Are you considering entering the world of international trade but unsure where to start? An export-import agency agreement can be your key to navigating this complex landscape. By understanding the essential components of such a contract, you'll be better equipped to establish a successful partnership that drives growth and efficiency. Dive into our article to learn more about crafting the perfect agreement that suits your business needs!

Parties Involved

An export-import agency agreement involves multiple parties, including exporters (typically manufacturers or wholesalers), importers (often retailers or local distributors), and the agency (the intermediary that facilitates trade). The exporter, based in a specific country, supplies goods like electronics or textiles, while the importer, located in a different country, seeks those products for its market. The agency plays a crucial role, often registered in both countries, that manages logistics, negotiations, and compliance with local regulations. Parties also include legal entities such as trade organizations, which may offer support services like market research or legal advice to ensure smooth transactions. Each party's responsibilities, rights, and obligations are vital for establishing a successful trade relationship.

Scope of Services

The Scope of Services in an export-import agency agreement outlines the specific responsibilities and tasks assigned to the agency. This includes facilitating international trade operations, ensuring compliance with local and international regulations, managing documentation (such as bills of lading, invoices, and customs forms), and coordinating logistics (transportation via sea, air, or land). Additionally, market research to identify potential buyers or suppliers, negotiating terms and prices, and providing advisory services on tariffs and trade agreements are essential tasks linked to this scope. The agency is also expected to maintain communication with various stakeholders, including suppliers, buyers, and customs authorities, to ensure timely delivery and smooth transactions. Regular reporting on market trends and performance analytics aligns with the responsibilities outlined in this agreement.

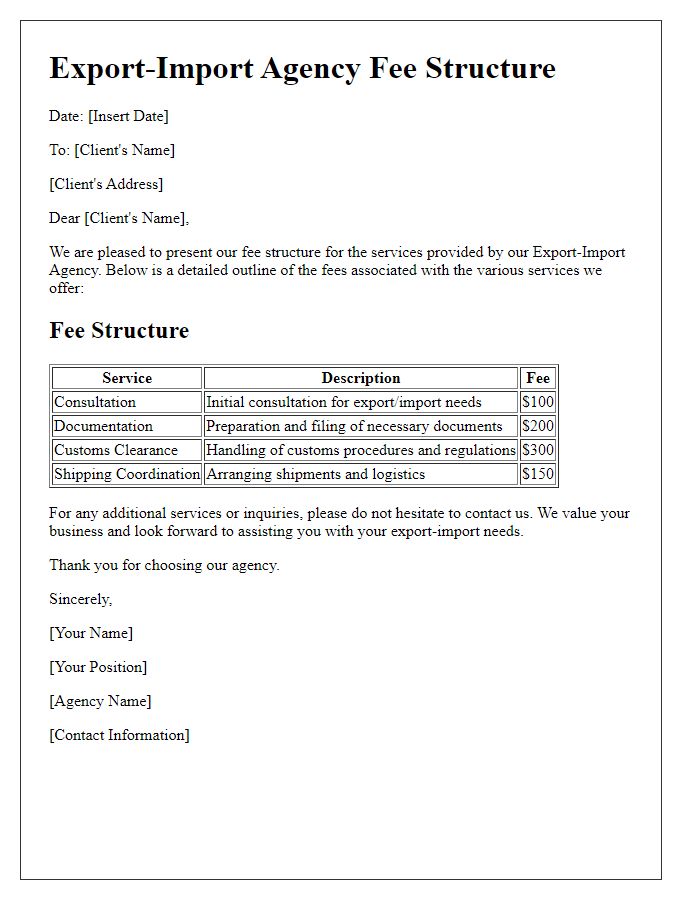

Compensation Terms

Compensation terms crucially outline the financial arrangements between parties involved in an export-import agency agreement. This involves commissions calculated based on the total value of goods traded, often set at a variable percentage ranging from 2% to 10%, depending on the product category and market conditions. Payment schedules typically specify terms such as net 30 or net 60 days following the invoice date, ensuring timely compensation for services rendered. Additionally, provisions for travel expenses, advertising costs, and other operational expenses may be included, requiring receipts or prior approvals. Lastly, incentives for exceeding sales targets might be negotiated, providing additional financial rewards that motivate performance and growth in international trade activities.

Duration and Termination

The duration of the export-import agency agreement is set for a period of three years, commencing from the effective date stated in the introductory clause. Termination of this agreement can occur under specific conditions, including mutual consent of both parties or upon written notice of at least 60 days prior to the desired termination date. Additionally, if either party fails to comply with the terms outlined, the agreement can be terminated immediately, ensuring that both parties uphold their obligations. Should any unforeseen circumstances arise, such as legal restrictions or market changes that impede business operations, either party reserves the right to initiate termination after providing adequate justification.

Confidentiality and Intellectual Property

Confidentiality in export-import agency agreements ensures that sensitive information shared between parties remains secure. This includes trade secrets, financial data, and proprietary operational methods that relate to international transactions. Intellectual property (IP) rights, such as trademarks and patents, must be safeguarded within the agreement framework, preventing unauthorized use or reproduction of unique branding or innovative products. Clear stipulations regarding the handling of confidential information and IP ownership help mitigate risks of data breaches and enhance trust between the involved companies, ensuring that business operations in high-stakes environments, like global markets, follow legal and ethical standards.

Comments