Negotiating payment terms with your vendors can seem daunting, but it's an essential step towards fostering a healthy business relationship. Clear communication is key, and presenting your case thoughtfully can pave the way for mutually beneficial arrangements. Whether you're looking to extend payment timelines or adjust initial deposit requirements, establishing an open dialogue is crucial. Ready to dive into the details and discover effective strategies for your next negotiation? Let's explore!

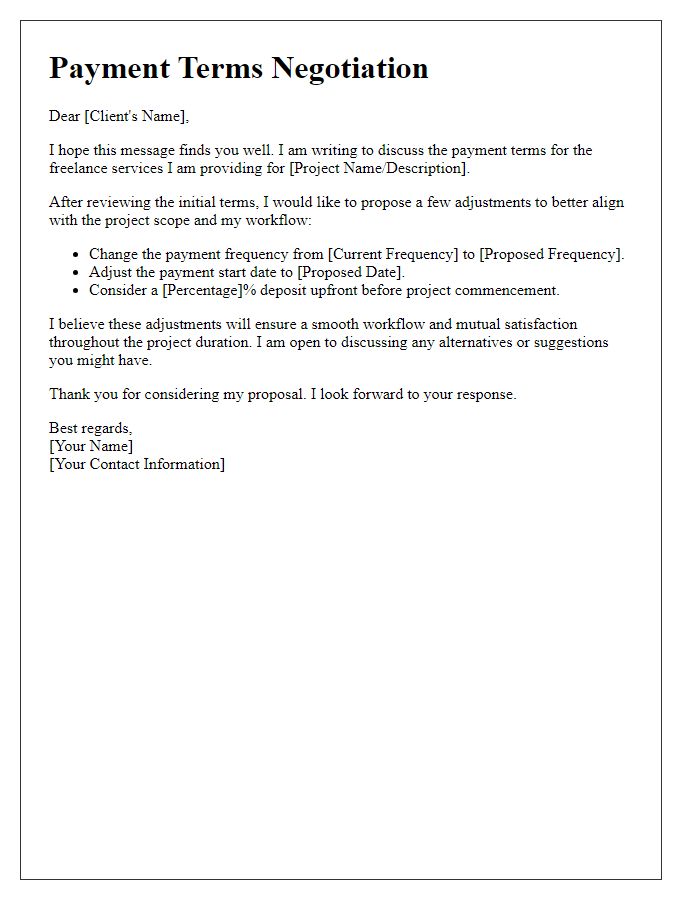

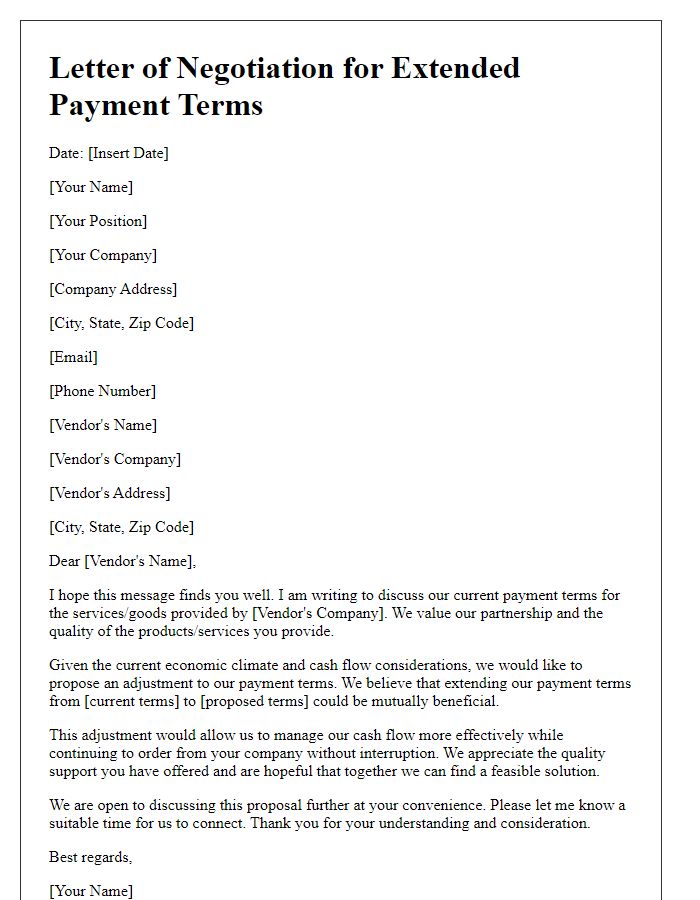

Clear Subject Line

Negotiating vendor payment terms involves understanding both parties' needs. Clear subject lines such as "Proposal for Revised Payment Terms" are critical for effective communication. Vendors often prefer faster payment cycles, such as Net 30 or Net 60 terms, to maintain cash flow. On the other hand, buyers may seek extended terms, such as Net 90, to manage economic demands or project timelines. Ensuring transparency about payment schedules, interest on late payments, and early payment discounts can lead to mutually beneficial agreements. Having relevant financial data, such as sales forecasts and historical payment behavior, can support negotiations and demonstrate commitment to timely payments.

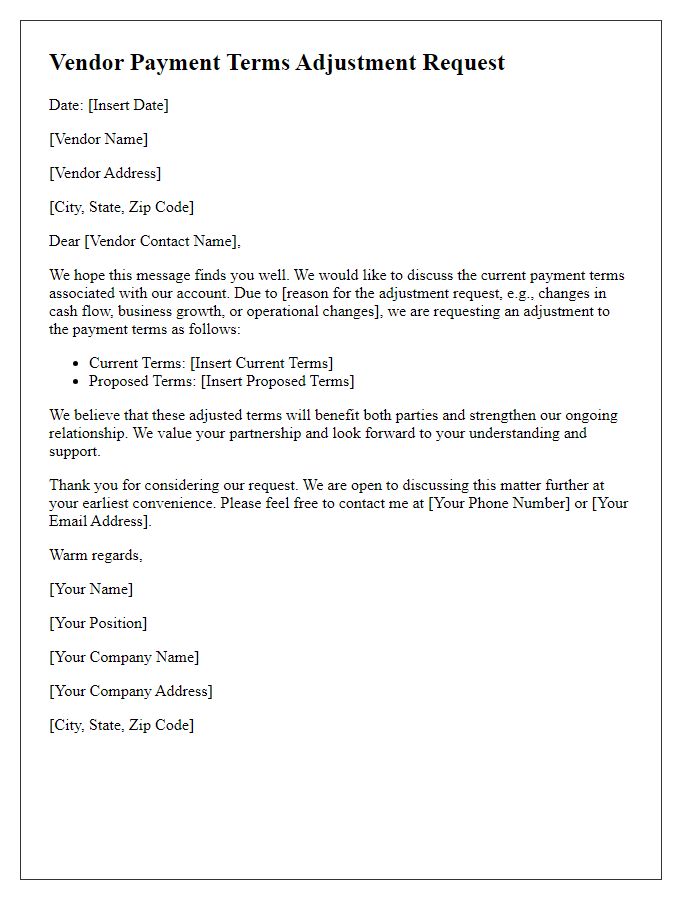

Formal Salutation

Negotiating vendor payment terms can significantly impact cash flow and operational efficiency for a business. Establishing clear guidelines, such as net 30 or net 60 payment terms, allows companies to maintain financial stability. In some industries, early payment discounts of 2% for net 10 can incentivize timely transactions and strengthen vendor relationships. Understanding local regulations, such as the prompt payment obligations under the UK's Late Payment of Commercial Debts Act, is essential. Effective communication during these negotiations fosters collaboration and encourages equitable outcomes for both parties involved.

Introduction of Purpose

Negotiating vendor payment terms is a critical aspect of maintaining positive supplier relationships and ensuring smooth cash flow management. Establishing clear and mutually beneficial payment agreements can prevent misunderstandings and foster cooperation. Factors such as industry standards, company cash flow cycles, and vendor reliability must be considered during these discussions. In many cases, payment terms can affect the overall pricing strategies and profitability margins of both parties. Addressing these issues early on can lead to a more favorable agreement for future transactions and collaborative efforts.

Current Terms Overview

Current vendor payment terms often specify Net 30 (thirty days post-invoice) for payment, a standard practice in business transactions. Many organizations implement these terms to manage cash flow, allowing a window for processing and budget allocation. Early payment discounts, such as 2% off invoices settled within 10 days, can incentivize timely settlement of accounts. Conversely, extended terms like Net 60 or even Net 90 may be requested for large-scale projects requiring additional budgetary considerations. Understanding the implications of these terms on operational budgets is crucial for maintaining healthy vendor relationships and ensuring financial stability.

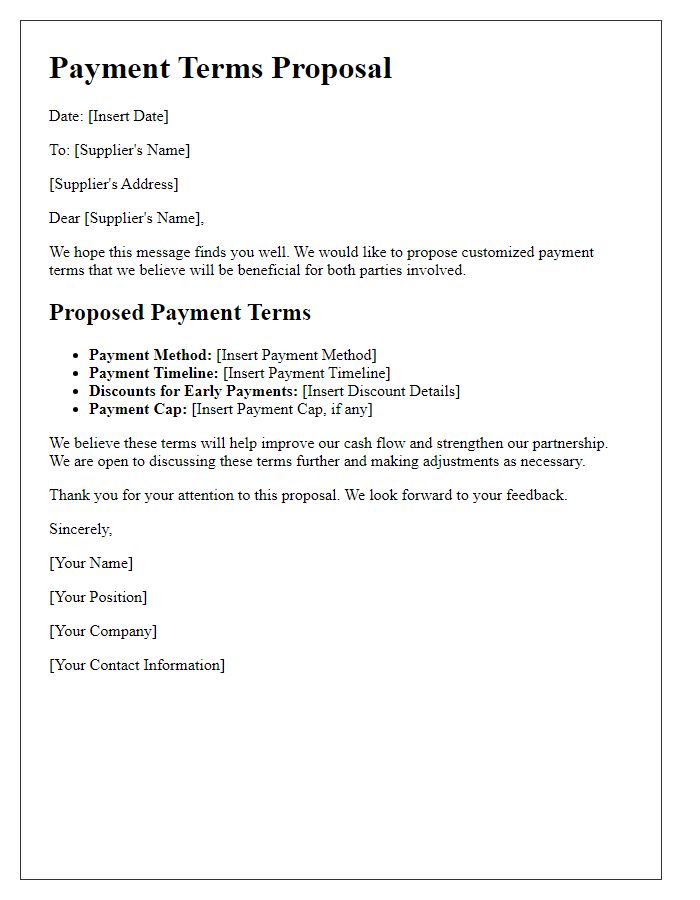

Proposed Changes and Justifications

Negotiating vendor payment terms involves a clear understanding of the proposed changes and justifications that back these modifications. Suggested alterations might include extending payment periods from 30 days to 45 days, which can enhance cash flow management for businesses, particularly in industries like manufacturing where product cycles are longer. A reduction in the early payment discount from 2% to 1.5% can be justified by maintaining greater liquidity, allowing the company to invest more effectively in growth opportunities. Moreover, implementing tiered payment structures based on order volume can incentivize larger purchases and strengthen vendor relationships. Each adjustment aims to create a mutually beneficial partnership, ensuring consistent cash inflow for vendors while providing flexibility for the purchasing company.

Comments