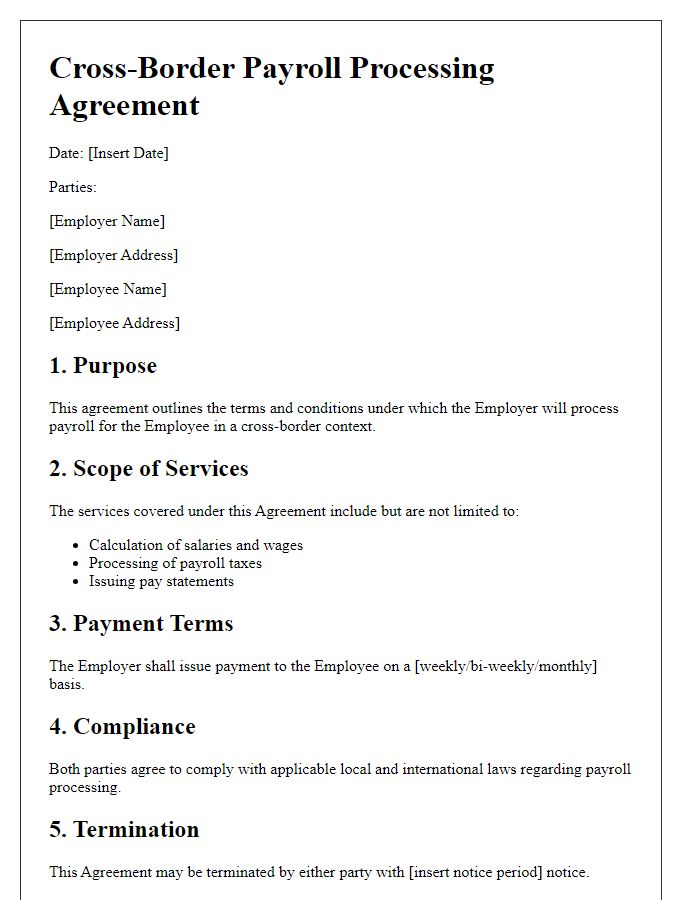

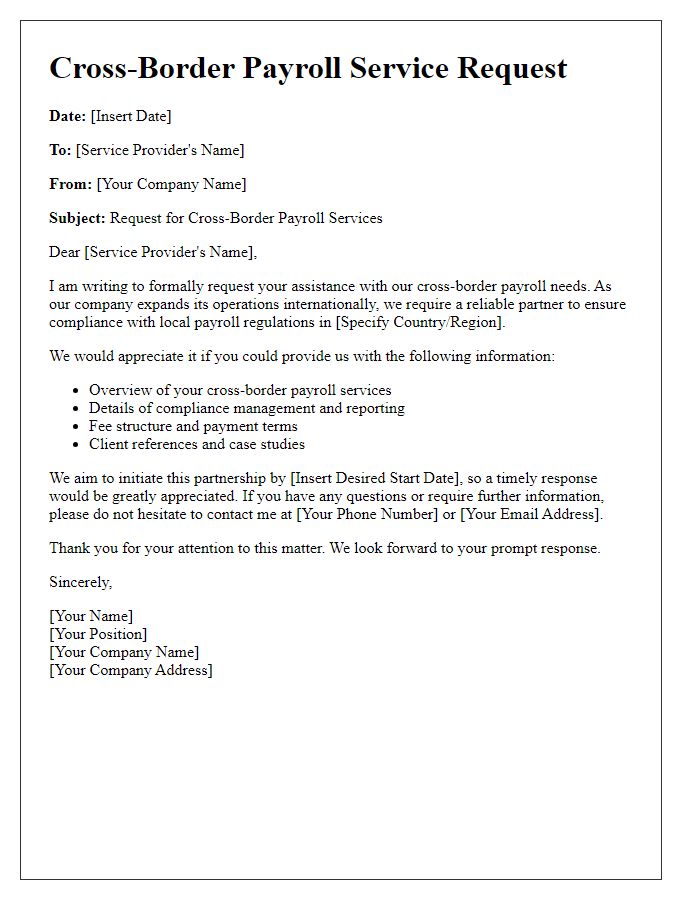

Are you navigating the complexities of cross-border payroll processing? With businesses expanding globally, understanding the nuances of international payroll is more important than ever. From compliance with local tax regulations to ensuring timely payments, the challenges can feel overwhelming. Join us as we delve into effective strategies and best practices to simplify your cross-border payroll journey!

Compliance with International Regulations

Cross-border payroll processing involves navigating complex international regulations that can vary significantly between countries. Organizations must ensure adherence to local labor laws in jurisdictions like the European Union, which mandates specific guidelines on employee rights, tax obligations, and social security contributions. Accurate compliance requires understanding the intricacies of laws such as the General Data Protection Regulation (GDPR) for employee data protection and tax treaties to avoid double taxation in countries such as the United States and Canada. Additionally, payroll systems must accommodate currency conversions, exchange rates, and potential fluctuations due to geopolitical events impacting financial transactions, ensuring that employee compensation is timely and legally compliant.

Currency Exchange and Conversion Rates

Cross-border payroll processing involves complex currency exchange mechanics, impacting both employee compensation and organizational budgeting. Exchange rates fluctuate daily, influenced by various economic indicators such as inflation rates and geopolitical events. For instance, the Euro (EUR) to US Dollar (USD) conversion rate may vary, with historical rates showing fluctuations between 1.10 and 1.20 over the past year. Accurate conversion is crucial for ensuring employees receive fair compensation in their local currency, which can be affected by bank fees and transaction costs. Additionally, organizations must account for the timing of exchange rates, as payroll periods may cross over rate changes, resulting in discrepancies if not managed properly. Understanding the nuances of foreign exchange markets and engaging reliable financial institutions for currency conversion is essential for maintaining effective cross-border payroll operations.

Taxation Laws in Each Country

Cross-border payroll processing requires a comprehensive understanding of taxation laws in each country involved. For instance, in the United States, Federal Income Tax regulations stipulate progressive tax rates ranging from 10% to 37% based on income brackets, while state taxes can vary significantly, with some states imposing flat rates or no income tax at all. In Canada, the federal tax rates range from 15% to 33%, supplemented by provincial taxes that also differ between regions, affecting net payroll calculations. The United Kingdom imposes Income Tax based on a tiered system ranging from 20% to 45%, with National Insurance contributions also playing a critical role in employee deductions. In Australia, the Pay As You Go (PAYG) tax system mandates tax rates between 0% to 45% depending on earnings, alongside superannuation contributions contributing to overall payroll considerations. Awareness of Social Security agreements, such as those between the U.S. and various EU nations, can prevent dual taxation, highlighting the necessity of precise compliance with international payroll laws.

Payroll Software Compatibility

Many organizations utilizing payroll software for cross-border processing face compatibility challenges. Different payroll systems, such as ADP Global Payroll or Paychex Flex, may not seamlessly integrate due to varying regulatory compliance requirements across jurisdictions. For instance, tax obligations in the United States differ significantly from those in the European Union, where GDPR regulations impose strict data handling standards. Furthermore, currency conversion issues can arise when managing payroll for employees in countries like Japan or Brazil, where fluctuations in exchange rates can influence net pay. Implementing compatible payroll solutions that accommodate multiple currencies, tax codes, and local labor laws can enhance payroll accuracy and efficiency, ensuring timely payments and regulatory adherence.

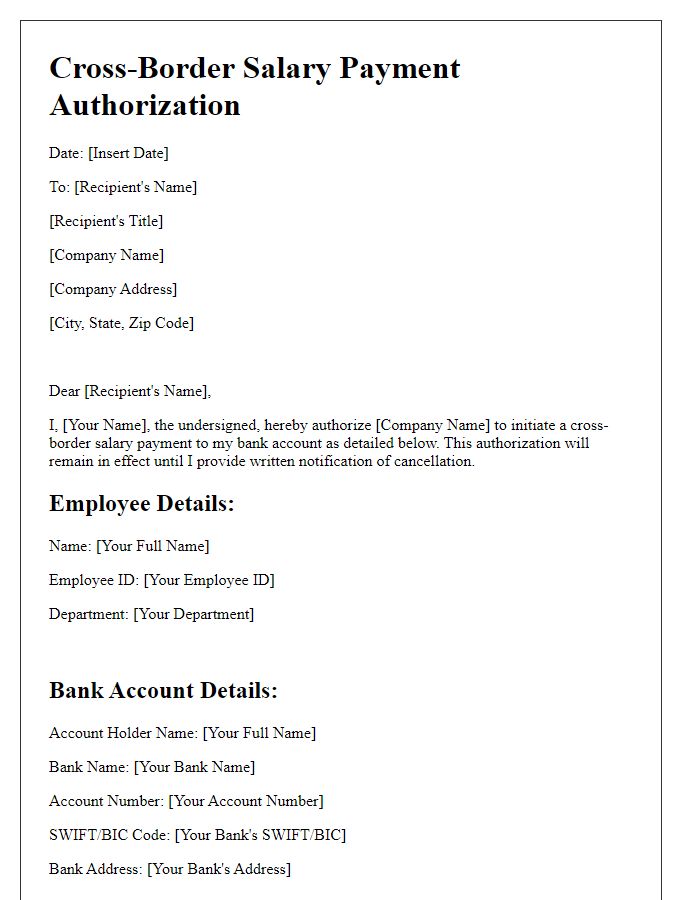

Data Security and Privacy Compliance

Cross-border payroll processing entails handling sensitive employee data across multiple jurisdictions, necessitating strict adherence to data security and privacy compliance. Organizations must comply with regulations such as the General Data Protection Regulation (GDPR) in the European Union, which mandates that personal data (including salary information and identification details) is processed lawfully, transparently, and for specific purposes. In addition, compliance with the California Consumer Privacy Act (CCPA) may apply to businesses operating in or dealing with employees from California, emphasizing the importance of consumer rights related to personal information. Utilizing secure technologies, such as end-to-end encryption and secure cloud storage solutions, is essential to protect sensitive data from breaches. Furthermore, implementing staff training on data handling practices can significantly mitigate risks associated with unauthorized access to payroll records. Regular audits and risk assessments ensure ongoing compliance with international data protection laws, safeguarding employee privacy and maintaining trust in cross-border operations.

Comments