Are you feeling a bit overwhelmed by the intricacies of employee tax withholding adjustments? You're not alone! Many employers find themselves navigating the complexities of ensuring accurate tax deductions for their staff. If you're curious about how to effectively manage these adjustments, keep reading for tips and a helpful template to get you started!

Employee Information

Proper employee tax withholding adjustments are crucial for accurate payroll management. Employee information, including full name, Social Security number, and current address, must be meticulously documented to ensure compliance with IRS regulations. The withholding amount, which can range from single to multiple exemptions, directly influences the take-home pay and tax obligations. State regulations, such as those from California with its unique state income tax guidelines, also impact these calculations. Regular updates to employee tax forms, like the W-4, are necessary whenever there are changes in marital status, dependents, or additional income sources, ensuring the withholding aligns with the employee's current financial situation.

Current Tax Withholding Status

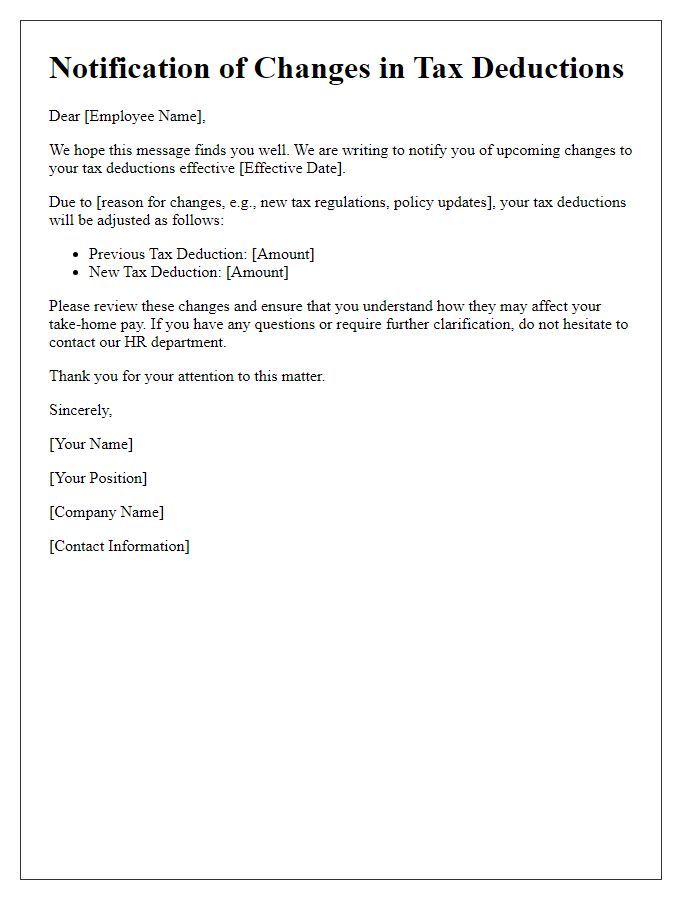

The current tax withholding status, especially for employees in the United States, is influenced by various personal factors, including filing status (single, married, head of household), number of dependents (children, relatives), and additional income sources (freelance work, investment income) that can affect the overall tax liability. Employees may need to complete IRS Form W-4, which allows the adjustment of withholding allowances to reflect changes in personal situations, such as marriage, divorce, or changes in employment. The tax withholding percentage varies by income bracket, with federal rates ranging from 10% to 37% as of the 2023 tax year. State tax withholding also plays a significant role, with rates differing considerably by state--California's top rate reaches 13.3%, while states like Texas have no income tax. Regular reviews of withholding status can lead to more accurate paychecks and help prevent underpayment penalties come tax season.

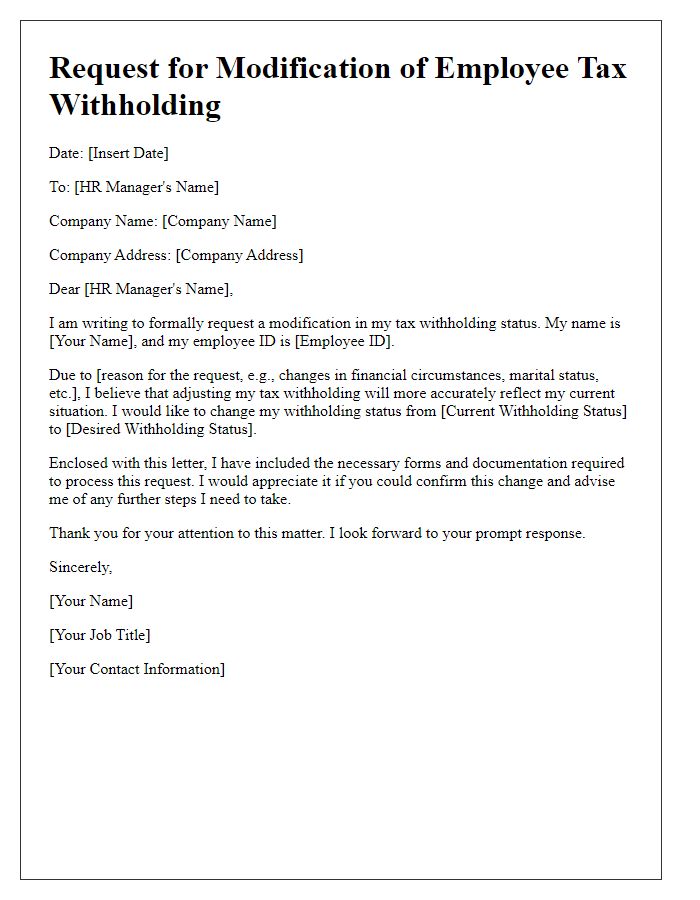

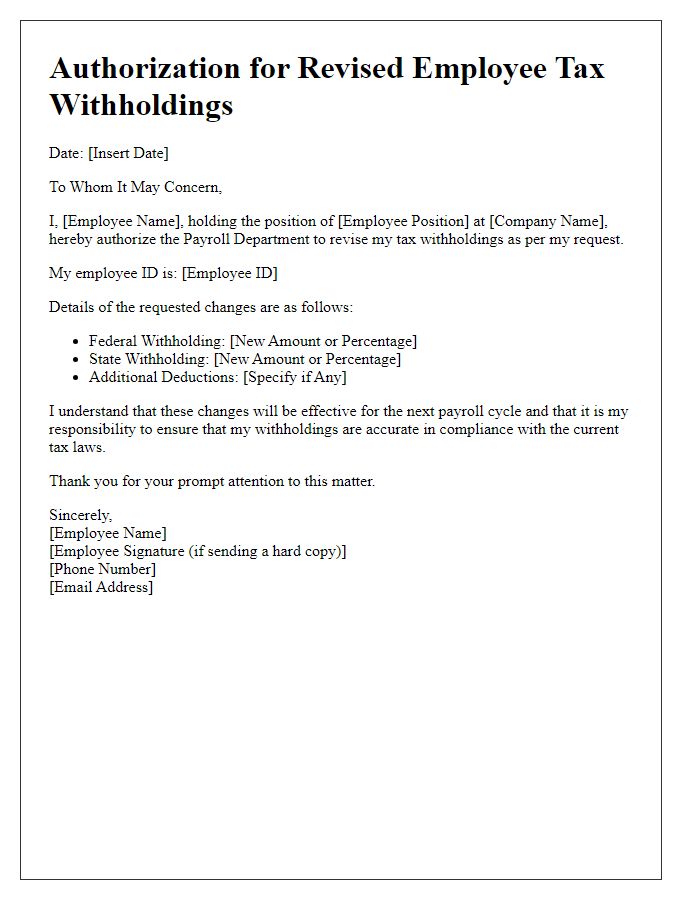

Requested Withholding Adjustment

An employee tax withholding adjustment is essential for ensuring accurate payroll deductions based on federal and state tax regulations. The adjustment reflects updates to personal exemptions, changes in filing status, or shifts in income, affecting the withholding rate. Employees might request this adjustment due to life events, such as marriage, childbirth, or significant salary increases, impacting their tax liabilities. The Internal Revenue Service (IRS) Form W-4 is typically utilized for these changes, allowing employees to specify the number of allowances or additional withholding amounts. Accurate adjustments can prevent tax underpayment or overpayment, ensuring employees receive proper refunds or liabilities during tax filing season.

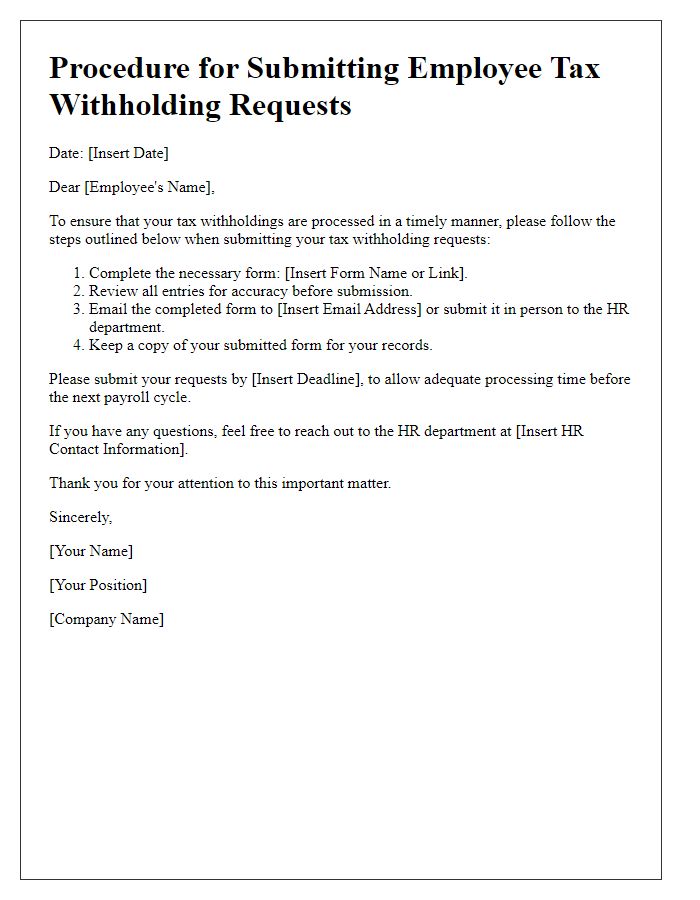

Effective Date of Change

In an employee tax withholding adjustment, the effective date of change signifies the specific date on which the modified withholding amounts take effect. For example, an employee may request a change in their federal tax withholding percentage due to a shift in financial circumstances or tax status. This adjustment often requires the submission of a new Form W-4, particularly if the employee's personal situation, such as marital status or number of dependents, has changed. Employers need to ensure that these changes are accurately reflected in payroll systems by the effective date, which can vary depending on payroll cycles (bi-weekly, monthly) and state regulations. Early notification of changes allows for compliance with IRS guidelines and avoids any discrepancies in the employee's take-home pay.

Contact Information for Queries

Employers must provide contact information for employees seeking assistance with tax withholding adjustments. A dedicated HR email address (such as hr@companyname.com) allows for streamlined communication. A direct phone number (e.g., (555) 123-4567) ensures employees can quickly reach someone knowledgeable. Additionally, establishing office hours (such as Monday to Friday, 9 AM to 5 PM) helps employees to know the best times to call or visit. Ultimately, clear, accessible contact options foster support and ensure employees can effectively manage their tax concerns.

Letter Template For Employee Tax Withholding Adjustment Samples

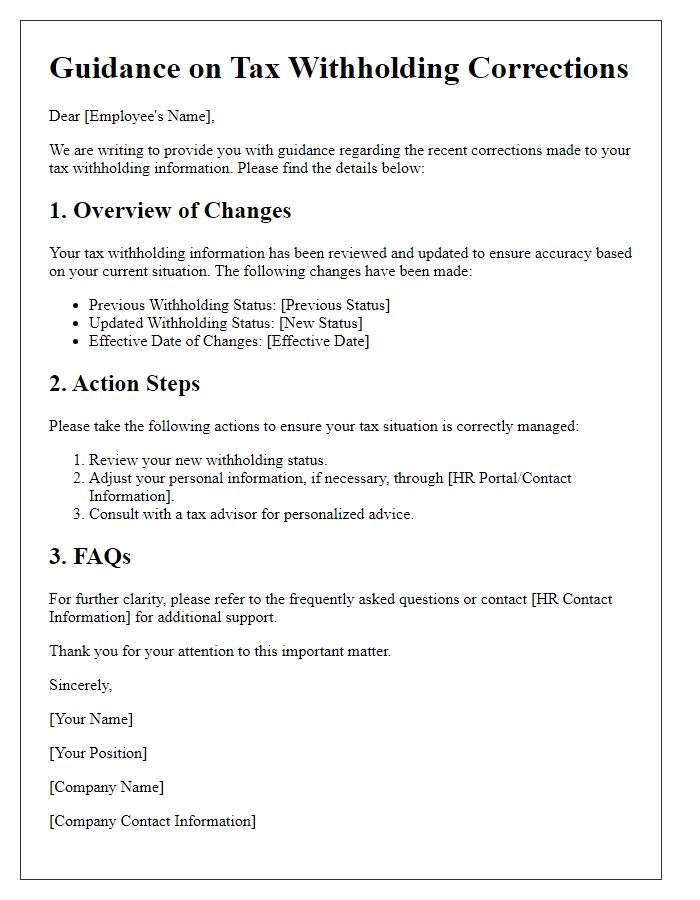

Letter template of guidance for employees on tax withholding corrections

Comments