Are you considering volunteering and want to ensure you're protected? Understanding volunteer insurance is vital for safeguarding yourself and the community you aim to support. Many organizations offer coverage options to protect volunteers from unforeseen accidents or incidents while they lend a hand. Read on to discover essential details about volunteer insurance and how it can benefit you in your charitable endeavors!

Personal and Contact Details

Volunteering in various organizations or events can involve certain risks, making volunteer insurance essential for protection. Personal details such as full name, including middle initials, can provide clarity on identity. Address should include street, city, state, and zip code, ensuring accurate communication regarding emergencies. Phone number must be a reliable contact point, ideally a mobile number for immediate reach. Email address is crucial for digital correspondence or updates regarding volunteer opportunities or insurance changes. Date of birth is often required for identifying age-related risks in activities. Emergency contact information should designate a person (including name and phone number) who can be reached in case of an incident, ensuring prompt assistance and proper communication channels are maintained during volunteer events.

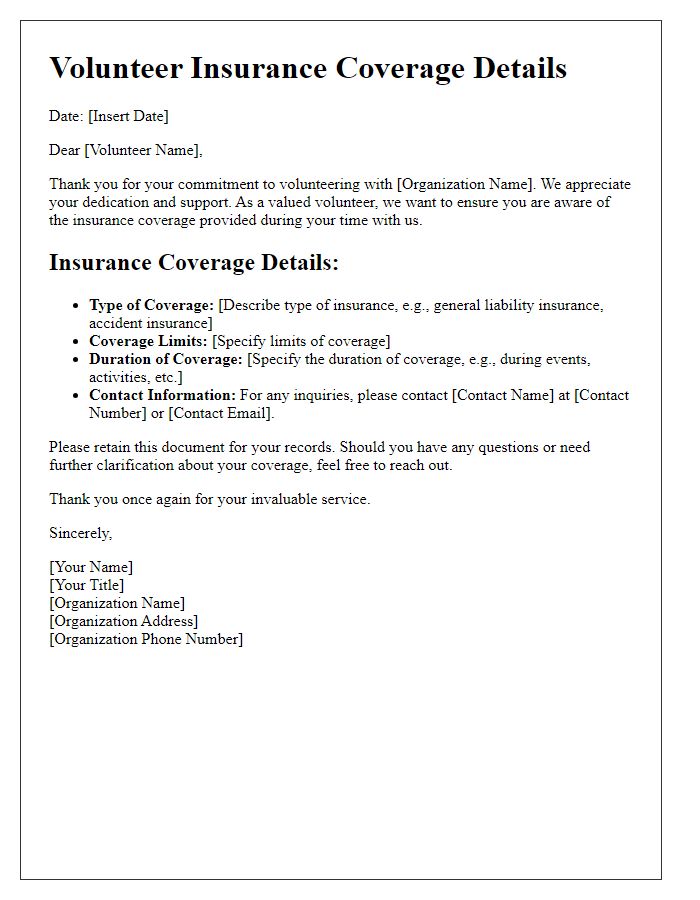

Insurance Coverage Summary

Volunteer insurance information provides crucial insights into protective measures available for individuals engaging in unpaid work. Coverage typically encompasses general liability, which safeguards against accidental injuries or property damage occurring during volunteer activities. For instance, organizations like the American Red Cross or Habitat for Humanity might require volunteers to understand these insurance policies before participating in community service programs. Furthermore, personal accident coverage might protect volunteers against injuries sustained while performing tasks, including travel-related incidents. Organizations often highlight the importance of verifying coverage limits, as some policies may only provide basic protection, leaving volunteers potentially vulnerable. Prior awareness of these details ensures that volunteers can confidently contribute, knowing that their well-being is addressed.

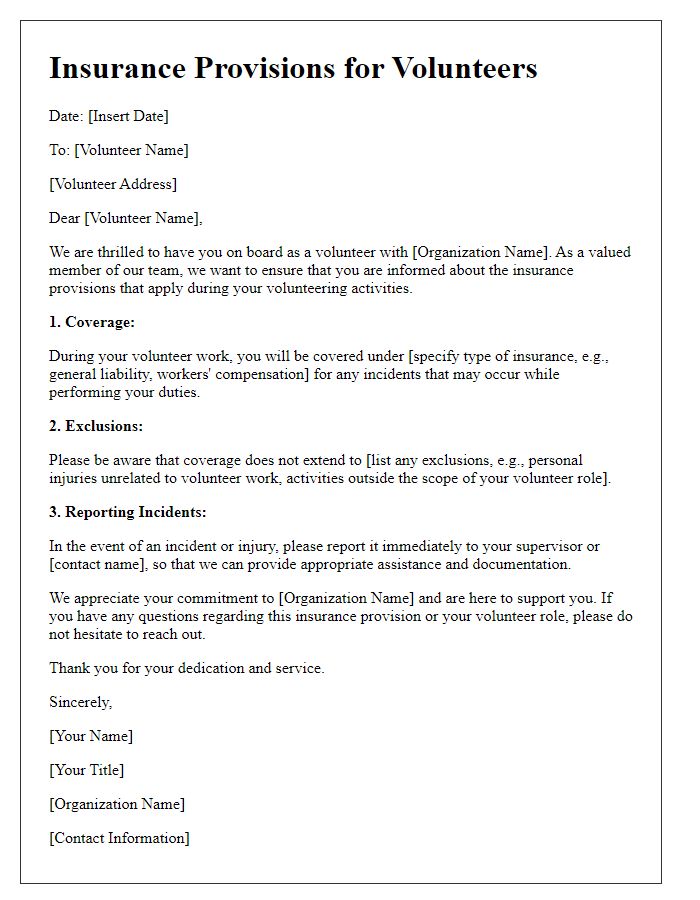

Claim Process and Guidelines

Volunteer insurance provides essential coverage for individuals participating in volunteer activities, safeguarding them from potential liabilities. Each organization must establish clear claim processes, detailing the necessary steps for reporting incidents during volunteer work. Volunteers must notify designated personnel immediately after an incident, ensuring timely documentation of the event on forms provided by the organization. These forms often require specifics such as the date, location (e.g., community center, park), and nature of the injury or damage. It is vital to gather evidence, including photographs and witness statements, to strengthen the claim. Organizations should outline the timeframe for submitting claims, typically within 30 days post-incident, and clarify contact information for insurance representatives. Finally, follow-up processes should be described to keep volunteers informed about claim status and any necessary additional information required.

Emergency Contact Information

Emergency contact information is critical for ensuring safety during volunteer activities. Each volunteer must provide details such as full name, relationship to the volunteer, and current phone number for immediate access in case of an emergency. This information should be updated annually or whenever there is a change in personal circumstances. Organizations often keep these details confidential and secure as part of their risk management protocols. Additionally, volunteers should be encouraged to discuss their health conditions or specific needs, promoting a safer and more prepared environment for all participants.

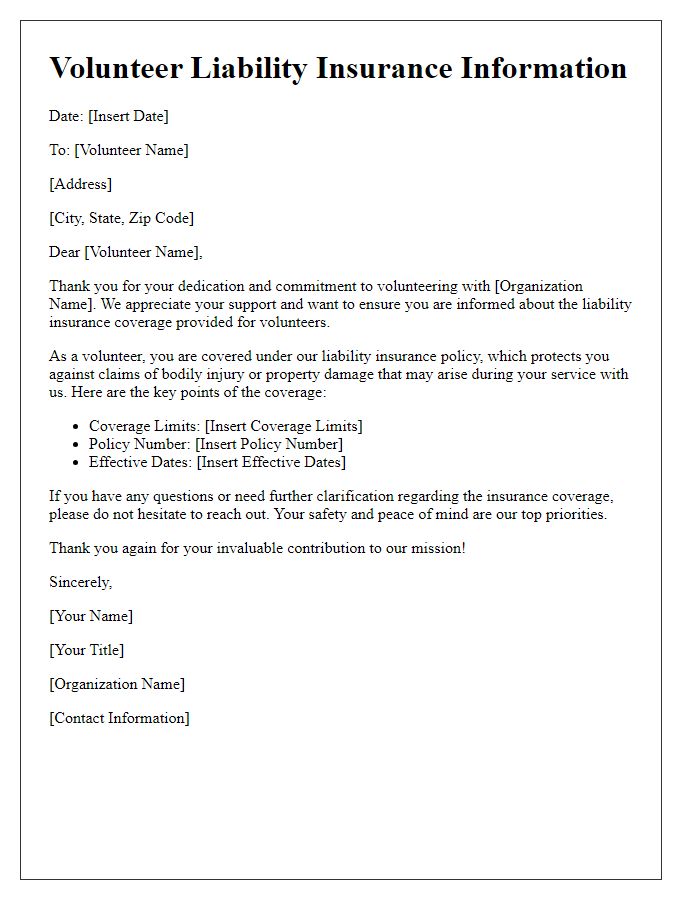

Policy Terms and Conditions

Volunteer insurance provides essential coverage for individuals participating in community service activities, protecting them from potential liabilities during their service. Each policy varies, but common terms include coverage for medical expenses incurred due to accidents, generally up to $1,000,000, which may cover emergency treatment, hospital stays, and rehabilitation costs. Additionally, some policies outline the importance of reporting incidents within a specified timeframe, typically 24 hours, to ensure proper claims processing. It is vital to understand any exclusions, such as injuries during non-sanctioned activities or activities deemed high-risk, like extreme sports. Indemnity clauses may also prevent volunteers from suing the host organization for negligence, reinforcing the need for comprehensive knowledge of the policy's specifics. Any changes in the volunteer's role or location may also necessitate updated insurance coverage.

Comments