Are you feeling overwhelmed by the prospect of adjusting your audit schedule? Don't worry; you're not alone. Many professionals find themselves needing to tweak timelines to ensure everything runs smoothly and efficiently. Dive into our article for tips on crafting the perfect letter for audit schedule adjustments, ensuring no detail is overlooked!

Reason for Adjustment

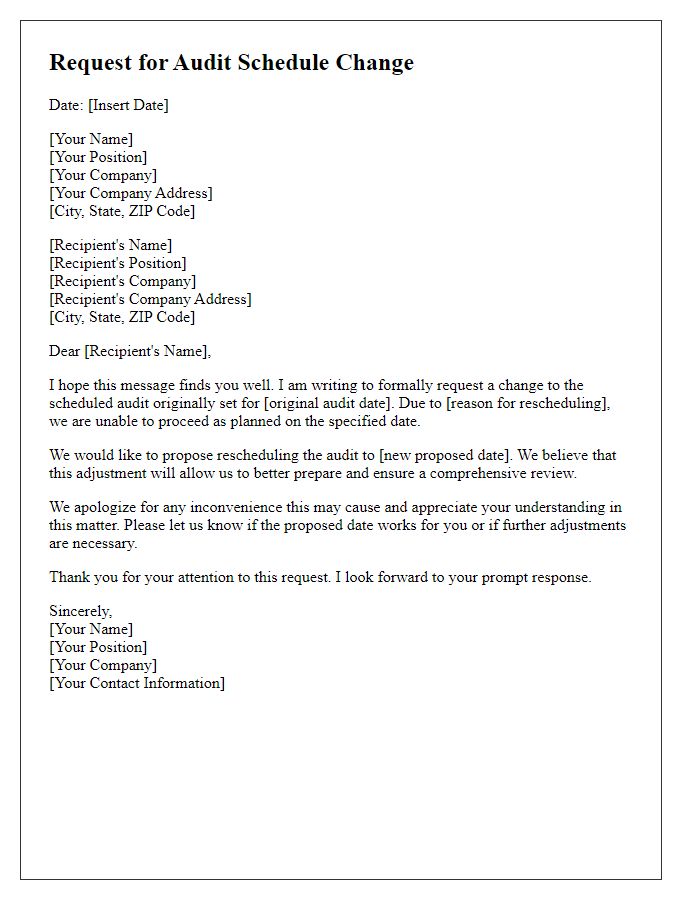

Inaccurate staff availability due to unforeseen circumstances can necessitate an adjustment to the audit schedule for the financial year 2023-2024. Staff members assigned to key audit roles may face unexpected personal obligations or health issues, impacting the timely completion of required audits. Additionally, fluctuations in operational activity from major clients might demand a reassessment of priorities, with resource allocation shifted to ensure critical financial statements are reviewed during high-traffic periods. Timely adjustments to the schedule guarantee compliance with regulations set forth by the Financial Accounting Standards Board (FASB) and uphold the integrity of the audit process while accommodating necessary changes.

New Proposed Dates

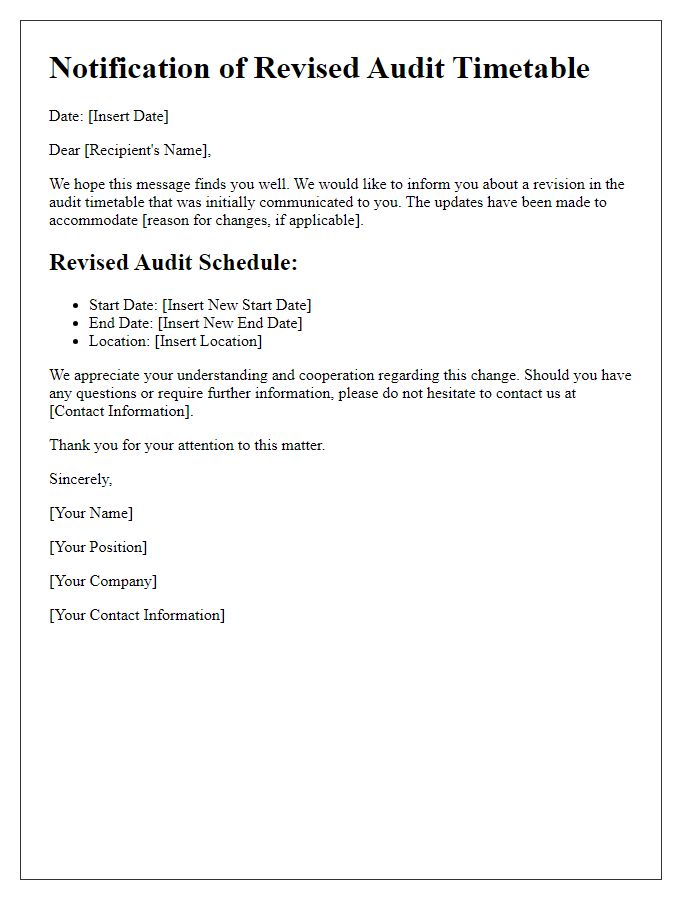

The audit schedule adjustment requires careful consideration of new proposed dates to ensure a seamless transition. The original schedule, initially set for January 15 to January 20, 2024, conflicts with critical deadlines on financial reporting. The audit team, based in New York City, has reviewed potential adjustments and suggests rescheduling to February 5 through February 10, 2024. This new timeframe aligns with the team's availability and allows for comprehensive preparation, including review of the 2023 transaction records and compliance with regulatory standards established by the Financial Accounting Standards Board (FASB). Clear communication of these changes to all relevant stakeholders is essential for maintaining transparency and accountability in the audit process.

Participant Availability

Adjustments to audit schedules may be required due to participant availability. Key stakeholders, such as department heads or team leaders, often have prior commitments that can affect their presence during scheduled audits. For instance, an availability conflict may arise if a department head is attending industry conferences (like the Annual Audit Conference in Las Vegas), other organizational meetings, or critical project deadlines, leading to missed opportunities for input and essential feedback. It is crucial to communicate with all involved parties early to gather availability data, thus enabling the creation of a revised audit timetable that accommodates key participants. This approach ensures comprehensive engagement and effective auditing processes.

Impact on Audit Timeline

An adjustment to the audit schedule can significantly impact the overall audit timeline, including the phases of planning, fieldwork, and reporting. A rescheduled audit may lead to compressed timeframes, requiring auditors to accelerate their procedures to meet original deadlines. For instance, a revised timeline may necessitate a reassessment of risk areas, particularly if the dates fall during critical financial reporting periods such as fiscal year-end closing in December. Moreover, resource allocation must be reconsidered, as team members may have prior commitments, resulting in potential delays. The interaction with client personnel could also be affected, particularly if key stakeholders are unavailable. Consequently, this alteration might lead to an increased likelihood of achieving incomplete or insufficient audit evidence, ultimately impacting the quality and effectiveness of the audit conducted.

Contact Information for Queries

In an audit schedule adjustment scenario, maintaining clear and accessible contact information is crucial for effective communication. The designated contact person, often a Senior Auditor or Audit Manager, should be listed prominently, including their full name and direct phone number. An email address must also be provided to facilitate quick inquiries or requests for clarification. For example, the Senior Auditor, John Smith, can be reached at (555) 123-4567 or john.smith@auditfirm.com. Additionally, it is beneficial to specify backup contacts, such as a Junior Auditor, Jane Doe, available at (555) 987-6543 or jane.doe@auditfirm.com, ensuring queries are promptly addressed even if the primary contact is unavailable. Clear instructions for reaching these individuals can streamline communication during the audit process.

Comments