Are you feeling overwhelmed by your student loans and unsure of where to start with repayment? Navigating the ins and outs of student loan repayment can be daunting, but it doesn't have to be! In this article, we'll break down everything you need to know about launching your repayment journey, from understanding different repayment plans to tips on managing your budget. So grab a cup of coffee, settle in, and let's dive into the essential steps for initiating your student loan repayment!

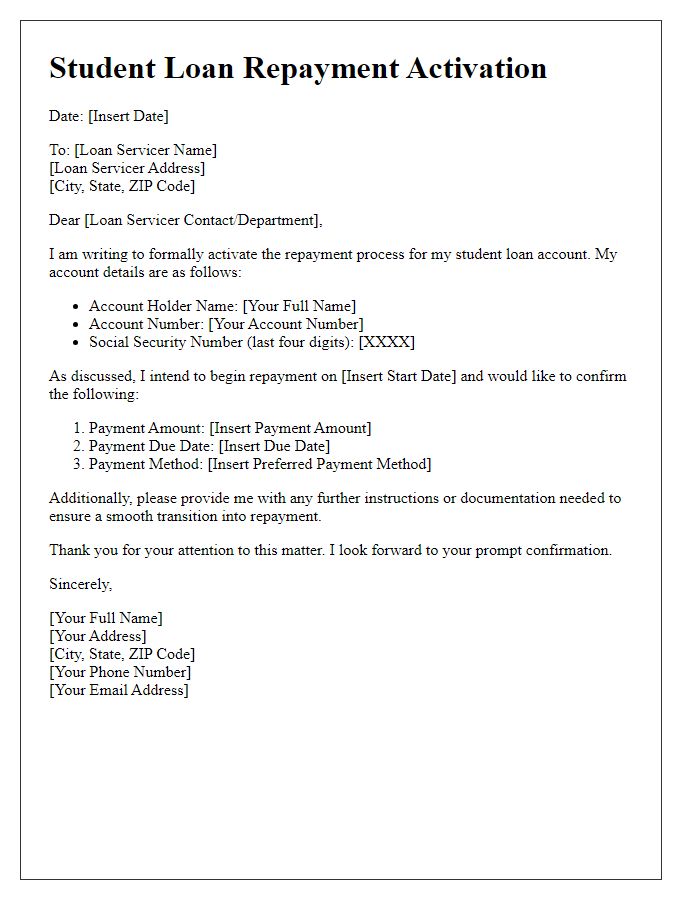

Clear Introduction and Purpose

Student loan repayment represents a significant financial responsibility for graduates, such as those from public universities like the University of California. The purpose of initiating repayment involves understanding the specific terms and conditions related to federal loans, which may include options for income-driven repayment plans, deferment, or forbearance. Borrowers need to familiarize themselves with their loan servicer, such as Nelnet or Navient, and keep track of critical deadlines that may arise, including the six-month grace period following graduation. Detailed budgeting is crucial for managing monthly payments, which can range from hundreds to thousands of dollars depending on total debt, interest rates, and repayment plans selected. Financial literacy resources, including FAFSA(r) (Free Application for Federal Student Aid) guidelines, can provide essential insights into better managing student loan obligations.

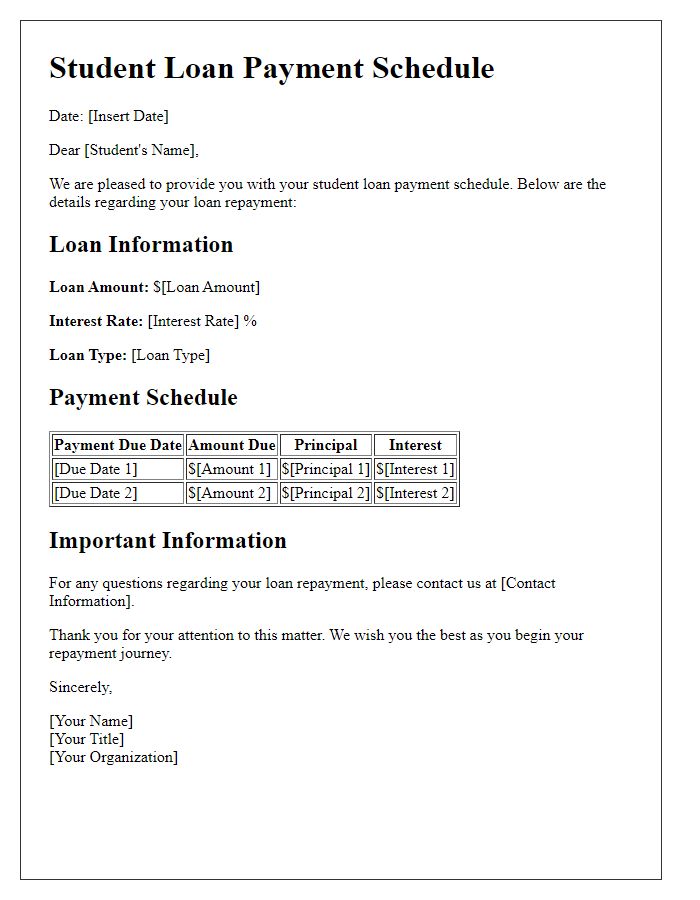

Loan Details and Repayment Terms

Initiating the repayment process for student loans involves understanding the specifics of the loan agreement, including the type of loan, outstanding balance, interest rates, and repayment terms. Federal Direct Loans, typically offered by the U.S. Department of Education, often have a fixed interest rate around 4.53% for undergraduate students. The standard repayment term spans 10 years, allowing for manageable monthly payments which may start at approximately $100 depending on the total loan amount, usually averaging around $30,000 for a four-year degree. Alternatives such as income-driven repayment plans can adjust payments based on income and family size, potentially extending the repayment period beyond 20 years. It's essential to consider options for deferment or forbearance during times of financial hardship, which can temporarily pause payments without defaulting on the loan. Understanding these details helps borrowers make informed decisions to ensure timely repayment and avoid penalties.

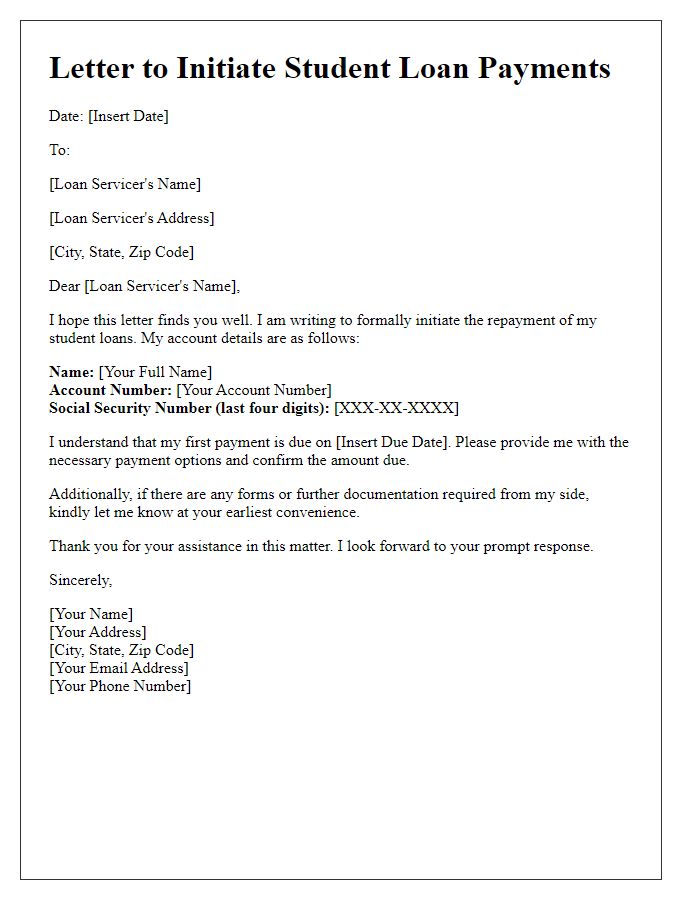

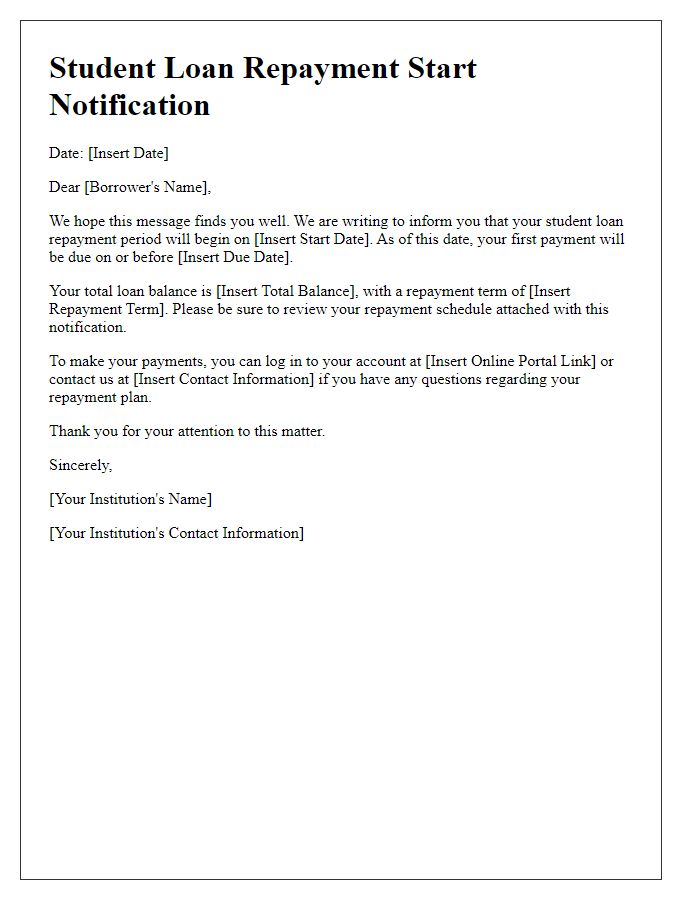

Payment Options and Methods

Understanding student loan repayment initiation is crucial for borrowers navigating their financial responsibilities. Federal student loans, such as Direct Subsidized Loans and Direct Unsubsidized Loans, typically provide a grace period of six months before repayment starts. Various payment options are available, including standard repayment, which spans up to ten years, and income-driven repayment plans, adjusting monthly payments according to income levels. Borrowers may also consider loan consolidation, which combines multiple loans into a single loan, potentially simplifying repayment. Additionally, automatic debit options can lead to interest rate reductions for borrowers, promoting timely payments. Important deadlines exist for choosing a repayment plan or applying for forgiveness programs, such as Public Service Loan Forgiveness, which require a minimum of 120 qualifying payments while working in eligible public service jobs. Understanding these elements can empower borrowers to make informed decisions regarding their loan repayment journey.

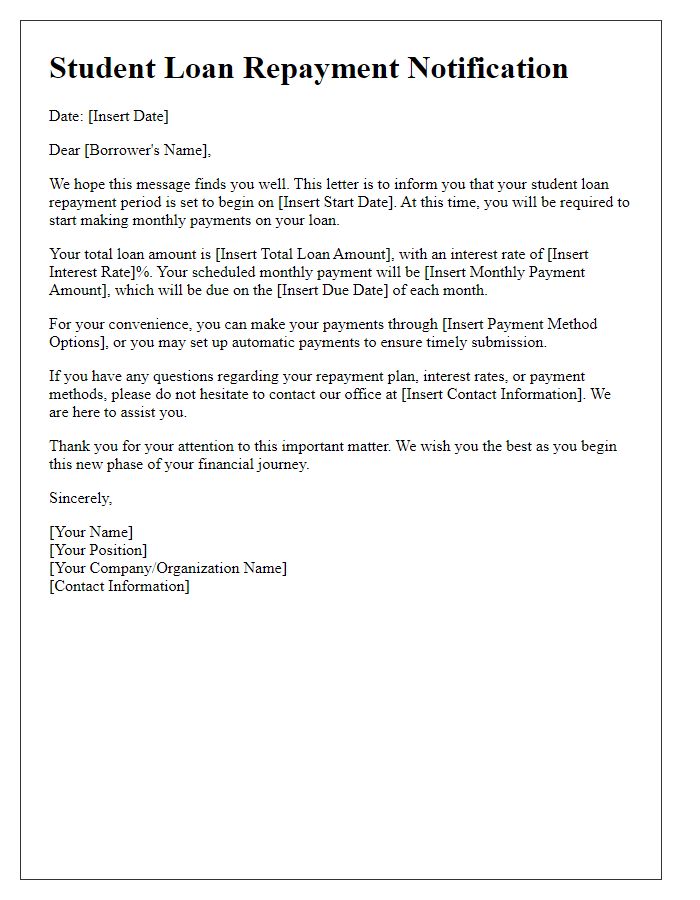

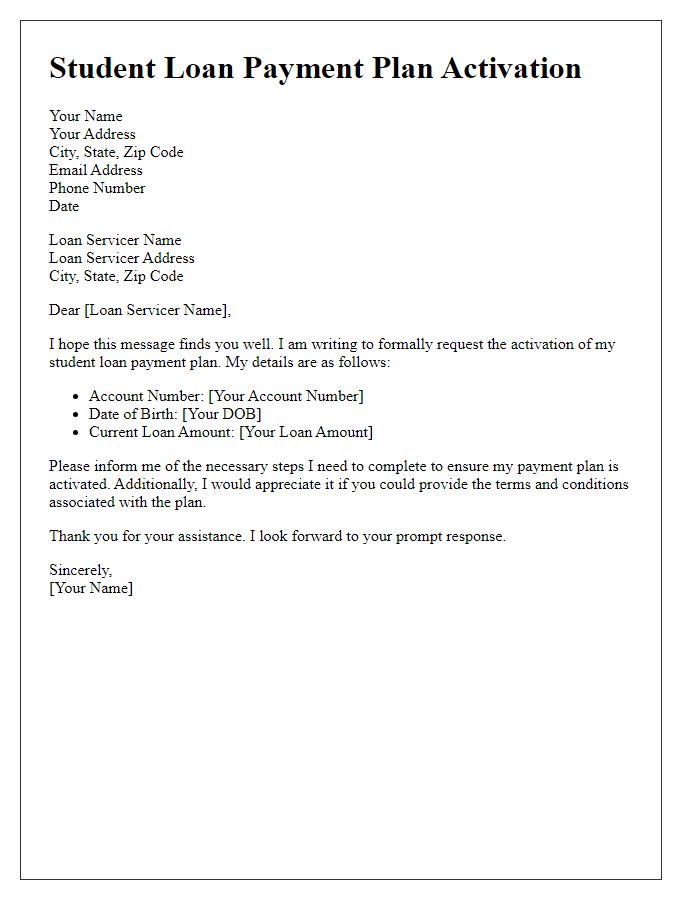

Contact Information for Assistance

Student loan repayment initiation requires clear communication channels for borrowers seeking assistance. Federal Student Aid provides contact information for various loan servicers, including Navient and FedLoan Servicing, which manage repayment plans. Assistance options include phone support during business hours, typically Monday to Friday, with specific service hours varying by servicer. For online support, borrowers can access account management portals or live chat features, providing quick resolutions. Additionally, the U.S. Department of Education offers resources and FAQs on their official website, guiding borrowers through the repayment process and available services. Ensuring that all contact information is accurate and easily accessible is crucial for effective borrower support.

Encouragement and Supportive Tone

Student loan repayment can understandably evoke feelings of anxiety and uncertainty. With the average student loan debt sitting at approximately $30,000 for graduates, initiating repayment is a significant step toward financial independence. Establishing a solid repayment plan tailored to individual circumstances can significantly ease this transition. Various repayment options are available, such as Income-Driven Repayment plans, designed to adjust monthly payments based on income levels. Universities and financial aid offices often provide resources and counseling services to support students throughout this process. Additionally, staying informed about interest rates, which can fluctuate, helps in managing debt effectively. Engaging with financial literacy programs offered by local community organizations can further enhance knowledge and confidence in handling repayments.

Comments