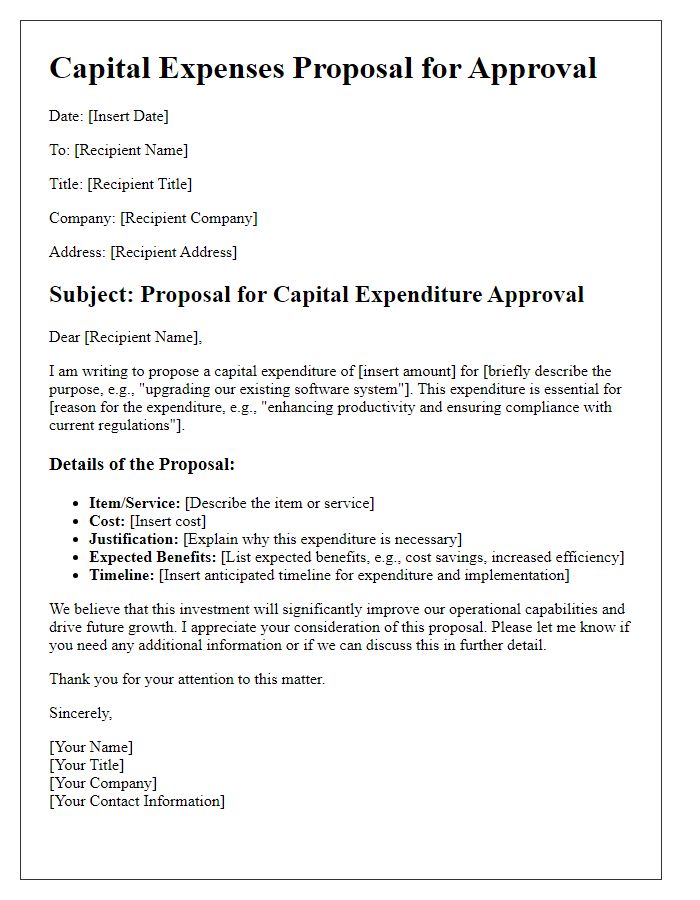

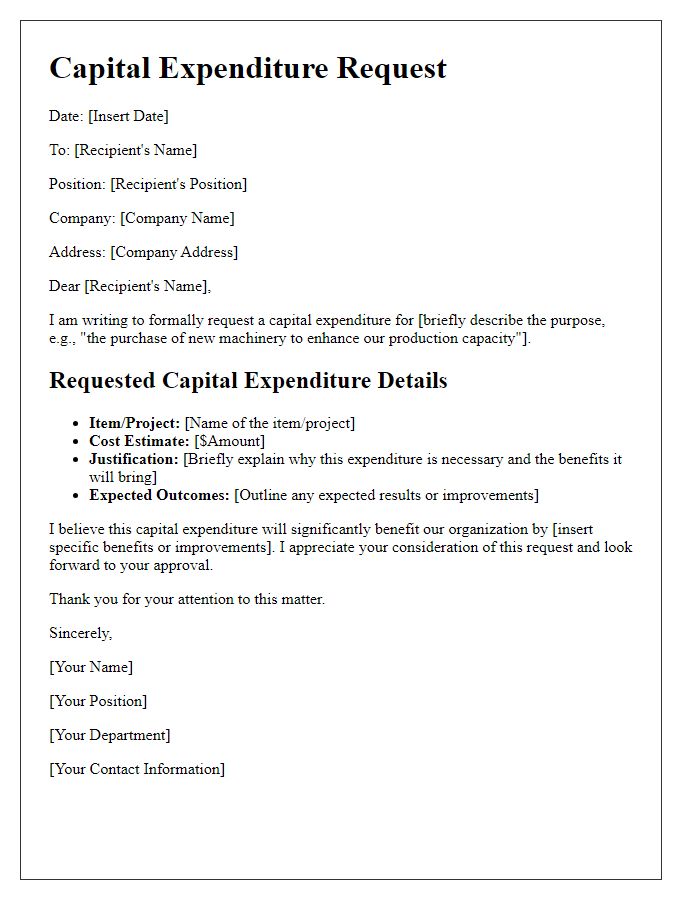

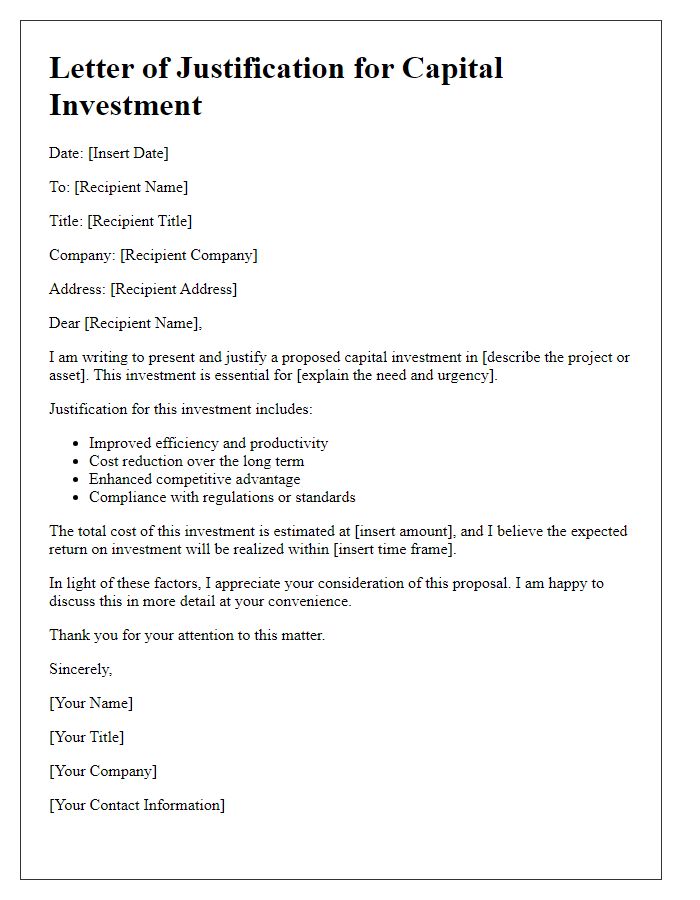

Are you tasked with justifying capital expenses for your project? Crafting a compelling letter can be the key to securing that vital funding. By clearly outlining the benefits and potential return on investment, you can effectively communicate why these expenses are essential for success. Join us as we dive deeper into the process, providing you with a detailed template to make your case more persuasive.

Project Overview

Capital expenses justification requires a clear overview of the project's objectives, financial implications, and anticipated benefits. The project aims to enhance infrastructure (physical or digital assets, such as buildings or software systems) within the organization, leading to increased efficiency. The expected investment totals $500,000, allocated primarily for the purchase of advanced machinery or upgraded technology. A comprehensive analysis of the return on investment (ROI) suggests a projected increase in productivity by 15% annually, offering the organization a competitive edge in the market. This endeavor aligns with the strategic goals (long-term plans of the organization) to innovate and improve operational processes, justifying the financial commitment. Stakeholders (individuals with an interest in the project) will benefit from improved service delivery and potential revenue growth as a result of these enhancements.

Financial Analysis

Capital expenses often require detailed justification to ensure alignment with organizational goals and financial health. These expenditures, such as investments in new machinery or facility upgrades, are substantial and typically exceed a predetermined threshold, often set at $5,000 or more. A comprehensive financial analysis involves examining projected return on investment (ROI) and payback period, highlighting how these expenses will enhance operational efficiency or increase revenue. For example, a proposed $100,000 investment in an advanced manufacturing system may lead to a 20% reduction in production costs and a projected increase in annual revenue by $150,000, thus significantly impacting the company's profitability. Documentation should include current budgeting forecasts and potential impacts on cash flow, ensuring stakeholders understand the strategic importance and long-term benefits of such capital expenditures.

Strategic Alignment

Strategic alignment of capital expenses plays a crucial role in advancing organizational goals and enhancing competitive advantage. By investing in state-of-the-art technology, companies, such as XYZ Corporation, can streamline operations, resulting in a projected 25% increase in efficiency within the next fiscal year. Upgrading facility infrastructure, particularly at the headquarters located in Silicon Valley, entails a budget of $2 million aimed at fostering innovation, improving employee productivity by 15%, and attracting top talent. Additionally, aligning capital expenditures with sustainability initiatives, such as the installation of solar panels, contributes to an estimated 30% reduction in energy costs annually. Such strategic investments directly correlate with long-term growth objectives and market positioning, compelling stakeholders to recognize their importance in maximizing return on investment.

Risk Assessment

Capital expenses justification for risk assessment focuses on identifying potential hazards associated with new projects or acquisitions. Manifestations of risks may include financial loss, compliance issues, or operational disruptions. A thorough analysis conducted by assessing risk factors such as environmental impacts, health and safety regulations, and market volatility becomes imperative. For instance, investing in machinery (like heavy industrial equipment) could lead to safety incidents if proper training and maintenance protocols are not established. Utilizing frameworks like ISO 31000 for risk management ensures comprehensive evaluation and mitigation strategies, protecting organizational assets valued in the millions and enhancing decision-making processes. Regular audits and reviews are critical to ensure ongoing compliance and risk monitoring.

Implementation Plan

Implementing a capital expense plan requires a thorough analysis of projected costs, benefits, and timelines. The comprehensive evaluation should encompass specific financial commitments, such as a budget of $500,000 allocated for infrastructure upgrades in the primary facility located in Downtown Los Angeles. The anticipated project duration spans six months, with key milestones including the completion of vendor selection by March 2024 and the beginning of installation by June 2024. Critical factors for consideration include compliance with local regulations and alignment with the overall strategic objectives of the organization, ensuring a robust return on investment (ROI) through increased efficiency and productivity. A detailed risk assessment will be conducted to mitigate potential pitfalls, such as supply chain disruptions or unforeseen project delays, thereby safeguarding the capital investment and enhancing operational capacity in the long run.

Comments