Are you struggling with issues related to duty-free purchases? Whether it's confusion over regulations or problems with refunds, navigating the world of duty-free can be quite tricky. In this article, we'll break down common challenges and share essential tips to ensure your shopping experience is seamless. Stick around to discover how you can tackle your duty-free purchase issues with ease!

Specific item details and purchase location

A duty-free purchase issue often arises from specific items that exceed the allowed limits when imported. Common products in such situations include alcohol (often over 1 liter per person for spirits) and tobacco (cigarettes typically limited to 200 per adult). The point of purchase significantly aids in resolution; for instance, purchase locations like Changi Airport (Singapore) or Heathrow Airport (London) have distinct regulations. Documentation, such as the purchase receipt and a copy of the passport, should be compiled to clarify travel and acquisition details. Retail permits within these duty-free shops ensure compliance with international customs regulations.

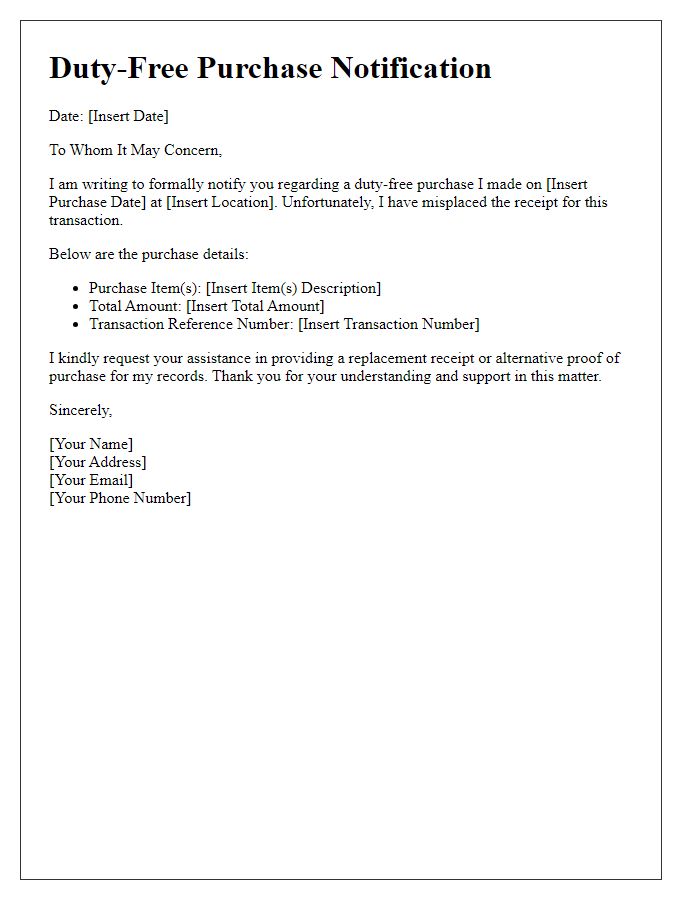

Original receipt or proof of purchase

The lack of an original receipt or proof of purchase can significantly hinder the resolution process for duty-free purchases made at international airport terminals, such as Charles de Gaulle in Paris or JFK in New York. Tax refund claims require clear documentation, typically a detailed receipt indicating the date, item description, and amount spent, including the currency used. Without this crucial evidence, customers may face challenges in obtaining refunds for duties paid, which can range from 5%-20% depending on the country's regulations. This situation often leads to frustrations, particularly following significant purchases, as customers seek reimbursement for taxes incurred on luxury items like designer fragrances or alcohol. Additionally, merchants may have specific policies regarding lost documentation, further complicating attempts to rectify the issue.

Description of the issue encountered

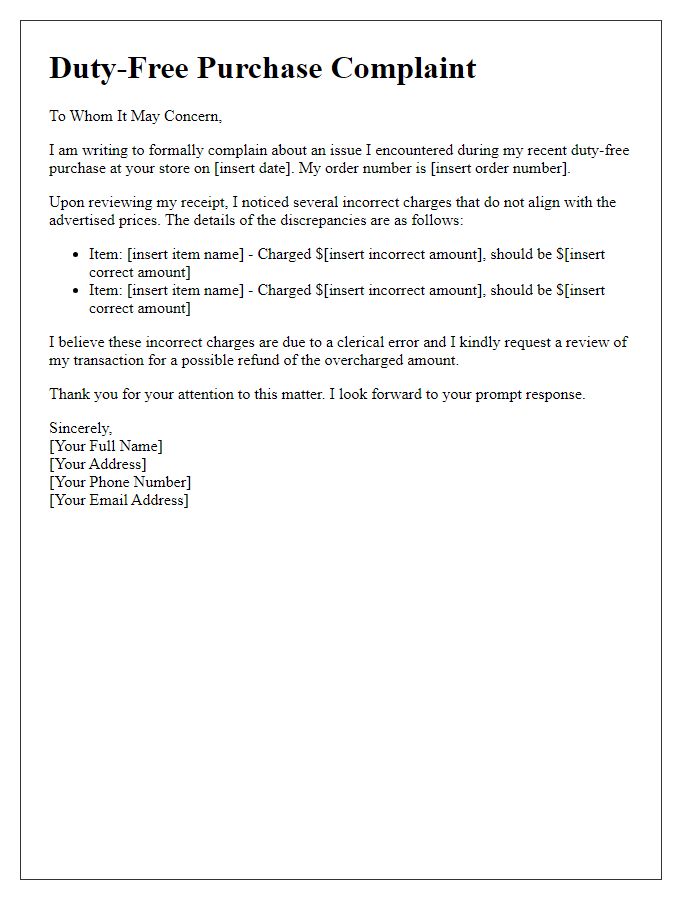

A duty-free purchase issue arose when attempting to buy a luxury watch at the London Heathrow Airport duty-free store. The advertised price of the watch was PS1,500, claiming a significant tax exemption for international travelers. However, during checkout, the cashier informed me that the final amount was incorrectly calculated, totaling PS1,650 due to additional fees not previously disclosed. This discrepancy created confusion regarding the duty-free policy and regulations, particularly with the EU customs allowance for travelers returning to the United States, which typically caps at $800. The unexpected charges and lack of clear communication on the pricing structure resulted in an unsatisfactory shopping experience, prompting the need for clarification on duty-free policies and potential restitution for the overcharge.

Customer contact information

Contacting duty-free sales representatives can help address concerns regarding purchase issues for travelers seeking tax-exempt items. Customers should prepare: full name, email address, phone number, and shipping address as crucial information for resolving inquiries. Providing a detailed description of the purchased items, including item names, dates of purchase, and store locations within international airports (e.g., Heathrow, JFK) enhances communication efficiency. Confirming passport information, including passport number and nationality, may be necessary to validate tax exemption. Summarizing the issue clearly aids in swift resolutions, addressing potential delays or discrepancies.

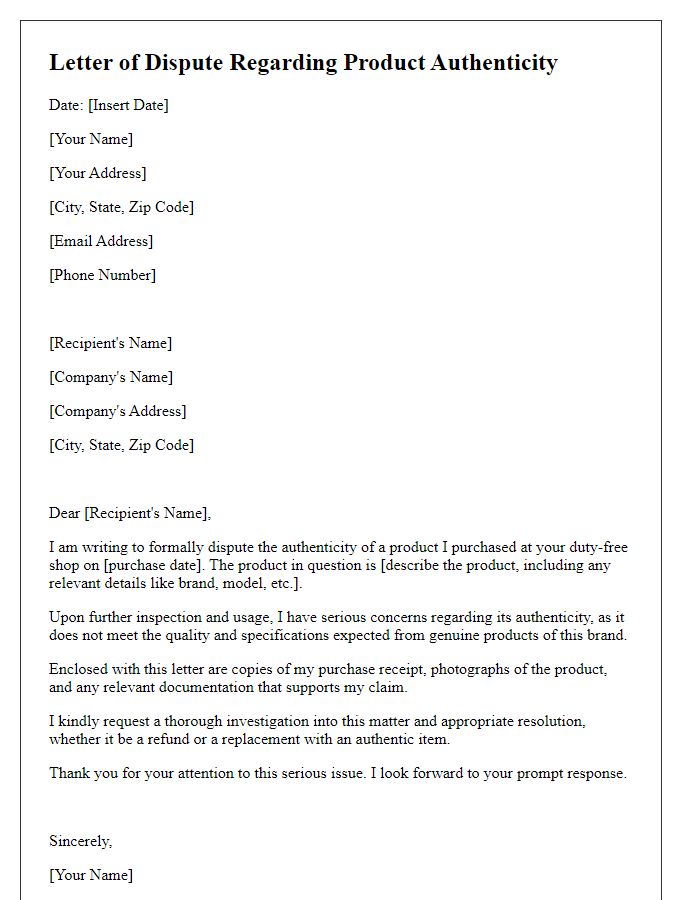

Requested resolution or refund preference

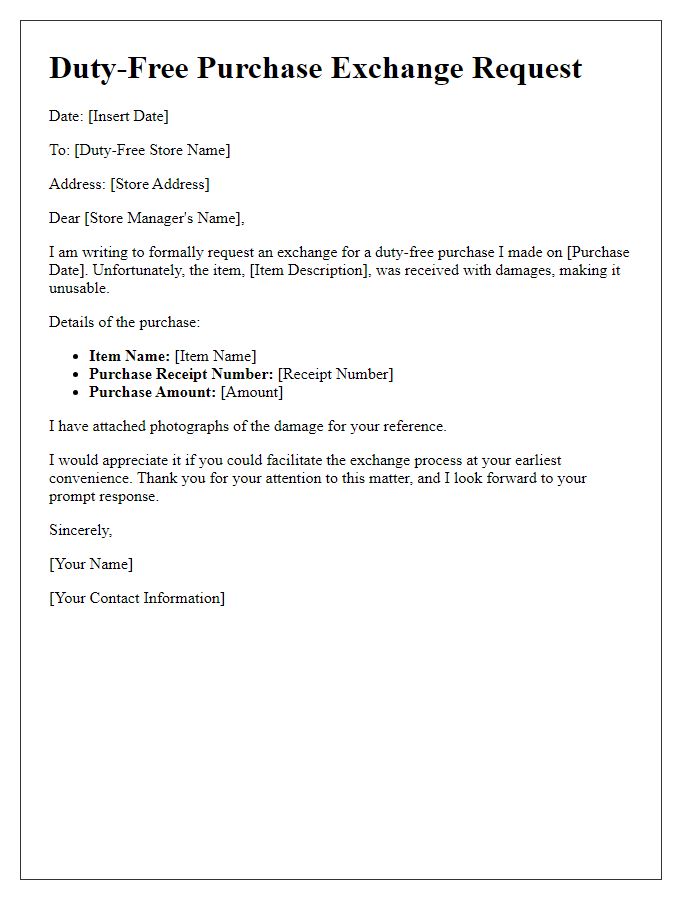

A duty-free purchase issue often arises when customers encounter problems with items bought in international airports, typically governed by regulations that allow travelers to buy goods free of local tariffs. Details such as transaction dates, purchase amounts, and specific product descriptions can significantly affect resolution procedures. For instance, perfumes, cosmetics, and electronics often represent popular items in duty-free shops. Customers facing complications, such as incorrect pricing or damaged goods, usually prefer resolutions that include refunds or replacements, contingent upon presenting valid receipts and adhering to respective airline and country regulations. Immediate actions usually require contacting customer service representatives familiar with local laws and store policies. Such prompt communications can facilitate smoother resolution processes for both parties involved.

Letter Template For Duty-Free Purchase Issue Samples

Letter template of duty-free purchase complaint regarding incorrect charges.

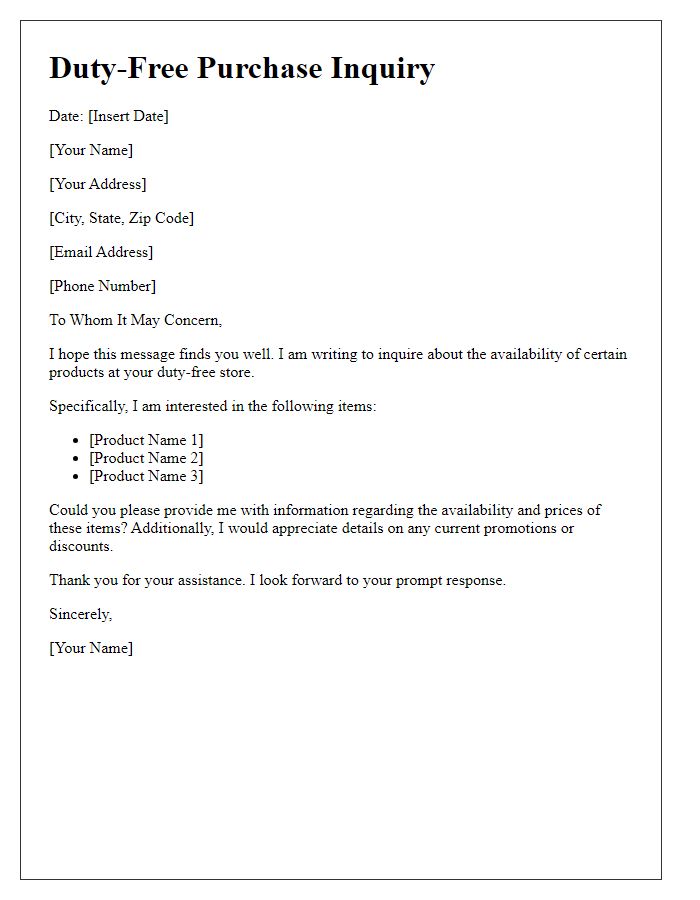

Letter template of duty-free purchase inquiry about product availability.

Letter template of duty-free purchase request for exchange due to damage.

Letter template of duty-free purchase appeal for a refund on defective items.

Letter template of duty-free purchase clarification for customs regulations.

Letter template of duty-free purchase feedback on customer service experience.

Letter template of duty-free purchase summary for tax reimbursement process.

Comments