Hey there! If you're looking to tackle your quarterly tax estimates, you've come to the right place. Putting together a tax estimate letter might seem daunting, but it can be straightforward with the right template. Stick around, and I'll guide you through creating a clear and efficient letter that ensures your estimates are spot on!

Personalized contact information

Filing quarterly tax estimates can ensure compliance and prevent penalties for self-employed individuals or small business owners. The estimated tax payments are typically based on the total expected income for the year, including wages, interest, dividends, and other sources of income. For individuals, the IRS recommends using Form 1040-ES, which provides a worksheet for calculations. The payment schedule includes four due dates: April 15, June 15, September 15, and January 15 of the following year. Accurate records of previous income (last year's tax return) and current earnings are crucial in determining the correct amount to estimate. Each state's tax agency may also have specific forms and guidelines, adding to the importance of local compliance.

Clear subject line

Quarterly Tax Estimate Submission: Q4 2023 - [Your Name]

Overview of estimated tax payment details

Estimated tax payments for the 2023 tax year require careful consideration for individuals and businesses alike. These payments, typically due on April 15, June 15, September 15, and January 15, aim to cover income tax obligations throughout the year, based on projected income. For individuals, estimated payments generally should amount to approximately 90% of the current year's tax liability or 100% of the previous year's tax, whichever is lower. Businesses, particularly S Corporations and Partnerships, must also account for estimated payroll taxes and self-employment taxes, which can significantly alter the total estimated payment figure. Payment methods include electronic funds transfer, checks, or using the IRS Direct Pay system, providing options for taxpayers to submit their obligations efficiently. Accurate estimation requires careful analysis of income changes, deductions, and tax credits available, which can fluctuate annually based on varying tax legislation, such as the Tax Cuts and Jobs Act of 2017.

Instructions for payment submission

Quarterly tax estimates serve as an essential obligation for individuals and businesses to pay their estimated tax liabilities to the Internal Revenue Service (IRS) in the United States. For the 2023 tax year, the deadlines for submissions occur on April 15, June 15, September 15, and January 15. Payments can be submitted via several methods, including the Electronic Federal Tax Payment System (EFTPS), making it convenient for taxpayers to manage their obligations seamlessly. Paper checks should be addressed to the U.S. Treasury, noting the taxpayer's identification number and the specific tax form being filed, such as 1040-ES for individuals or 1120-W for corporations, to ensure proper credit. It is crucial for taxpayers to calculate their estimated taxes accurately to avoid potential penalties, as underpayment may lead to additional financial obligations. Additionally, maintaining timely submission helps in managing cash flow and strategic financial planning throughout the year.

Deadline and consequences of late payment

Quarterly tax estimates are crucial financial responsibilities for self-employed individuals and businesses in the United States. The Internal Revenue Service (IRS) mandates these payments, typically due on April 15, June 15, September 15, and January 15 of the following year. Failure to submit these estimates by the deadlines can lead to significant penalties, including a failure-to-pay penalty, which can be calculated at 0.5% of the unpaid balance for each month the payment is late, up to a maximum of 25%. In addition, late payments may accrue interest, currently set at 3% annually, compounding daily. Proper planning and timely submissions are essential to avoid financial repercussions and to ensure compliance with federal tax regulations.

Letter Template For Quarterly Tax Estimate Submission Samples

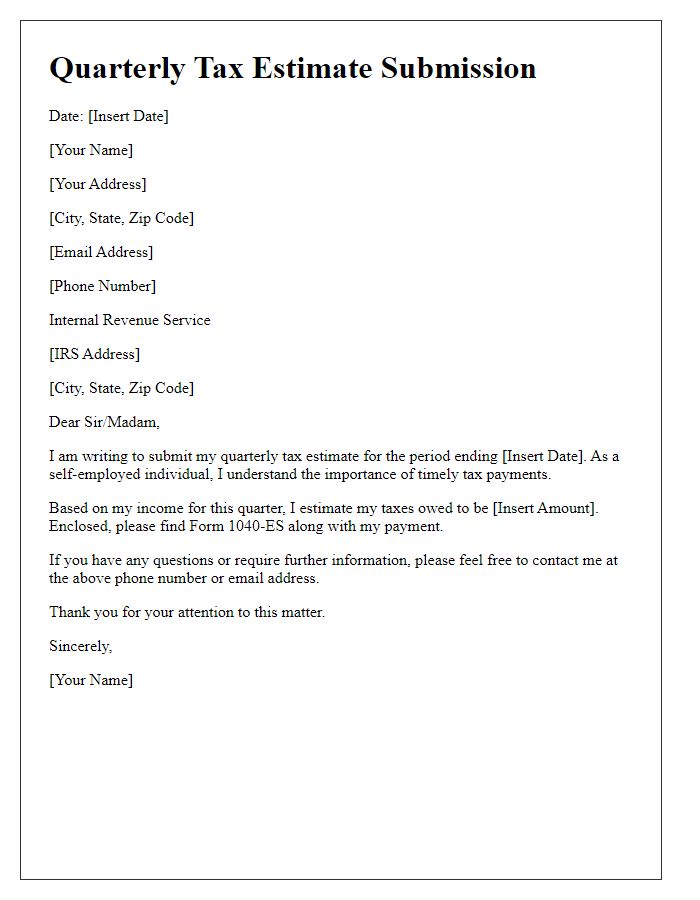

Letter template of quarterly tax estimate submission for self-employed individuals

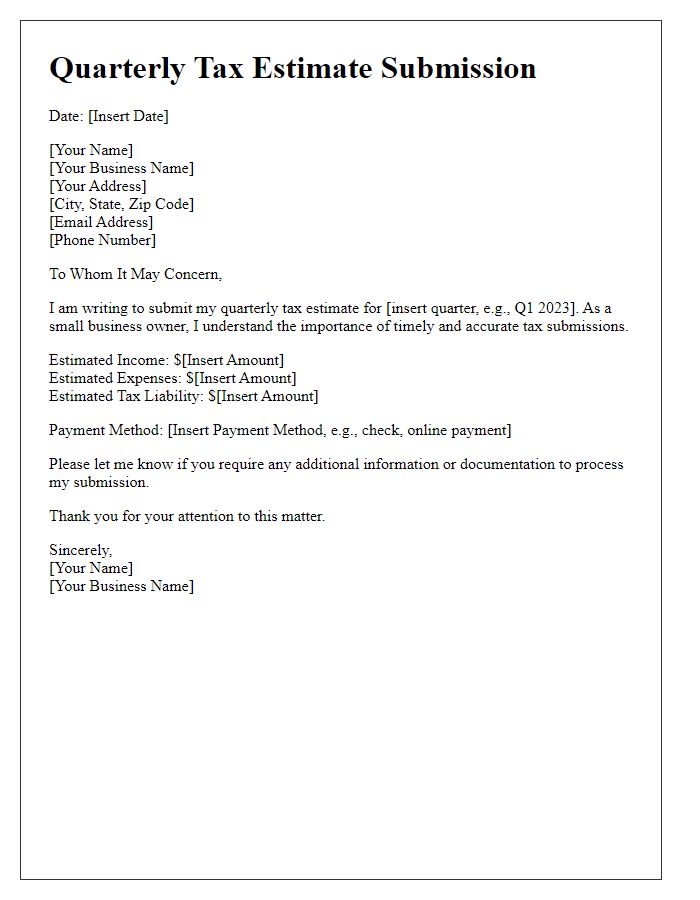

Letter template of quarterly tax estimate submission for small businesses

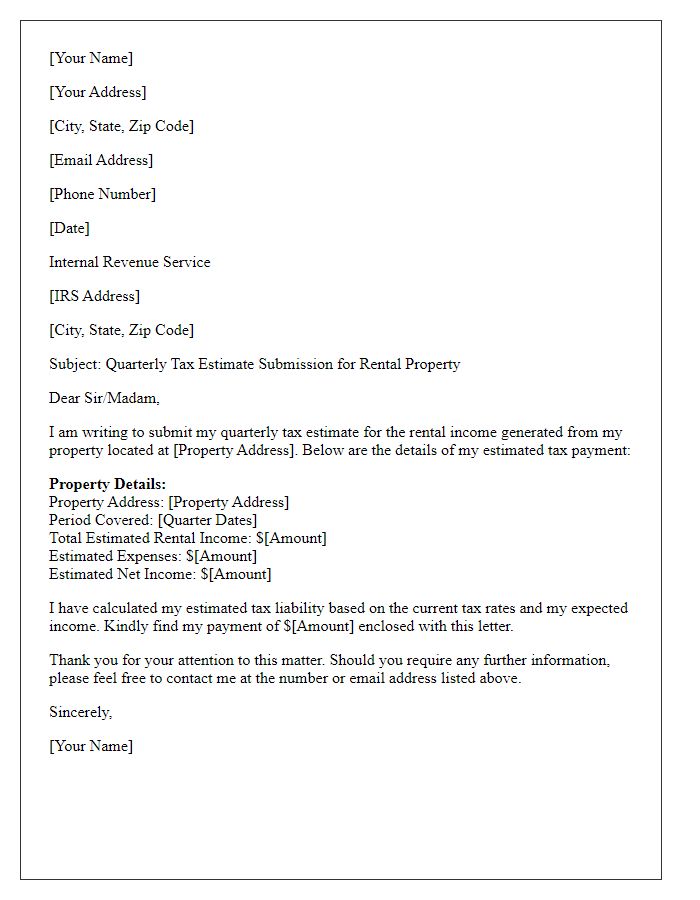

Letter template of quarterly tax estimate submission for rental property owners

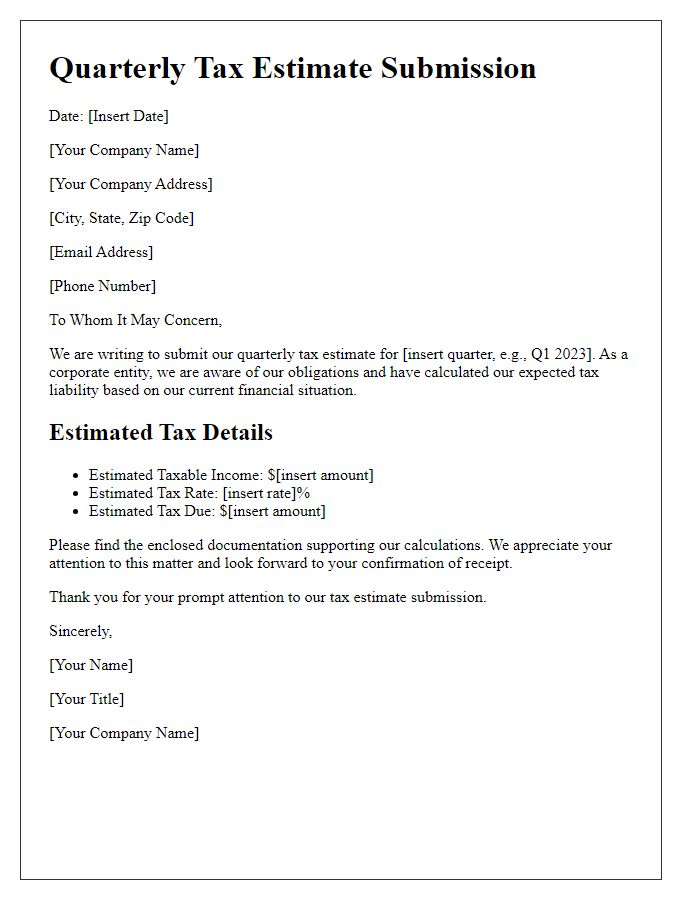

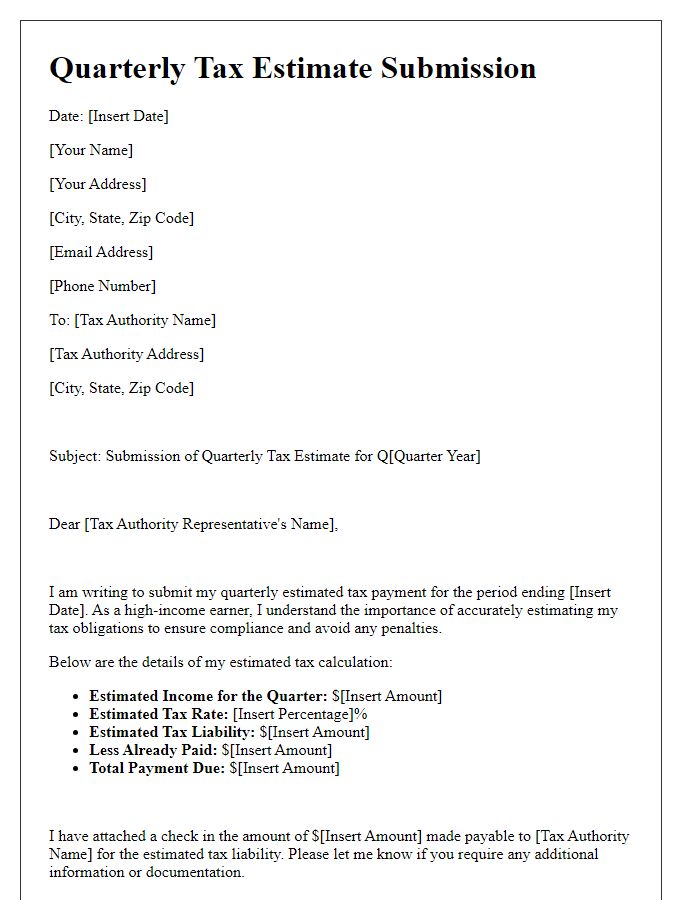

Letter template of quarterly tax estimate submission for corporate entities

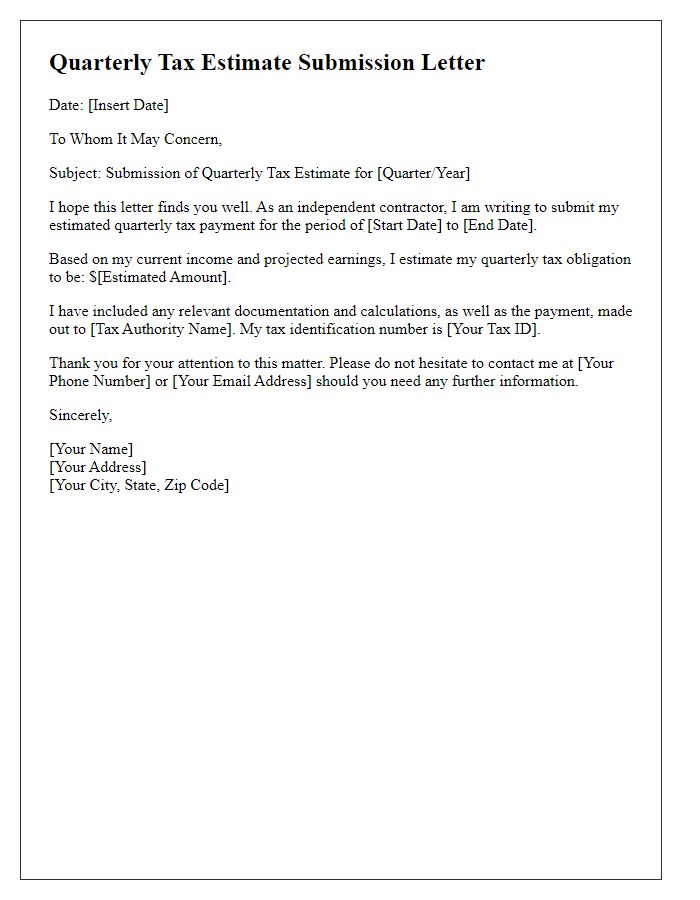

Letter template of quarterly tax estimate submission for independent contractors

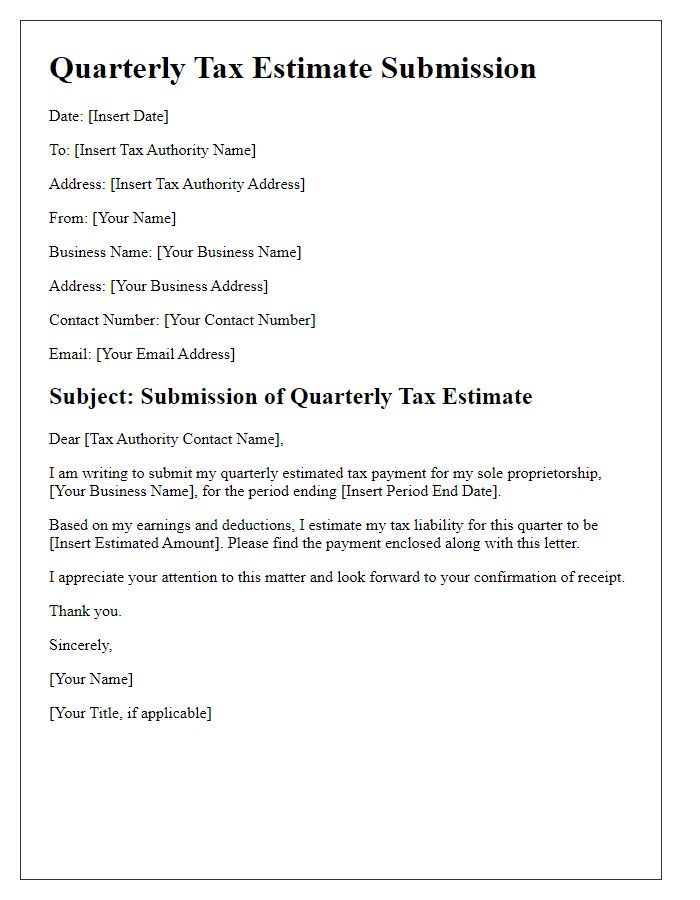

Letter template of quarterly tax estimate submission for sole proprietorships

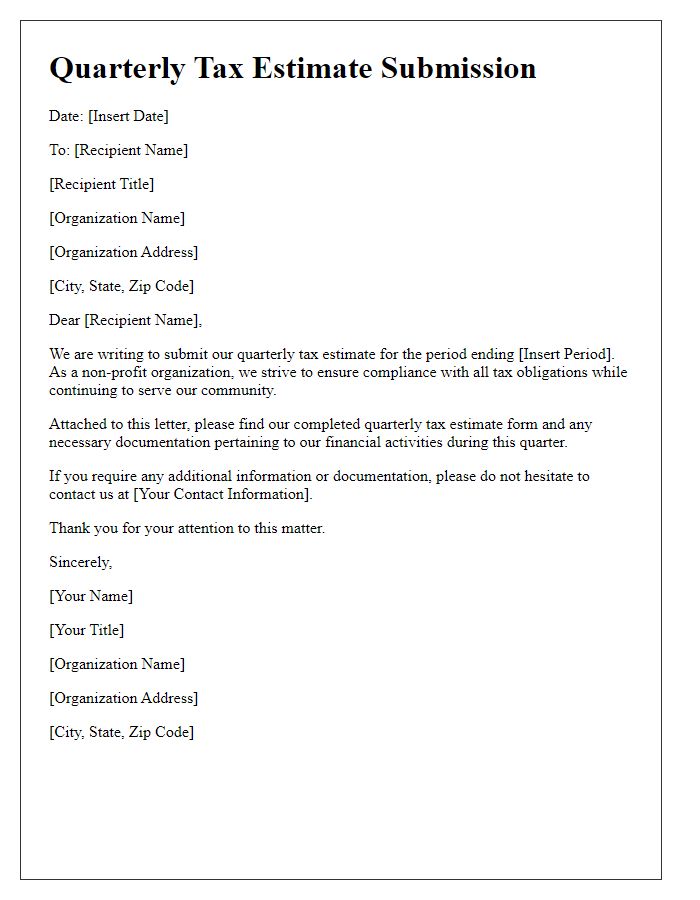

Letter template of quarterly tax estimate submission for non-profit organizations

Comments