Are you looking to establish a profit-sharing agreement but unsure where to start? Crafting a well-structured letter is key to laying out the terms and expectations clearly, ensuring that all parties understand their rights and obligations. This template will guide you through the essential components of the agreement, simplifying the process and making it accessible for everyone involved. So, let's dive into the details and get started on creating your profit-sharing agreement!

Purpose and Scope

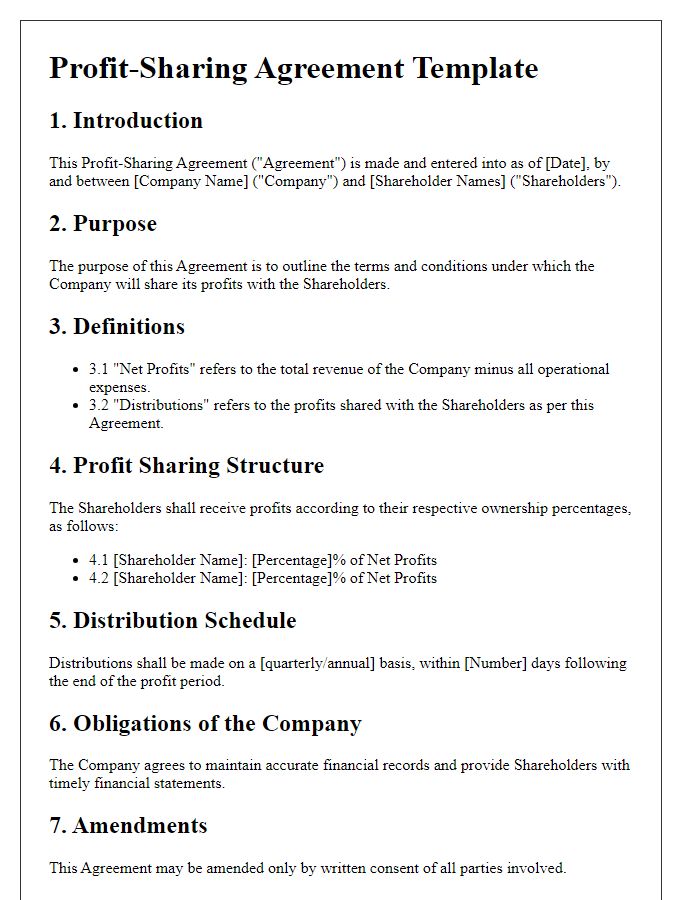

A profit-sharing agreement outlines the terms and conditions regarding the division of profits between multiple parties involved in a business venture. This document aims to define the purpose of sharing profits, which may include encouraging collaboration, increasing motivation among stakeholders, and aligning the interests of all parties. The scope of the agreement typically encompasses various aspects such as percentage distribution of profits, the time frame for profit calculation (e.g., quarterly or annually), types of revenue included (net profits, gross profits, etc.), and contingencies that might affect profit sharing (e.g., market downturns or exceptional expenses). Clear delineation of these points ensures all parties have a mutual understanding and sets expectations for future earnings distribution within the framework of the agreement.

Parties Involved

The profit-sharing agreement outlines the collaboration between business partners, specifically identifying the parties involved, which may include individual entrepreneurs, corporations, or partnerships. The primary parties are typically the Shareholders, who hold equity stakes in the venture, and the Managing Partners, responsible for day-to-day operations. Specific details regarding the percentage share allocated to each party, along with the criteria for profit calculation, play a critical role in the agreement's transparency and effectiveness. Additionally, there may be Minor Partners or Silent Investors with financial interests but limited involvement in management decisions. Each party's roles must be clearly defined to avoid potential disputes and ensure mutual understanding within the partnership, potentially influencing profit distribution ratios and decision-making processes.

Profit Calculation Methodology

A profit-sharing agreement outlines the method used to calculate profits among stakeholders in a business, typically involving revenue, expenses, and the determination of net profit. The calculation methodology often begins with total revenue generated during a specific accounting period, often measured quarterly or annually. Deducting operational expenses, which can include salaries, marketing costs, and overhead (e.g., rent, utilities), reveals gross profit. Subsequent deductions for taxes and interest payments yield net profit, the figure used for profit-sharing distribution. Stakeholders may also agree on specific percentages dedicated to profit-sharing, which can vary based on individual contributions, investments, or predefined agreements. Further stipulations may cover how losses are handled or guidelines for reinvesting profits back into the business, ensuring sustainability and growth.

Distribution Schedule

A profit-sharing agreement outlines the distribution schedule for a business's earnings among stakeholders. The schedule typically details the percentage of profits allocated to each partner, which may vary based on investment levels or roles within the company. For instance, a startup structure might allocate 40% to founding partners and 20% to employee stock options. The timing of distributions is also specified, often occurring quarterly or annually, providing clarity on payment schedules. Important dates such as the fiscal year-end (e.g., December 31) and distribution announcement dates are critical for financial planning. Additionally, the agreement may incorporate clauses regarding reinvestment of profits into business growth, which can influence future distribution percentages and timelines.

Term and Termination Conditions

A profit-sharing agreement typically includes a specified duration, such as one year or until a particular business milestone is achieved, allowing both parties to outline their expectations. Termination conditions may involve notice periods, breach of contract ramifications, or the financial performance thresholds that, if not met, allow either party to exit the agreement. Clear stipulations regarding amendments to terms, responsibilities upon termination, and remaining profit distributions ensure a fair conclusion, fostering continued positive relations between involved entities.

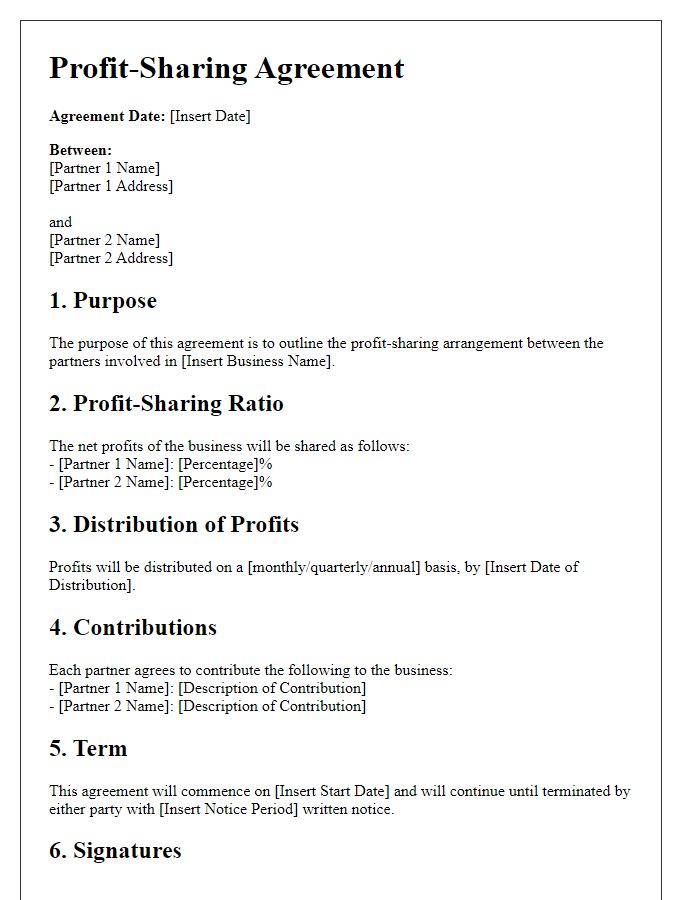

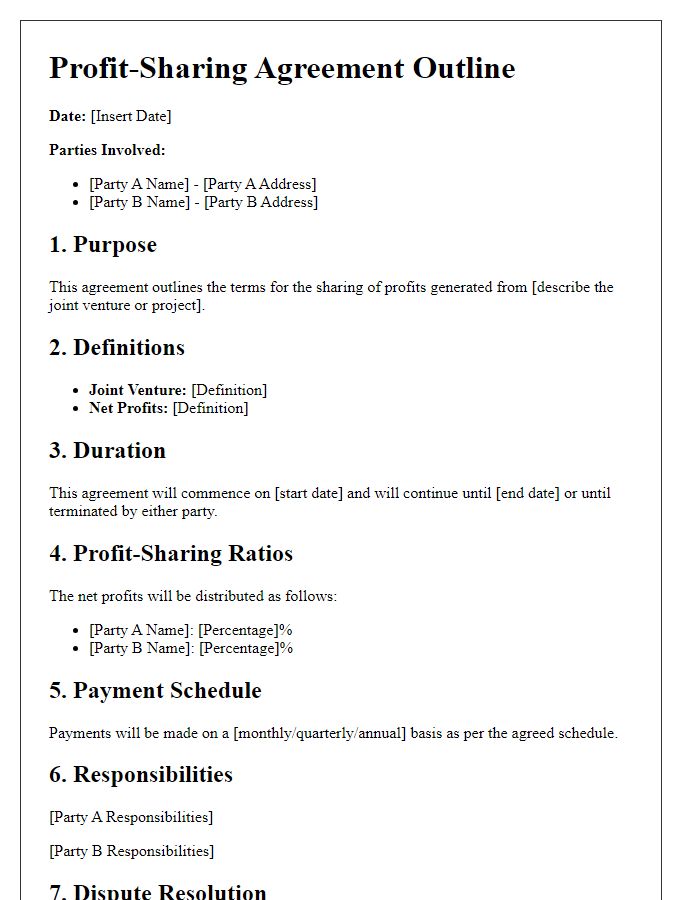

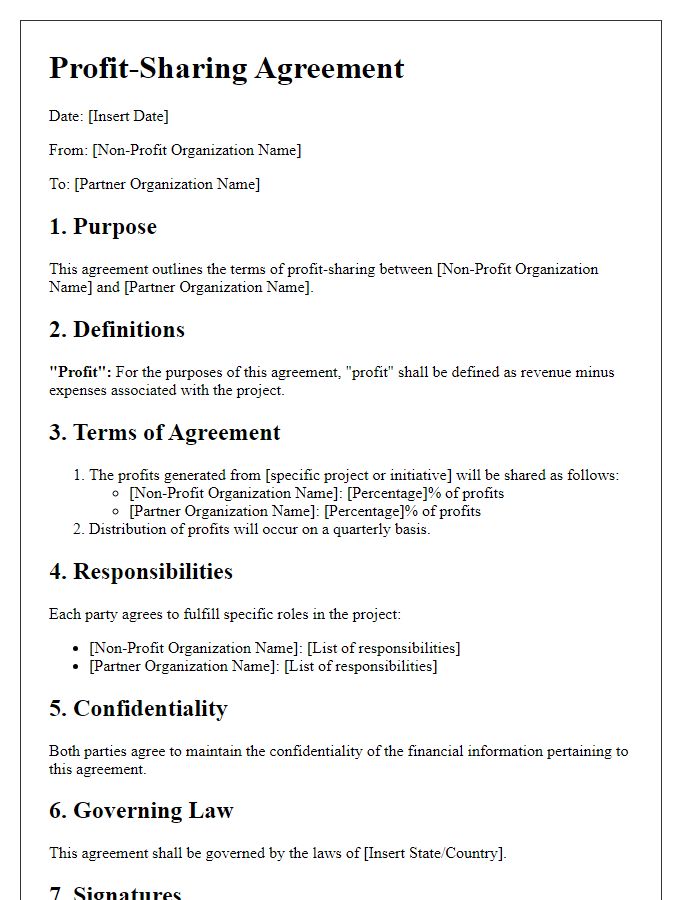

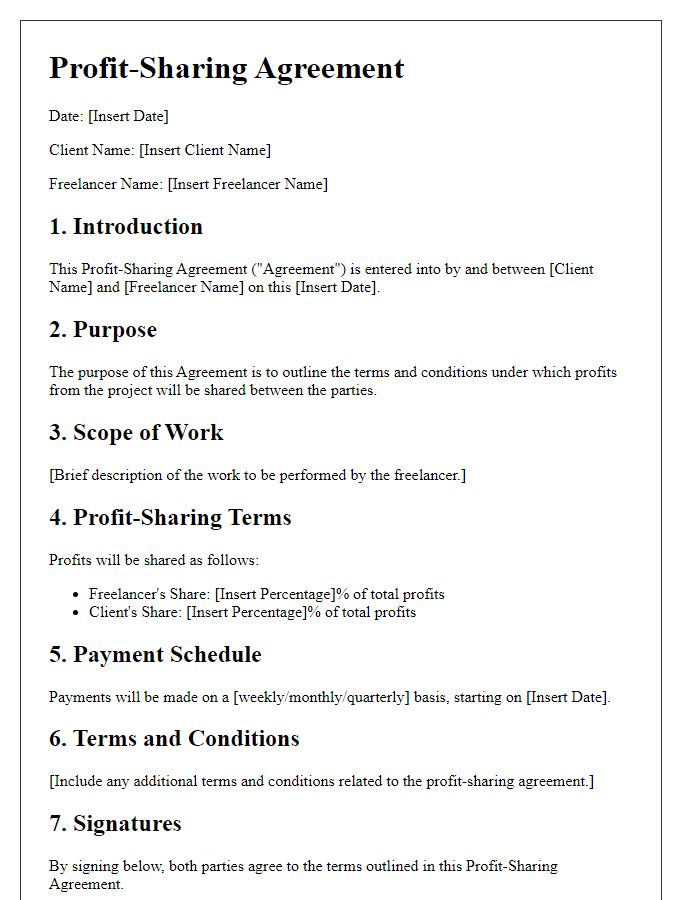

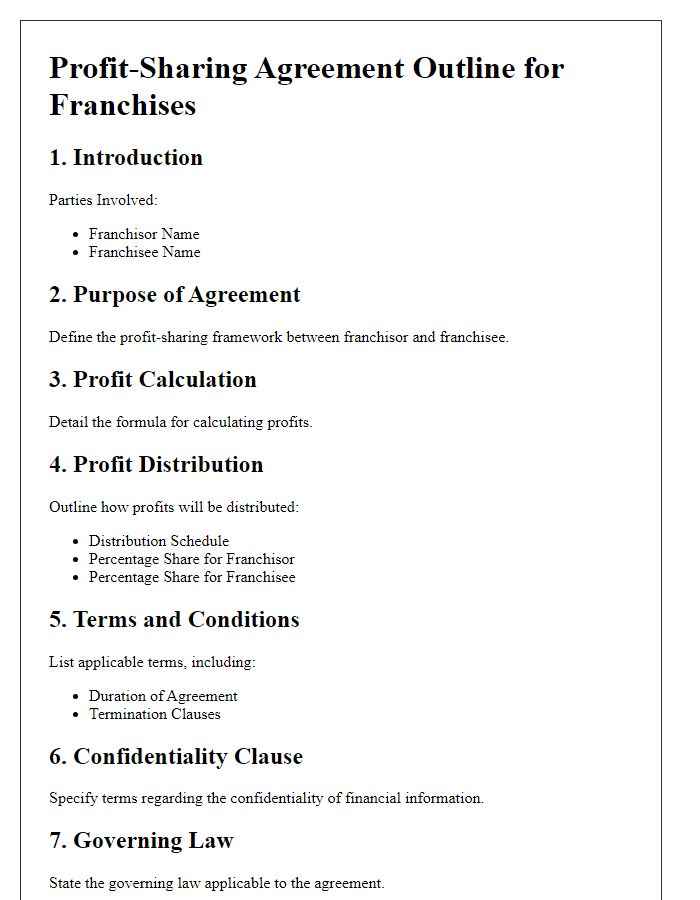

Letter Template For Profit-Sharing Agreement Outline Samples

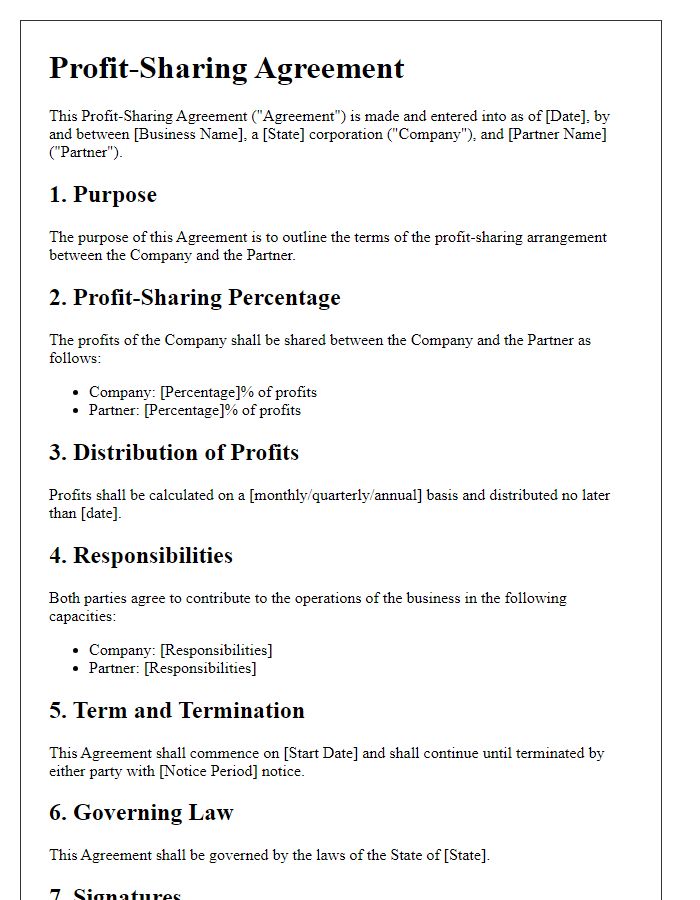

Letter template of profit-sharing agreement outline for small businesses.

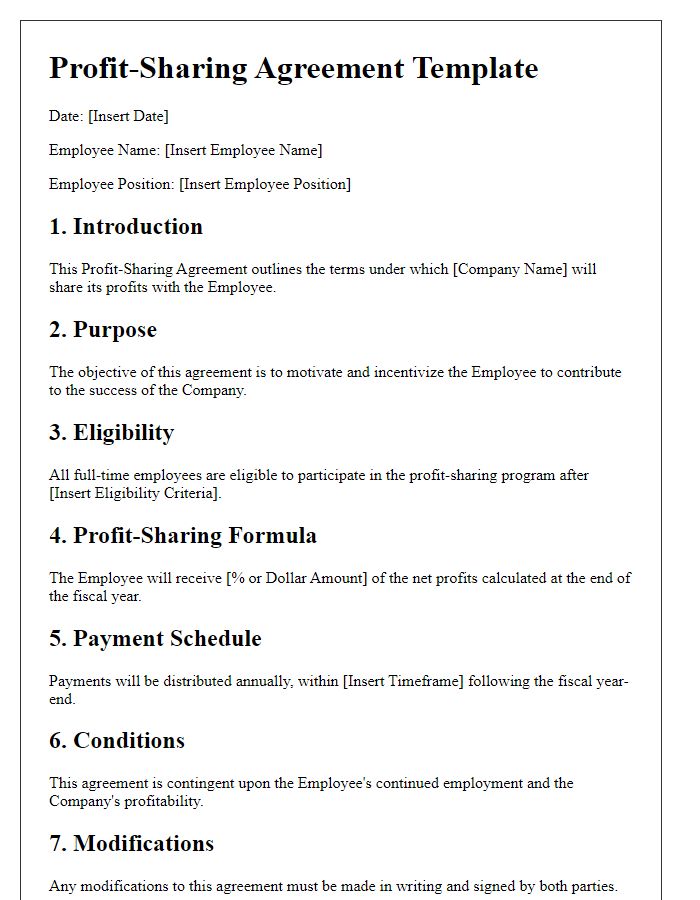

Letter template of profit-sharing agreement outline for employee incentives.

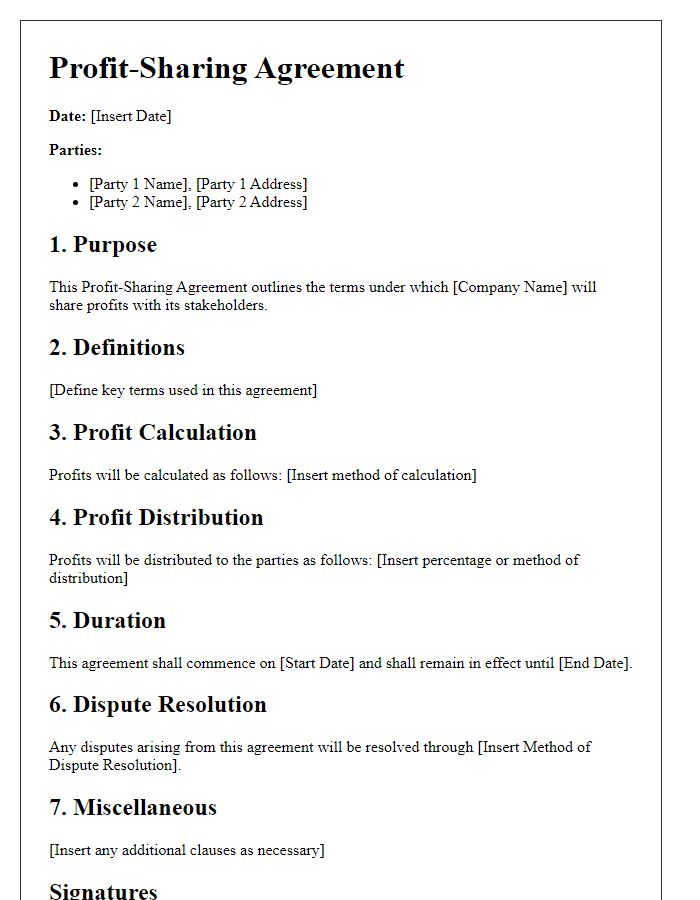

Letter template of profit-sharing agreement outline for family-owned businesses.

Comments