Are you tired of missing utility payment due dates and incurring late fees? Staying on top of your bills can feel overwhelming, but it doesn't have to be! In this article, we'll share a simple yet effective letter template to help you communicate with your utility provider regarding payment schedules. So, if you're ready to take control of your finances and ensure no due date slips by, keep reading!

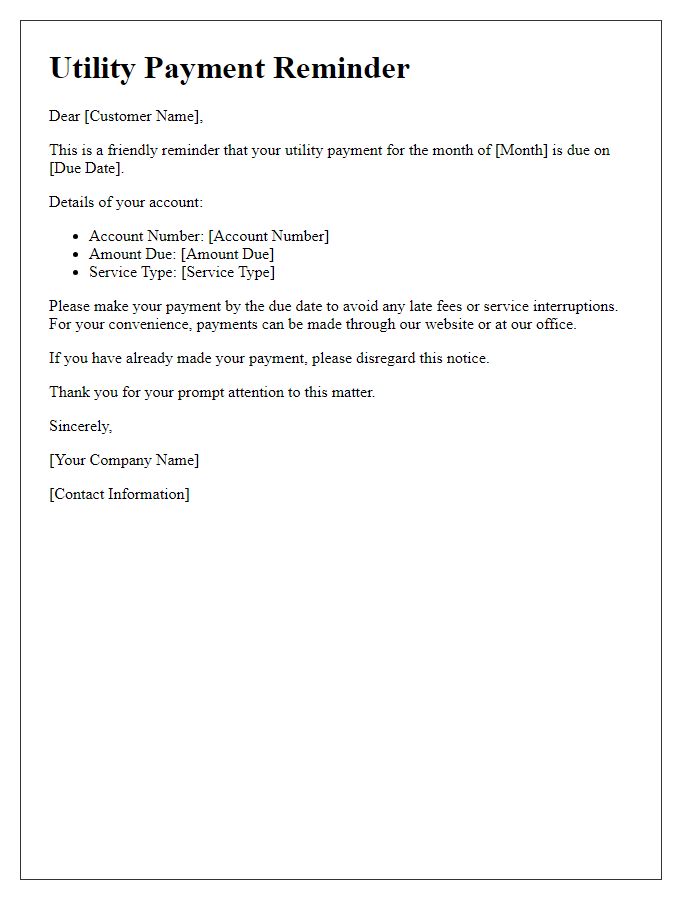

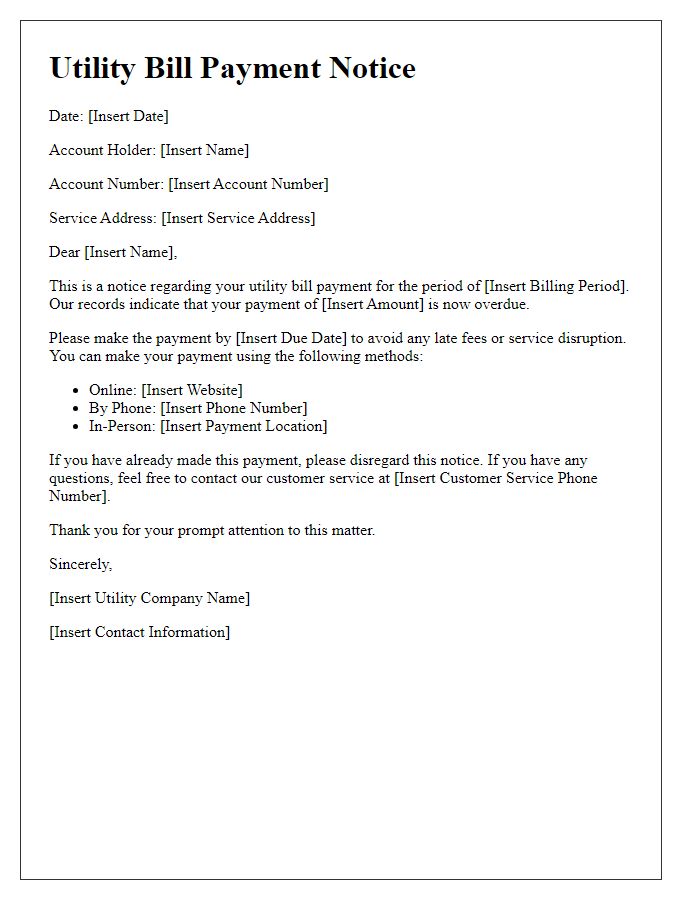

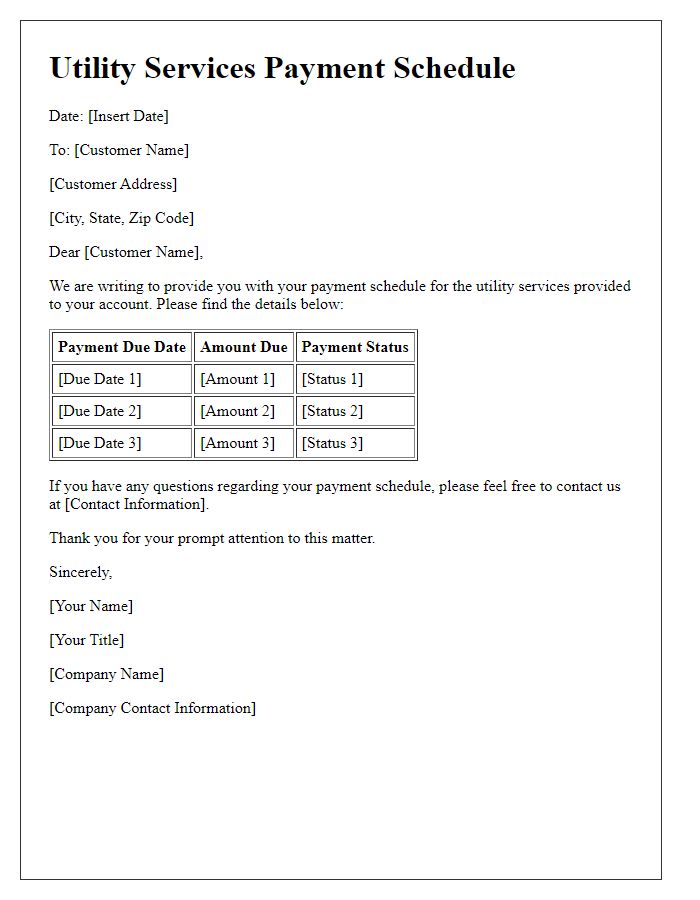

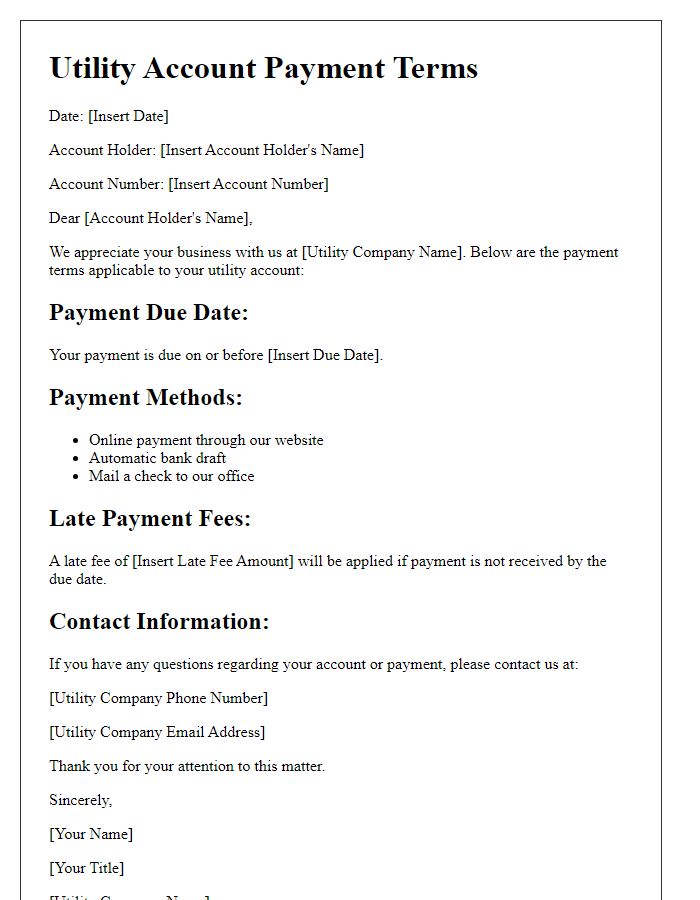

Clear Billing Information

Clear billing information is essential for utility customers to manage payment schedules effectively. Due dates (usually between the 1st and 15th of each month) indicate when payments are expected to avoid late fees. Service providers, such as electricity and water companies, send statements that detail usage (in kilowatt-hours for electric bills) and charges (itemized fees often including taxes and service fees). Consumers benefit from understanding their accounts, with the account number specified for reference. Clarity in payment methods (such as online portals, automatic bank drafts, and mail options) enhances convenience. Additionally, the inclusion of customer service contact details enables prompt support for billing inquiries and disputes.

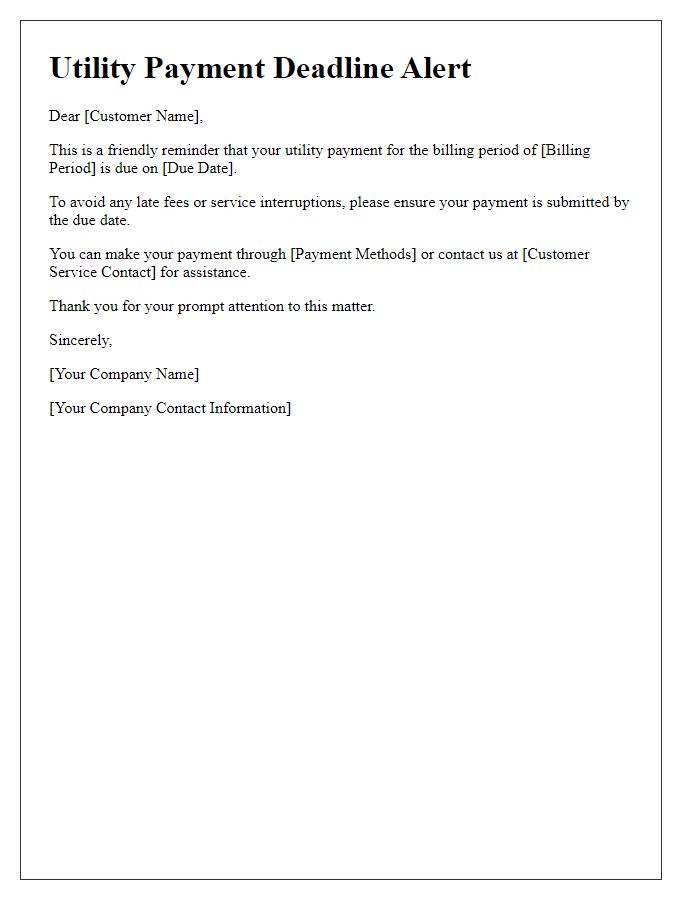

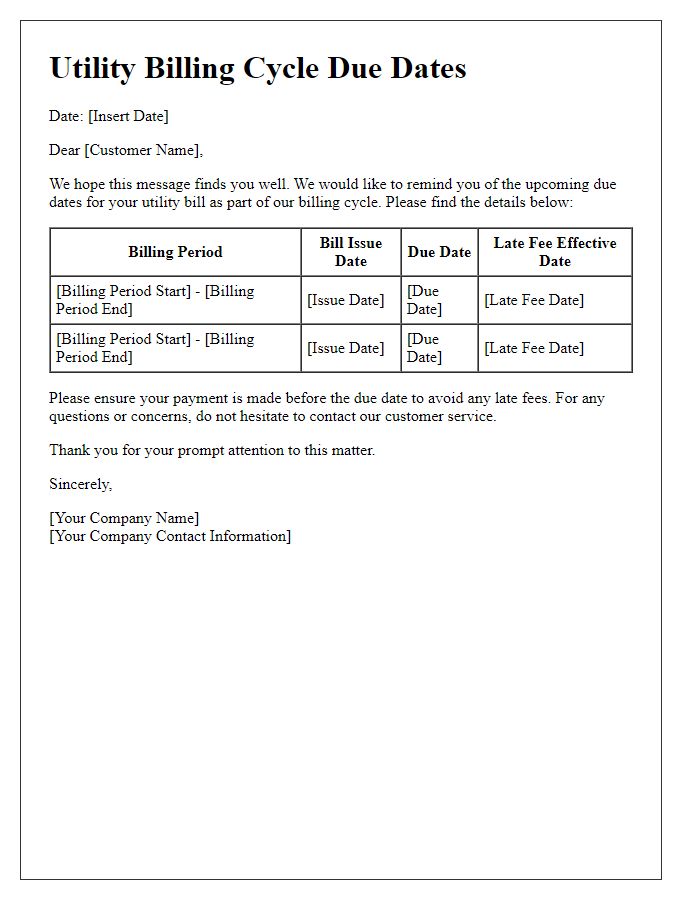

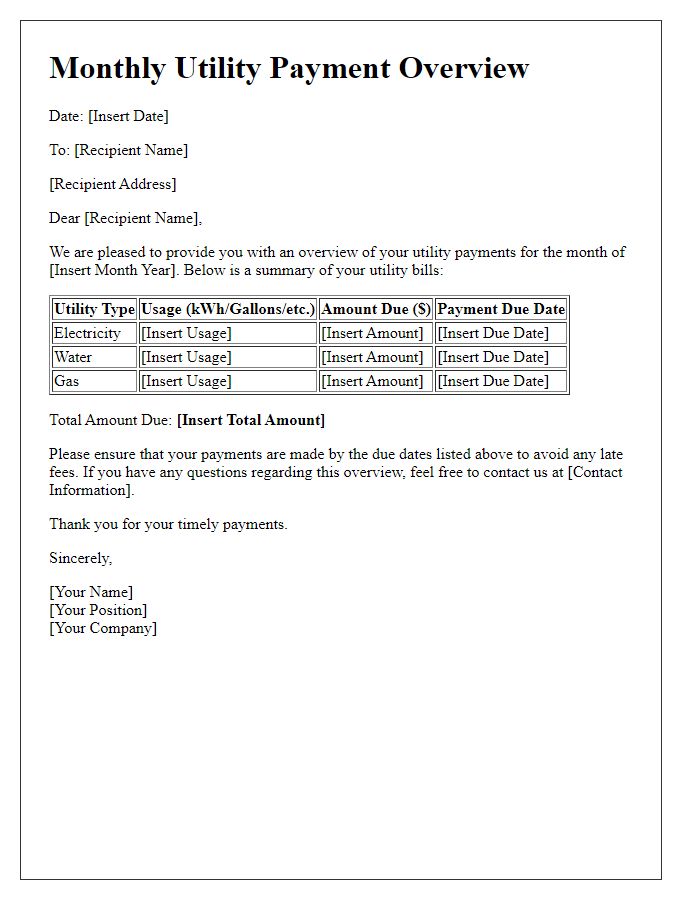

Specific Due Date Mention

Utility payment due dates are critical for maintaining uninterrupted services. For example, electricity bills typically have a due date of the 15th of each month, while water utility bills might be due on the 20th. Customers often receive reminders via email or physical mail approximately one week prior to the specific due date, aiding in timely payments. Late payments can incur fees, sometimes around $10 to $25, and may lead to service disconnection. It's essential to keep track of these dates in one's schedule, avoiding any disruptions in vital services such as heating, cooling, and water supply.

Payment Methods Offered

Utility companies offer a variety of payment methods to ensure timely settlement of bills. Options often include online payments through secure websites, which may support credit cards, debit cards, and electronic check transfers. Automatic Bank Drafts allow for seamless payments deducted directly from customers' bank accounts on due dates, preventing late fees and service disruptions. Payment kiosks in various locations provide cash payment options for those who prefer in-person transactions. Additionally, traditional methods such as mailing a check remain available for customers who favor physical correspondence. Late fees typically apply if payments are not made by specified deadlines, which varies by company, often setting due dates on the same day each month. Timely payments help maintain uninterrupted utility services, ensuring access to essentials like electricity, water, or gas.

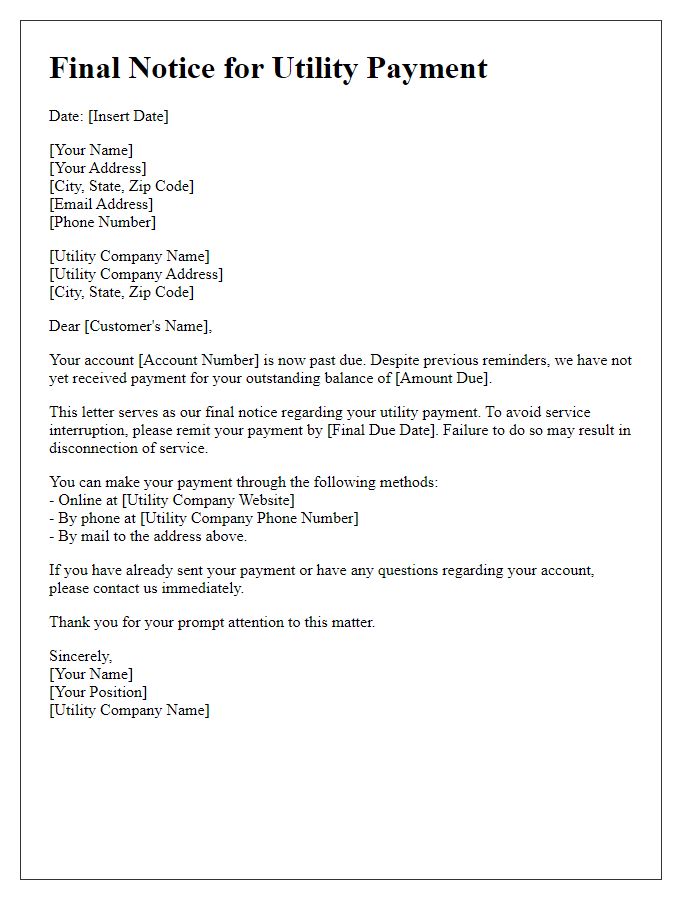

Consequences of Late Payment

Late payment of utility bills, such as electricity, gas, or water, can result in significant consequences for customers. A grace period of typically 10-15 days may be offered by utility providers before late fees are incurred, which can range from 1-5% of the unpaid balance. Failure to make timely payments can lead to disconnection of services, with reconnection fees averaging $50 in major cities like New York or Los Angeles. Additionally, a poor payment history can negatively impact credit scores, hindering future financial opportunities. For essential services, prompt payment is crucial to avoid disruptions that can affect daily life and well-being.

Customer Support Contact Information

Utility payment due dates are critical for ensuring uninterrupted service and avoiding late fees. Many utility companies, such as electric, gas, and water providers, operate on monthly billing cycles, typically setting due dates between the 15th and 30th of each month. Customers often receive notifications via email or postal mail detailing payment amounts and due dates. Late payments may incur penalties, such as a flat fee or a percentage of the outstanding balance, which can vary by provider. For assistance, customers can reach support teams through dedicated customer service lines or online chat options, often listed on company websites. Having accurate contact information readily available is essential for resolving payment inquiries or setting up payment arrangements promptly.

Comments