Hey there! Have you ever found yourself in a situation where your balance sheet doesn't quite add up? It happens to the best of us, and sometimes all it takes is a little adjustment to get everything back on track. In this article, we'll explore a simple letter template that can help you communicate those necessary changes effectively. So stick around to discover how to streamline your balance sheet adjustments with ease!

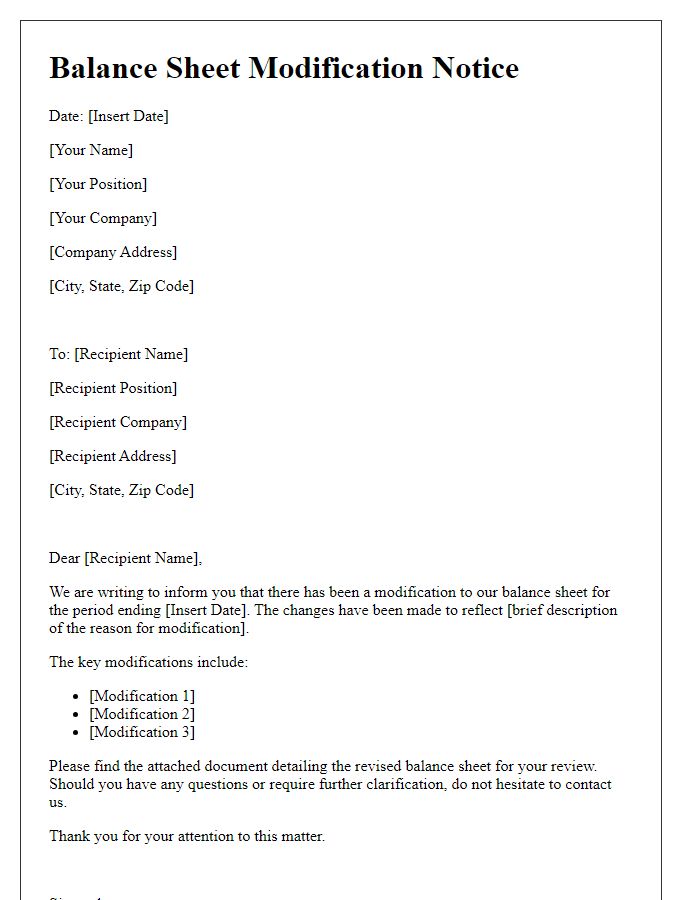

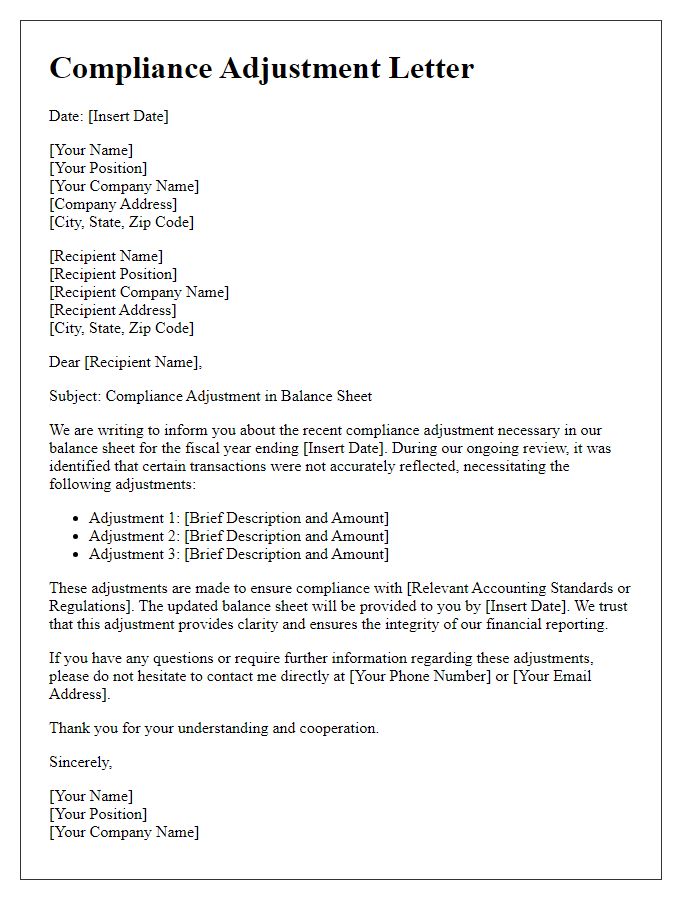

Purpose of Adjustment

The purpose of a balance sheet adjustment is to accurately reflect the financial position of a business at a specific point in time, typically the end of a fiscal period. Adjustments can include corrections for inaccuracies in asset valuations, such as accounts receivable, inventory, or fixed assets like machinery, which may have depreciated or been impaired. Additionally, liabilities might require adjustments to account for accrued expenses or contingent liabilities. These updates ensure compliance with accounting principles such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Accurate balance sheets provide stakeholders, including investors and creditors, with a truthful representation of the company's financial health, fostering informed decision-making. Regular adjustments are necessary during audits or financial reviews to align recorded values with actual conditions, enhancing transparency and credibility in financial reporting.

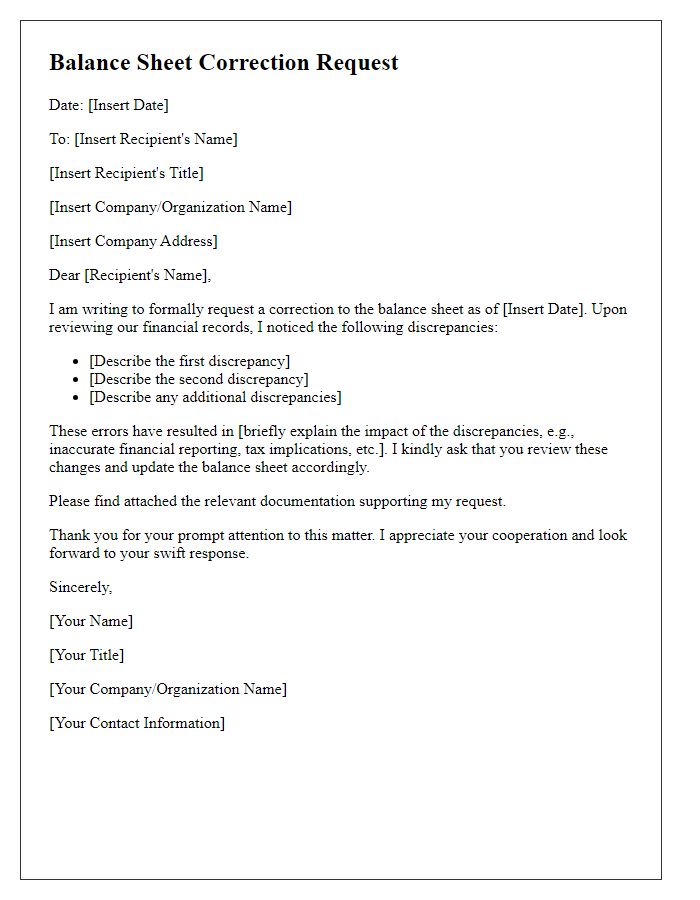

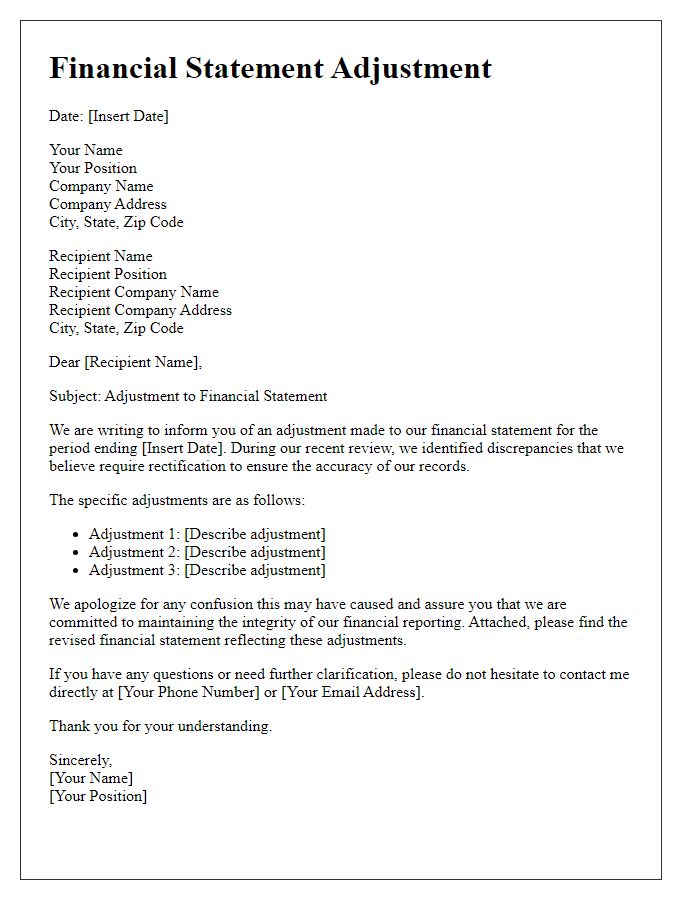

Detailed Financial Information

Accurate balance sheet adjustments are critical for reflecting the true financial position of a business, encompassing assets, liabilities, and equity. Regular evaluations of current assets, like cash and accounts receivable, alongside long-term assets such as property and equipment, ensure clarity in financial reporting. Notable liabilities include short-term obligations, typically due within one year, and long-term debts, often exceeding one year. Equity, representing ownership interest, encompasses retained earnings and contributed capital, crucial for understanding shareholder equity. Thorough documentation of adjustments, supported by financial statements dated as of December 31, provides transparency to stakeholders and aids in compliance with accounting standards such as GAAP or IFRS. Properly adjusting these figures is essential for accurate financial analysis and strategic decision-making, highlighting areas for improvement or investment opportunities.

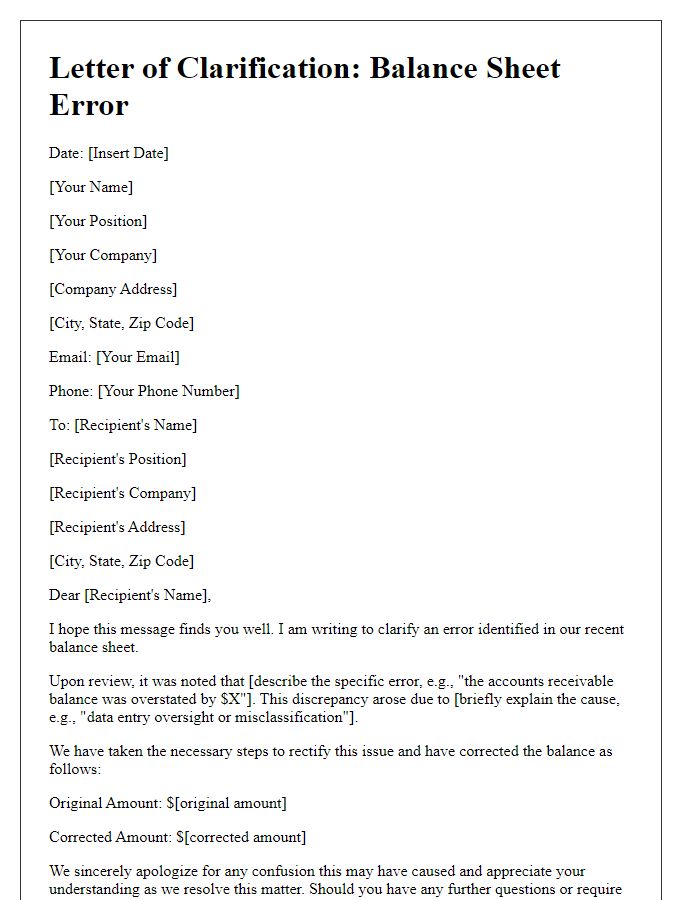

Justification for Changes

Balance sheet adjustments are crucial for accurate financial reporting. These changes may arise from various events, such as discrepancies identified during audits or financial reviews, shifts in asset valuation, or corrections of accounting errors. Significant adjustments often pertain to asset classes like Property, Plant, and Equipment (PP&E), where depreciation methods might be revised to comply with Generally Accepted Accounting Principles (GAAP). Liabilities, such as deferred tax liabilities, may require adjustments due to changes in tax regulations or updated tax rates. Stakeholders, including investors and creditors, rely on the accuracy of the balance sheet to make informed decisions, emphasizing the necessity for clear justification regarding these changes.

Impact on Stakeholders

Balance sheet adjustments can significantly impact various stakeholders within an organization. Shareholders (owners of the company's stock) may experience fluctuations in equity valuations due to changes in asset and liability assessments, directly affecting their investments' worth. Creditors (lenders or bondholders) might reassess the company's creditworthiness based on adjusted financial ratios, influencing their willingness to extend credit or adjust interest rates. Employees may face implications in terms of job security or wage adjustments as the company navigates financial stability metrics, while customers could experience variations in service quality or product pricing linked to the organization's fiscal health. Regulatory bodies, tasked with ensuring compliance, may require detailed documentation concerning the adjustments, affecting the company's reporting practices. Ultimately, these adjustments can create a ripple effect, influencing operational strategies and stakeholder relationships within both the short and long term.

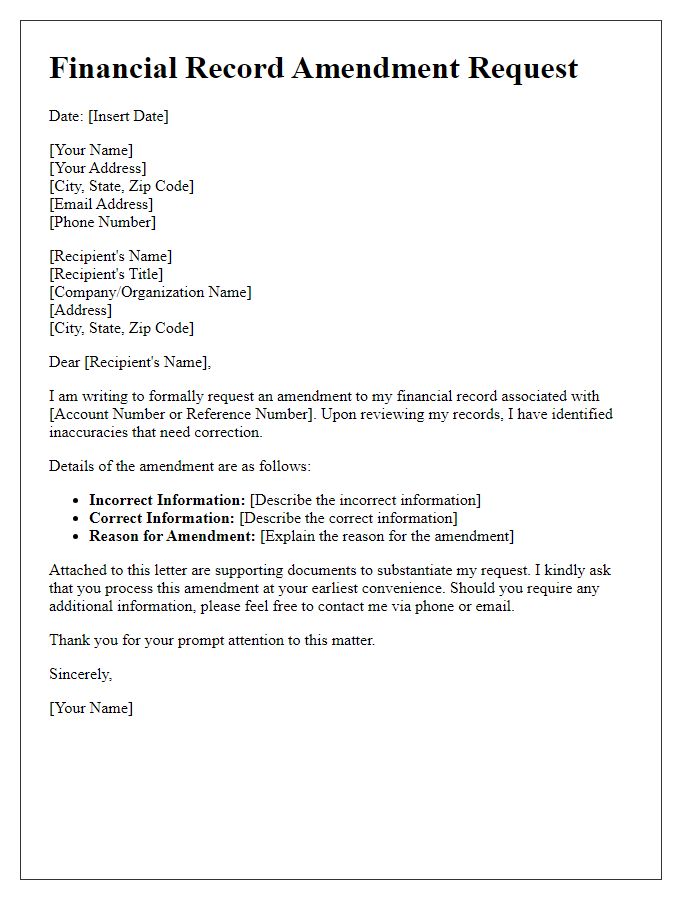

Contact Information for Queries

Balance sheet adjustments play a critical role in ensuring the accuracy of financial statements within organizations, particularly during year-end reporting periods. Key components such as assets (including tangible assets like corporate real estate and intangible assets like patents), liabilities (like short-term loans or long-term bonds), and equity (representing shareholder ownership) must align accurately to reflect the company's financial health. Any discrepancies in metrics such as the current ratio or debt-to-equity ratio can significantly impact investor confidence and decision-making. To facilitate communication regarding any queries related to these adjustments, provide a dedicated contact point--ideally an accounting manager or financial analyst--whose direct phone number (including area code) and email address are readily available to stakeholders for prompt resolution of concerns or clarifications.

Comments