Are you curious about the current status of your benefit plan audit? Understanding the progress of your audit is essential for ensuring compliance and safeguarding your organization's future. In this article, we'll break down what to expect during an audit process and how it can impact your benefits program. So, let's dive in and explore the intricacies of benefit plan audits together!

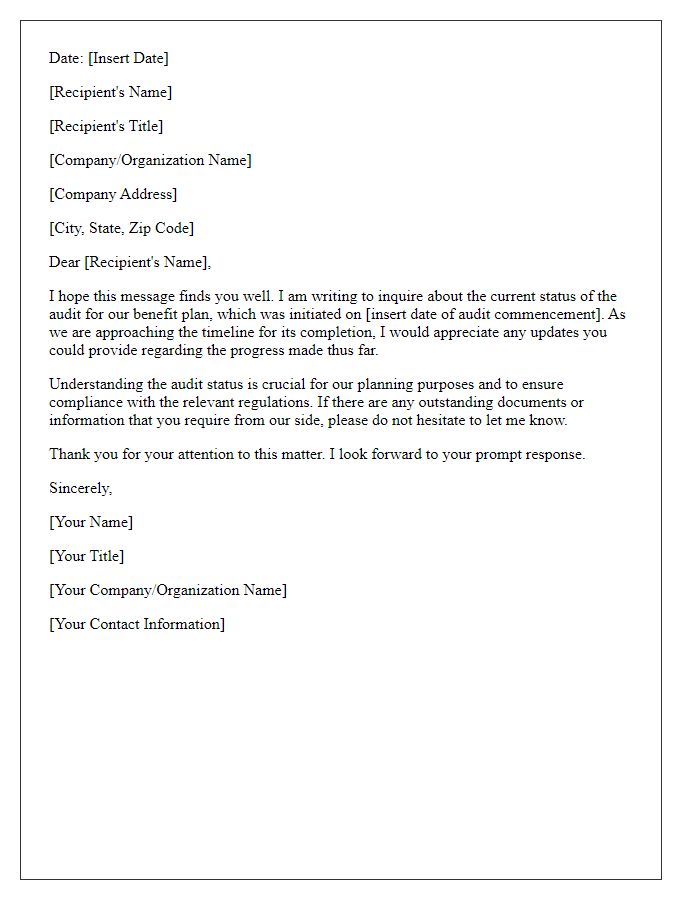

Audit scope and objectives

The benefit plan audit focuses on evaluating the adherence to regulations and internal policies governing employee benefit programs, specifically retirement plans, health insurance options, and wellness initiatives. The audit scope includes a thorough review of participant enrollment records, premium payments, and compliance with the Employee Retirement Income Security Act (ERISA) guidelines. Objectives involve identifying discrepancies in financial records, ensuring accurate benefit calculations, and assessing the overall effectiveness of the plan management in promoting employee well-being. Additionally, the audit aims to verify proper documentation of contributions and distributions, ensuring these align with established federal and state regulations.

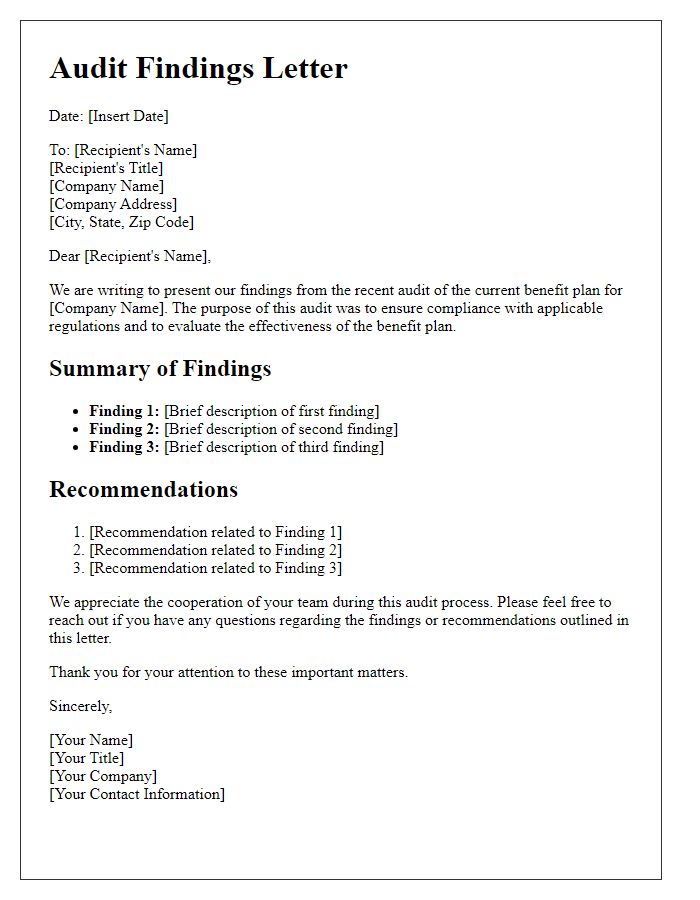

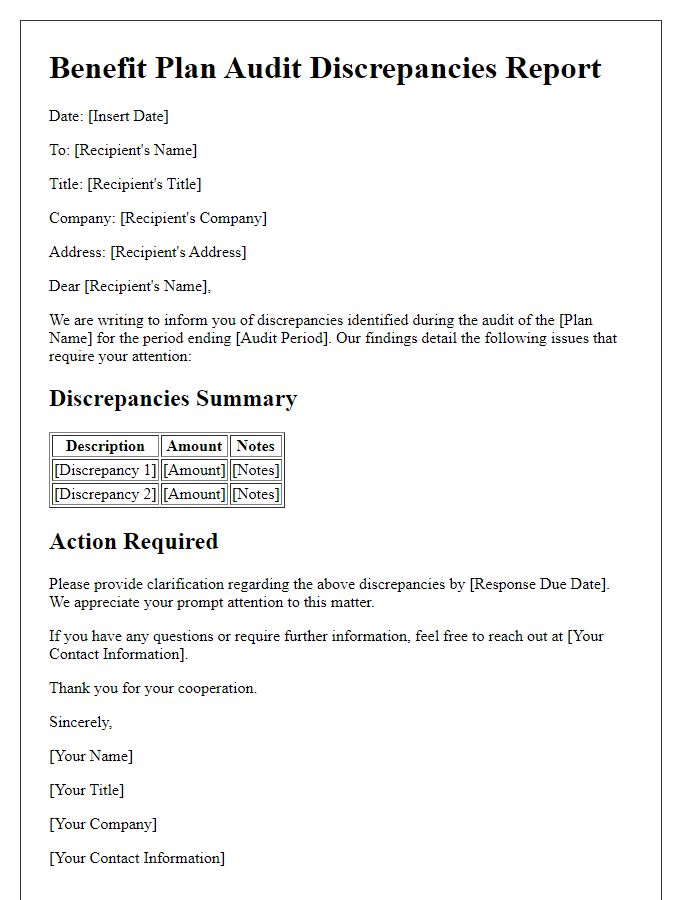

Key findings and observations

A benefit plan audit reveals critical findings regarding compliance with regulations and overall efficiency. Key observations indicate discrepancies in enrollment records affecting thousands of participants (approximately 17% errors found). Financial assessments highlight inadequate funding levels, potentially impacting benefits for nearly 1,200 employees. Additionally, the plan's communication strategies show insufficient engagement, with only 35% of employees actively understanding their enrolled benefits. Compliance issues arise pertaining to the Employee Retirement Income Security Act (ERISA), risking penalties. Overall, these findings underscore the need for immediate action to enhance documentation accuracy and employee education on benefit options, ensuring regulatory adherence and improved employee satisfaction.

Compliance and regulatory adherence

An audit of the benefit plan compliance and regulatory adherence is crucial for ensuring that all employee benefits align with established federal and state laws, including the Employee Retirement Income Security Act (ERISA) and the Affordable Care Act (ACA). This audit examines documentation processes, eligibility criteria, and benefit offerings to ascertain whether they meet legal standards. Key areas of focus include accurate reporting of plan assets, adherence to disclosure requirements, and compliance with nondiscrimination rules in providing benefits to employees. Addressing any discrepancies found during the audit is vital to preventing potential penalties and enhancing employee trust in the organization's commitment to equitable benefits. Regular audits promote operational efficiency and uphold the integrity of the benefit offerings while protecting the organization from legal liabilities.

Recommendations for improvement

The most recent benefit plan audit revealed several areas requiring enhancement to ensure compliance and efficacy of the employee benefits program. The audit, conducted in July 2023 by an external firm, highlighted discrepancies in documentation processes regarding eligibility criteria for plan participants, notably affecting around 15% of enrollees, primarily in the health insurance sector. Additionally, the analysis indicated that the communication of benefits changes to employees was insufficient, leading to misunderstandings about coverage options during open enrollment periods. Implementing a centralized digital platform for documentation and regular training sessions for HR personnel could significantly improve clarity and accuracy. Moreover, fostering an ongoing feedback loop with employees regarding their benefit experiences can guide future adjustments to the plan, enhancing employee satisfaction and retention.

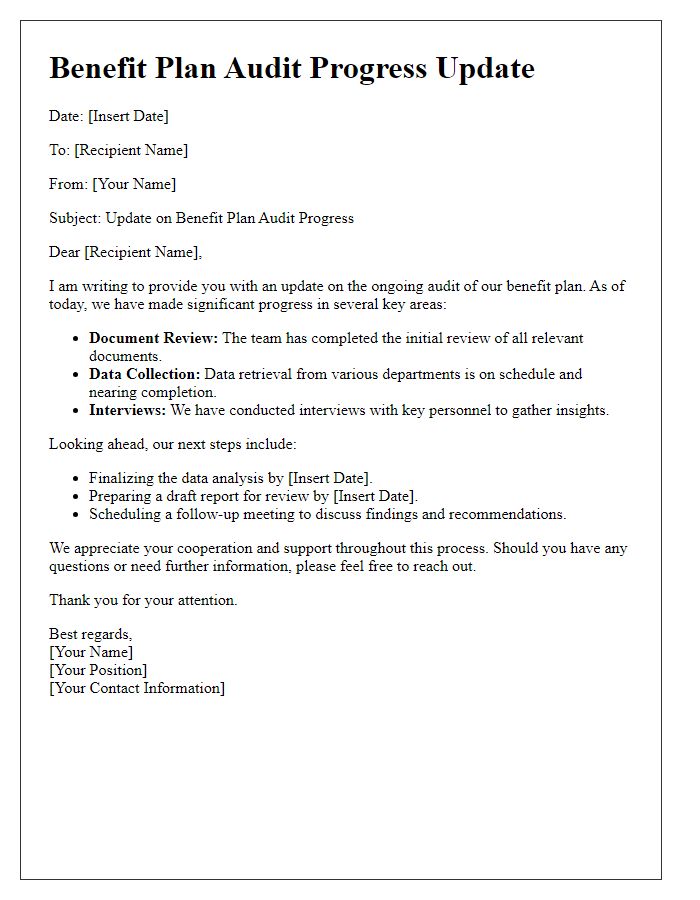

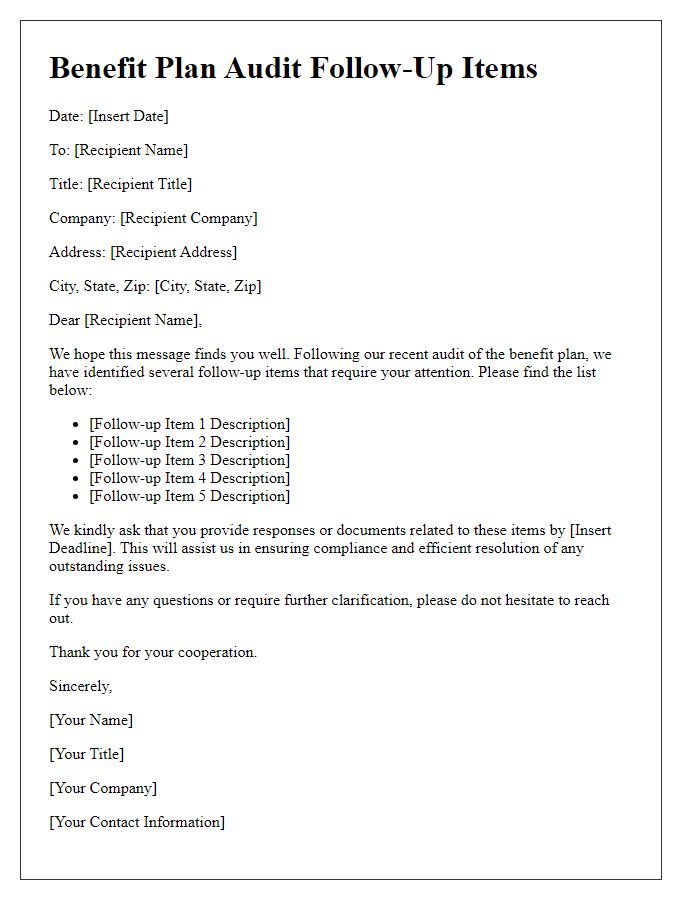

Next steps and timelines

The employee benefit plan audit process, critical for compliance with the Employee Retirement Income Security Act (ERISA), moves into its next phase with several key steps. The audit, conducted by certified public accountants (CPAs) specializing in employee benefit plans, will evaluate financial statements and internal controls. Preliminary findings will be available by November 15, 2023, with a detailed report expected by December 1, 2023. During this timeline, plan administrators must gather all necessary documentation, including participant data from the plan recordkeeper located in Boston, Massachusetts, and summary plan descriptions mandated by regulatory requirements. It is crucial to address any identified discrepancies or irregularities post-audit to ensure adherence to compliance standards. The final step includes submitting the Form 5500, due by July 31, 2024, to the Department of Labor (DOL) detailing the financial status of the benefit plan.

Comments