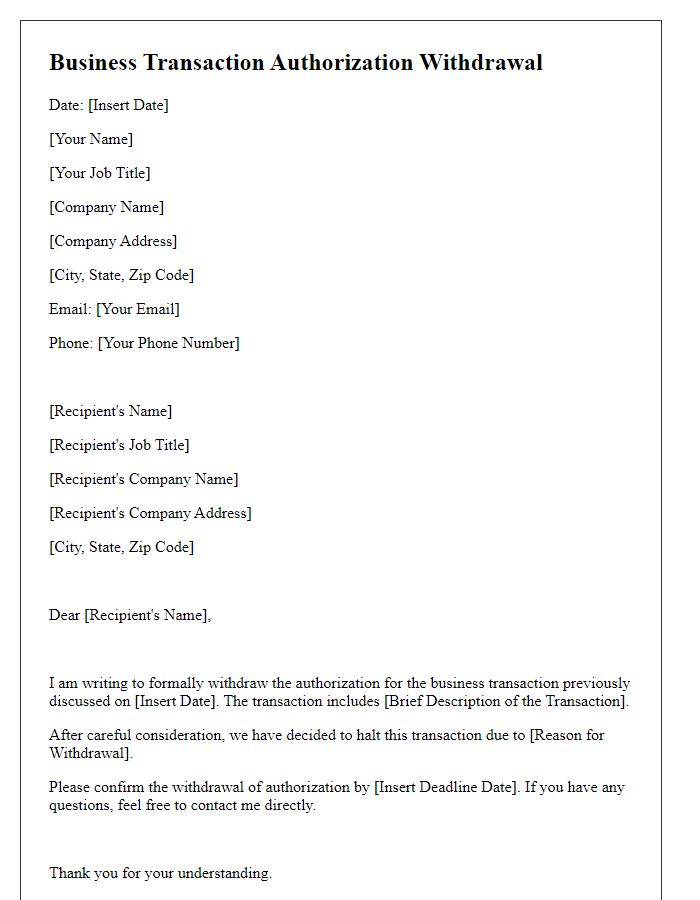

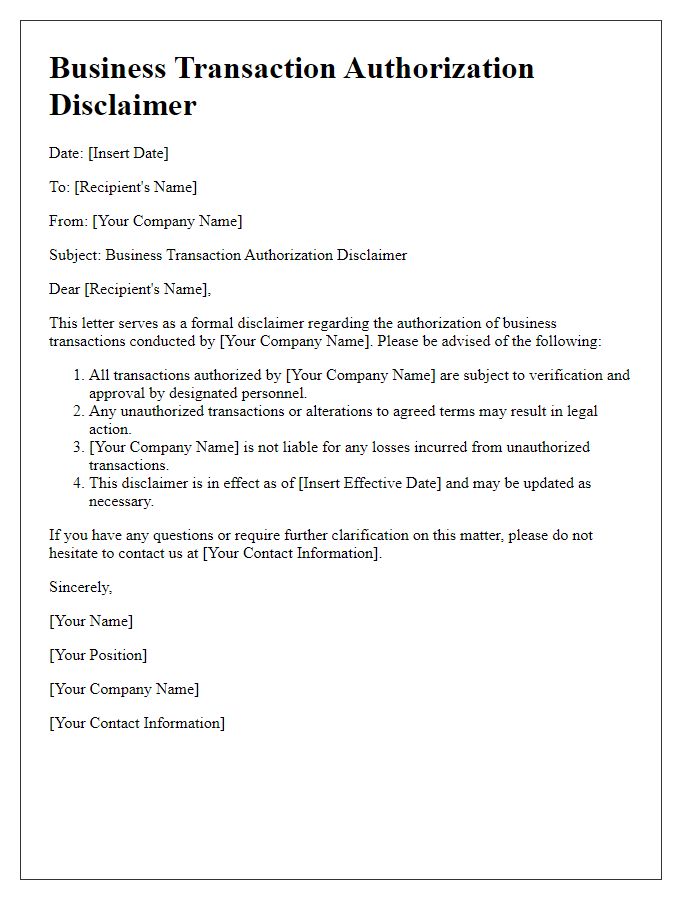

Signatures and Legal Disclaimers

In business transactions, signatures serve as a crucial element for authorization, ensuring that both parties agree to the terms outlined in contracts. Legal disclaimers provide necessary information regarding the limitations of liability and obligations. This process typically involves the collection of signatures from authorized representatives of both entities, confirming acceptance of the agreement formulated by the involved parties. For instance, in financial transactions, authorized signatures must appear on documents such as contracts and invoices, indicating consent for the transfer of funds or provided services. Furthermore, disclaimers outline any potential risks or exclusions that may arise from the agreement, legally safeguarding all parties during the transaction process.

Comments