Are you feeling overwhelmed by your utility bills and searching for ways to ease your financial burden? It's completely understandableâmany people are in the same boat, and that's why exploring payment flexibility options can be a game changer. These alternatives not only help manage your expenses but also provide peace of mind during tough times. Curious to learn more about how you can benefit from these options? Keep reading!

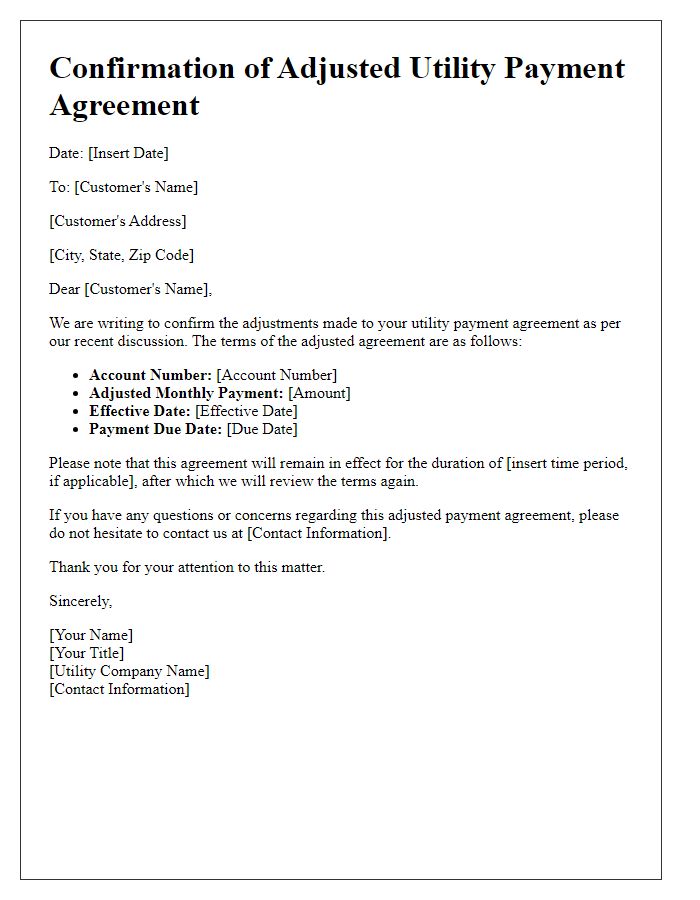

Personalize Recipient Information

Utility payment flexibility options offer customers various choices to manage their bills more effectively. These options include payment plans that spread out payments over a few months, allowing individuals to pay utility companies (such as water, electricity, or gas) in smaller, manageable installments. Customers may also be offered deferment plans, where payments can be postponed for a specific duration due to financial hardship or unforeseen events, such as job loss or medical emergencies. Many utility providers implement community assistance programs that provide extra resources to residents facing difficulties, with eligibility often based on specific criteria like income levels or household size. These initiatives aim to alleviate stress during challenging times, ensuring continued access to essential services without the burden of sudden, hefty forward payments.

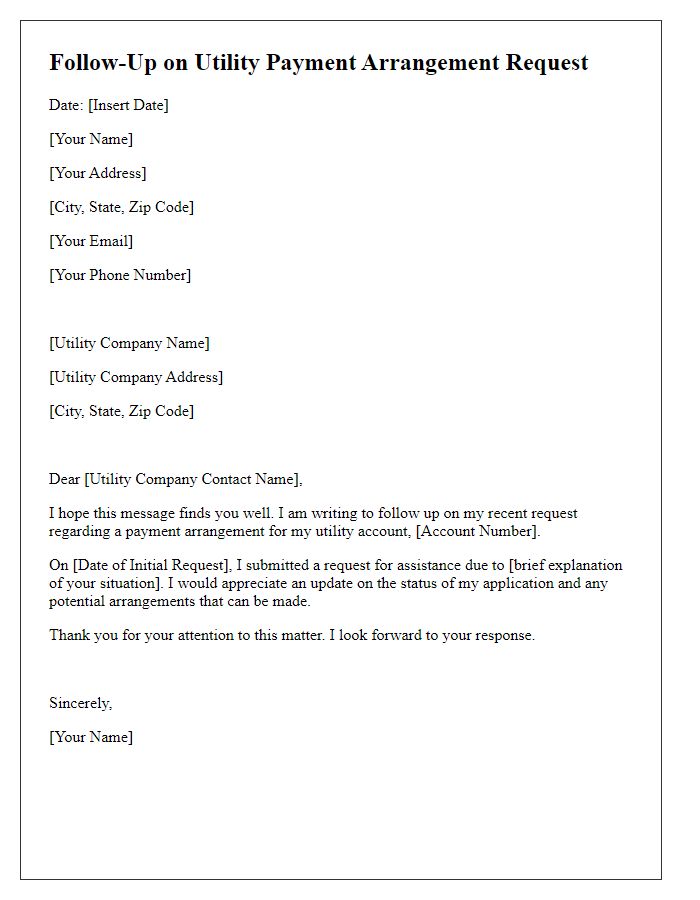

State Purpose Clearly

Utility payment flexibility options provide customers with essential alternatives to meet their financial obligations. Options include payment plans that allow consumers to spread their payments over several months, reducing the burden of large one-time payments. Such arrangements can be particularly beneficial during times of economic hardship or unforeseen expenses, ensuring continued access to essential services like electricity, water, and gas. Additionally, some utility companies offer deferment programs, which temporarily postpone payment deadlines, giving customers necessary breathing room. Financial assistance programs may also be available, targeting low-income households or those facing extreme financial challenges, thereby fostering community support and stability. Understanding these options can empower consumers to manage their utility bills more effectively.

Offer Flexible Payment Options

Utility companies often provide flexible payment plans to assist customers facing financial difficulties. These plans might include arrangements such as installment payments, allowing customers to pay bills gradually instead of a lump sum. For example, a customer may opt for a payment schedule that divides their total due amount into smaller monthly payments over three to six months. Additionally, some utilities offer deferred payment options, which permit customers to postpone part of their bills during high-cost seasons, like winter months when heating expenses escalate. Certain programs, particularly during economic downturns, may provide temporary financial assistance, ensuring essential services like electricity, gas, or water remain uninterrupted. Customers can typically inquire about these options by contacting their local utility service provider, fostering a valuable dialogue to maintain service continuity.

Highlight Benefits and Consequences

Utility payment flexibility options provide significant financial relief for customers during difficult times. Programs such as the United States federal Low-Income Home Energy Assistance Program (LIHEAP) can help households manage energy costs by offering financial assistance during peak usage months, typically winter or summer, when bills can spike dramatically. In addition, payment plans allow consumers to spread their utility bills over several months, easing the burden of large lump sum payments that can exceed hundreds of dollars. While these options offer immediate benefits by reducing financial strain and helping prevent service disconnection, they may also involve consequences such as additional fees or higher total costs over time due to accrued interest. Maintaining communication with utility companies can ensure access to these options without compromising long-term financial stability.

Include Contact Information

Utility payment flexibility options allow customers to manage their bills effectively during financial difficulties. Various plans are available, including payment extensions, budget billing, and deferred payment arrangements. Budget billing averages monthly utility expenses over a year, ensuring predictable payments based on estimated annual usage. Payment extensions provide additional time to settle outstanding balances without late fees, often up to 30 days. Deferred payment arrangements allow customers to spread out overdue amounts over several months, making them more manageable. Customers seeking assistance should contact their utility provider, providing specific account numbers, and reaching out through designated hotlines or customer service emails for tailored solutions.

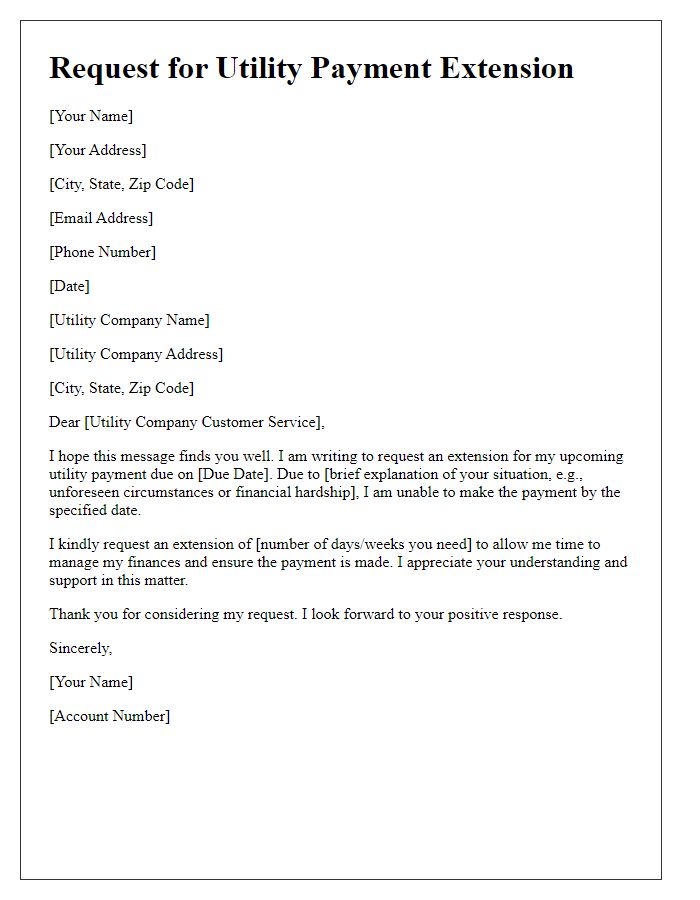

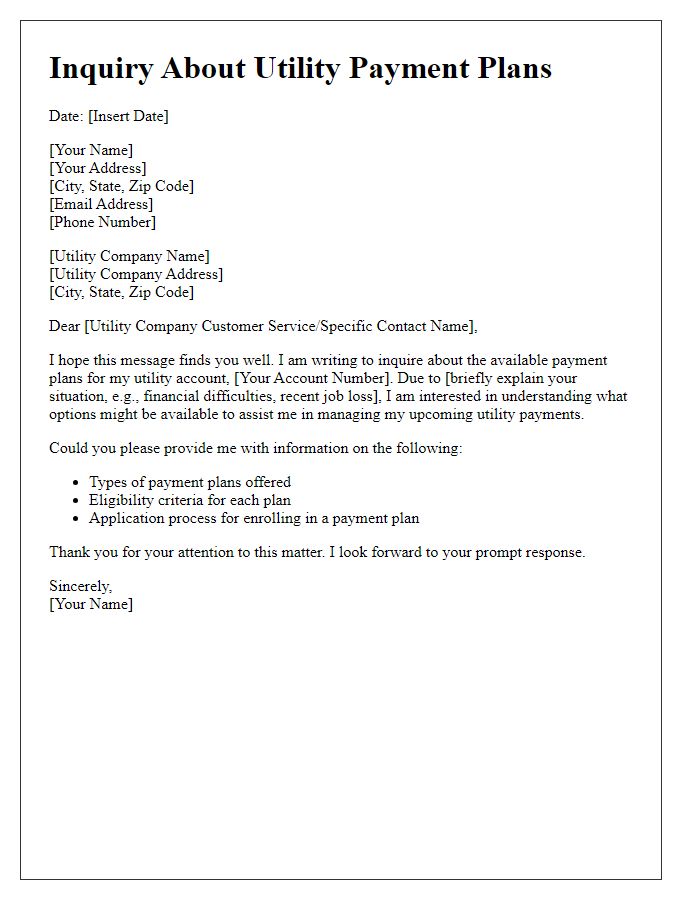

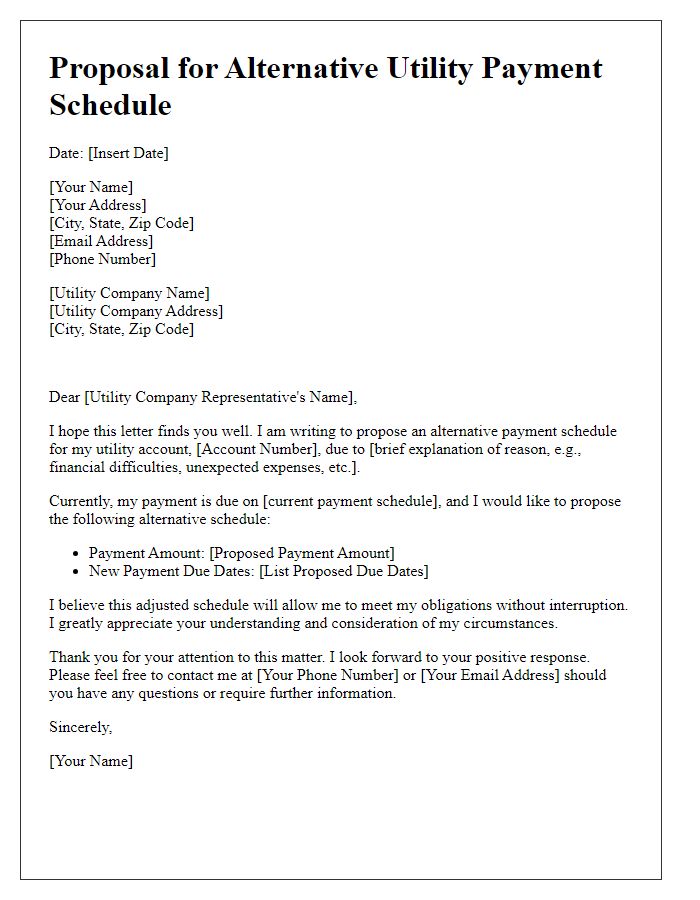

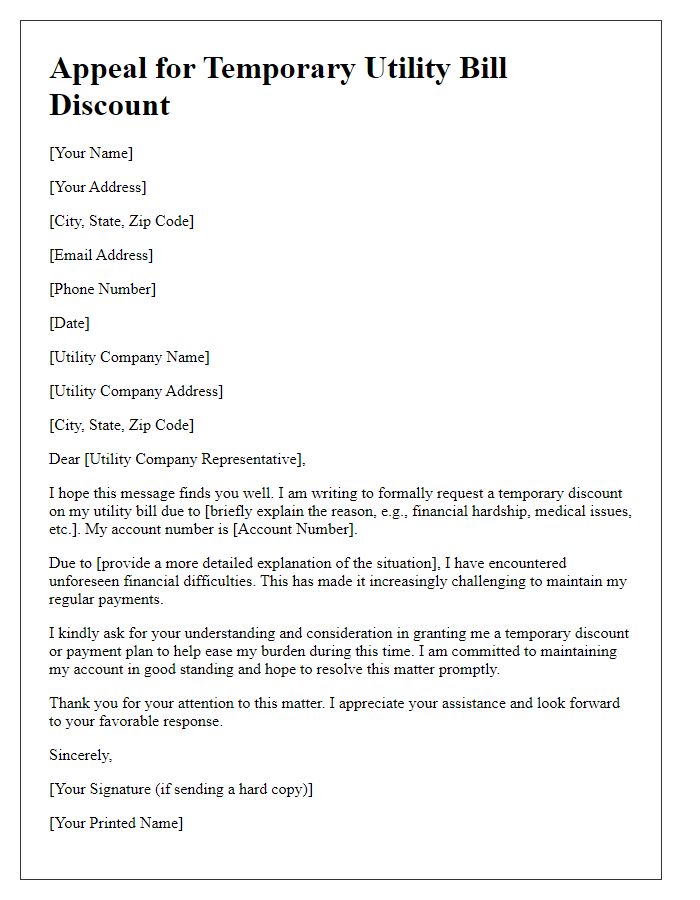

Letter Template For Utility Payment Flexibility Options Samples

Letter template of notification for financial hardship impacting utility payments

Letter template of request for utility payment reduction due to circumstances

Letter template of complaint regarding inflexible utility payment policies

Letter template of suggestion for enhanced utility payment assistance programs

Comments