Are you navigating the complexities of a liquidation agreement? Understanding the essential elements involved can make all the difference in ensuring a smooth process. This article breaks down key instructions and considerations every business should keep in mind during liquidation. Join us as we explore these vital aspects and equip you with the knowledge you need to move forward confidently!

Parties Involved

A liquidation agreement involves several critical parties. The primary party, referred to as the "Debtor," is the individual or entity undergoing liquidation, often facing insolvency or financial distress. The "Creditors" are those owed money by the Debtor, which can include banks, suppliers, employees, and investors, each potentially pursuing their claims during the liquidation process. A "Liquidator," appointed by a court or the creditors, manages the liquidation process, ensuring asset evaluation and distribution according to legal and contractual obligations. Lastly, "Stakeholders" represent individuals or organizations interested in the outcome, such as shareholders or regulatory bodies. Clear identification of these parties ensures structured communication and compliance throughout the liquidation process, protecting the rights and interests involved.

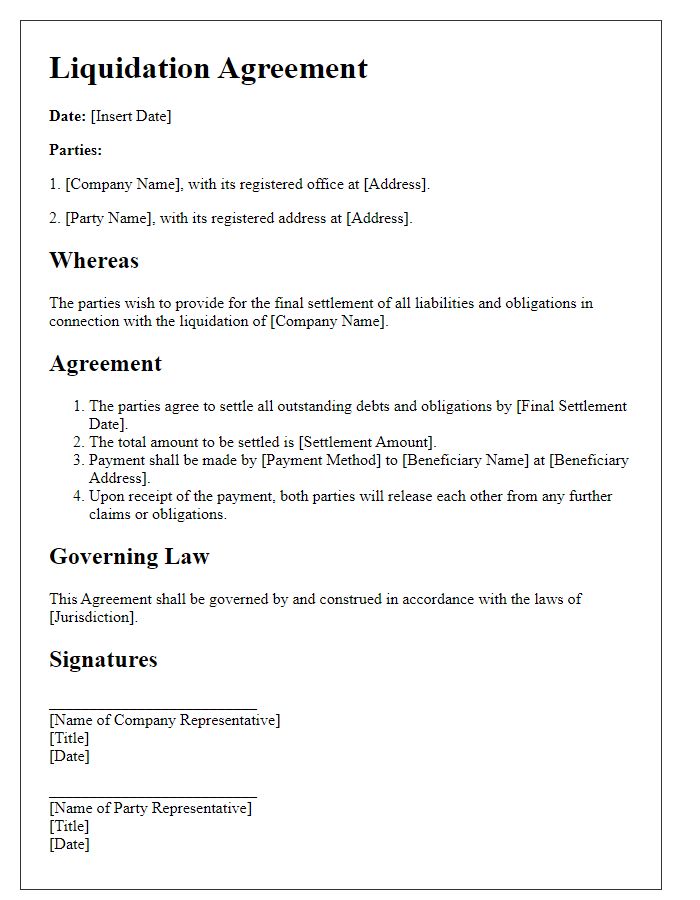

Terms and Conditions

A comprehensive liquidation agreement provides clear terms and conditions to protect all parties involved in the winding up process of a business. Essential components include the identification of the company (including registration number) undergoing liquidation, the appointed liquidator, and the specific date when the liquidation commences. Clauses detailing the distribution hierarchy of remaining assets, including secured and unsecured creditors, are crucial for transparency during asset allocation. Additionally, terms should encompass the process for notifying creditors and stakeholders, the timeline for claims submission, as well as the responsibilities of the liquidator throughout the liquidation process. Compliance with legal regulations such as the Companies Act in the jurisdiction ensures that all actions taken during the liquidation adhere to required standards and protects against potential legal ramifications.

Asset Distribution

In a liquidation agreement for asset distribution, the process entails several key steps to ensure fair and legal allocation of assets among creditors and stakeholders. The assets, such as inventory, real estate, and liquidated funds, must be accurately valued and documented, often by a licensed appraiser. After valuation, a comprehensive list of creditors, detailing the amounts owed, should be compiled to facilitate equitable distribution. The liquidation process may be overseen by a appointed trustee, responsible for ensuring compliance with applicable regulations, such as those outlined in the Bankruptcy Code. Furthermore, the distribution plan must be transparent, often requiring approval from a majority of creditors within specific timeframes (e.g., 30 days) to prevent disputes. Each distribution must be recorded, providing a clear audit trail for future reference, ensuring all parties understand the allocation process.

Obligations and Liabilities

In a liquidation agreement, companies undergoing financial distress must navigate their obligations and liabilities to ensure a smooth cessation of operations. Obligations include settling debts owed to creditors, which may range from secured loans with banks (often exceeding millions of dollars) to unsecured debts like outstanding invoices from suppliers. Liabilities also encompass employee severance packages, which are dictated by labor laws in jurisdictions such as the United States, where severance pay can amount to several weeks or months of salary based on tenure. Additionally, assets must be liquidated to cover these debts, including physical property like office buildings or equipment, and intangible assets like patents or trademarks. Compliance with applicable regulations, like the Bankruptcy Code in the US, is critical to protect against potential legal repercussions. Proper execution of these obligations and managing liabilities is crucial for the responsible closure of business operations.

Legal Compliance

Liquidation agreements are crucial for ensuring legal compliance in winding up a business. These agreements outline the process of selling assets, settling debts, and distributing remaining funds among creditors and shareholders. Clear adherence to statutory regulations, such as the Companies Act in the United Kingdom or the Bankruptcy Code in the United States, ensures legal protection and minimizes liability. Documentation must include detailed asset descriptions and valuations, creditor lists, and a timetable for the liquidation process. Failure to comply with legal requirements can result in penalties or challenges from creditors. Legal counsel is advisable to navigate complex regulations effectively and safeguard stakeholders' interests.

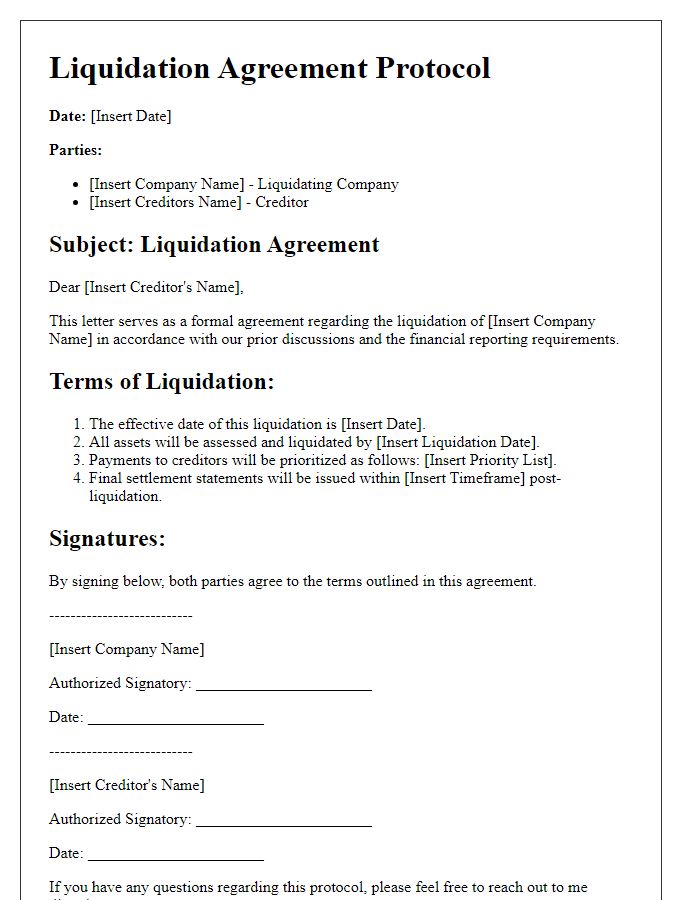

Letter Template For Liquidation Agreement Instruction Samples

Letter template of liquidation agreement steps for creditor notifications.

Letter template of liquidation agreement guidelines for stakeholder involvement.

Letter template of liquidation agreement essentials for business dissolution.

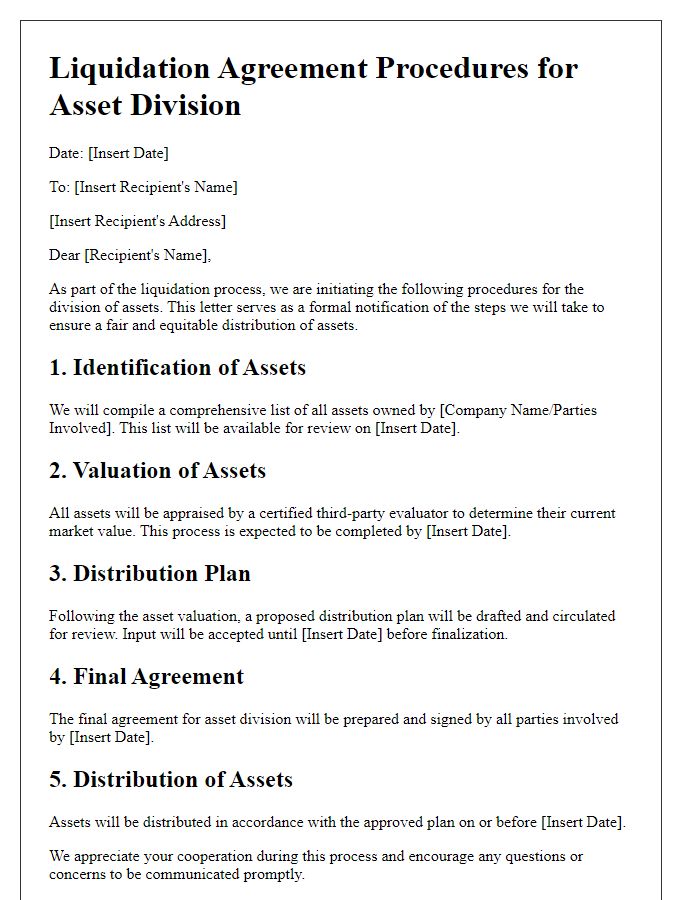

Letter template of liquidation agreement outline for compliance requirements.

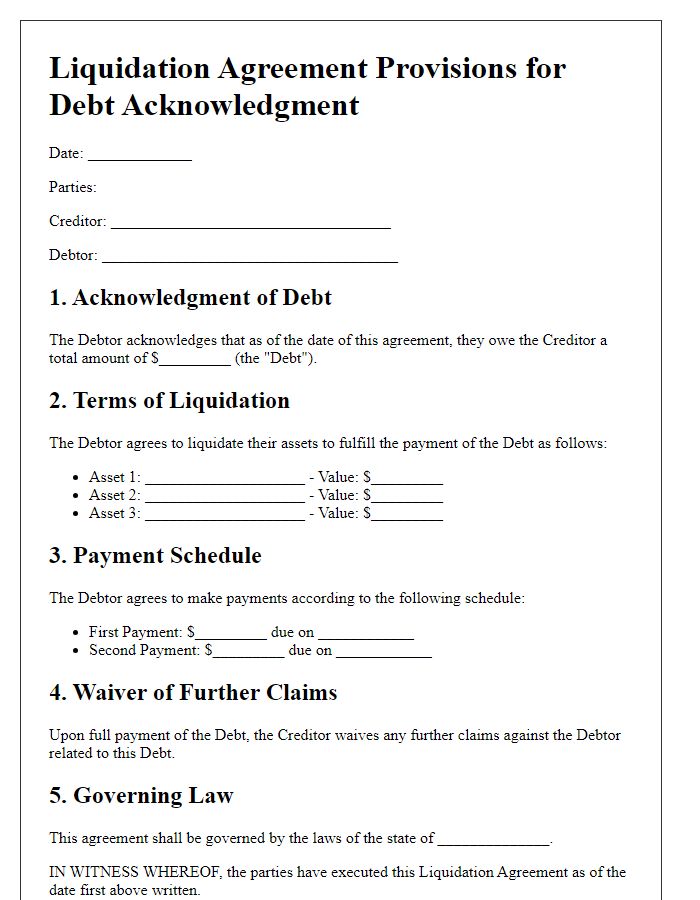

Letter template of liquidation agreement provisions for debt acknowledgment.

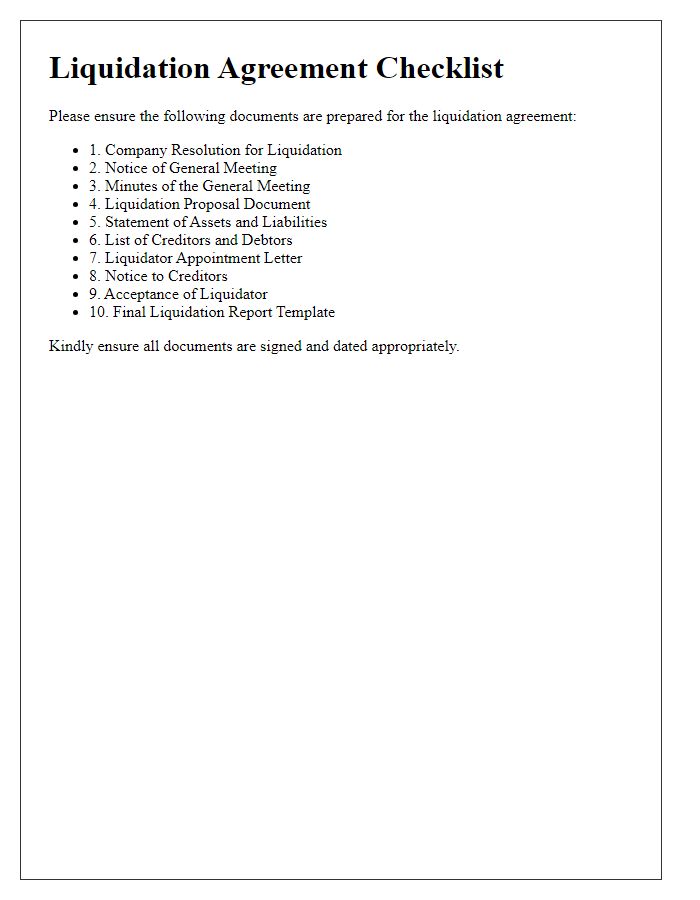

Letter template of liquidation agreement checklist for document preparation.

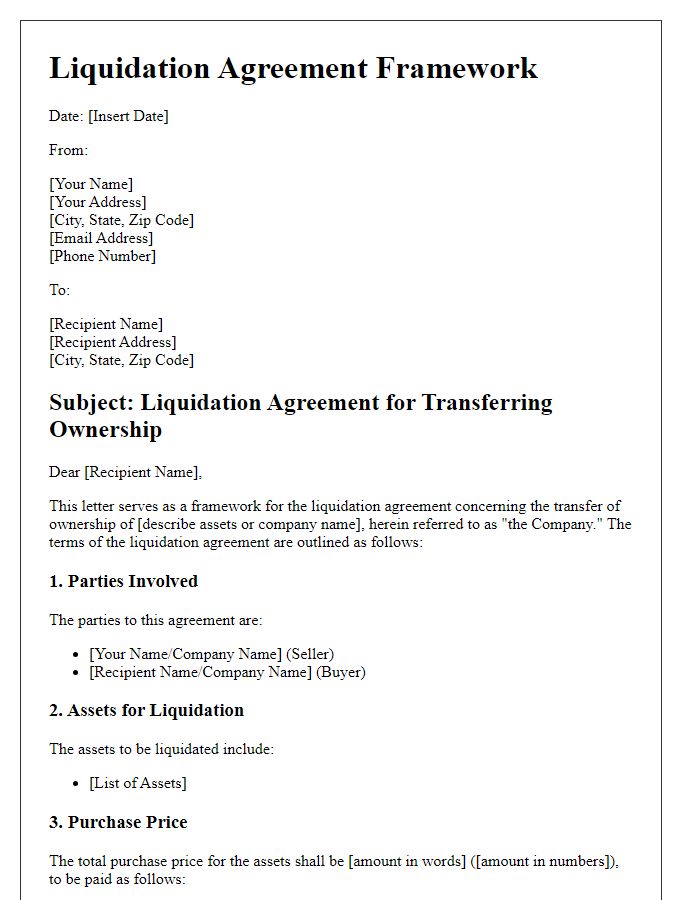

Letter template of liquidation agreement framework for transferring ownership.

Comments