Are you looking to take control of your utility expenses? Understanding how to effectively budget for your utility bills can make a significant difference in your monthly finances. In this guide, we'll explore practical strategies and tips to help you plan your utility budget with confidence. So, if you're ready to streamline your expenses and save some money, keep reading to discover more!

Stakeholder identification and roles.

Stakeholder identification is crucial for effective utility budget planning, involving key entities such as government agencies, utility companies, community organizations, and consumers. Government agencies like the Environmental Protection Agency (EPA) set regulations that influence budgets. Utility companies, including regional providers like Pacific Gas and Electric (PG&E), manage service delivery and are responsible for financial forecasting. Community organizations, such as the Neighborhood Association of XYZ, represent consumer interests and help gather feedback on community needs. Consumers, the general population receiving services, provide insights into usage patterns and expectations. Understanding the roles of these stakeholders ensures collaboration and transparency in establishing a sustainable and equitable utility budget that meets the diverse needs of the community.

Historical data analysis.

Historical data analysis of utility expenditures in homes, particularly electricity and water bills, reveals patterns crucial for effective budgeting. Average monthly electricity usage typically ranges from 500 to 1,500 kilowatt-hours (kWh) depending on household size and seasonal trends. Water consumption averages about 3,000 to 7,000 gallons monthly, influenced by factors such as family size and outdoor irrigation. In cities like New York, the average cost per kWh is approximately $0.21, while water rates can be around $0.004 per gallon. Noteworthy seasonal fluctuations occur, with summer months often incurring higher usage due to air conditioning needs. Incorporating this data into budget forecasts allows homeowners to allocate resources efficiently, ensuring adequate savings or adjustments in spending as necessary. Analysis of historical trends provides insights into potential future costs, helping families or individuals create realistic financial plans to manage their utility expenses effectively.

Forecasting and market trends.

Utility budget planning guides are essential for managing energy expenses, especially in dynamic markets. Accurate forecasting models utilize historical consumption data, adjusting for variables such as seasonal demand fluctuations and economic indicators. Market trends indicate shifts toward renewable energy sources, with states like California aiming for 100% clean energy by 2045, influencing utility pricing structures. A comparison of utility providers, including major companies like Duke Energy and Con Edison, reveals varying rate plans and customer incentives. Understanding these factors enhances strategic financial management, allowing households and businesses to allocate resources more effectively while minimizing waste.

Risk assessment and management.

A utility budget planning guide is crucial for effective risk assessment and management in financial planning. Various methodologies, such as forecasting and sensitivity analysis, help identify potential risks associated with fluctuating utility costs. Key factors include market volatility, regulatory changes, and seasonal demand shifts. Incorporating historical data from previous years enables better predictions of expenditure patterns in natural gas, electricity, and water usage. Specific utilities, such as Duke Energy (serving millions in the southeastern United States) and Pacific Gas and Electric (a major provider in California), demonstrate different risk exposure based on geographical factors and operational practices. Developing contingency plans to address unexpected spikes--like a 20% increase in electricity rates due to supply chain disruptions--ensures organizations remain financially resilient while fulfilling their operational needs in various industries.

Cost-saving strategies and initiatives.

Utility budget planning is essential for effective financial management, particularly for households looking to reduce monthly expenses while maintaining comfort and convenience. Implementing cost-saving strategies such as energy-efficient appliances and LED lighting can lead to significant reductions in electricity consumption, with some estimates suggesting up to 75% savings compared to traditional bulbs. Additionally, utilizing programmable thermostats can optimize heating and cooling schedules, potentially lowering utility bills by 10 to 30%, based on U.S. Department of Energy recommendations. Water-saving fixtures, including low-flow faucets and showerheads, can also decrease water usage by approximately 30%, contributing to lower water bills. Furthermore, participating in local utility programs, such as rebates for energy upgrades or demand response initiatives, can offer financial incentives for adopting sustainable practices, ultimately enhancing budget stability.

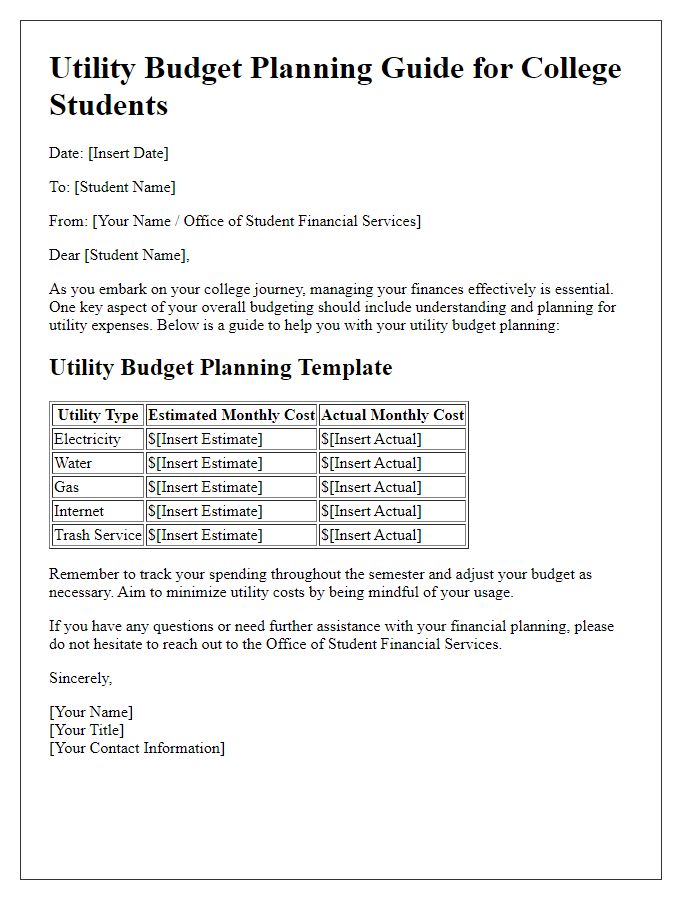

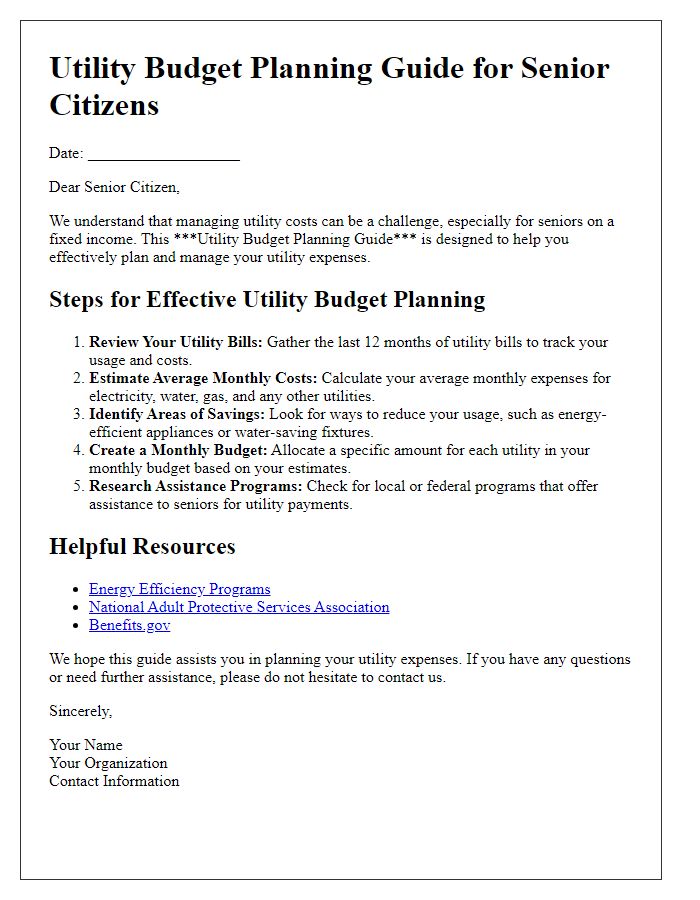

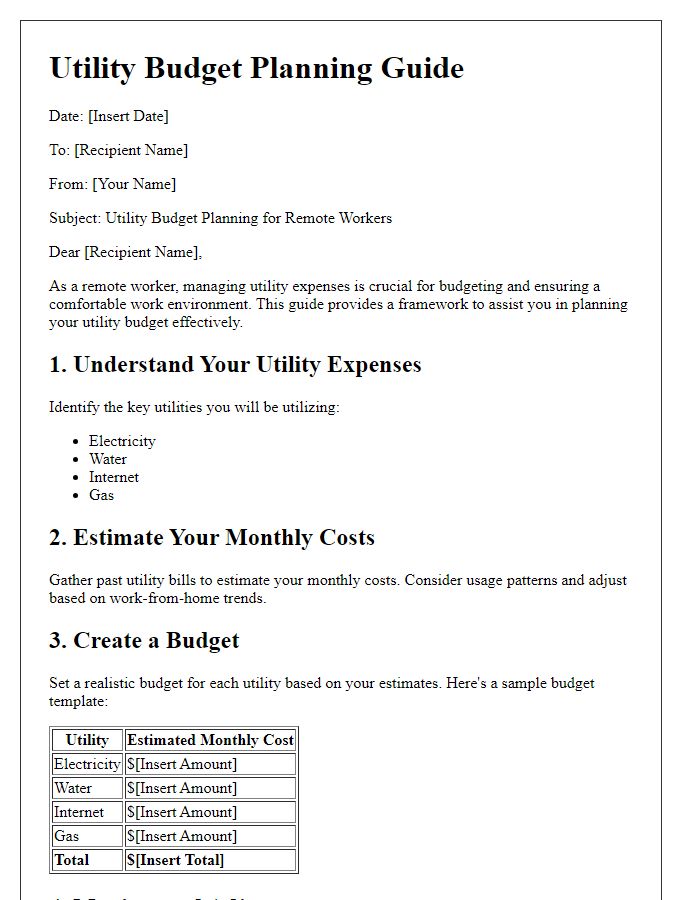

Letter Template For Utility Budget Planning Guide Samples

Letter template of Utility Budget Planning Guide for Non-Profit Organizations

Letter template of Utility Budget Planning Guide for Government Agencies

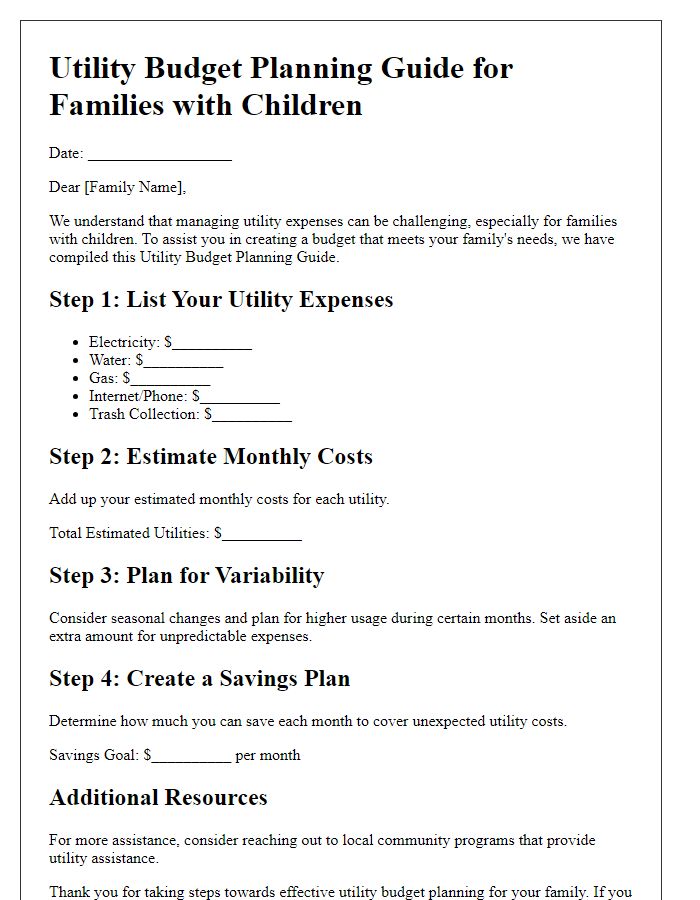

Letter template of Utility Budget Planning Guide for Families with Children

Comments