Are you considering starting a home-based business or formalizing an existing one? Creating a home-based business agreement is a crucial step to ensure clarity and protection for all parties involved. This simple document outlines the terms of your business relationship, including roles, responsibilities, and profit-sharing. Dive deeper into how to craft the perfect agreement that safeguards your interests by reading more!

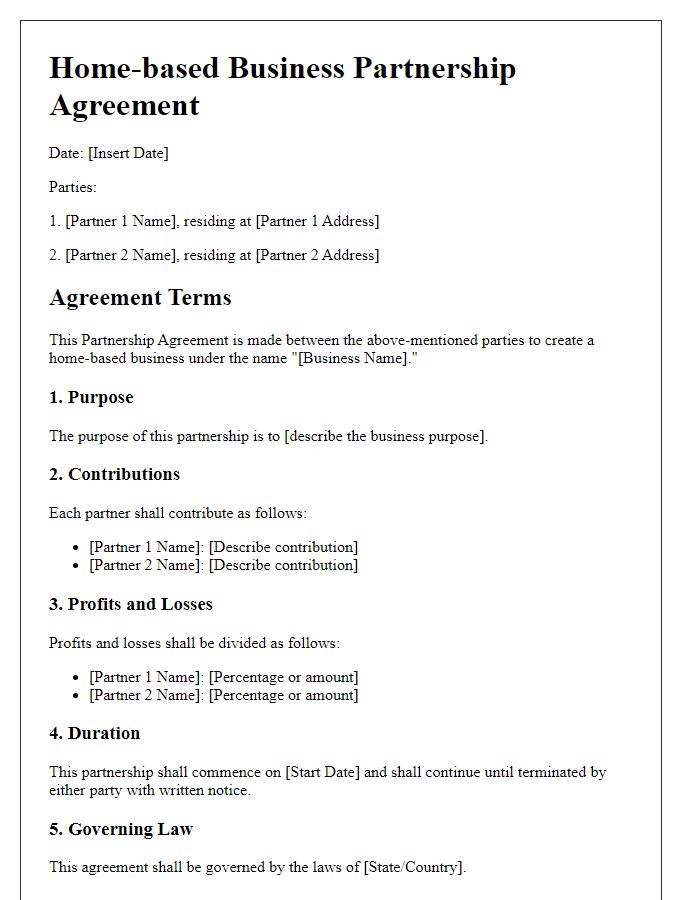

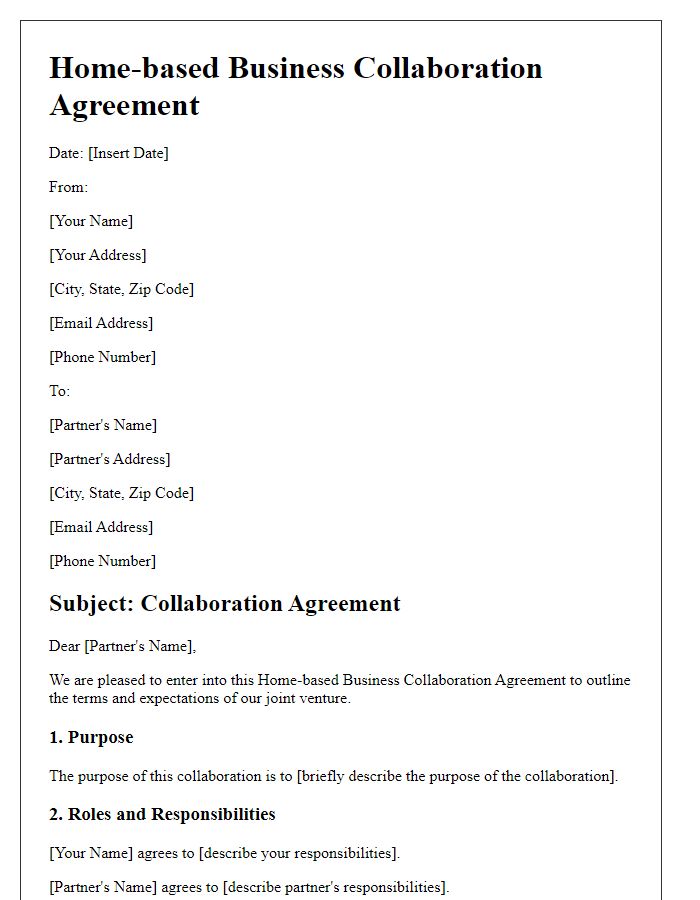

Parties Involved

In a home-based business agreement, the parties involved typically include the home-based entrepreneur, often referred to as the "Business Owner," and any partners or investors supporting the business, identified as "Partners" or "Investors." The Business Owner is responsible for daily operations and decision-making, while Partners may contribute capital, expertise, or resources. In cases where there are customers or clients, they can be defined as "Clients" in the agreement. Each party's rights, responsibilities, and profit-sharing structure can be detailed, ensuring clarity and preventing potential disputes. Identifying specific individuals or entities involved, along with their roles and contributions, is essential for establishing a legally binding framework for the operation of the business.

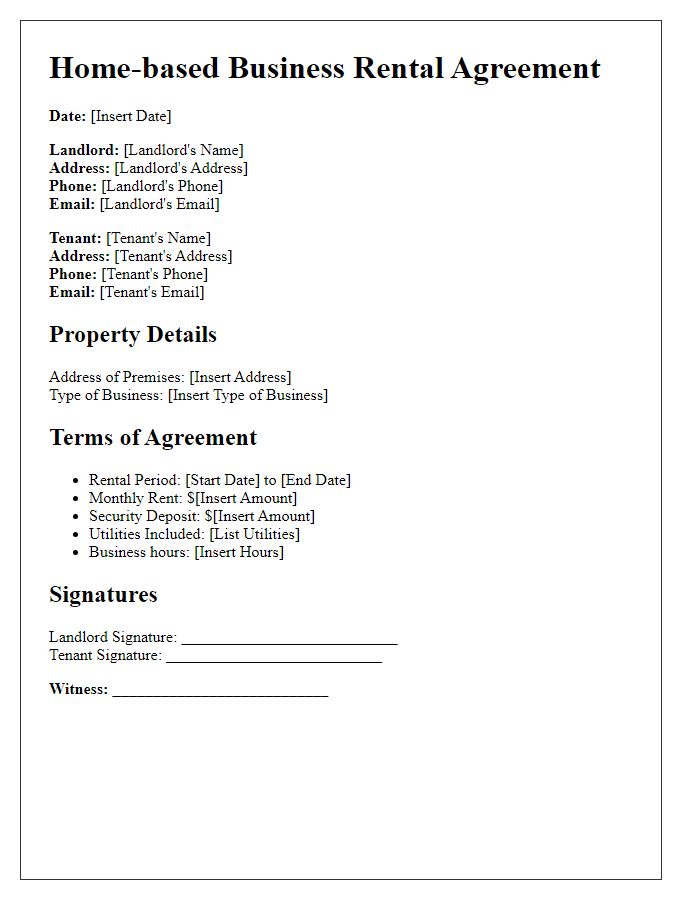

Business Description

A home-based business agreement outlines the operations and terms for small enterprises run from residential locations, often including details about the business model, services offered, and target market. Common business types might include e-commerce operations, consultation services, or craft production. A vital aspect is adherence to local zoning laws that may restrict certain activities in residential areas, often requiring permits or licensing. The agreement should also detail financial arrangements such as profit-sharing, expenses, and taxation responsibilities. Additionally, protecting intellectual property rights, such as trademarks or copyrights, can be crucial in securing the business's unique identity while establishing clear expectations regarding confidentiality and non-disclosure among involved parties.

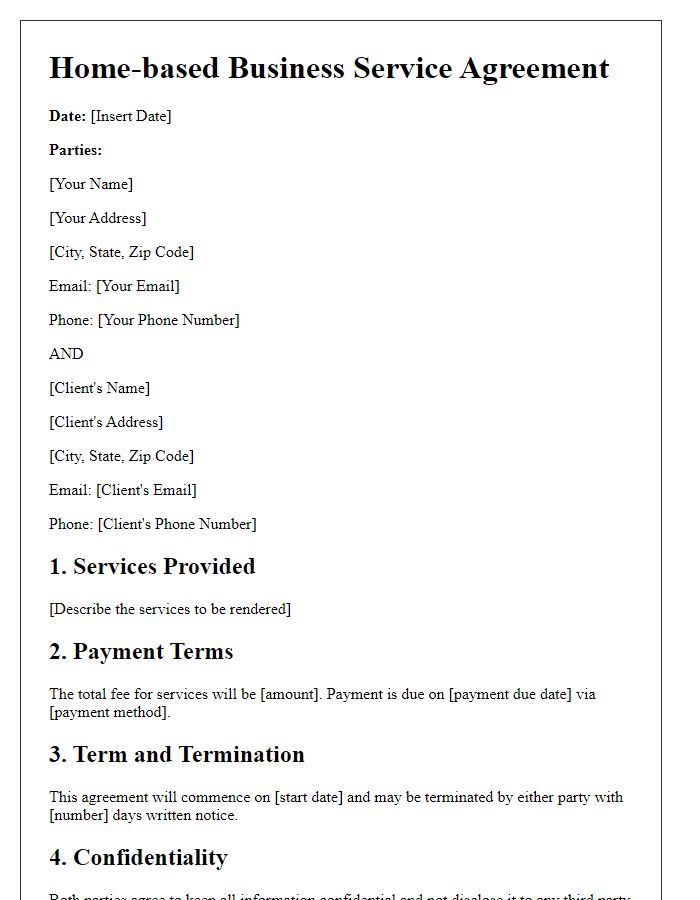

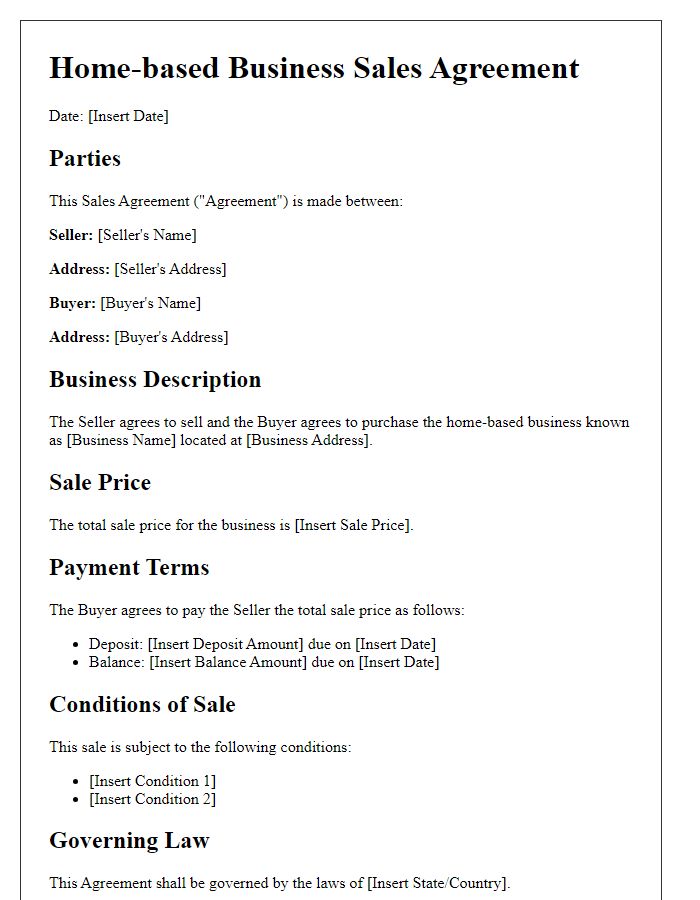

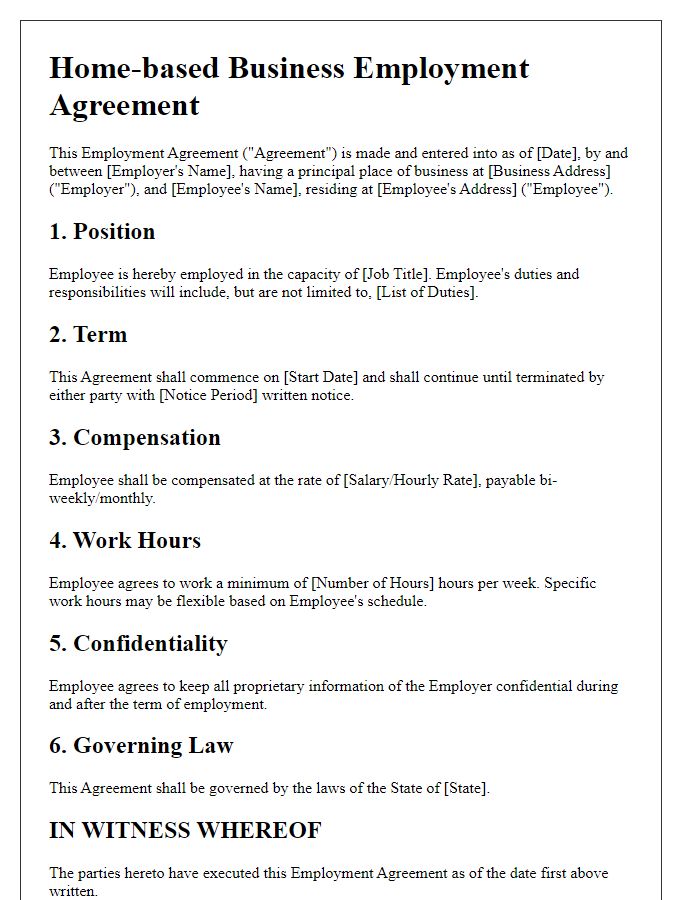

Terms and Conditions

A home-based business agreement establishes essential terms and conditions to ensure a clear understanding between parties involved. This document typically outlines key areas such as services provided, payment structure, and the duration of the agreement. For instance, the agreement might specify a monthly payment of $500 for marketing services rendered by a freelancer, effective from January 1, 2024. The responsibilities of each party, including communication methods and timelines for project completion, are also detailed. Additionally, confidentiality clauses safeguard proprietary information, ensuring that trade secrets remain protected during and after the agreement. Furthermore, provisions for termination outline the notice period required, typically 30 days, and any conditions under which the agreement may be canceled. This formal document not only clarifies expectations but also minimizes potential disputes, creating a professional framework for the home-based business's operations.

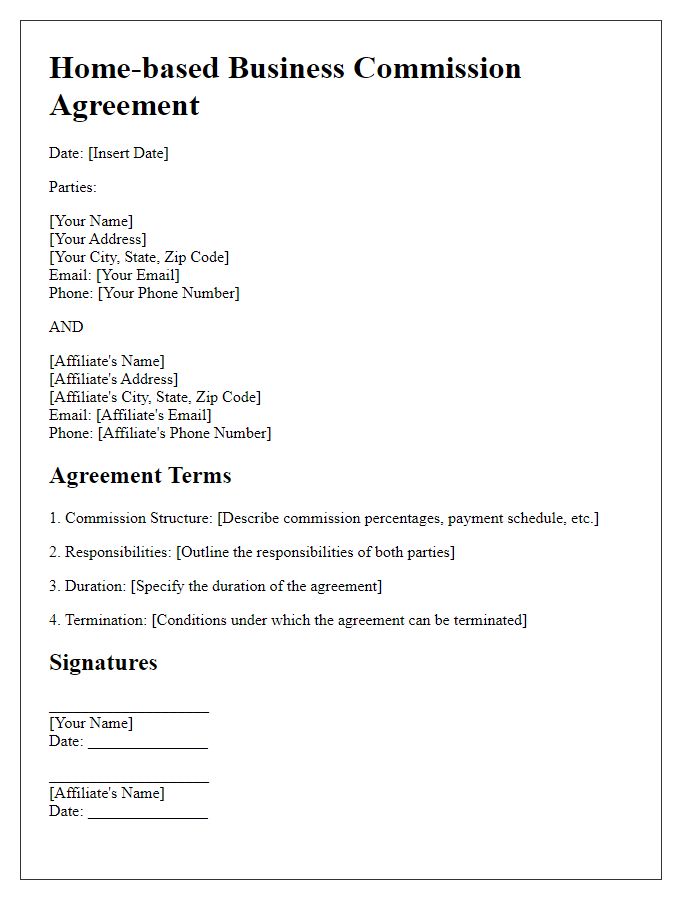

Payment and Compensation

A home-based business agreement should outline specific terms regarding payment and compensation to ensure clarity and fairness for all parties involved. Compensation structures may vary based on the nature of services rendered and could include fixed fees, hourly rates, or commission-based earnings. For example, a freelance graphic designer may charge a fixed fee of $500 per project or an hourly rate of $50 for services, while a consultant may receive a 10% commission on sales generated through their recommendations. Payment schedules must be clearly defined, specifying due dates, acceptable payment methods (such as bank transfers, checks, or online payment platforms), and any late fees applicable to overdue payments. To further protect both parties, terms regarding reimbursement of expenses incurred during the business operation should also be included, detailing eligible expenses and the process for submitting claims.

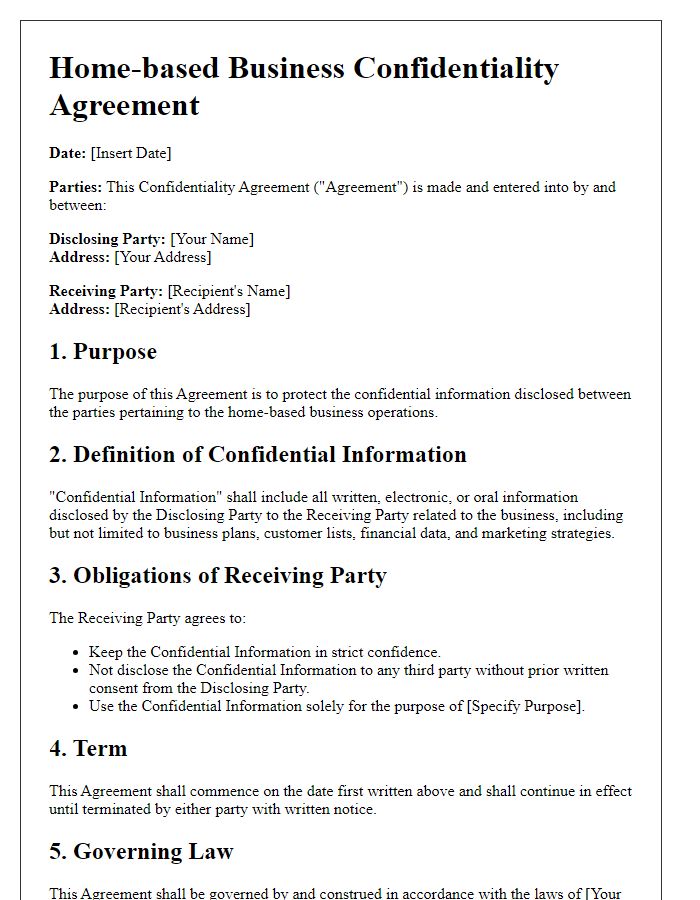

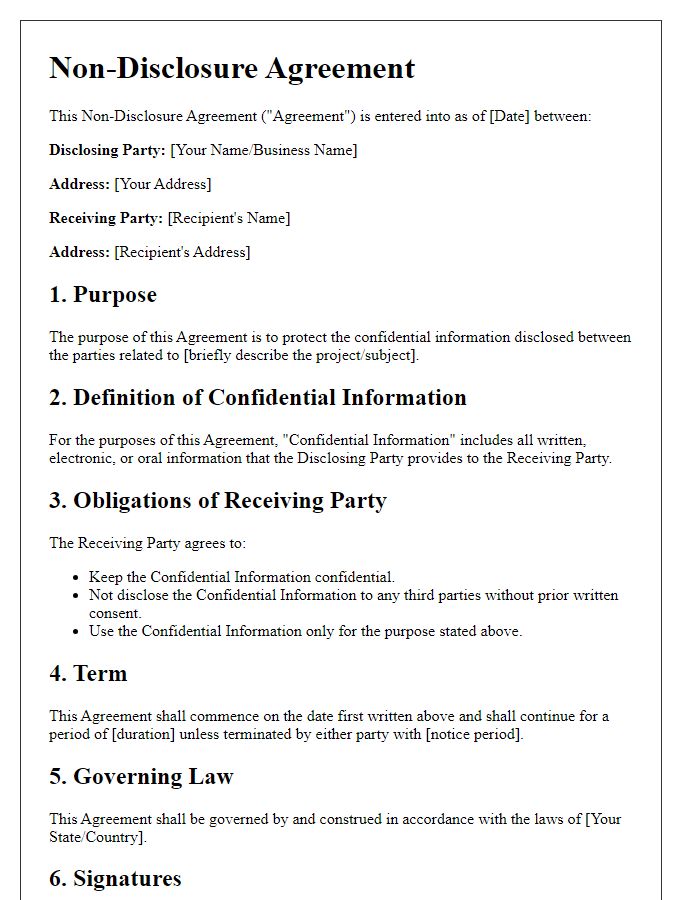

Confidentiality and Non-Disclosure

In a home-based business environment, maintaining confidentiality is crucial for protecting sensitive information and trade secrets. A well-structured Confidentiality and Non-Disclosure Agreement (NDA) outlines the obligations of both parties involved in the business arrangement. Key components include the definition of confidential information, which encompasses proprietary data, client lists, and business strategies, and the term of the agreement, often spanning one to five years post-termination. It is important to specify the permissible use of disclosed information, ensuring it is solely for the purpose of fulfilling the business relationship. Additionally, provisions addressing the return or destruction of confidential materials upon agreement termination are critical for safeguarding information. Clear consequences for violations, including legal recourse and monetary damages, reinforce the seriousness of the agreement, creating a protective framework for startups operating from home.

Comments