Are you looking to navigate the world of foreign exchange transactions with ease? Understanding the intricate details of forex trading can seem daunting at first, but it doesn't have to be! With the right tools and knowledge, you can confidently manage your currency exchanges and maximize your returns. Stick around as we delve deeper into the essentials of foreign exchange transaction detailsâthere's so much more to discover!

Exchange Rate Information

Foreign exchange transactions heavily rely on exchange rate information, which indicates the value of one currency against another, such as the Euro (EUR) against the United States Dollar (USD). As of October 2023, the exchange rate fluctuated frequently, reflecting factors like economic stability, geopolitical events, and market sentiment. For instance, a recent event, the European Central Bank's announcement of interest rate changes, resulted in a significant euro appreciation of approximately 1.5% against the dollar. Market participants closely monitor these rates via Forex trading platforms, which provide real-time data essential for making informed trading decisions. Accurate exchange rate information is pivotal for businesses engaged in international trade, enabling them to assess costs and optimize their financial strategies effectively.

Transaction Date and Time

Foreign exchange transactions often include pivotal details that impact both trading and accounting processes. Transaction date and time serve as crucial identifiers, marking the exact moment when the currency exchange occurs. For instance, a transaction executed on October 5, 2023, at 3:45 PM Eastern Standard Time can influence market analysis and audit trails significantly. Accurate recording of this information aids in compliance with regulations set by financial authorities like the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. Additionally, discrepancies in transaction timing can lead to substantial currency risk or financial discrepancies in valuation.

Amount and Currency Details

Foreign exchange transactions require precise details for clarity and accuracy. The transaction amount significantly impacts the exchange rate, especially when dealing with large sums, with typical amounts ranging from a few hundred to millions of dollars. Currency details are vital, including the currency codes, such as USD (United States Dollar), EUR (Euro), or JPY (Japanese Yen), which indicate the specific currencies involved in the transaction. Additionally, fluctuations in the foreign exchange market can affect the final amount received after conversion, often requiring awareness of rates published by banks or financial institutions at specific times, typically with updates every business day. It's crucial to document the transaction date, as it can determine the applicable exchange rate for that precise moment.

Beneficiary Details

Beneficiary details in foreign exchange transactions are critical for ensuring accurate and timely transfers. Including essential information such as the beneficiary's full name (as per official identification), bank account number, and the specified currency in which the transaction will occur is crucial. Additionally, the recipient's bank name (which could be a major financial institution such as JPMorgan Chase or HSBC), branch location (such as London or New York), and SWIFT/BIC code (a standardized format for Business Identifier Codes) will facilitate a smooth transfer process. Transparency in providing these details minimizes the risk of errors or delays, ensuring funds reach intended recipients efficiently.

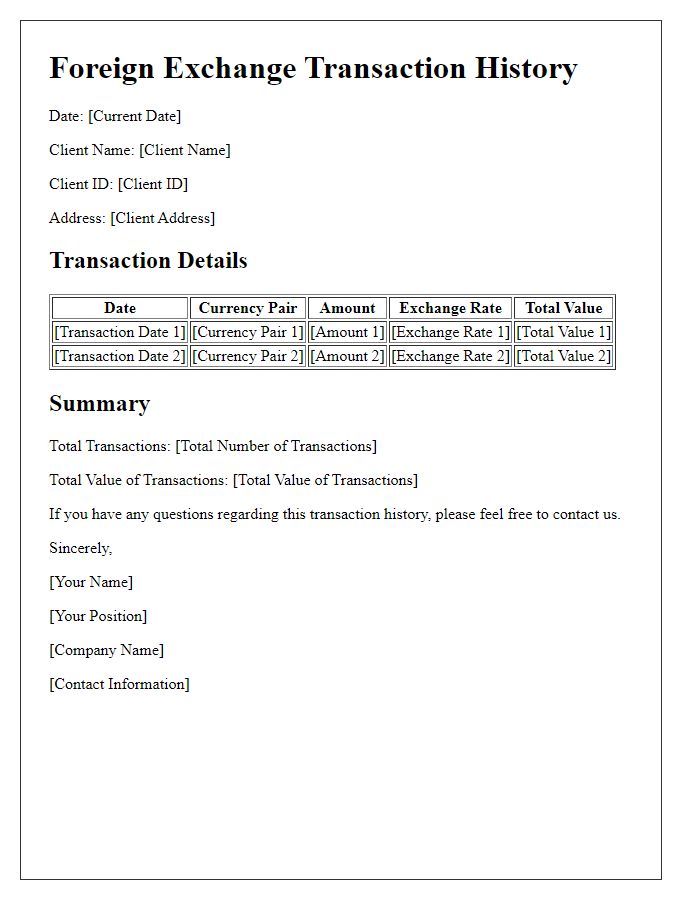

Reference or Transaction ID

Foreign exchange transactions often require detailed information for accurate tracking and reconciliations. A reference number, or transaction ID, is essential for identifying specific currency exchanges, such as USD to EUR conversions. Each ID is unique, ensuring easy retrieval of transaction history, which may include the date of the transaction (often recorded in the format YYYY-MM-DD), the involved parties (such as financial institutions or individuals exchanging funds), and the total exchanged amount (often reflecting live market rates). Accurate documentation also encompasses the exchange rate applied (for example, 1 USD to 0.85 EUR), the fees incurred during the transaction, and any associated timestamps indicating when the transaction was executed or settled. This information is crucial for compliance with international financial regulations and auditing purposes.

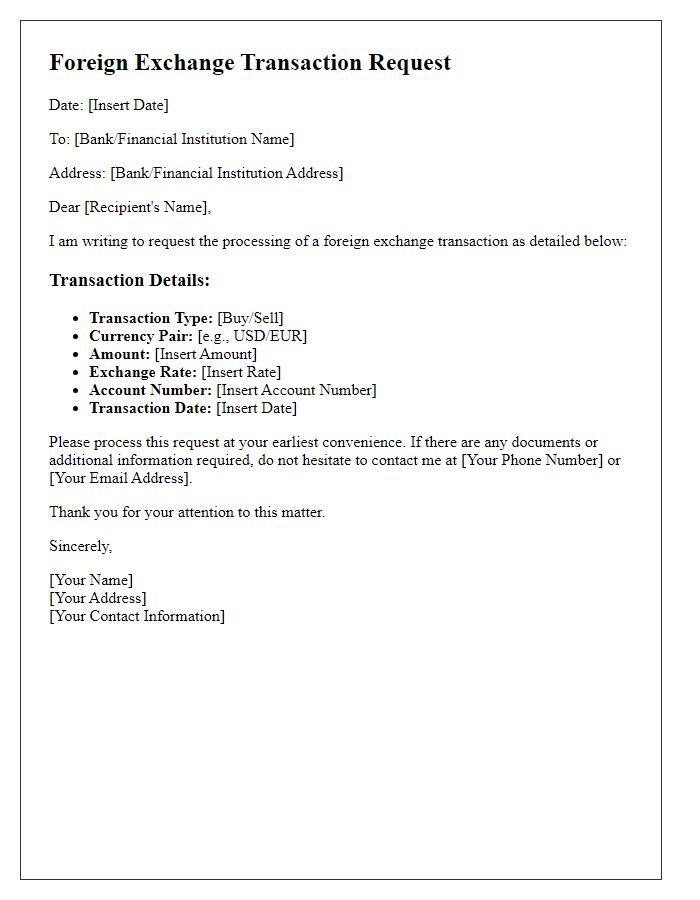

Letter Template For Foreign Exchange Transaction Details Samples

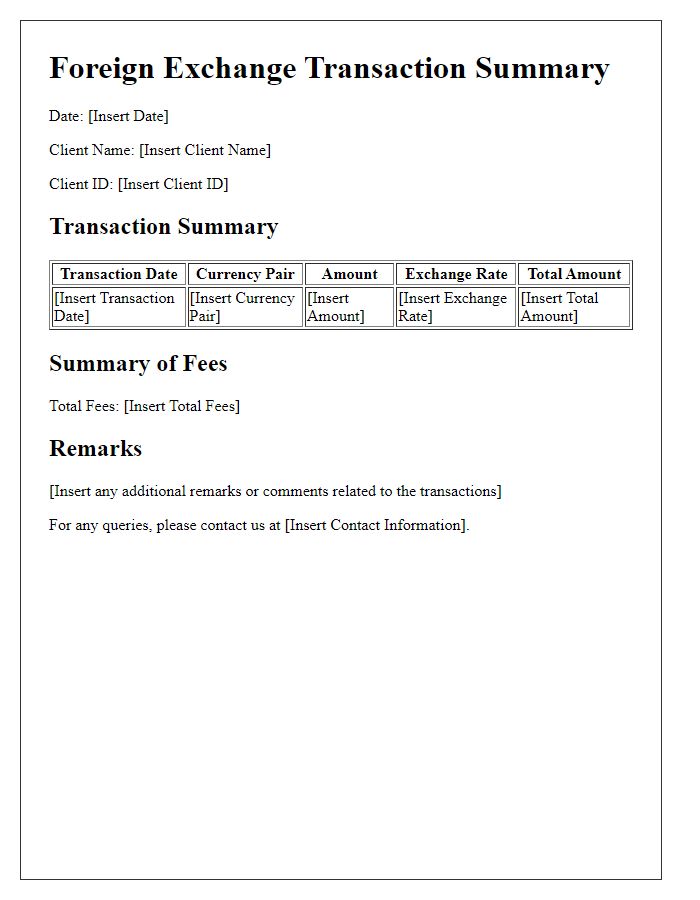

Letter template of foreign exchange transaction summary for client review.

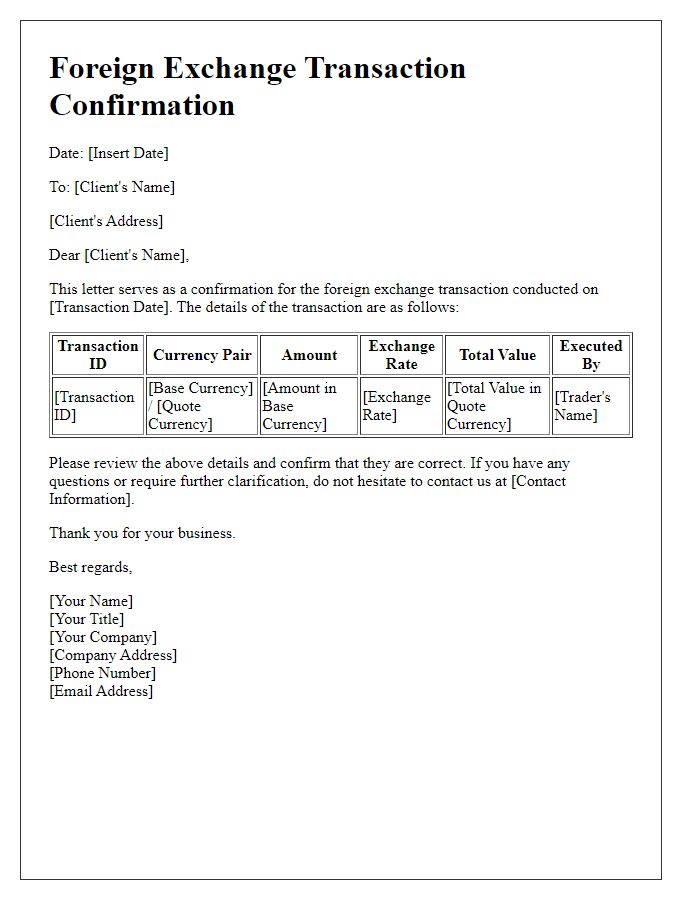

Letter template of foreign exchange transaction confirmation for regulatory compliance.

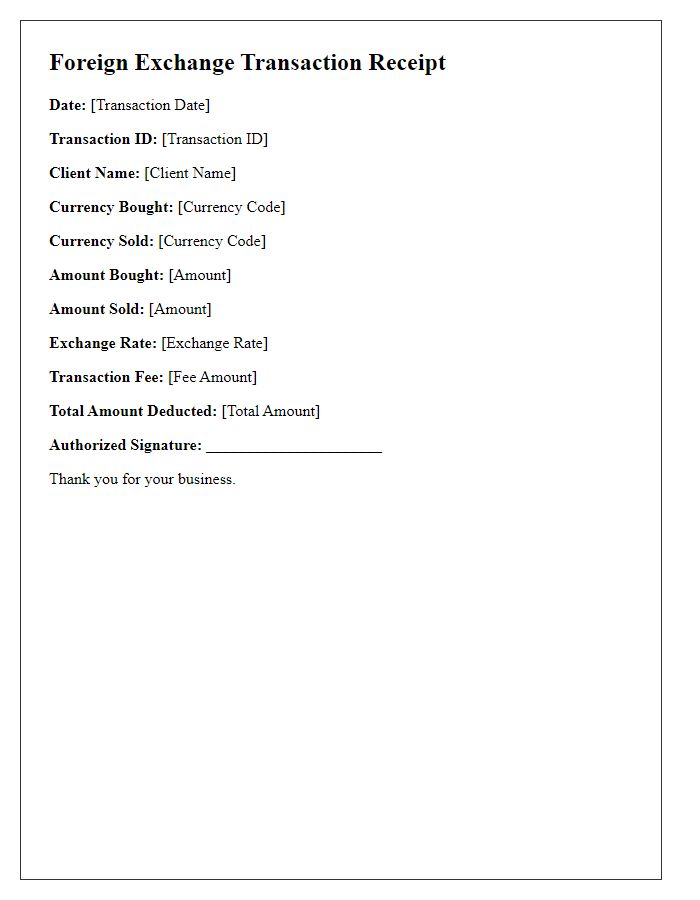

Letter template of foreign exchange transaction receipt for accounting purposes.

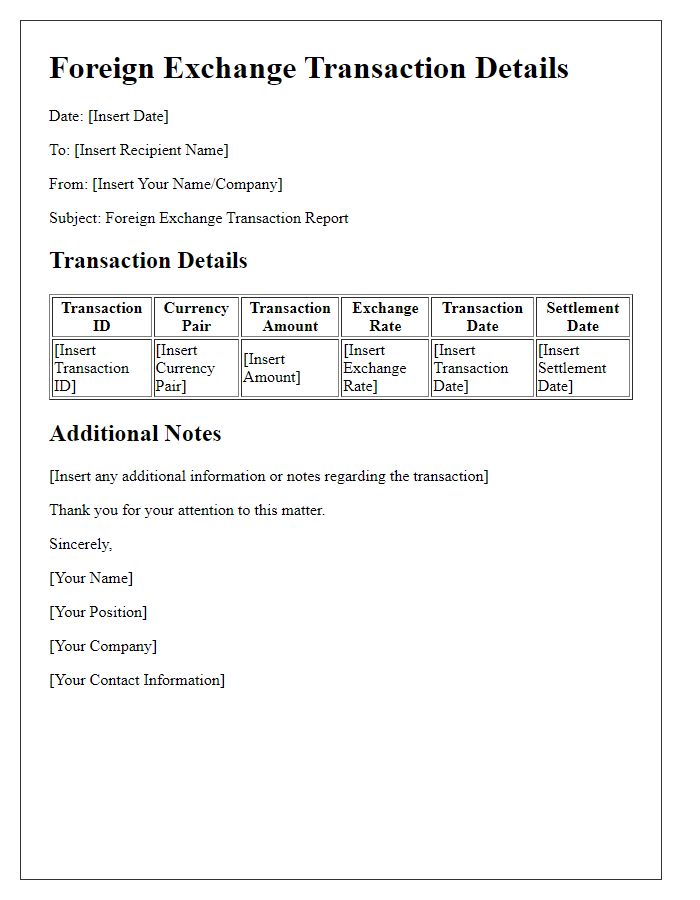

Letter template of foreign exchange transaction details for audit trail.

Letter template of foreign exchange transaction explanation for client inquiries.

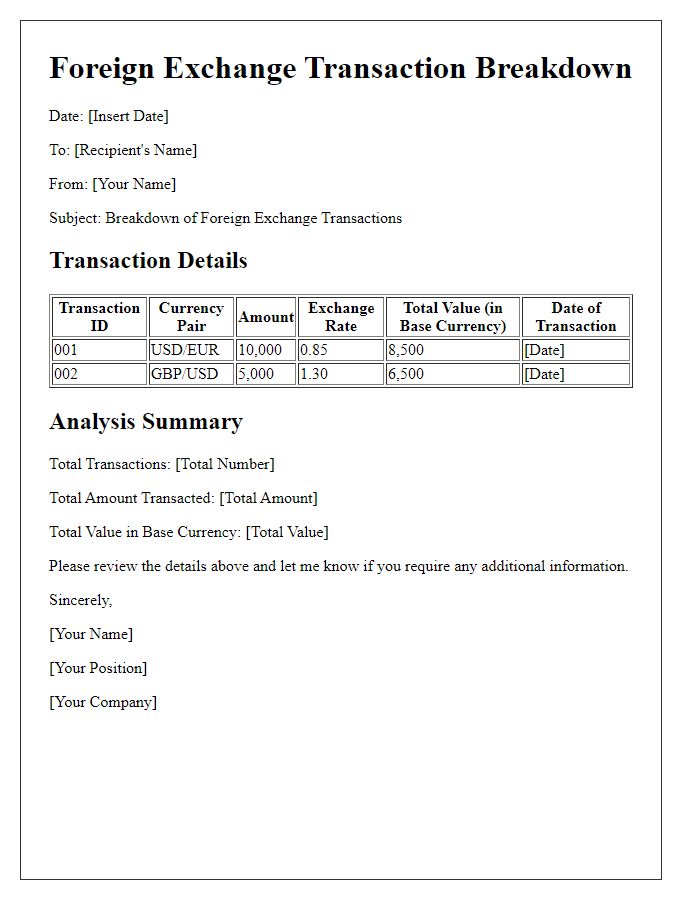

Letter template of foreign exchange transaction breakdown for financial analysis.

Letter template of foreign exchange transaction notification for stakeholders.

Letter template of foreign exchange transaction updates for market trends.

Comments