Are you in need of a reliable letter template to provide proof of insurance for your transportation services? Whether you're a seasoned professional or just starting out, having the right documentation is essential to maintaining trust and compliance with clients and regulations. Crafting a clear and concise letter can simplify the process and ensure everyone is on the same page regarding your coverage. If you want to dive deeper into the specifics of creating an effective insurance proof letter, keep reading!

Policyholder Information

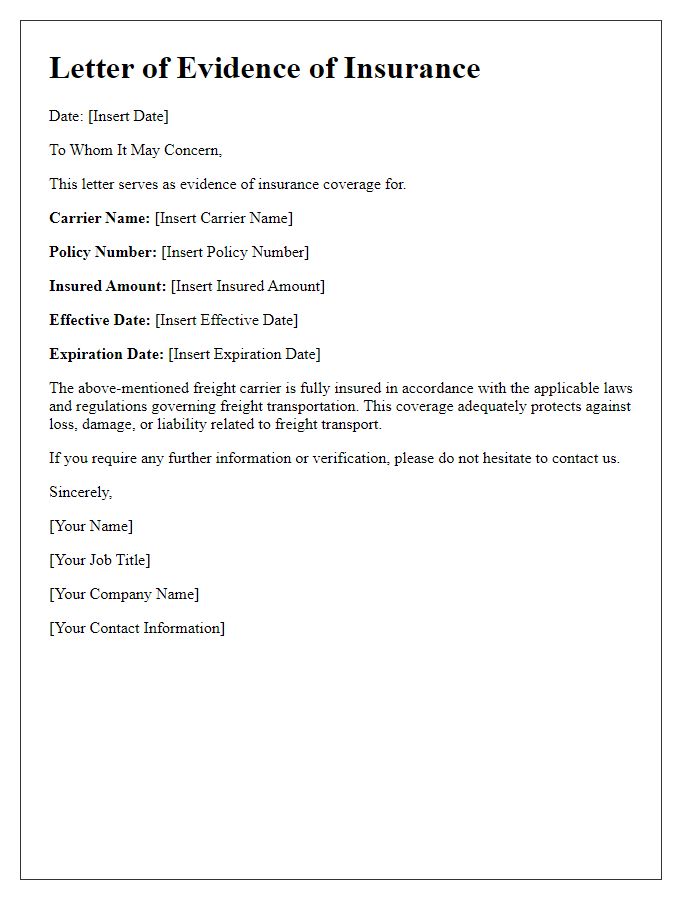

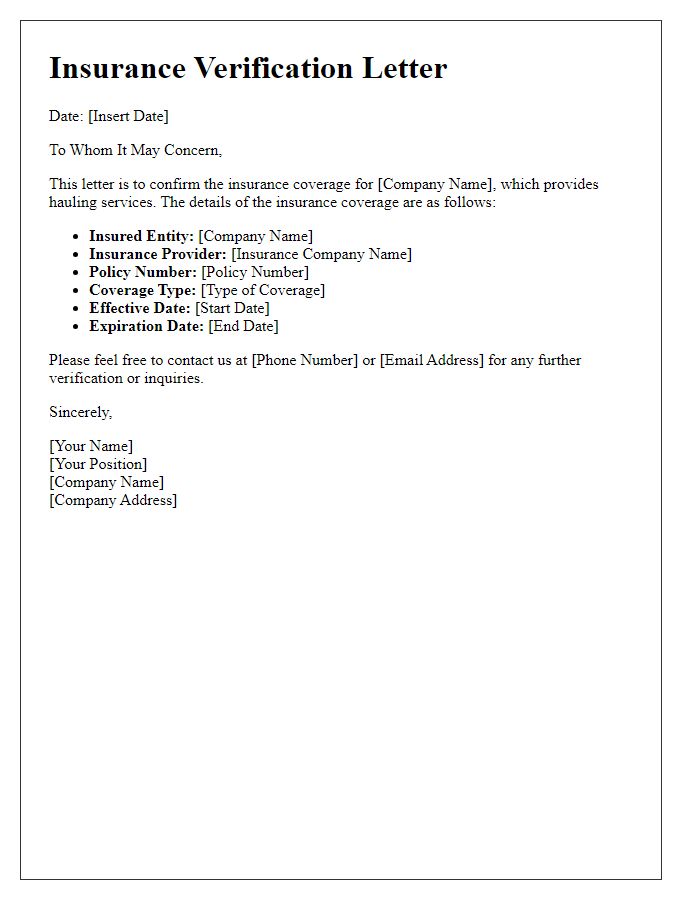

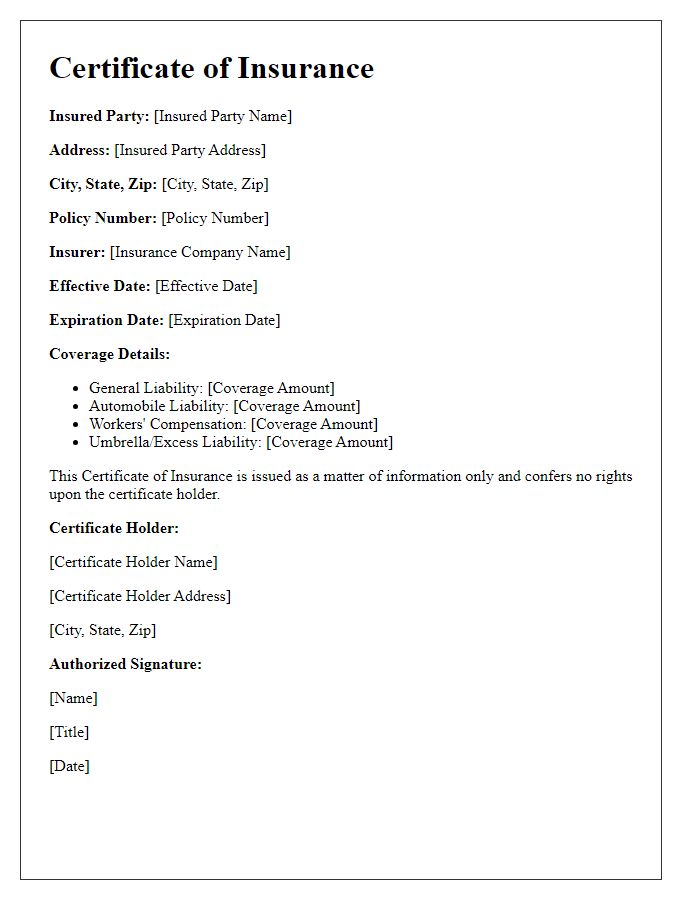

Providing transportation service insurance proof is crucial for safeguarding assets during transit. Policyholder information, including the full name, address, and contact details, ensures that the insurer can promptly communicate about coverage terms. Details such as policy number (often a unique identifier), type of coverage (like cargo insurance or liability protection), and effective dates (the period during which insurance is valid) are vital components. Specifics like the name of the transportation service provider (e.g., UPS, FedEx) and the nature of the cargo being transported further clarify the insurance coverage extent and limitations. Accurate documentation assists in addressing potential claims efficiently.

Insurance Company Details

Transportation services often require proof of insurance to ensure safety and compliance with regulations. Insurance companies, such as State Farm, Geico, or Allstate, provide coverage for various types of transportation, including freight carriers and logistics companies. A typical insurance policy may include details such as policy number, coverage limits (often expressed in millions of dollars), and effective dates (generally a year from issuance). The validation process in transportation services usually involves verifying the insurance documents, which may be requested by clients or regulatory bodies, ensuring that liabilities are covered during transit operations.

Policy Number and Coverage Dates

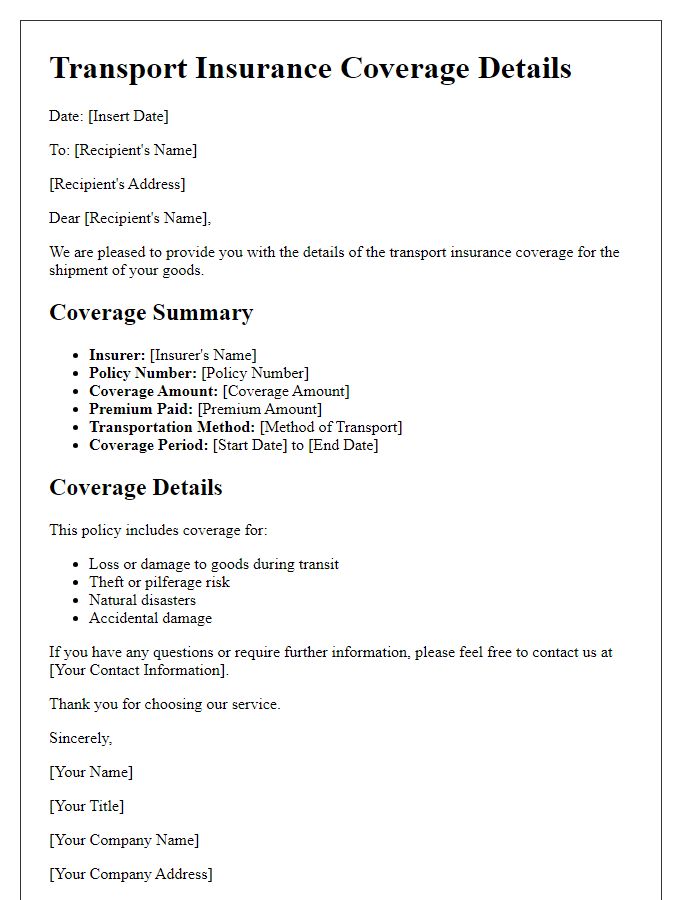

Transportation service insurance plays a crucial role in protecting assets during transit. A policy number (unique identification assigned to an insurance policy) ensures easy tracking and access to all relevant coverage details, often required for loan agreements or business contracts. Coverage dates (start and end dates of the insurance policy) are vital for confirming the period of protection, ensuring assets are covered from accidental damage or loss during specified transport times. This is particularly important for high-value equipment or sensitive goods, where insurance documentation may be needed to address claims effectively in situations such as theft, natural disasters, or accidents occurring within the designated coverage period.

Description of Coverage

Transportation service insurance coverage includes a range of policies designed to protect both the insured party and the cargo being transported. Comprehensive general liability insurance offers coverage for incidents occurring during transportation, with limits typically set at $1 million per occurrence. Cargo insurance protects goods from damage or loss during transit, often covering theft, natural disasters, and accidental damage. Policies may also include driver liability coverage, ensuring protection against bodily injury claims arising from accidents involving insured vehicles. Additional endorsements, such as inland marine insurance, safeguard cargo during various points of transit over land, enhancing overall protection. It is crucial for transportation companies to maintain proper documentation of coverage to comply with industry regulations and provide proof to clients and partners.

Contact Information for Verification

For transportation service insurance verification, include details such as the policy number (often a combination of letters and numbers specific to the insurance provider), the name of the insured entity (such as a logistics company), the effective dates (start and expiration), and contact information for the insurance provider (including phone numbers and email addresses). This verification may involve reaching out to the insurance representative, or claims adjuster based on the policyholder's region. Providing comprehensive contact information ensures quick and efficient verification, especially in high-demand scenarios like fleet operations or freight shipping.

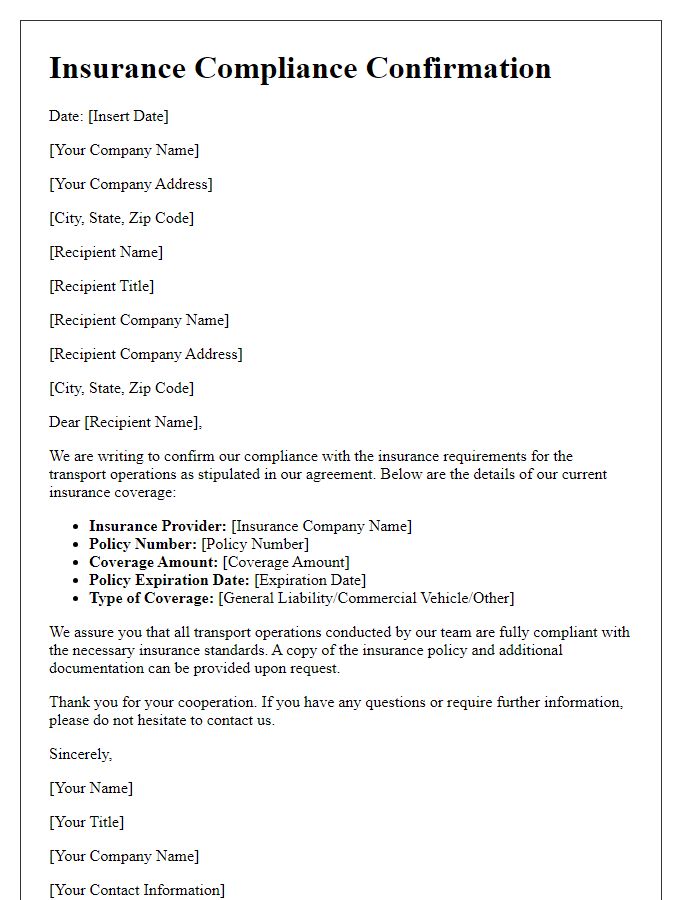

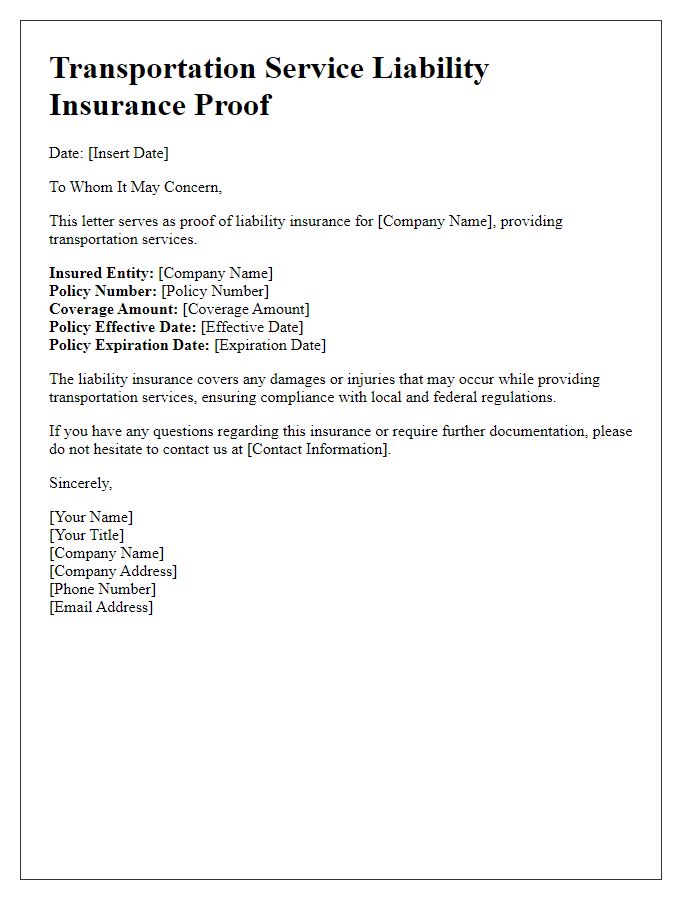

Letter Template For Transportation Service Insurance Proof Samples

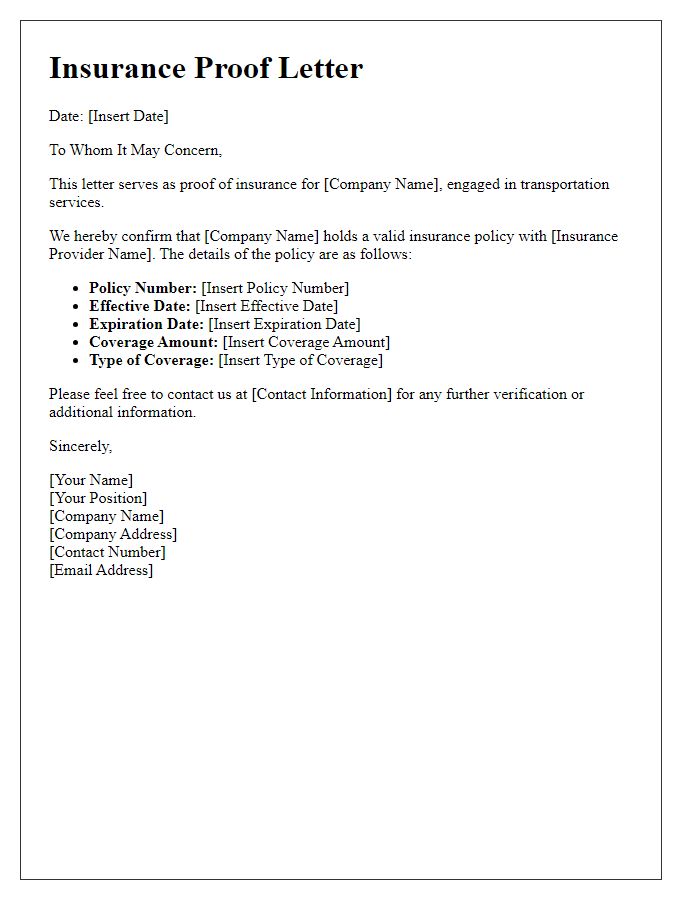

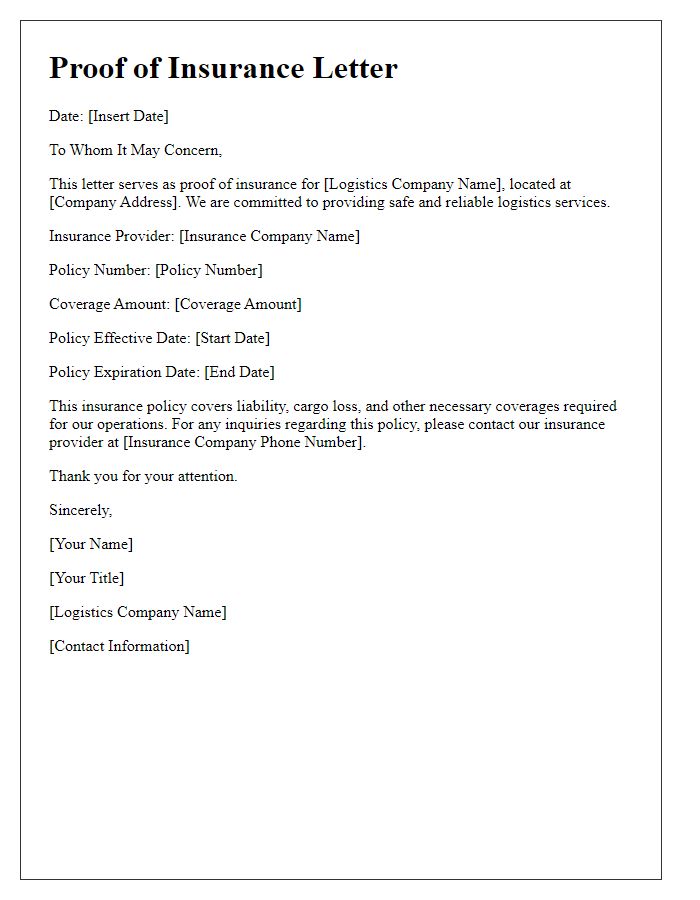

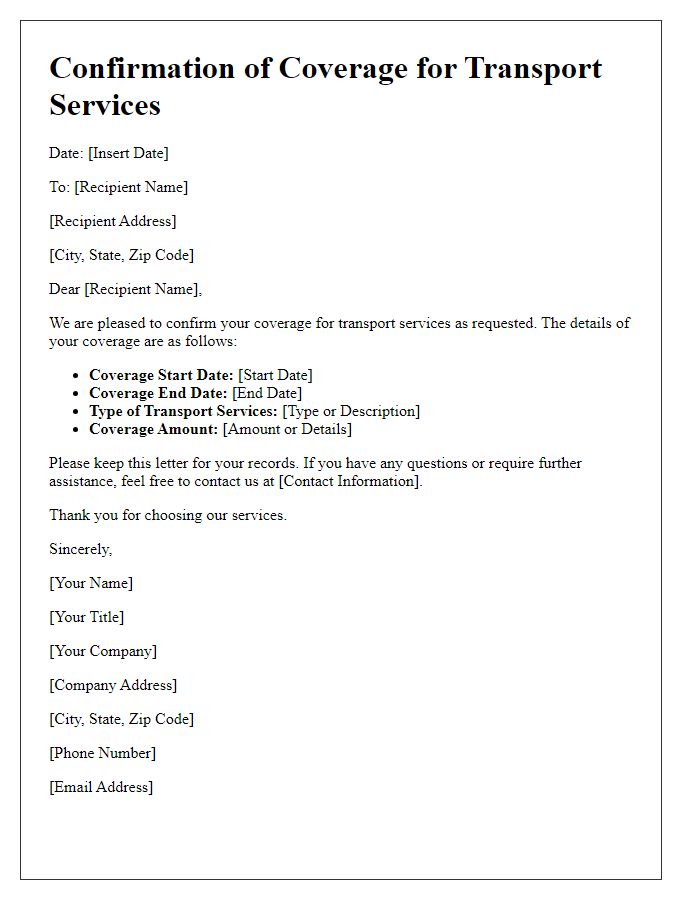

Letter template of insurance proof for transportation service providers.

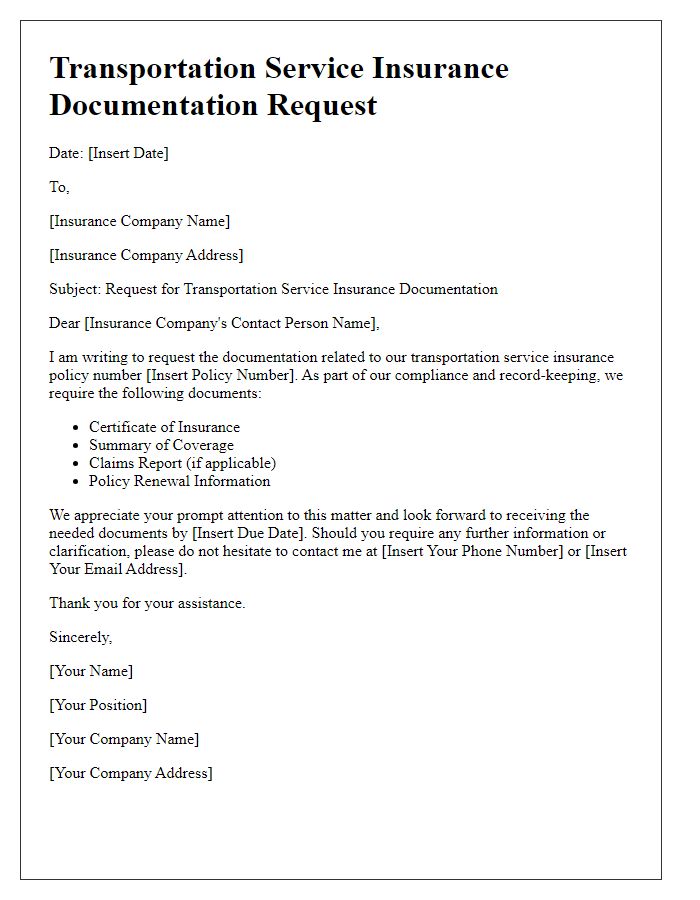

Letter template of transportation service insurance documentation request.

Comments