Are you considering extending trade credit to your suppliers but feeling uncertain about the risks involved? With trade credit insurance, you can safeguard your business from potential losses while fostering strong partnerships with your vendors. This protection not only helps maintain your cash flow but also enhances your ability to negotiate favorable terms. Curious about how to craft a compelling proposal for trade credit insurance? Read on for a detailed guide!

Business Overview

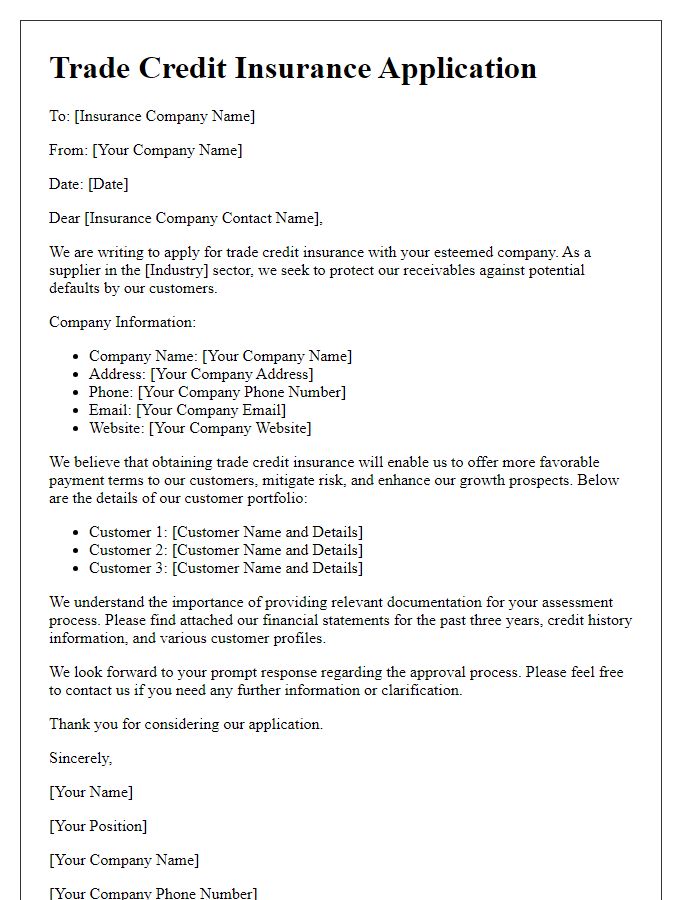

A trade credit insurance proposal provides essential protections against customer defaults in B2B transactions. Businesses like manufacturing firms or wholesale distributors often rely on trade credit insurance to mitigate financial risks associated with extending credit to clients, particularly in volatile markets. Major players in this sector, such as Allianz Trade or Euler Hermes, offer tailored solutions designed to safeguard a company's accounts receivable up to 90% of total outstanding invoices. By analyzing market data and customer creditworthiness, these insurers can help businesses, particularly SMEs (small and medium-sized enterprises), secure financing and enhance cash flow stability. Understanding global trends, such as the increase in late payments or economic downturns in regions like Europe or North America, can significantly influence the effectiveness of a trade credit insurance policy.

Financial Health and Stability

A comprehensive evaluation of the supplier's financial health and stability is crucial for assessing their ability to fulfill trade obligations. Key metrics such as the supplier's credit score, typically ranging from 300 to 850, offer insight into their reliability in managing debt. Moreover, analyzing financial statements, including the balance sheet and income statement, provides vital information on their liquidity ratios (like the current ratio, which should ideally be above 1.5), profitability margins, and overall debt levels (ideally below 40%). Monitoring the supplier's credit history, specifically payment behavior over the past 24 months, ensures timely settlements and reduced risk levels. Additionally, industry benchmarks (such as average days sales outstanding of 45 days in manufacturing) can facilitate comparisons and identify potential red flags. Expanding on these financial aspects allows for a well-rounded analysis, thereby ensuring informed decisions regarding trade credit insurance proposals.

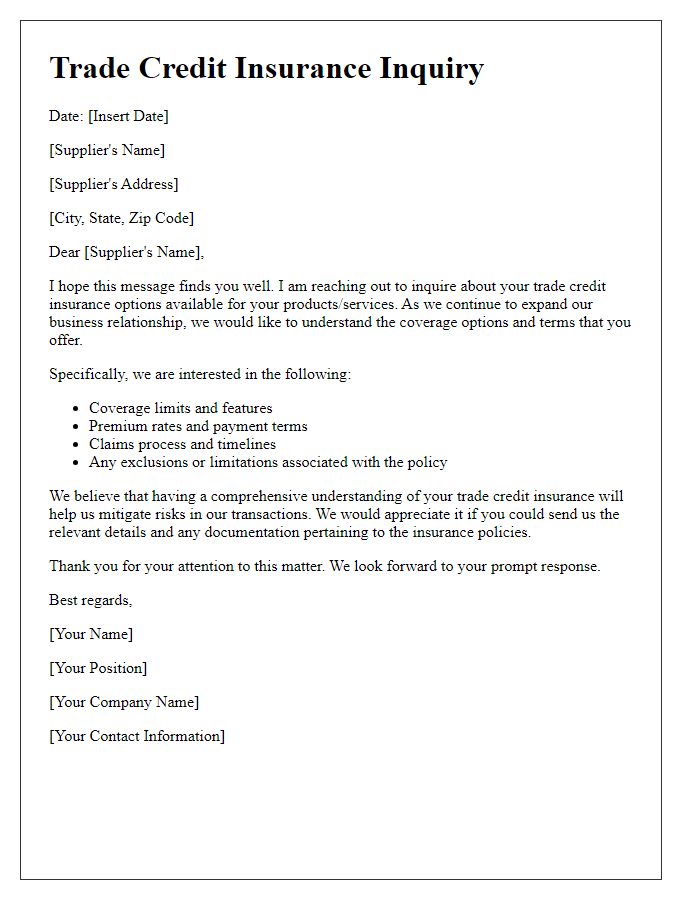

Credit Risk Assessment

Trade credit insurance serves as a vital tool for businesses to mitigate credit risk associated with extending payment terms to suppliers and customers. This type of insurance protects companies against defaults, providing coverage for outstanding invoices (typically up to 90% of the owed amount). A comprehensive credit risk assessment involves analyzing financial statements, credit history, and industry trends of potential customers to gauge their ability to meet obligations. For instance, an assessment might focus on the current ratio (current assets divided by current liabilities), which should ideally exceed 1.0, indicating sufficient liquidity. Furthermore, examining external credit ratings from agencies such as Moody's or Standard & Poor's can provide insight into the creditworthiness of potential clients. A thorough evaluation of these factors allows businesses to make informed decisions and effectively manage their trade credit risk.

Trade References

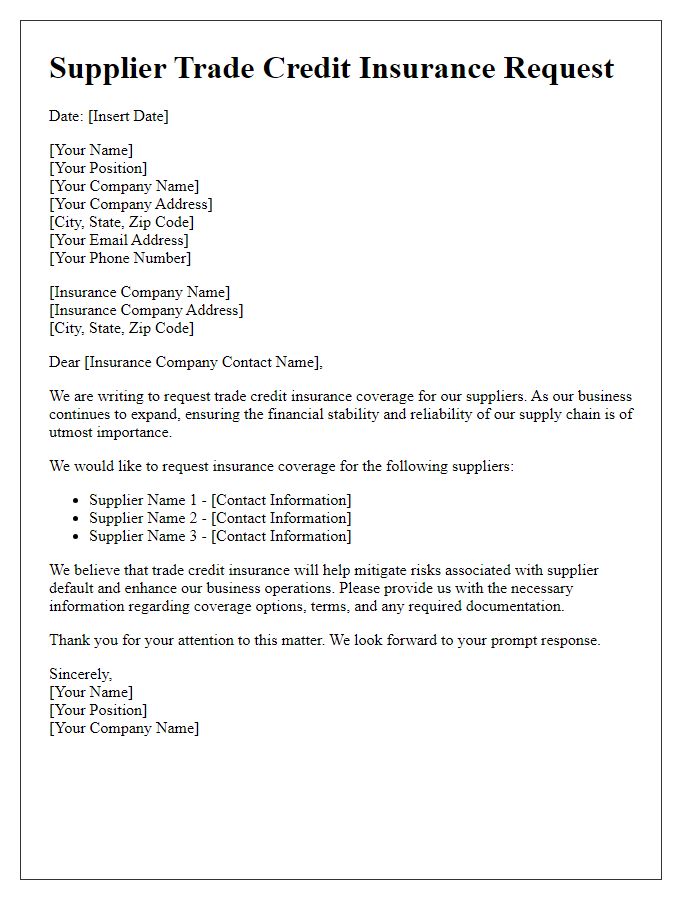

Trade credit insurance protects businesses from the risk of non-payment by customers, ensuring financial stability and reducing the impact of potential defaults. When applying for this insurance, trade references play a crucial role in demonstrating the reliability and creditworthiness of a business. Reliable trade references, such as suppliers and vendors with established payment histories, indicate to insurers the likelihood of on-time payments. Providing detailed information about these references, including company names, contact details, credit limits, and payment terms, can enhance the proposal's credibility. Having a solid background in successful transactions with notable partners can significantly increase the chances of obtaining favorable trade credit insurance terms.

Insurance Coverage Needs

Supplier trade credit insurance serves as a financial safety net for businesses engaging in credit sales, protecting against customer defaults or insolvencies. Companies often seek coverage for a range of financial transactions, including accounts receivable valued at millions of dollars, which can be jeopardized by economic fluctuations. Effective policies typically cover a diverse array of clients across multiple industries, ensuring comprehensive risk management. This type of insurance is essential for sustaining liquidity and maintaining operational stability in competitive markets. Evaluating specific coverage requirements, such as coverage limits, policy exclusions, and claim procedures, is critical for securing the most suitable plan. Insightful analysis of customer creditworthiness and market trends plays a pivotal role in determining appropriate insurance levels.

Comments