Are you looking for an easy and effective way to request a bank reconciliation? Whether you're managing finances for a personal account or a business, having a clear template can save you time and ensure accuracy. In this article, we'll guide you through a simple letter format that makes your request straightforward and professional. So, let's dive in and explore how you can streamline your bank reconciliation process!

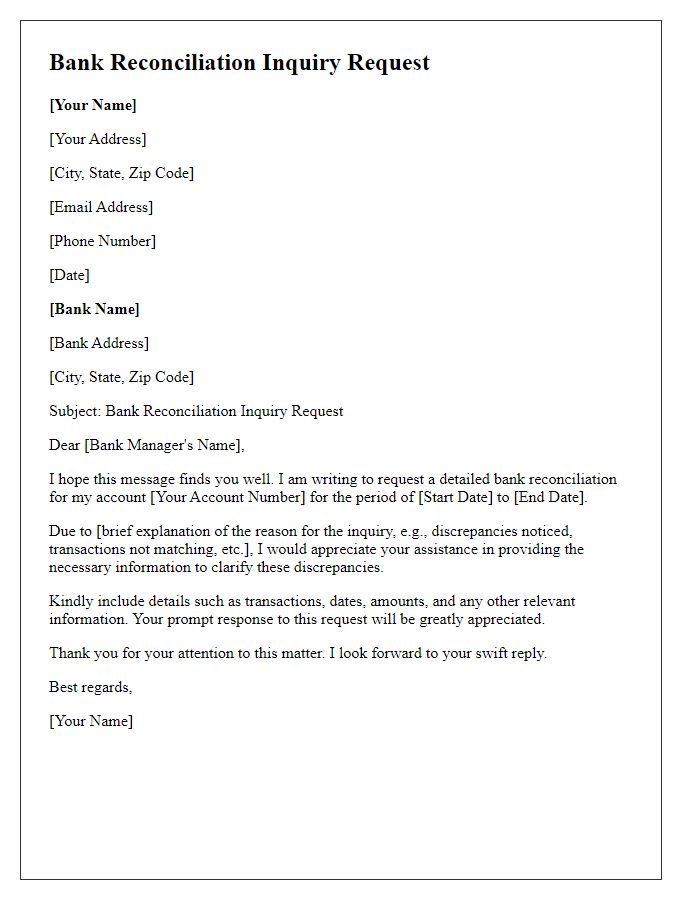

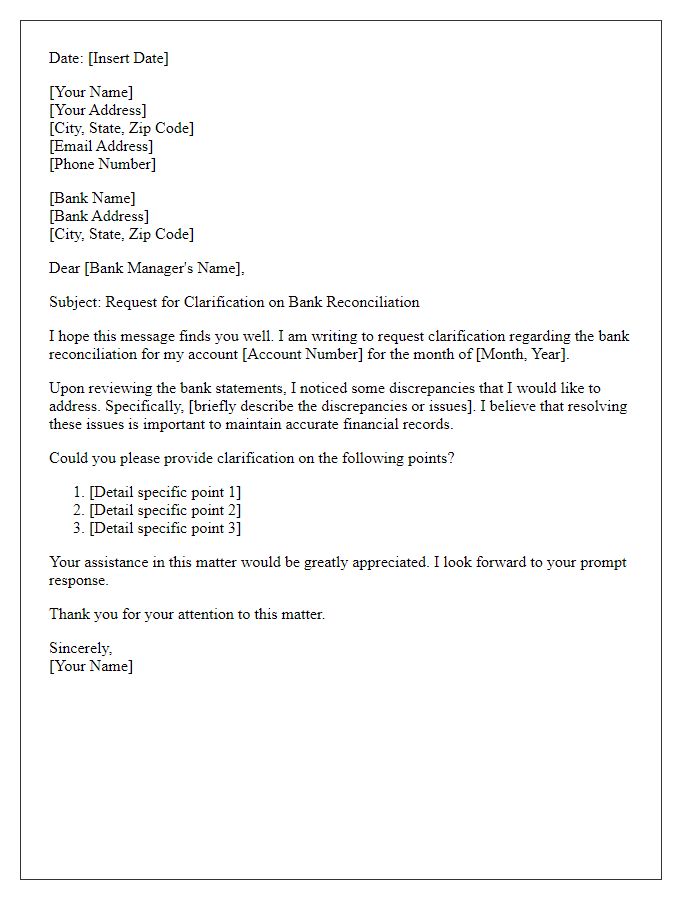

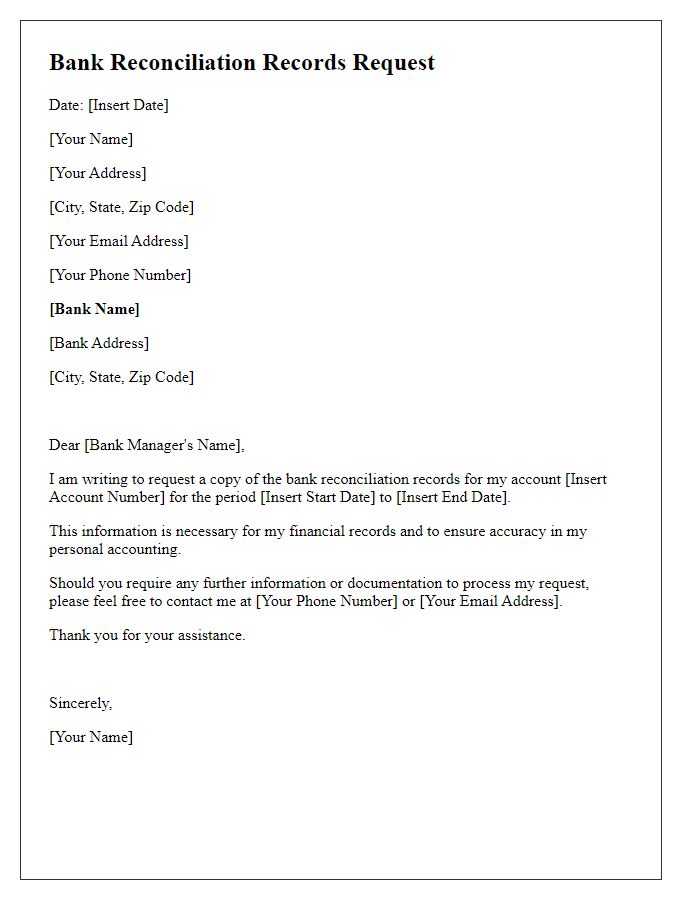

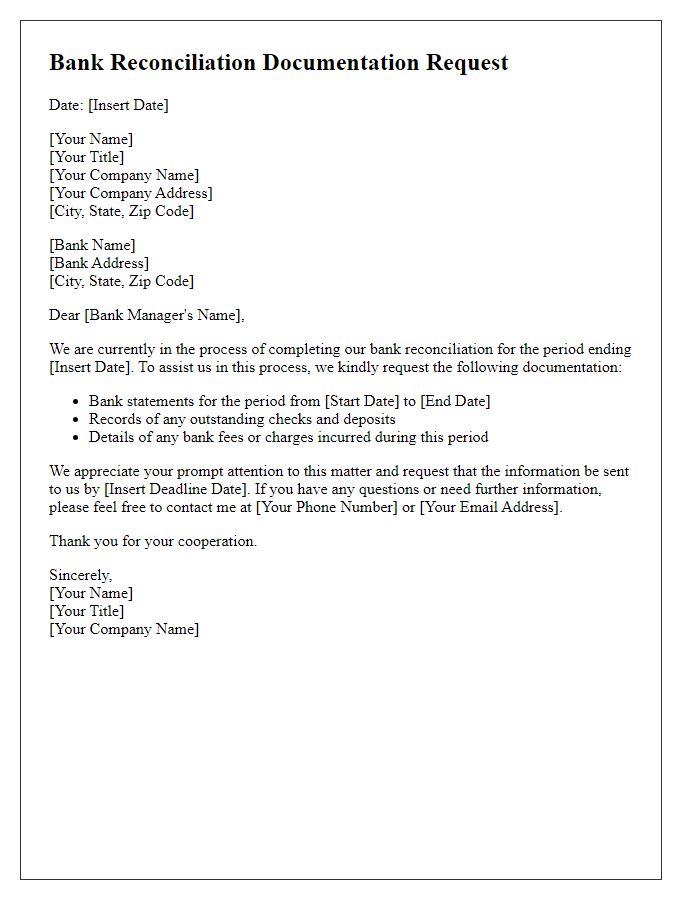

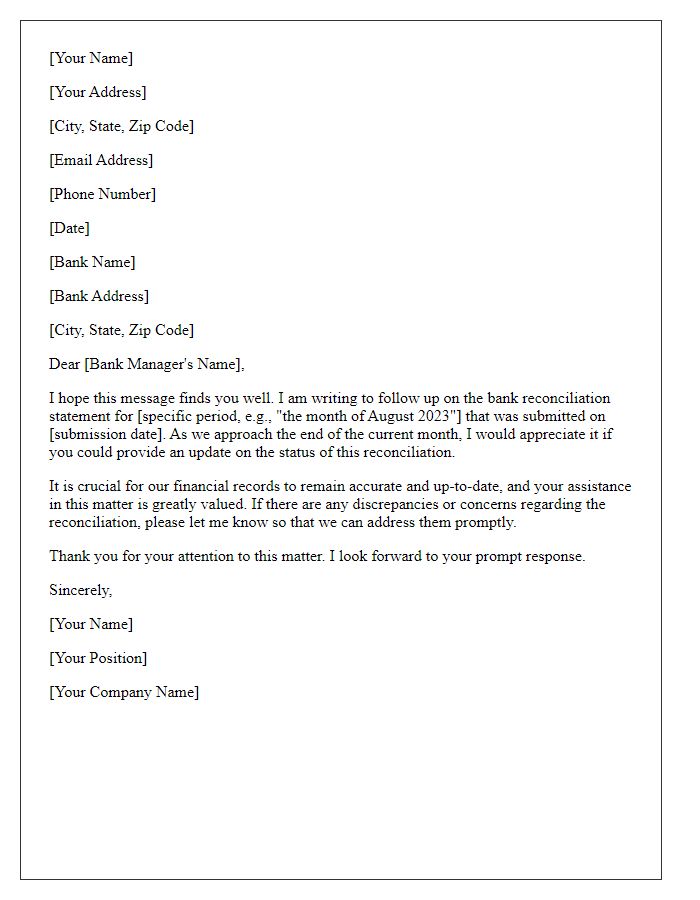

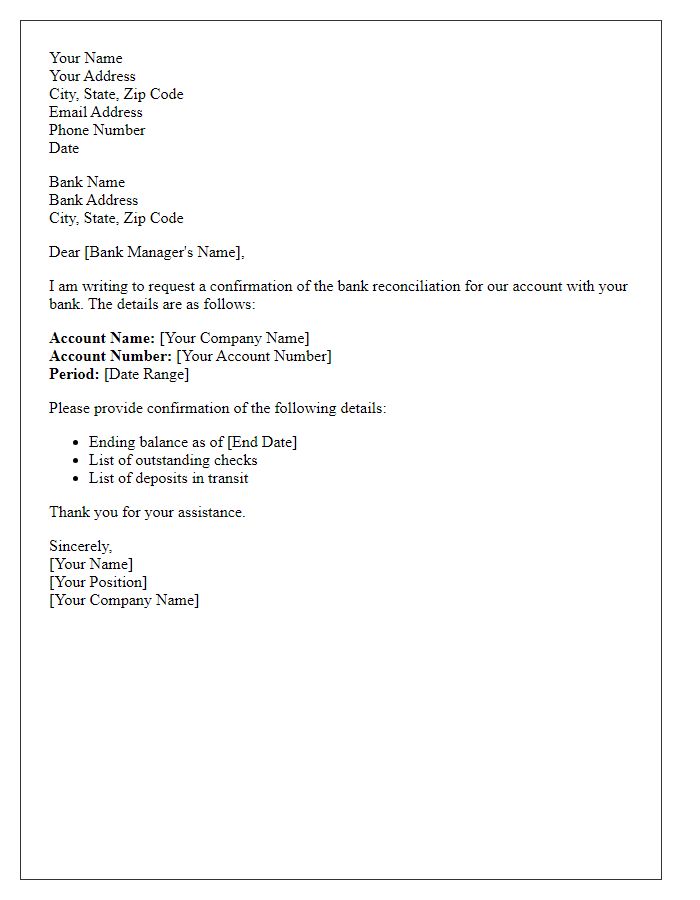

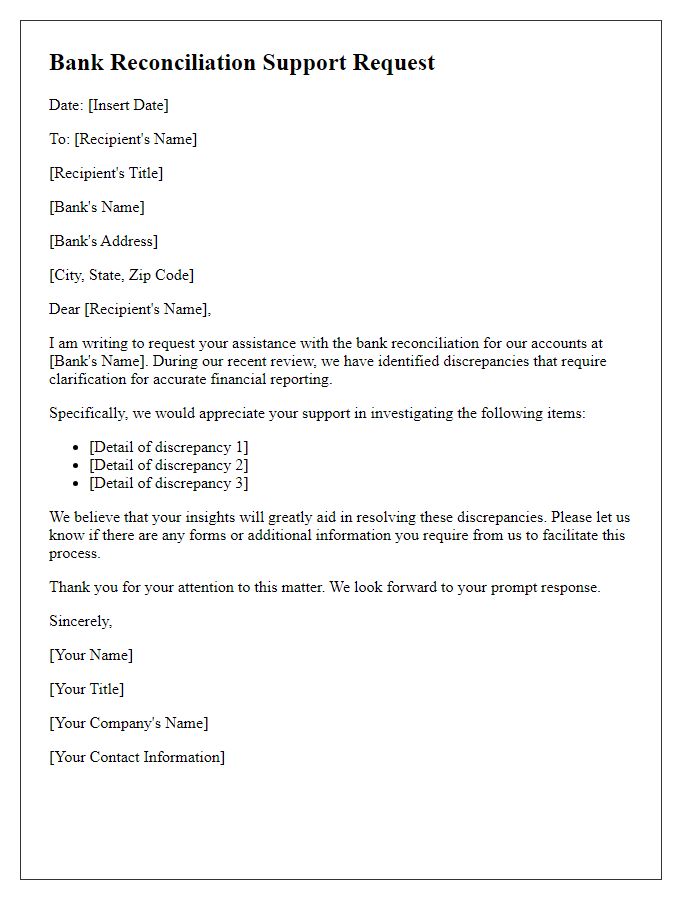

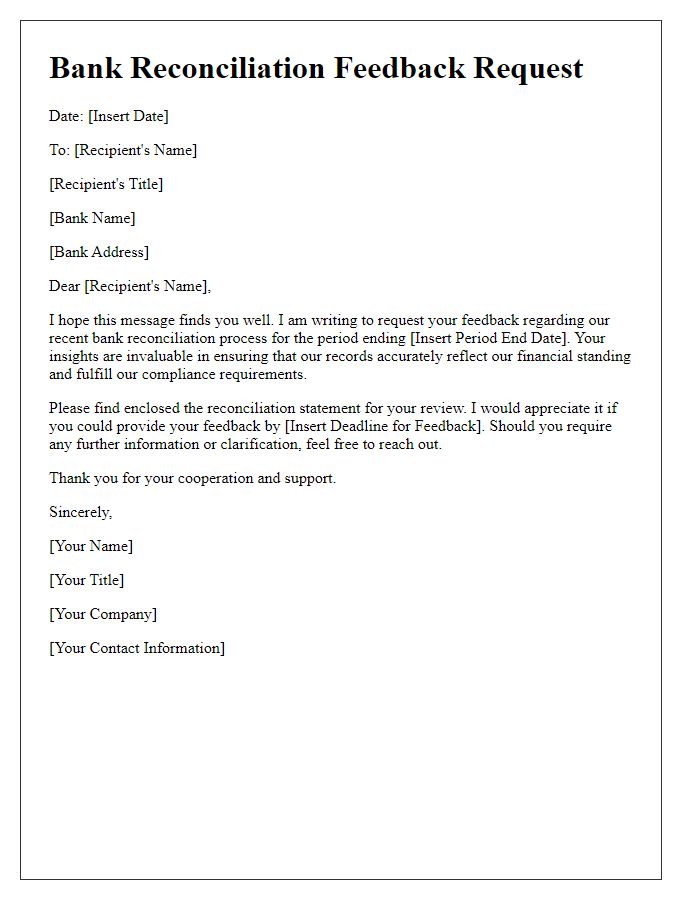

Clear Subject Line

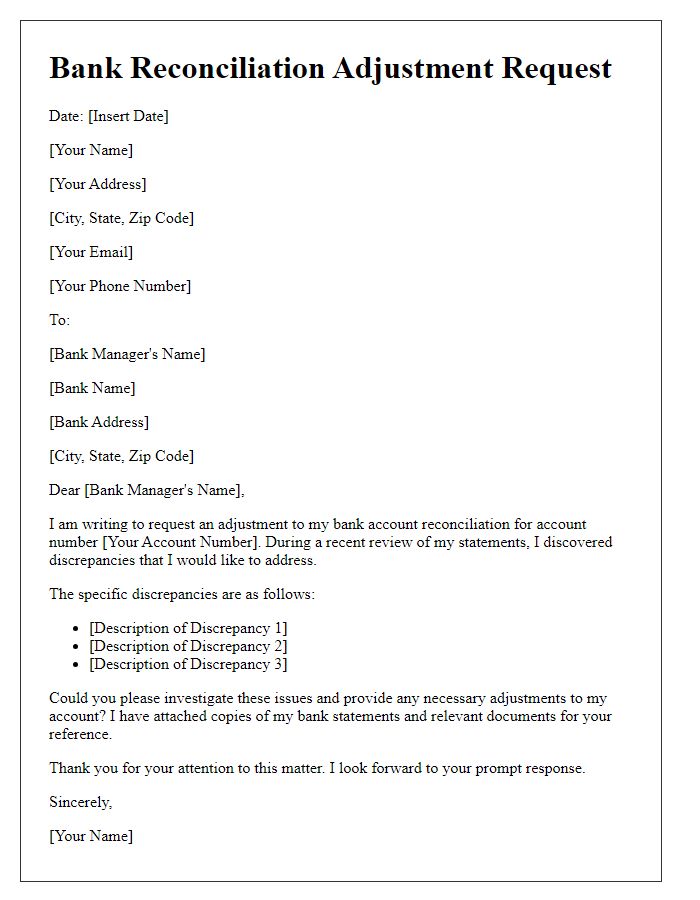

A bank reconciliation request aims to resolve discrepancies between a company's financial statements and bank statements. This includes identifying differences in transactions, such as deposits or withdrawals. Accurate reconciliation is essential to ensure financial integrity. Common issues involve outstanding checks, bank errors, or timing differences. The appropriate financial documents, including bank statements from the financial institution, company ledger, and reconciliation reports, should be gathered for review. Timely communication with bank representatives can expedite the reconciliation process and ensure the accuracy of the company's financial records.

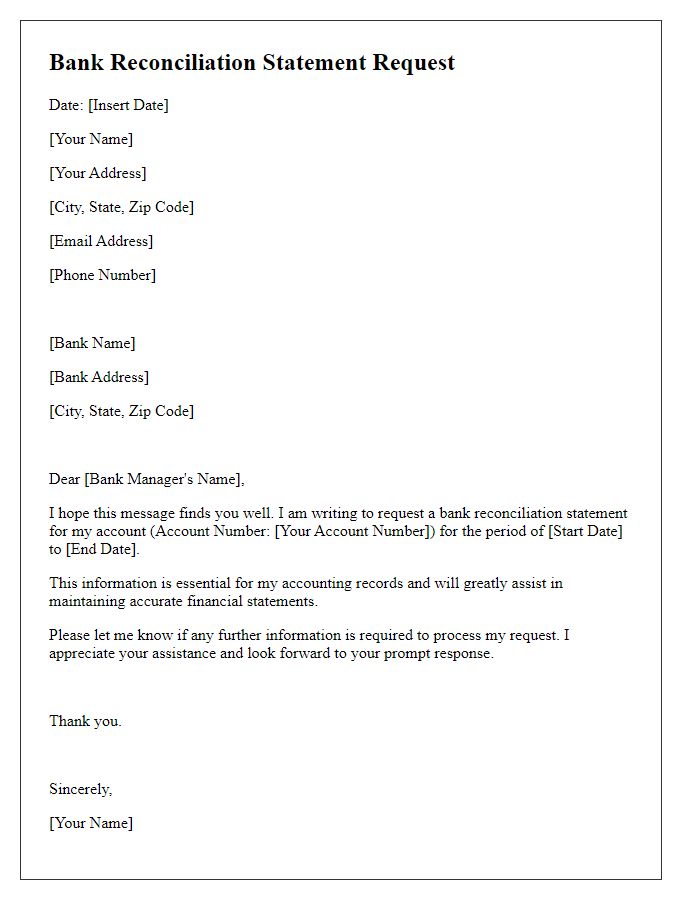

Relevant Account Details

In bank reconciliation processes, relevant account details such as the account number, bank name, and transaction dates are crucial for accurate identification. The account number, typically a series of digits (often 10-12), links to specific customer records within the banking institution. The bank name represents the financial institution, which may vary from regional banks to national banks, impacting transaction processing times. Transaction dates, usually formatted in day, month, and year (e.g., 01/10/2023), provide context for aligning internal records with bank statements. Understanding these details ensures effective communication and expedites the reconciliation procedure.

Specific Transaction Dates

A bank reconciliation request for specific transaction dates can clarify discrepancies between financial records and bank statements. Accurate record-keeping is essential for identifying transactions, such as deposits and withdrawals, occurring between January 1, 2023, and January 31, 2023. This time frame typically allows businesses to settle discrepancies that may arise due to errors in data entry or timing differences. For instance, a deposit of $5,000 recorded on January 15 may not yet reflect in the bank statement until February 1. Furthermore, identifying any outstanding checks, like a payment of $1,200 issued on January 28, can also streamline financial reporting and ensure all transactions within this period are accurately matched.

Contact Information

Bank reconciliation is an essential accounting process that involves comparing internal financial records with the bank statement to ensure accuracy. This process typically takes place monthly or quarterly and requires detailed information like account numbers, transaction dates, and amounts. It helps identify discrepancies such as unrecorded transactions, bank errors, or unauthorized charges. Maintaining accurate records is crucial for financial health, particularly for small businesses, as it directly impacts cash flow management, financial reporting, and audit preparedness. Effective communication with banking institutions is vital during this process to resolve any outstanding issues promptly.

Polite Request for Reconciliation

A bank reconciliation request aims to resolve discrepancies between accounting records and bank statements. Essential financial documents, such as bank statements from the fiscal year 2022, should be attached for verification. Timely responses are crucial, especially before quarterly financial audits. Discrepancies may arise from outstanding checks, deposits in transit, or bank errors. Establishing a direct line of communication, such as an email address or phone number, is beneficial for prompt resolution. Financial institutions must prioritize these requests to ensure accurate financial reporting and maintain trust with clients.

Comments