Are you curious about how a stock option plan can benefit you and your team? In this article, we'll break down the essentials of stock options, explaining their significance in today's corporate landscape. We'll also discuss how these plans not only align the interests of employees with those of the company but also serve as powerful incentives for performance and retention. So, let's dive in and explore the ins and outs of stock option plans together!

Introduction and Purpose

A stock option plan serves as a strategic incentive mechanism offered by companies to their employees, particularly in the technology and startup sectors. Designed to align the interests of employees with those of shareholders, this plan grants employees the right to purchase company shares at a predetermined price, known as the exercise price, often below market value at the time of the option grant. The primary purpose is to motivate employees (particularly high-performing individuals) to contribute to the company's growth and success, ultimately enhancing overall shareholder value. This investment in employee engagement not only fosters loyalty but also encourages a culture of ownership, creating a collaborative environment essential for innovation and long-term sustainability in competitive markets.

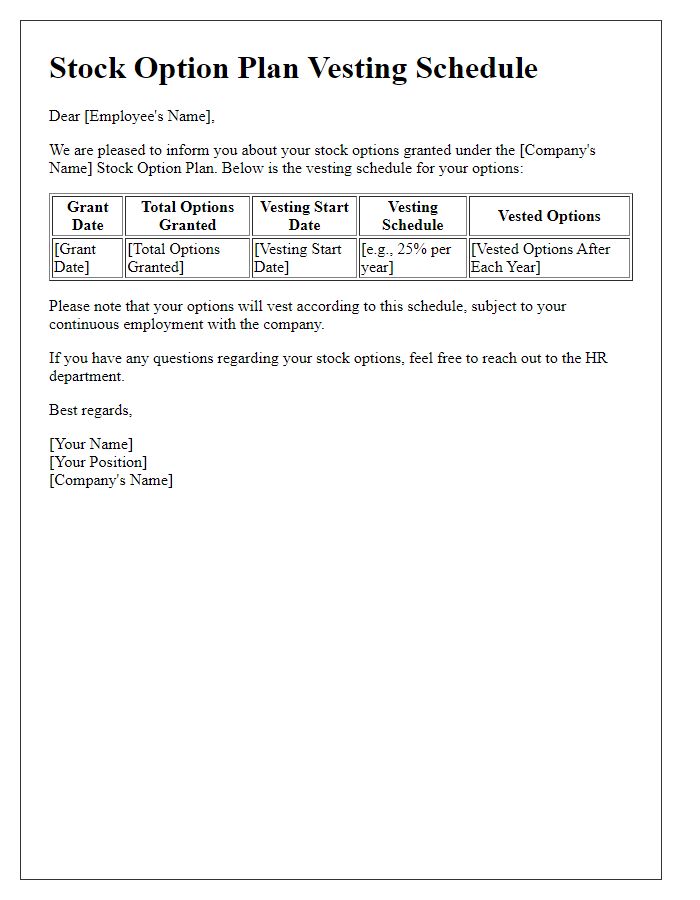

Eligibility and Vesting

The Stock Option Plan outlines key elements such as eligibility criteria and vesting schedules crucial for employees investing in company shares. Eligible participants include full-time employees and executives who have completed a minimum tenure of six months at the organization. The vesting schedule typically spans four years, with options vesting 25% annually on the anniversary of the grant date. In addition, employees may need to maintain performance targets set by the organization, ensuring alignment with company growth objectives. Specific provisions regarding termination or retirement may affect the vesting process, affecting the total number of options employees can ultimately acquire.

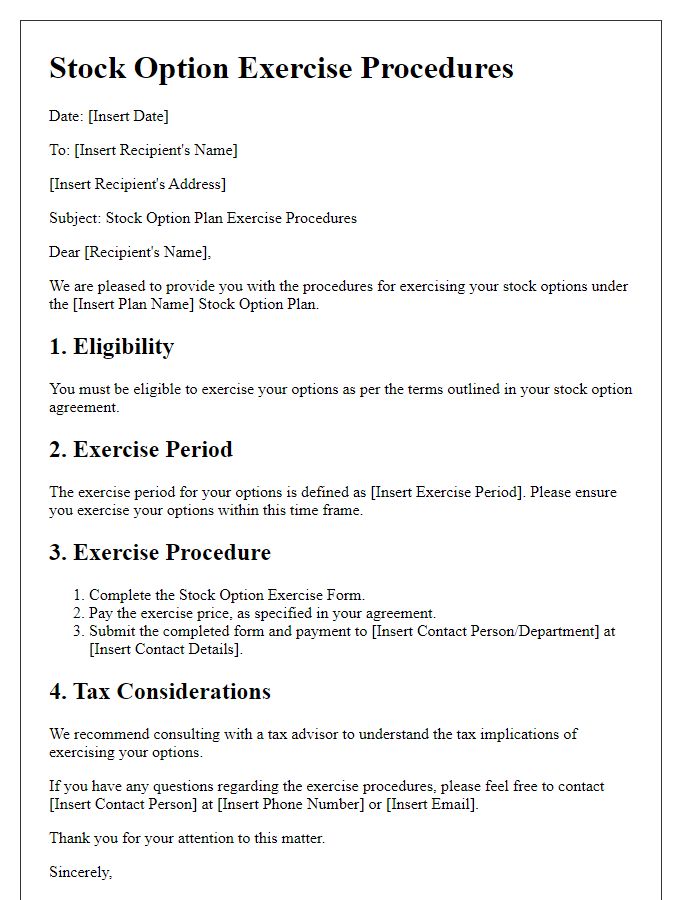

Exercise Price and Exercise Period

Stock option plans are crucial in employee compensation strategies, allowing employees to purchase company shares at a predetermined exercise price. The exercise price is typically set at the market price on the grant date and may vary based on specific policies. Employees usually have a defined exercise period, often spanning several years, to convert their options into actual shares. This period may include a vesting schedule, where employees earn the right to exercise over time, incentivizing long-term commitment to the company. In many plans, the exercise period can extend for several months after employment termination, depending on the company's rules. Understanding the mechanics of the exercise price and exercise period is essential for employees to fully realize the benefits of their stock options.

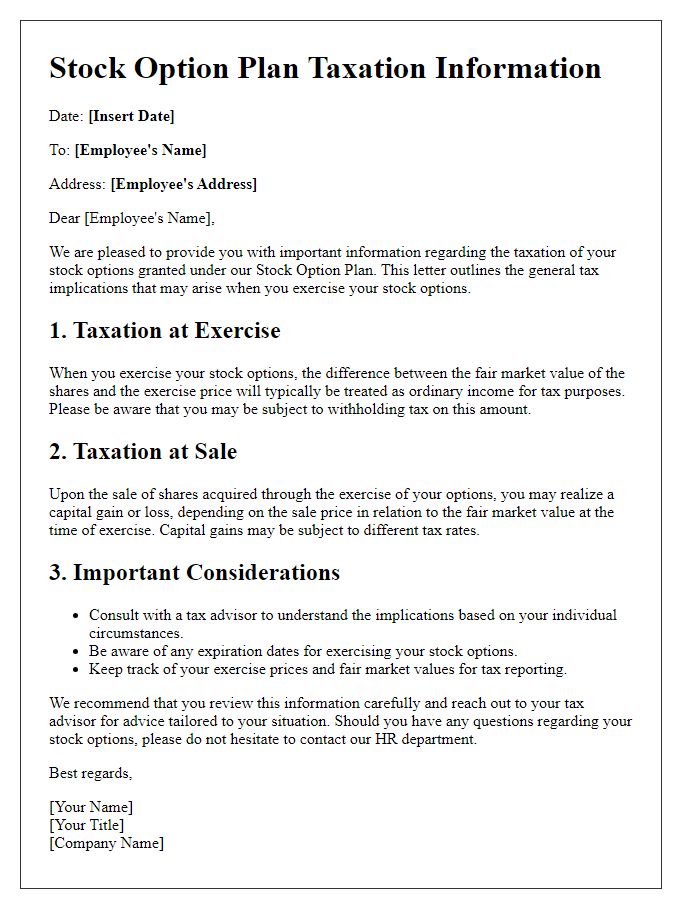

Tax Implications

Stock options represent a form of compensation granted to employees, offering the right to purchase company shares at a predetermined price (known as the exercise or strike price). Tax implications vary depending on the type of stock option -- Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). ISOs typically allow for favorable tax treatment if specific holding requirements are met, often resulting in capital gains tax rates instead of ordinary income tax rates when shares are sold. However, exercising ISOs might trigger Alternative Minimum Tax (AMT) in some situations. On the other hand, NSOs are taxed as ordinary income upon exercise, based on the difference between the fair market value and the exercise price, leading to tax liabilities at the time of exercise. Consequently, employees participating in stock option plans should consult tax professionals to fully understand the financial impact and compliance requirements associated with their specific stock options.

Terms and Conditions

Stock option plans provide employees with the opportunity to purchase company shares at a predetermined price, known as the exercise price. These options typically have a vesting schedule, often spanning four years, where employees gain the right to exercise a certain percentage of their options each year. The exercise price is usually set at the fair market value of the shares on the grant date, ensuring that employees benefit from the company's growth. Additionally, terms regarding expiration are crucial; options generally expire 10 years from the grant date, but may expire sooner if the employee leaves the company. It is essential to understand tax implications associated with exercising stock options, including potential capital gains taxes on profits realized when selling shares. Employees should also be aware of company-specific policies and procedures required to exercise options, which can vary by organization. Transparency in communication about these aspects fosters a better understanding of the benefits and responsibilities linked to the stock option plan.

Comments