In today's fast-paced world, staying compliant with legal regulations is essential for any association's success. With new laws and guidelines constantly emerging, it can feel overwhelming to keep up with the requirements that affect your organization. This article aims to simplify the legal landscape, offering practical insights and updates to keep your association on the right track. So, let's dive in and explore how to ensure your compliance strategy is up to date!

Regulatory Changes

The recent regulatory changes have significant implications for nonprofit associations, requiring a thorough review of legal compliance strategies. The IRS introduced updated guidelines on tax-exempt status in 2023, particularly affecting organizations with gross receipts exceeding $200,000 annually. States like California and New York implemented stricter nonprofit transparency laws, mandating more detailed financial disclosures in annual reports. Failure to comply with these regulations can lead to penalties, loss of tax-exempt status, or increased scrutiny from regulatory bodies. Associations must also consider updated fundraising regulations, particularly regarding online donations and data protection, which necessitate adjustments in membership practices and outreach efforts.

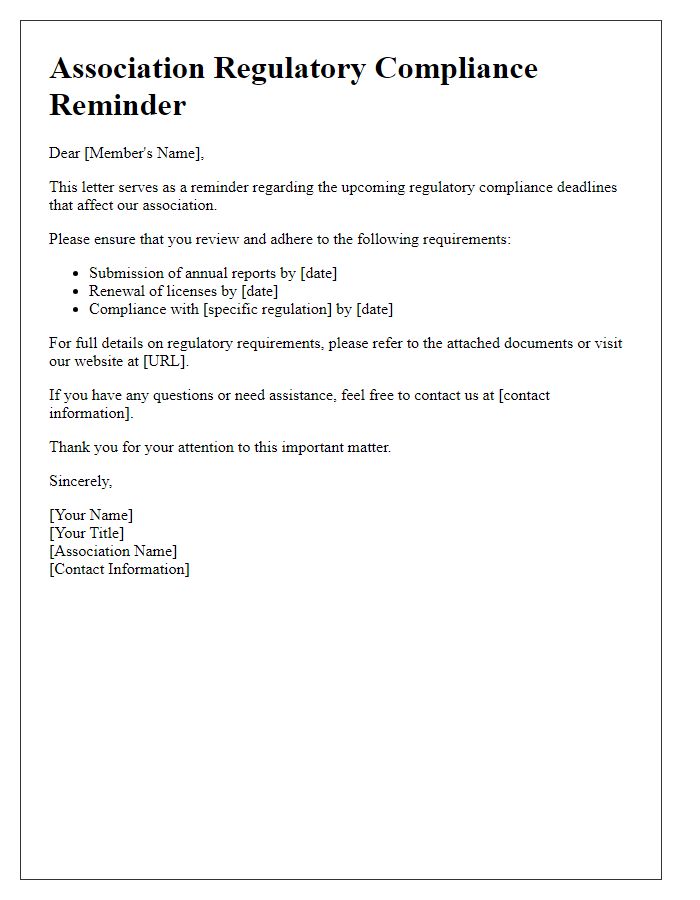

Compliance Requirements

Compliance requirements for associations involve adherence to federal, state, and local laws governing nonprofit organizations. Essential documents include by-laws which outline governance structures, conflict of interest policies ensuring board member transparency, and annual financial statements reflecting fiscal responsibility. The IRS Form 990 is a crucial filing reflecting financial integrity and must meet deadlines to maintain tax-exempt status. Additionally, state charitable registration is vital for fundraising activities, requiring adherence to each state's regulations. Regular training on compliance matters for board members enhances understanding and reduces risk of violations, promoting a culture of accountability and ethical conduct within the organization. Regular audits and compliance checklists help ensure alignment with evolving legal standards, cementing trust with stakeholders and the community.

Risk Management Strategies

Risk management strategies are essential for associations to navigate potential legal challenges effectively. Regular compliance audits (conducted quarterly or semi-annually) are vital for identifying gaps in adherence to regulations. Training programs for staff at locations like community centers and administrative offices ensure that employees understand their responsibilities regarding legal standards. Additionally, developing a crisis communication plan prepares the association to handle incidents swiftly and professionally. Monitoring changes in laws (such as the Sarbanes-Oxley Act or GDPR) impacts governance policies and enhances transparency. Implementing robust insurance coverage tailored to specific operational risks protects assets and maintains member confidence. Collaboration with legal advisors facilitates informed decision-making around risk exposure in events and activities.

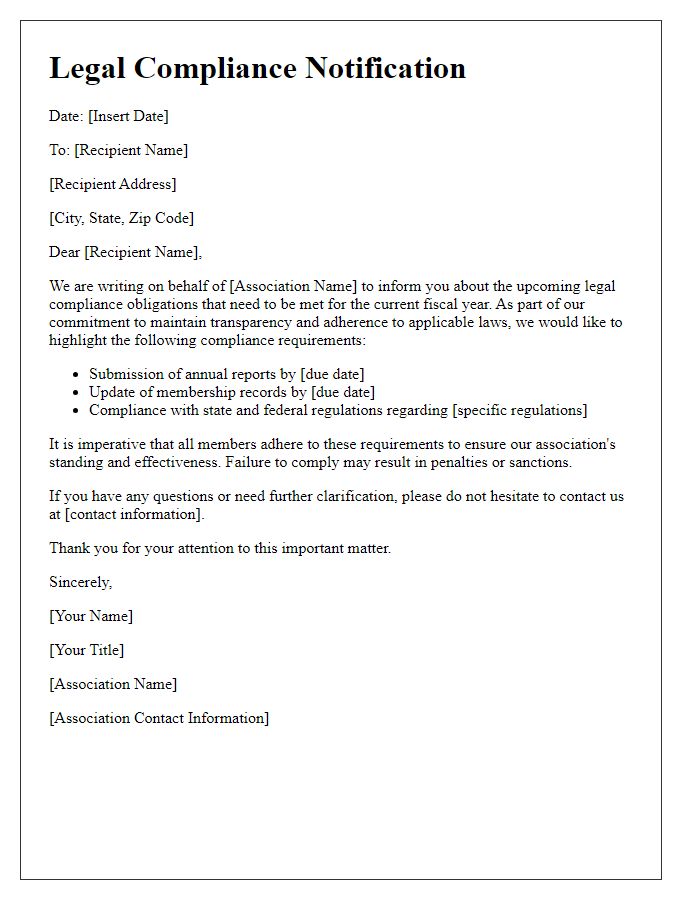

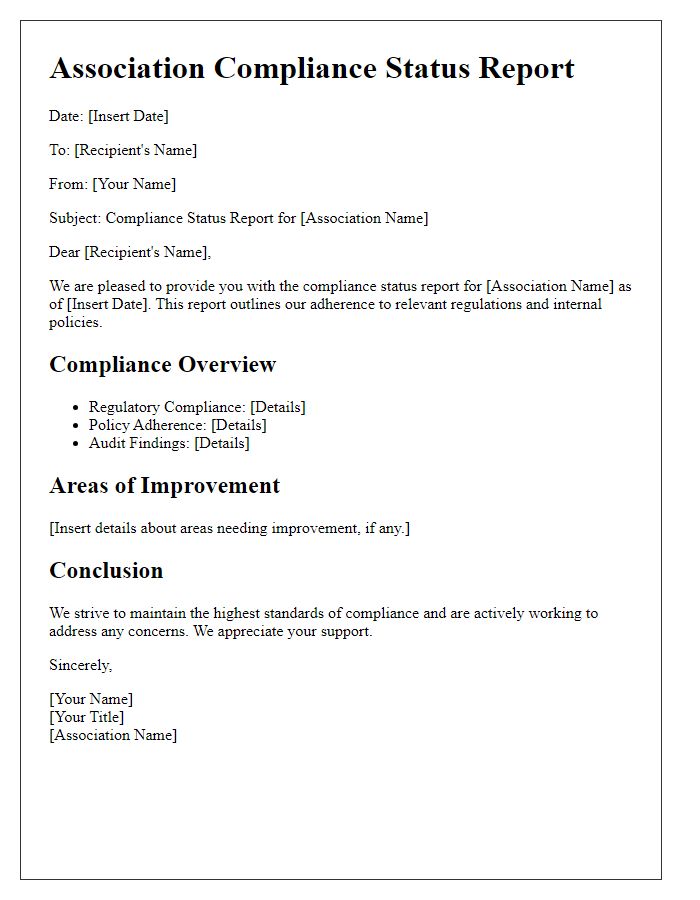

Reporting Procedures

The association's reporting procedures encompass a range of legal compliance measures designed to ensure accountability and transparency in operations. These procedures include the regular submission of financial statements, adherence to the guidelines set forth by the Internal Revenue Service (IRS), and compliance with state regulations, particularly in states like California where nonprofit organizations face strict scrutiny. Each year, the association must file Form 990, which provides detailed financial information and highlights the organization's mission and achievements. Furthermore, documentation related to grants and donations must be systematically recorded and maintained, adhering to audit requirements which typically occur biennially. The association's governance structure includes a compliance officer responsible for monitoring adherence to compliance protocols and ensuring staff training on these procedures, particularly during quarterly meetings to address any updates or changes in legal requirements.

Training and Education Initiatives

Training and education initiatives play a vital role in ensuring legal compliance within associations. Educational programs focused on key topics, such as regulations from the Internal Revenue Service (IRS) regarding tax-exempt status and the standards set forth by the Federal Trade Commission (FTC) on advertising and fundraising practices, are essential. Regular workshops and online courses can enhance member awareness of pertinent laws, including the Americans with Disabilities Act (ADA) requirements for accessibility and the Health Insurance Portability and Accountability Act (HIPAA) relating to patient privacy. These initiatives foster a culture of compliance, promoting understanding of legal obligations among staff and members, ultimately safeguarding the association's reputation and operational integrity. Robust record-keeping practices and regular compliance audits further solidify the effectiveness of training efforts.

Comments