Are you feeling overwhelmed by the process of filing a travel insurance claim? You're not aloneâmany travelers struggle to navigate the complexities involved. Understanding the steps and necessary documentation can make all the difference in successfully securing your refund. So, if you're looking for helpful tips and a reliable letter template to simplify your claim, keep reading!

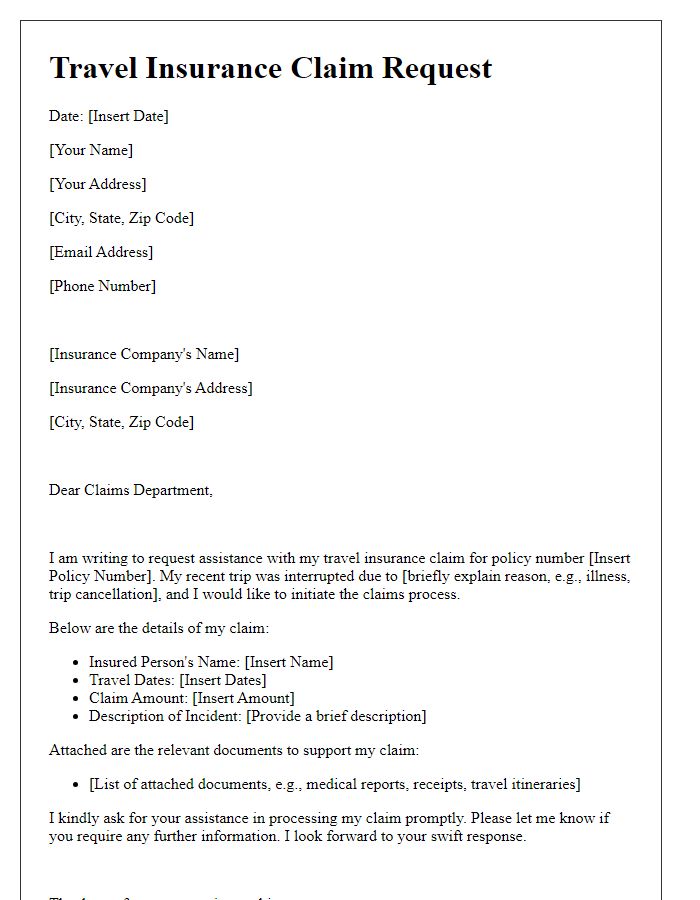

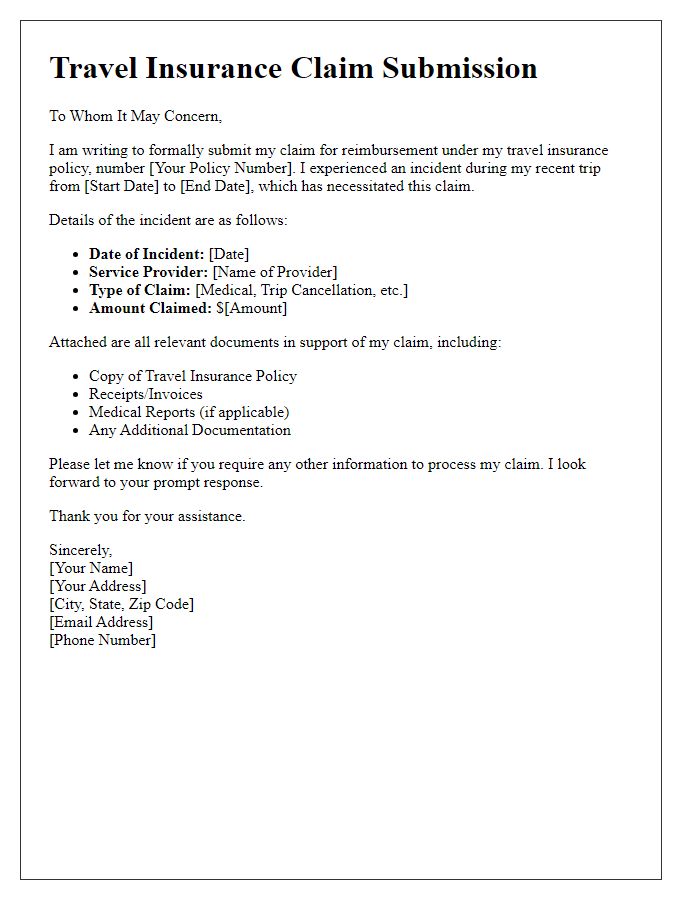

Policy Number and Personal Details

Travel insurance claims require clear documentation and specific details to process effectively. The policy number, a unique identifier assigned to your insurance plan, is crucial for tracking your claim within the insurer's system. Personal details include your full name, date of birth, and contact information, which allows the insurer to verify your identity and link the claim to the correct policy. Additionally, providing details about the travel dates, destination, and specific reason for the claim--such as medical emergencies or trip cancellations--enhances the clarity and efficiency of the claims process. Accurate and thorough information aids faster resolution and ensures you receive the assistance needed during your travel disruptions.

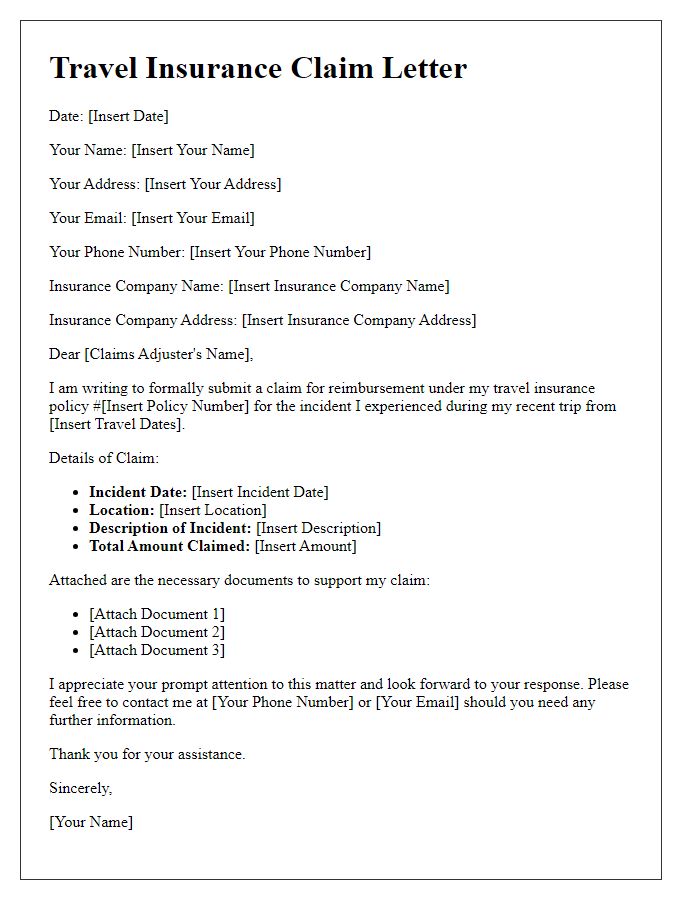

Description of Incident and Loss

During a recent trip to Bali, Indonesia, on October 5, 2023, I experienced a significant incident that impacted my travel plans. While engaging in a scheduled excursion to the popular Ubud Rice Terraces, I suffered a slip and fall accident. The incident occurred on a slippery path near Tegallalang, resulting in a sprained ankle. Immediate medical attention was required, leading to a visit to the nearest clinic, where I incurred medical expenses totaling approximately $250 for diagnosis and treatment. Besides the medical costs, I also faced additional losses, including cancellation of my planned tours and accommodations for the following days due to my inability to walk comfortably, resulting in further expenses of $500. The overall impact disrupted my travel itinerary, causing not just financial loss but also significant emotional distress during what was intended to be a relaxing vacation.

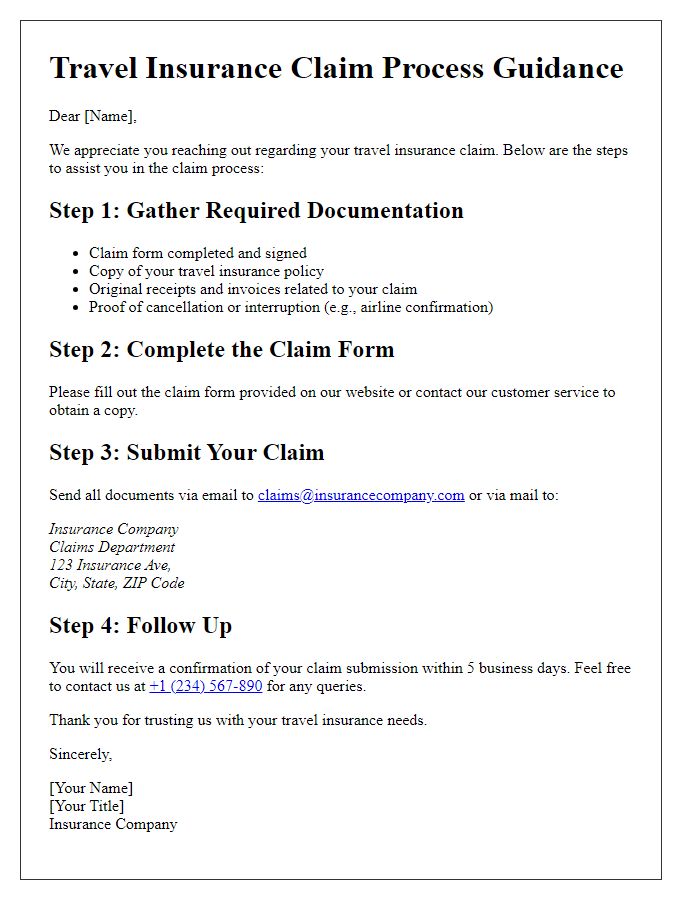

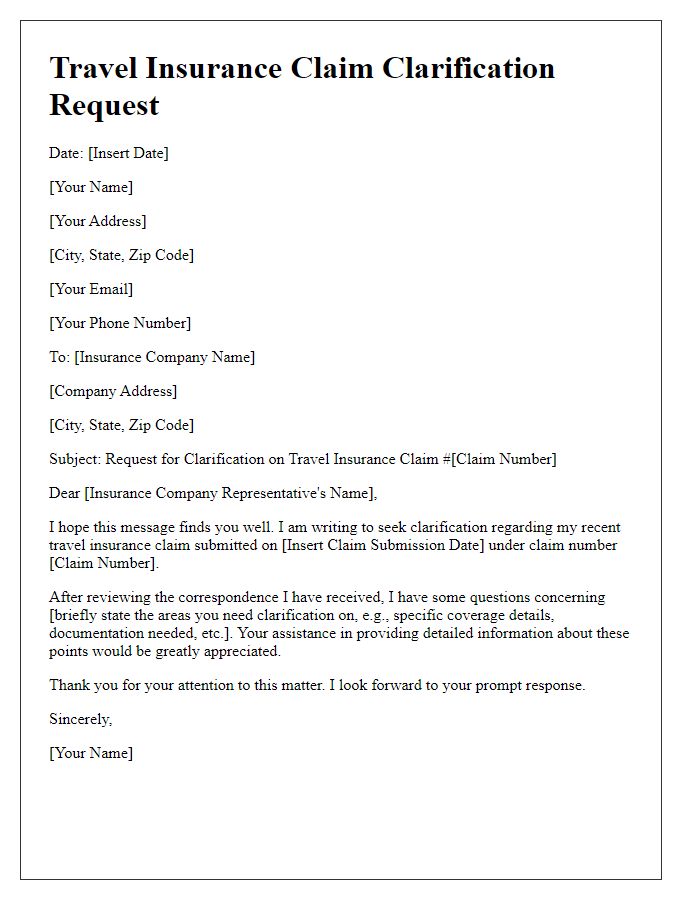

Supporting Documentation and Evidence

Travel insurance claims often require substantial documentation to substantiate the request. Essential evidence includes medical reports detailing the illness or injury, receipts for any medical expenses incurred during the trip, and proof of trip interruption or cancellation, such as original flight itineraries or hotel reservations. It is critical to include police reports for theft incidents, as well as photographs of damaged property or lost items, to bolster the claim's validity. Collecting supporting documentation is vital for a seamless claims process, ensuring that all necessary information is readily available for assessment by the insurance provider.

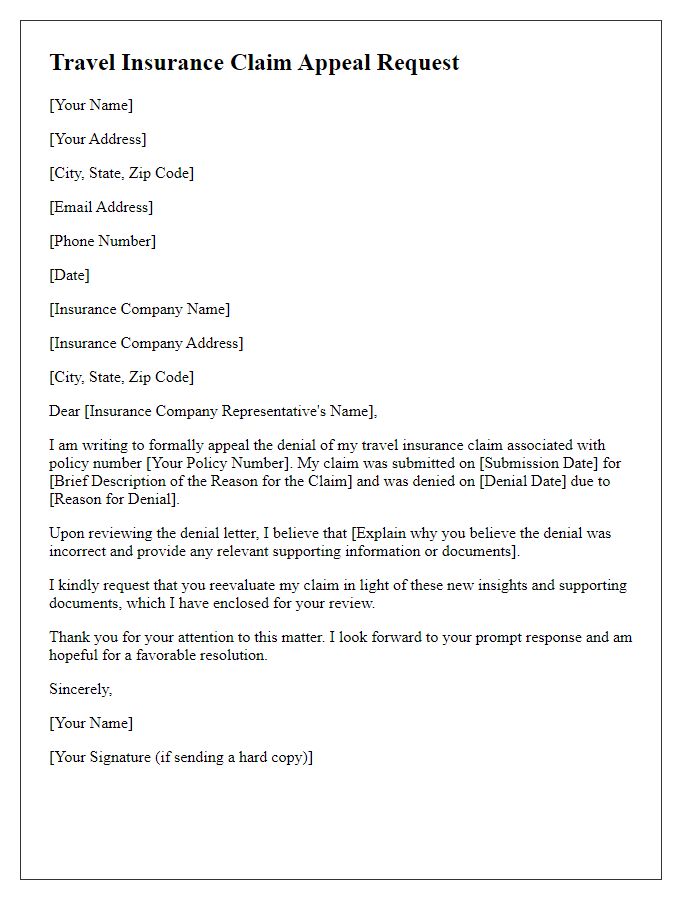

Request for Reimbursement or Coverage

Travel insurance claims often arise from unforeseen events, such as medical emergencies or trip cancellations, leading to financial stress for travelers. Policies under Travel Guard or Allianz may cover costs associated with flight delays, lost luggage, and emergency medical services abroad. Claims should be supported by detailed documentation, including receipts, incident reports, and medical records, ensuring a comprehensive presentation of incurred expenses. Submitting claims promptly, typically within 30 days of the event, increases the chances of successful reimbursement. Additionally, contacting the insurance company's customer service for guidance can streamline the claims process and provide clarity on covered events and required documentation.

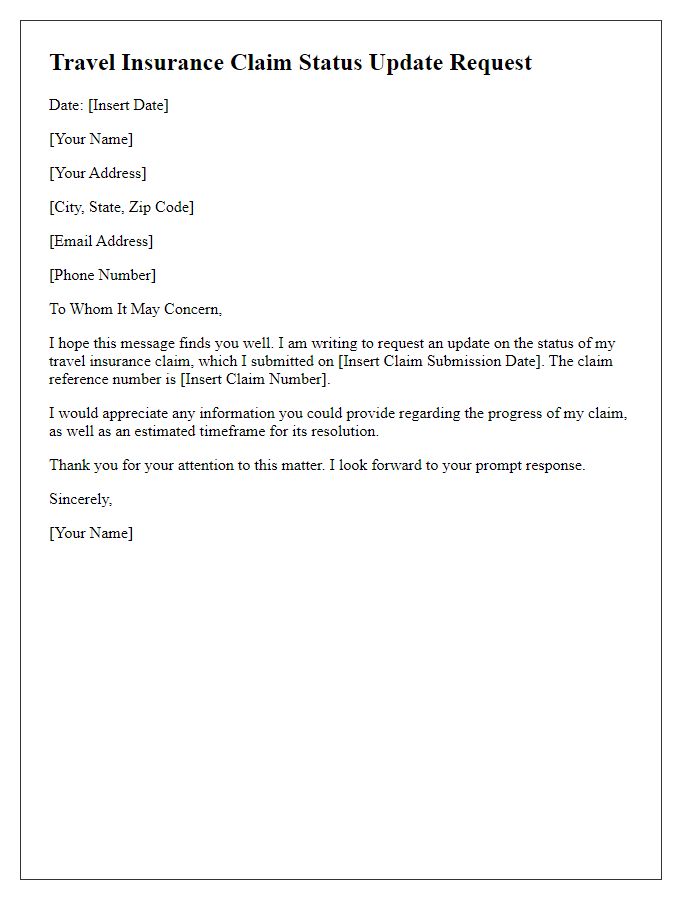

Contact Information and Response Deadline

When initiating a travel insurance claim, essential information includes contact details such as your full name, email address, phone number, and policy number to ensure proper identification and swift processing. Specify the incident date, location, and a detailed account of the events, attaching any necessary documentation like receipts, medical reports, or police reports to substantiate the claim. Set a response deadline, typically around 30 days from submission, to encourage timely communication and resolution. Noting the specific insurance company name, along with the claims department's address, is crucial for directing correspondence accurately, ensuring that communication aligns with the correct processing channels for efficient claim management.

Comments