Are you feeling overwhelmed by financial obligations and in need of some breathing room? Creating a payment plan can be a clever way to manage your expenses while still honoring your commitments. In this article, we'll provide you with a handy template for requesting payment plan terms, ensuring you communicate your needs clearly and professionally. So, let's dive in and help you take the first step towards financial peace!

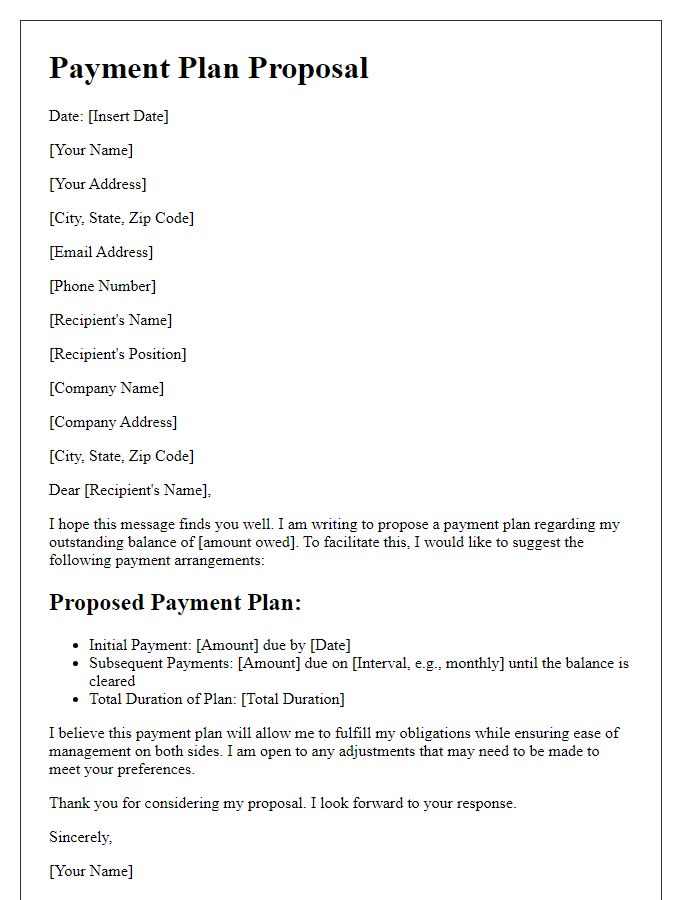

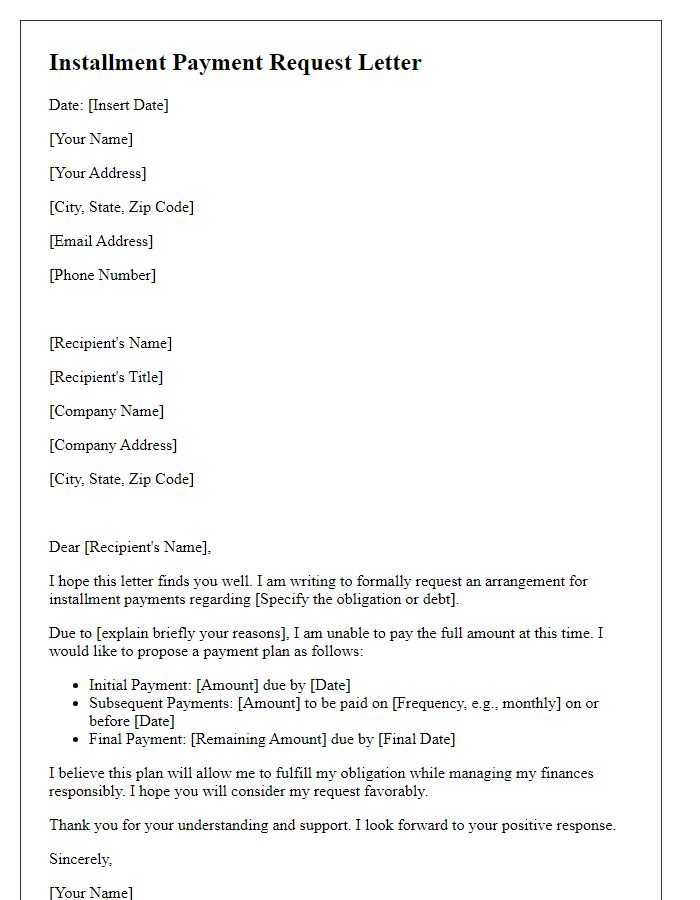

Personal and contact information

To initiate a payment plan request, it is crucial to provide accurate personal and contact information. This includes your full name, which identifies you as the account holder. Next, include your current residential address, consisting of street number, street name, city, state, and zip code, ensuring the accurate delivery of any correspondence. Additionally, provide a valid phone number, which could encompass area code followed by seven digits, allowing for direct communication regarding your request. It is advisable to include an email address to facilitate efficient electronic communication and provide updates regarding the payment plan. Including your account number, typically a unique identifier assigned by the financial institution, further assists in processing your request promptly.

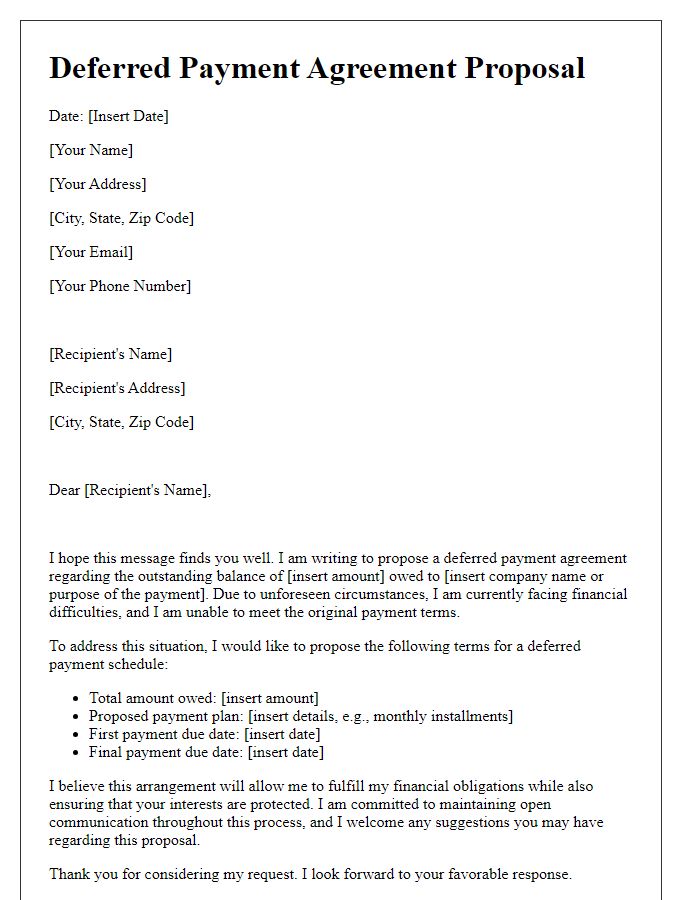

Account details and outstanding balance

An individual's account details, specifically their unique identification number and registered email address, are essential for processing financial requests. The outstanding balance, which is currently $2,500, needs to be addressed to prevent further penalties. Timely payments, as stipulated in the proposed payment plan, can help manage the financial obligation effectively. Adhering to the outlined terms within the payment plan ensures that late fees, typically an additional 5% of the outstanding amount, are avoided while also improving credit score status over time.

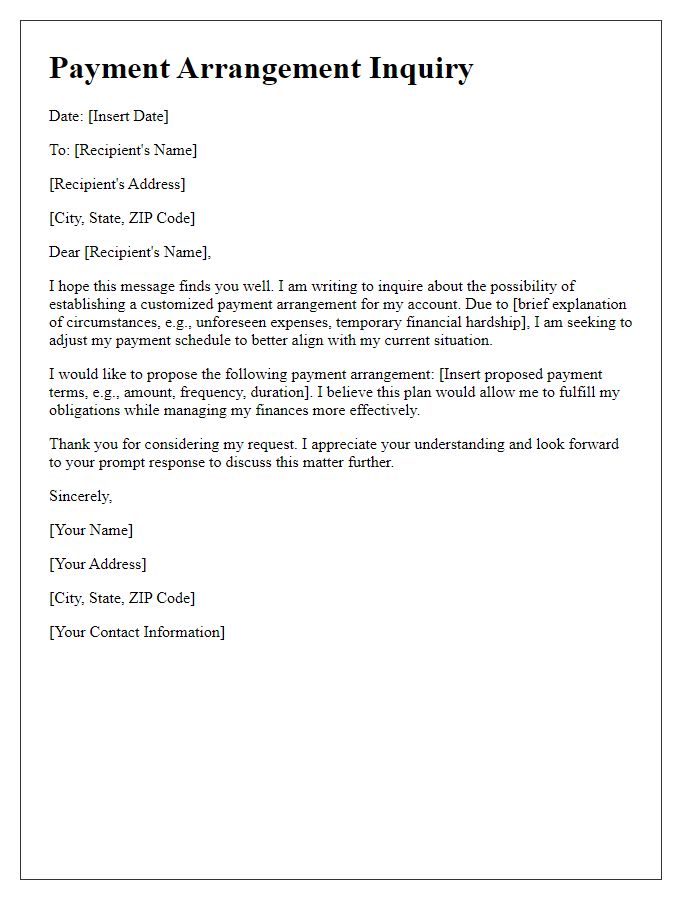

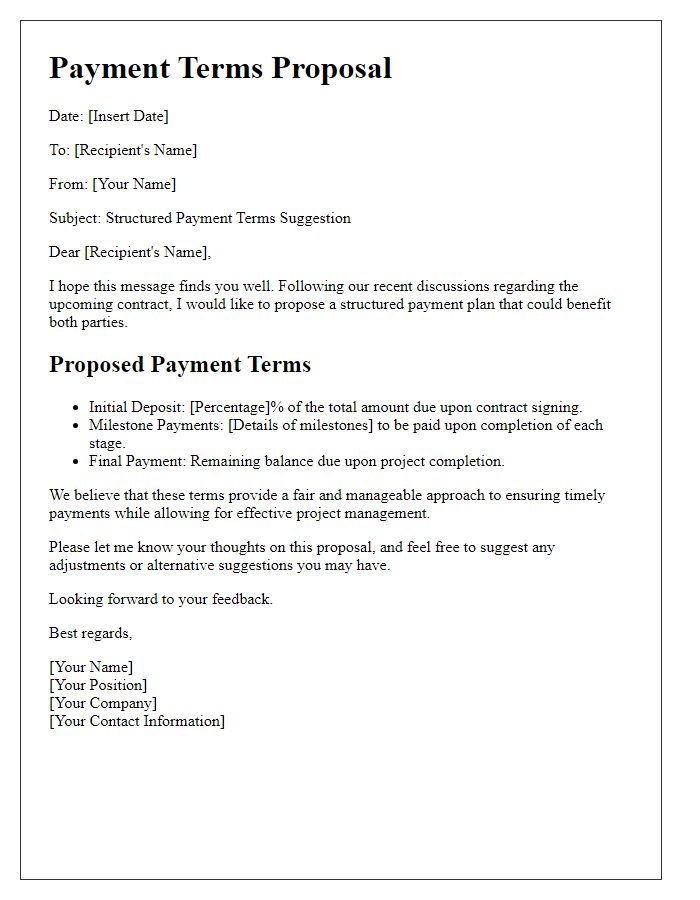

Proposed payment terms and schedule

Proposed payment plans require careful consideration to ensure both parties' interests are aligned. Effective payment terms often span several months, typically ranging from 6 to 24 months, depending on the total amount owed, which could vary from a few hundred dollars to thousands. A common approach is to outline a fixed monthly payment schedule, detailing the exact amount due on a specific date each month, such as the 1st or the 15th. For example, if the total balance is $1,200, a 12-month plan would entail monthly installments of $100. Additionally, it may be important to address aspects such as late fees (often around 5% of the outstanding amount) and early payment incentives to encourage timely payments. Clarity in communication about these terms is essential for fostering trust and ensuring a mutually beneficial agreement.

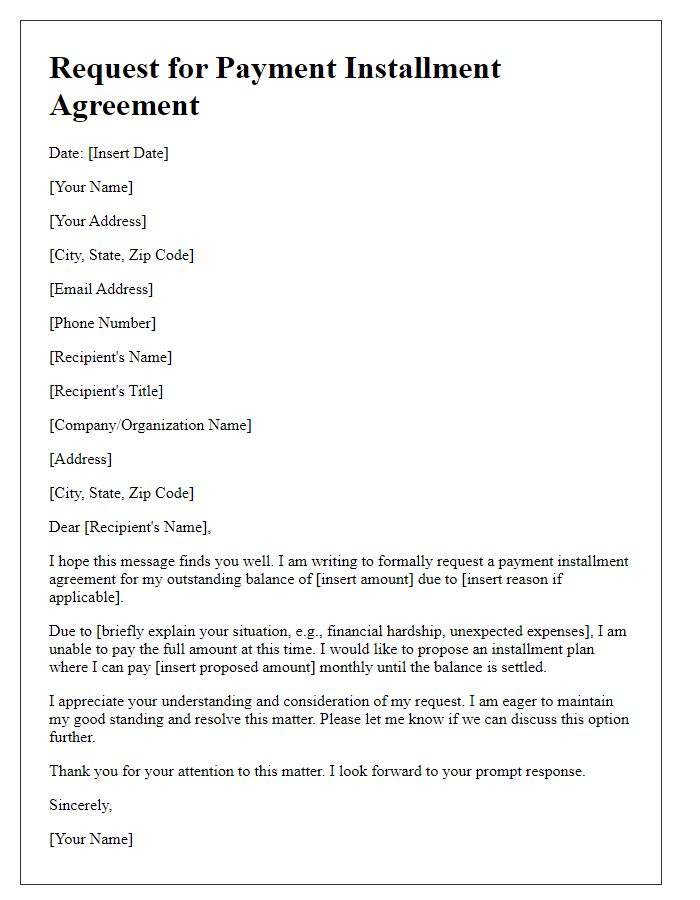

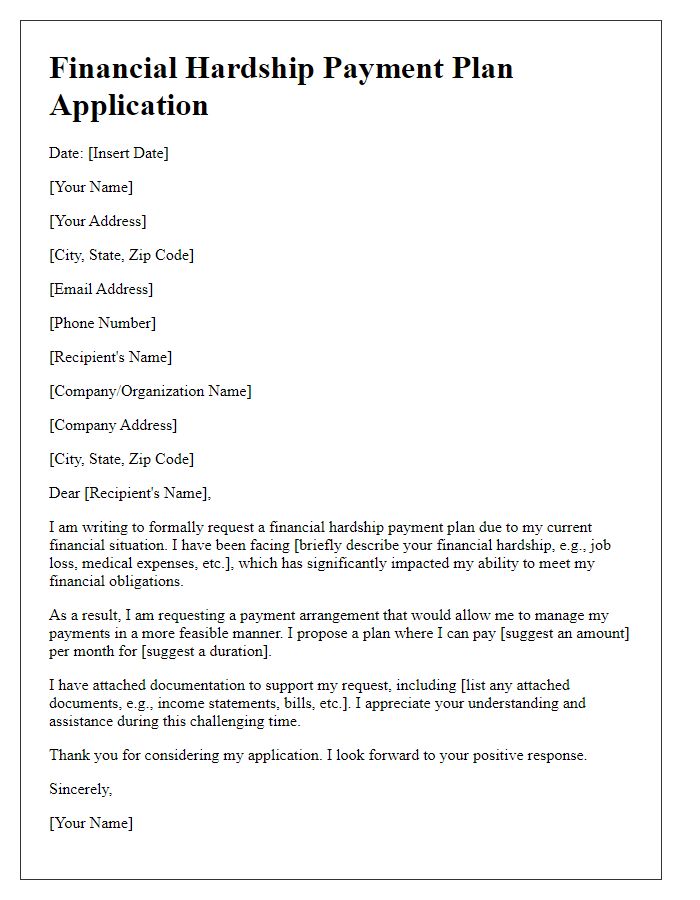

Justification for the request

In times of financial hardship, individuals may seek to establish a payment plan to manage their debts more effectively. A well-structured payment plan allows for the division of a total debt amount, such as $5,000 for overdue credit card bills, into manageable monthly installments. For example, agreeing to pay $500 monthly over a ten-month period can alleviate stress and ensure timely settlements. Justifying the need for such arrangements often involves presenting evidence of current financial difficulties, like job loss or medical expenses, which disrupt the ability to pay in full. Financial institutions, such as Chase Bank or Wells Fargo, typically evaluate these requests based on the applicant's previous payment history, income sources, and outstanding balances, which may determine eligibility for modified terms. Clear communication with creditors, expressing intent to resolve debts responsibly, can foster goodwill and encourage flexible repayment options. Legal options for debt protection under bankruptcy laws may also be explored as a last resort, allowing individuals to safeguard essential assets while focusing on debt resolution.

Assurance statement and signature

A payment plan request can provide individuals or businesses with a structured approach to manage debt obligations. Crafting a clear and concise assurance statement can inspire confidence, emphasizing commitment to adhere to agreed-upon payment terms. For instance, stating a specific duration for the payment plan, such as "a twelve-month repayment period" with monthly installments of $100, illustrates financial responsibility. Further, including a signature can legitimize the agreement, showcasing acknowledgment of the terms set forth. Utilizing an appropriate date and providing contact information enhances transparency and fosters trust between the involved parties.

Comments