Are you a vendor looking to boost your cash flow while building strong relationships with your partners? Early settlement benefits could be the solution you've been searching forâoffering you advantages like discounted invoices and faster payments. By embracing this strategy, you not only enhance your financial stability but also demonstrate your commitment to collaboration. Curious about how early settlement benefits can transform your business? Read on to discover the ins and outs!

Payment Terms Adjustment

Early settlement benefits optimize cash flow for businesses, encouraging prompt payment resolutions with vendors. Companies can negotiate more favorable payment terms, such as discounts (often ranging from 2% to 5%) for settling invoices before the due date. Such arrangements enhance supplier relationships, creating a cooperative environment that fosters long-term partnerships. Utilizing electronic invoicing (e-invoicing) systems accelerates the payment process, reducing administrative overhead and ensuring timely transactions. Additionally, establishing clear communication regarding adjusted payment schedules strengthens trust and transparency, ultimately leading to improved operational efficiencies.

Early Settlement Discount

Early settlement discounts incentivize businesses to pay their invoices promptly, fostering better cash flow management. Vendors typically offer a percentage reduction (commonly between 1% to 3%) off the total invoice amount for payments made within a specified timeframe, often within 10 to 15 days of the invoice date. This practice enhances financial relationships between suppliers and clients, encouraging timely payments while reducing accounts receivable days. Early settlement benefits can lead to significant savings, particularly for larger transactions, ultimately contributing to improved budgeting and financial planning for companies. Implementing these discounts not only boosts vendor liquidity but also strengthens partnerships in competitive industries.

Invoice Processing Efficiency

Vendor early settlement benefits can enhance invoice processing efficiency significantly. Streamlining payment terms (for example, reducing from 30 days to 10 days) incentivizes vendors to provide services or goods promptly, fostering stronger business relationships. Early payment discounts, often between 1-3%, can lead to substantial savings in procurement costs. Utilizing automated accounts payable systems enables quicker invoice approvals, minimizing manual interventions and delays. Timely settlements also mitigate the risk of late fees and potential disruptions in supply chains. Overall, prioritizing early settlements supports operational efficiency and financial health for businesses.

Cash Flow Management

Vendor early settlement benefits enhance cash flow management by incentivizing prompt payments. Organizations, such as manufacturing firms, negotiate terms with suppliers, like discounts ranging from 1% to 5%, for early invoice payments, typically within 10 to 30 days. Improved cash flow allows these companies to reinvest in operations or manage expenses efficiently. Financial metrics, including Days Payable Outstanding (DPO), show the effectiveness of these strategies, impacting overall liquidity and supplier relationships. Early settlements not only strengthen partnerships but also streamline purchasing processes, creating a more stable financial framework for continued growth and sustainability.

Long-term Partnership Opportunities

Early settlement benefits for vendors can foster long-term partnerships in supply chain management. When suppliers, such as manufacturers or distributors, offer discounts for early payment, companies can improve cash flow management and enhance financial stability. These benefits, sometimes ranging from 2% to 5% discount within 10 to 30 days, incentivize timely payments and strengthen relationships. Over time, strong collaboration leads to better negotiation terms, priority during shortages, and access to exclusive products from vendors. Enlisting software tools for tracking invoices and payments can streamline the process, ensuring both parties maximize their potential and maintain trust within the partnership.

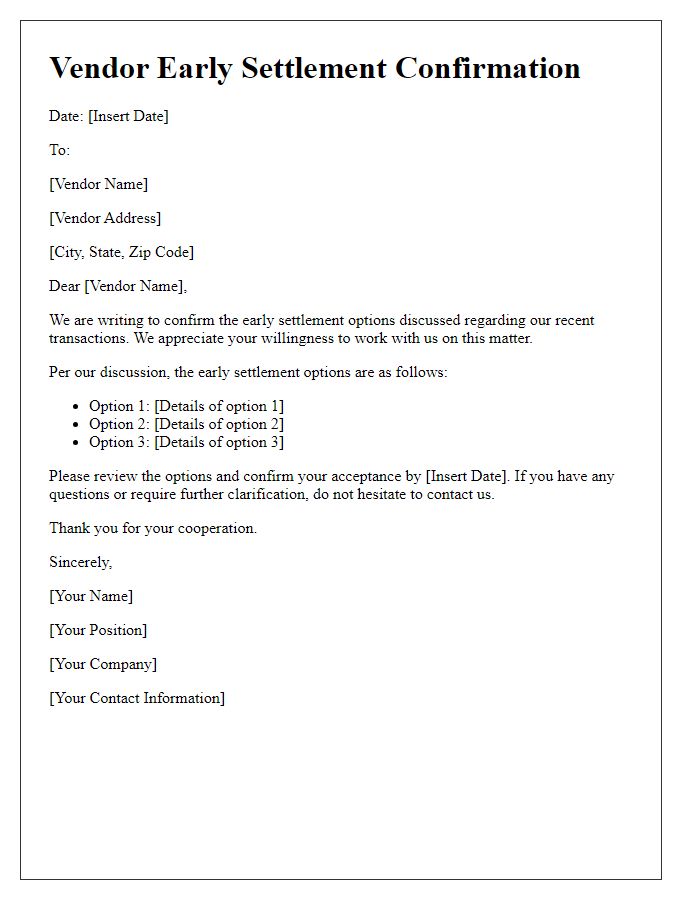

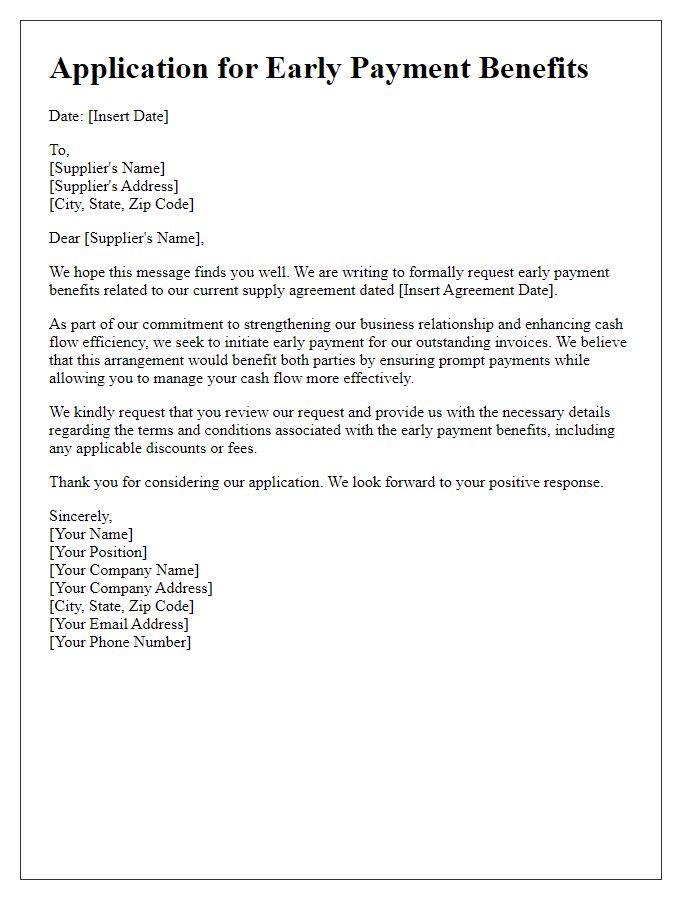

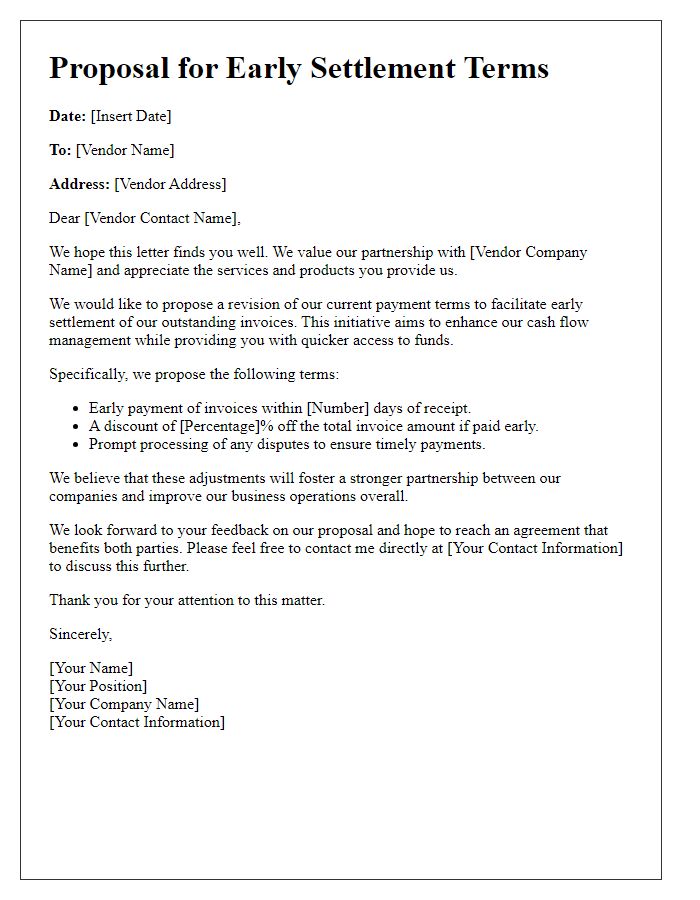

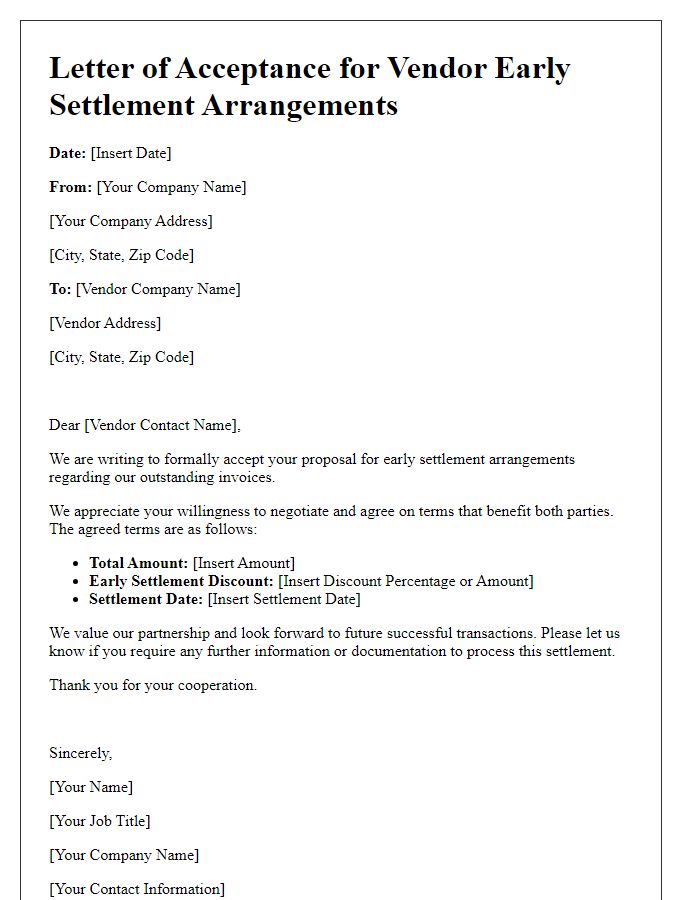

Letter Template For Vendor Early Settlement Benefits Samples

Letter template of request for early settlement benefits for vendor agreements

Letter template of reminder for vendor early payment benefits eligibility

Comments