Are you looking to ensure the accuracy of your vendor records? A vendor information verification request letter can streamline the process, making it easier to maintain clear communication and trust with your suppliers. By outlining your expectations and confirming essential details, you set the foundation for a fruitful partnership. Read on to discover how to draft a clear and professional request that gets the results you need!

Clear subject line

Vendor information verification requests ensure accurate and up-to-date details for effective business transactions. A clear subject line, such as "Vendor Information Verification Request" or "Request for Verification of Vendor Details," helps recipients identify the purpose of the communication instantly. Including specific data, like the vendor's name and account number, enhances clarity. This process is crucial for maintaining compliance with organizational standards and preventing fraud. Accurate vendor information is vital for processing orders, payments, and maintaining strong supplier relationships, directly impacting business operations and financial health.

Vendor details request

In the process of vendor information verification, accurate data collection is crucial to ensure compliance and accountability. Vendors, such as suppliers or contractors, should provide comprehensive details, including their registered business name, Tax Identification Number (TIN), and physical business address. Verification may involve obtaining a copy of the vendor's business license, registration documents, and insurance certificates, should evidence of legitimacy become necessary. Additionally, critical financial information, such as bank account details and payment terms, must be submitted to facilitate efficient transactions. This systematic verification helps prevent fraud and fosters a trustworthy environment for business relations.

Deadline for response

Vendor information verification ensures accuracy and integrity in business partnerships. Timely completion of this process impacts operations and financial transactions. To facilitate a smooth workflow, it is essential to establish a clear deadline for responses, typically set within 5 to 10 business days from the request date. This timeframe allows for thorough review and confirmation of details such as tax identification numbers, contact information, and banking details, which are critical for maintaining trust and compliance. Adhering to this deadline promotes accountability and enhances communication efficiency between parties.

Purpose of verification

Vendor information verification aims to ensure the accuracy and reliability of supplier data in business transactions. Accurate records (like tax identification numbers, bank account details, and contact information) protect against fraud and errors. Verification processes assess business legitimacy, check compliance with regulatory standards, and confirm service capabilities. Additionally, maintaining up-to-date vendor information enhances supply chain efficiency and supports informed decision-making. Regular checks on vendor financial stability (evaluating credit scores or bankruptcy histories) aid companies in mitigating risks associated with financial instability. Proper verification strengthens partnerships, fosters trust, and promotes long-term collaborations.

Contact information for inquiries

Vendor information verification is crucial for maintaining accurate records within supply chain management. Essential details include the vendor's legal business name, registered address, and primary contact person, which ensure compliance and facilitate inquiries. Accurate phone numbers allow for direct communication, while verified email addresses enable fast written correspondence. Additionally, obtaining the vendor's tax identification number is necessary for tax reporting purposes. Regular verification of this data enhances data integrity and minimizes risks associated with fraudulent activities within procurement processes.

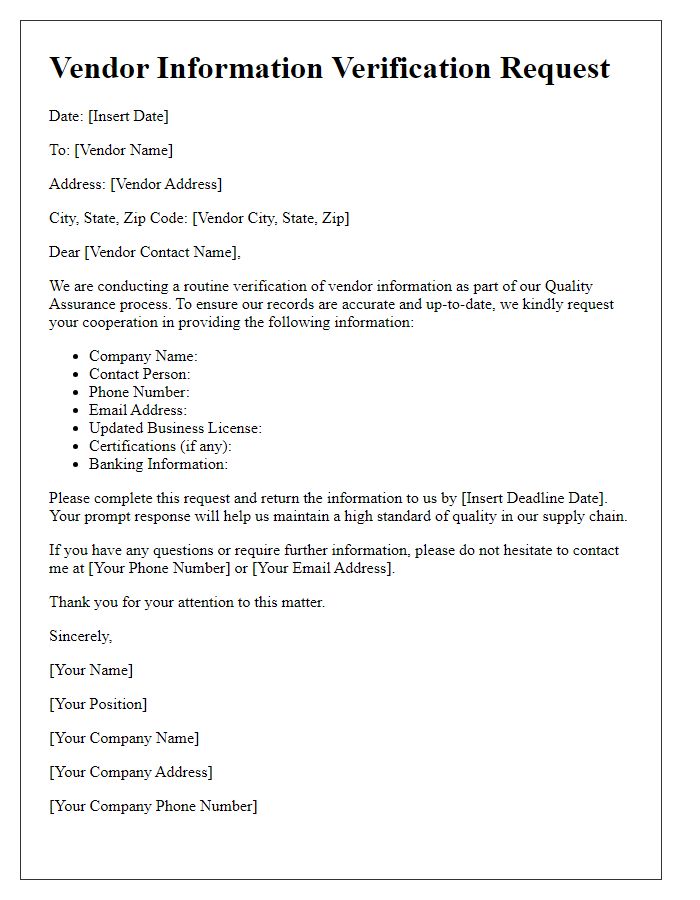

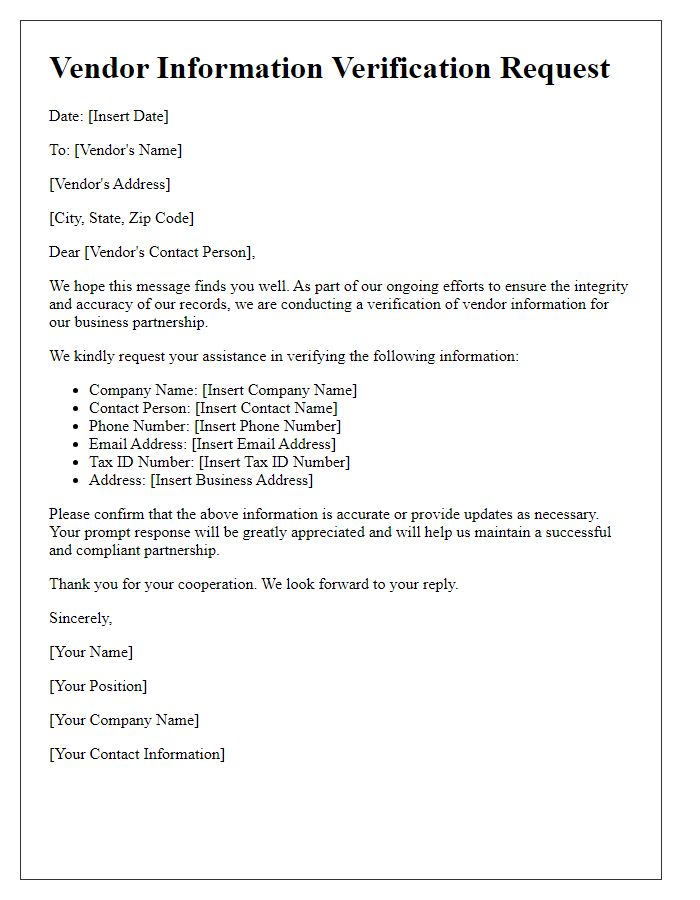

Letter Template For Vendor Information Verification Request Samples

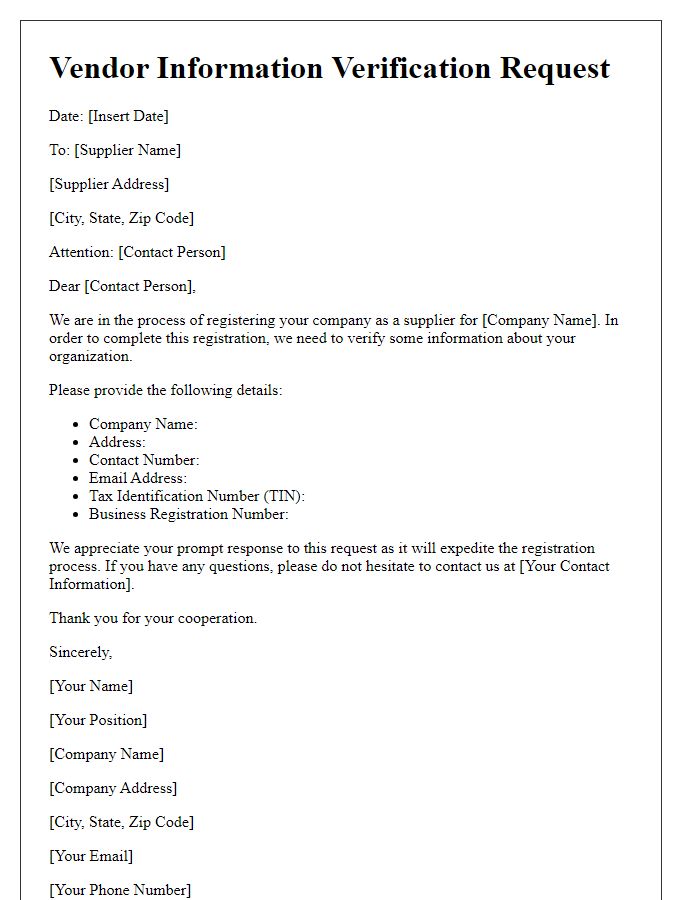

Letter template of Vendor Information Verification Request for Supplier Registration

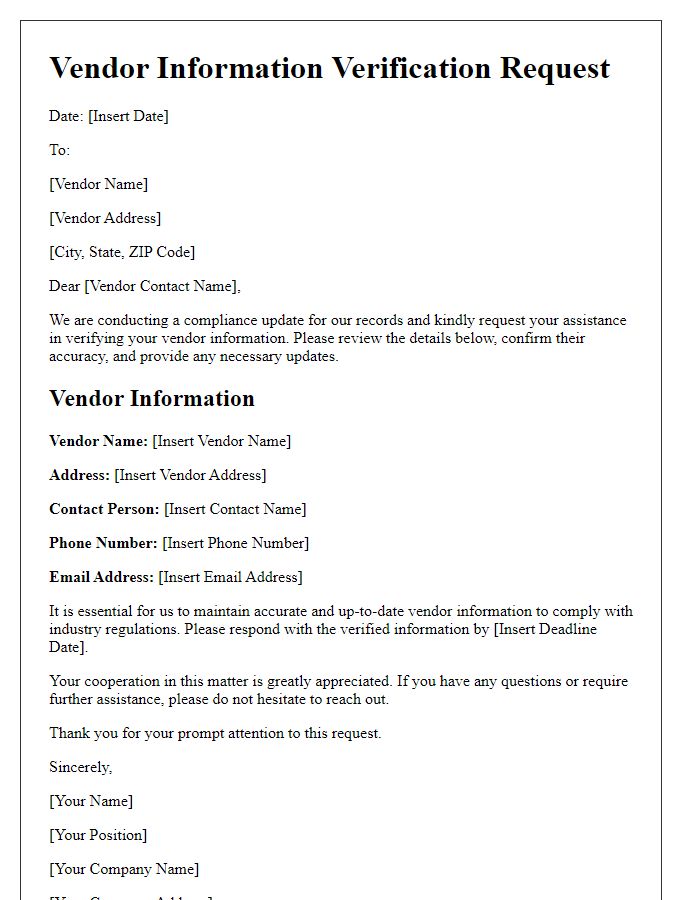

Letter template of Vendor Information Verification Request for Compliance Update

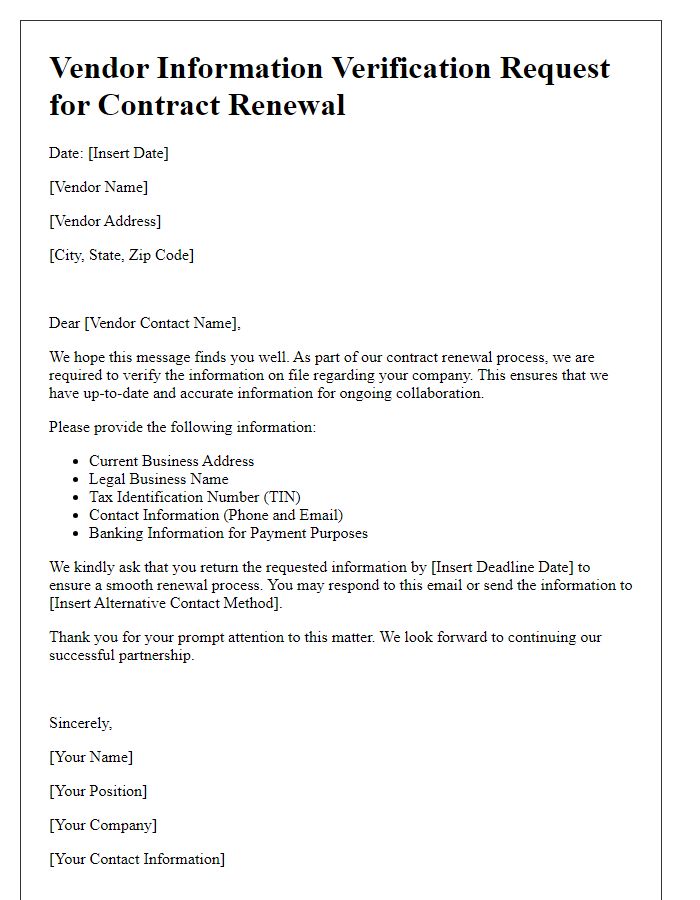

Letter template of Vendor Information Verification Request for Contract Renewal

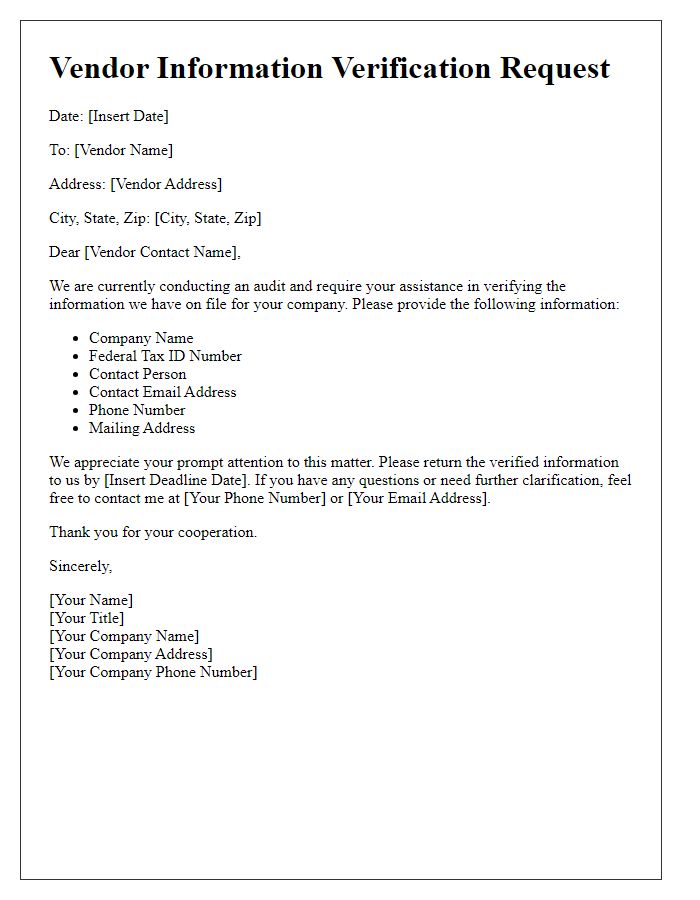

Letter template of Vendor Information Verification Request for Audit Purposes

Letter template of Vendor Information Verification Request for Address Confirmation

Letter template of Vendor Information Verification Request for Tax Information Update

Letter template of Vendor Information Verification Request for Payment Processing

Letter template of Vendor Information Verification Request for Risk Assessment

Letter template of Vendor Information Verification Request for Quality Assurance

Comments