Are you ready to tackle the often-confusing world of customs duty payments? Whether you're a seasoned importer or just getting started, understanding the essentials can save you time and money. In this article, we'll break down the key elements of a customs duty payment letter, making the process simpler and more straightforward for you. So, let's dive in and explore everything you need to know!

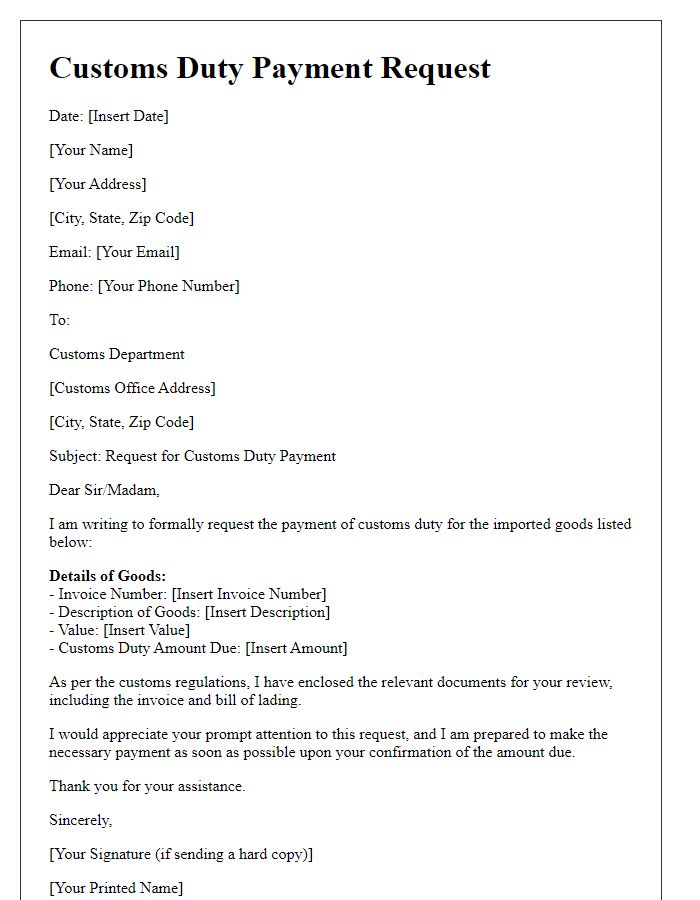

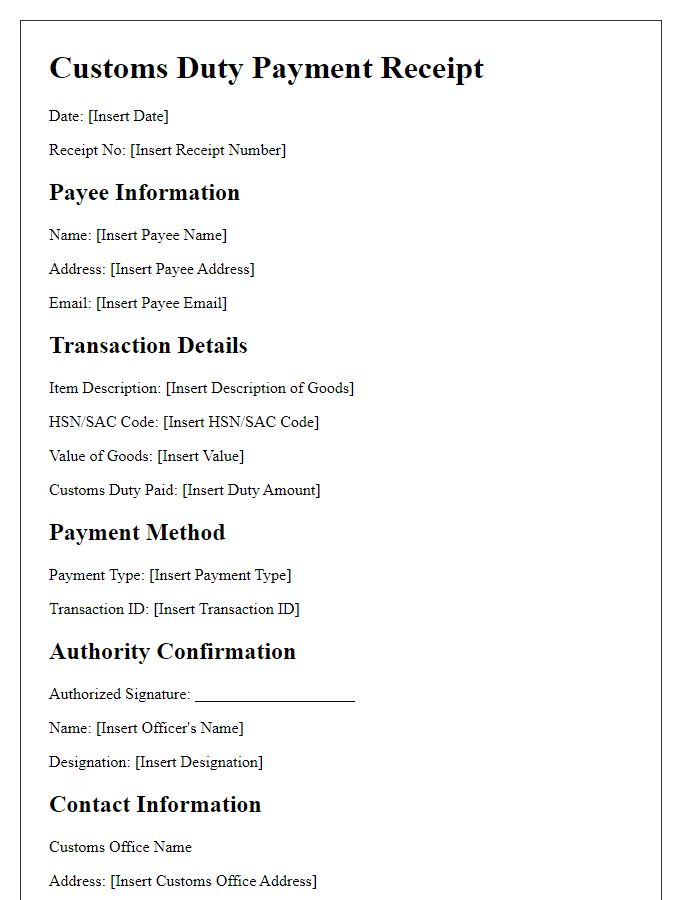

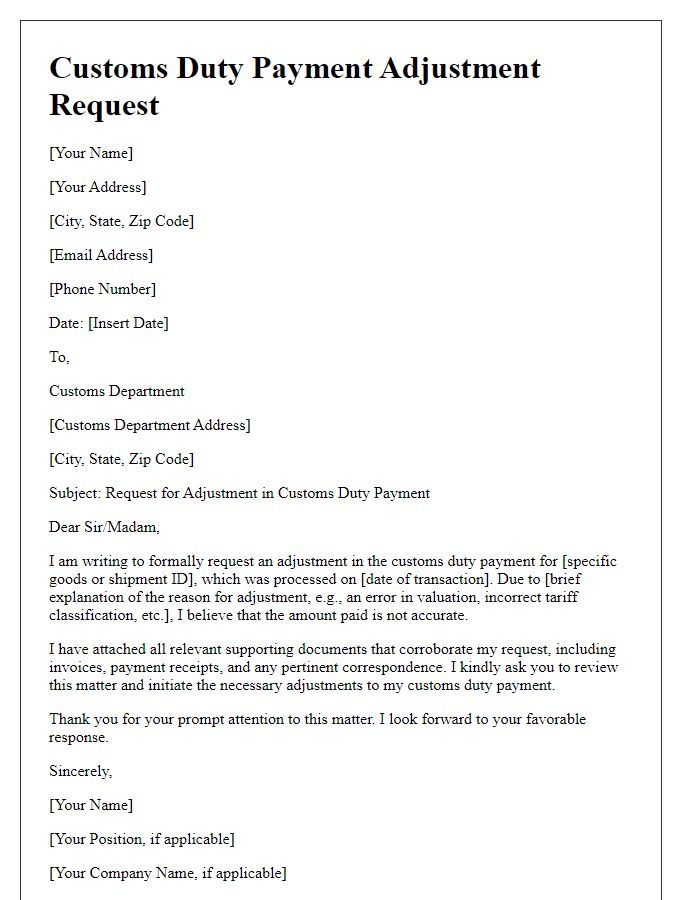

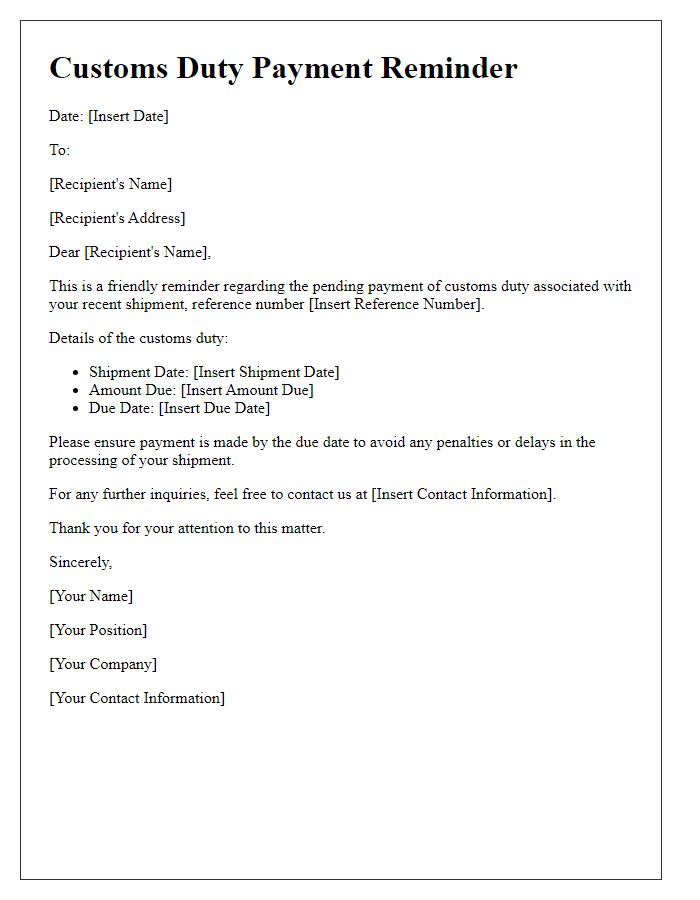

Sender and recipient details

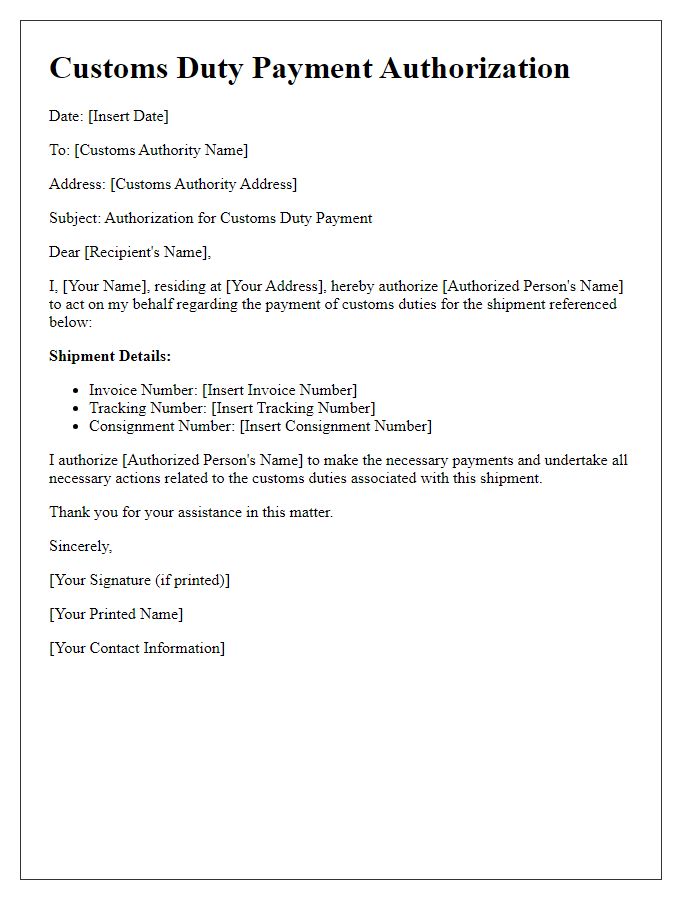

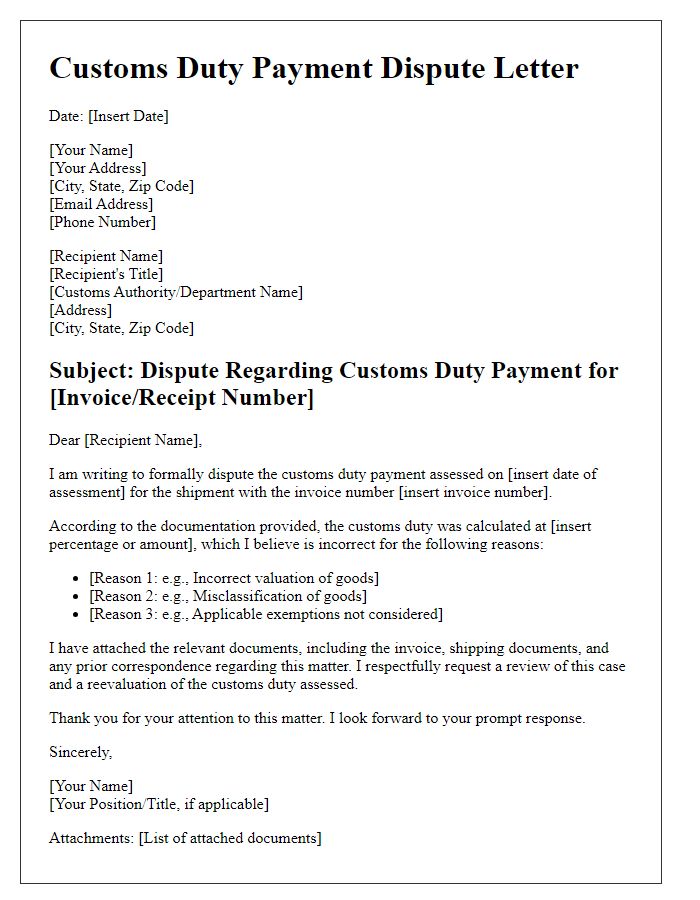

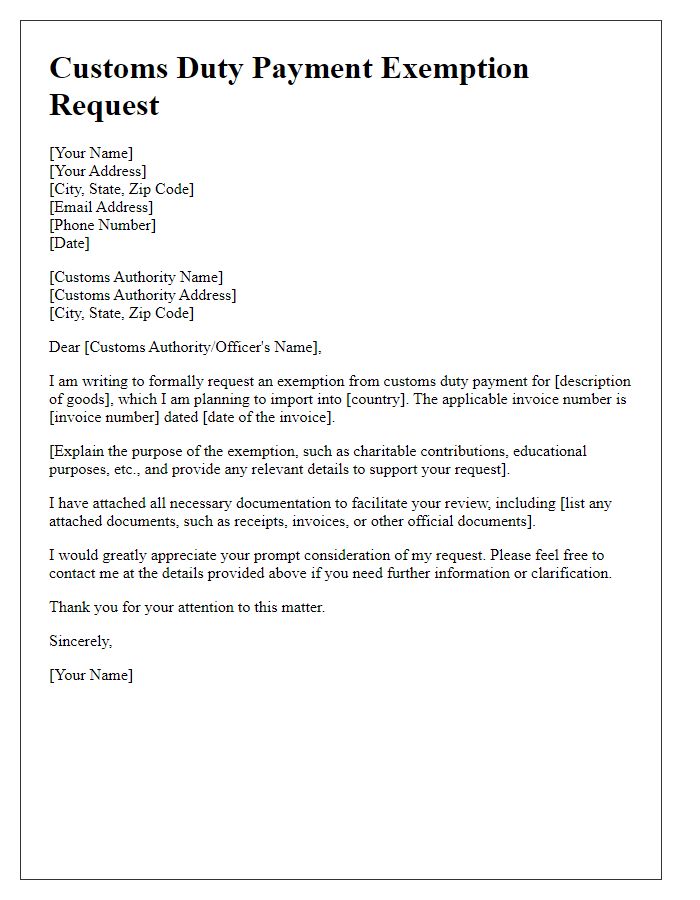

Customs duty payment notifications are crucial for international trade compliance. Clear sender details, including full name, address, and identification number (such as Tax Identification Number or VAT number), establish the entity responsible for the payment. Similarly, recipient details must include the full name, address, and customs registration number, aligning with shipment documentation. Accurate information ensures efficient processing at customs offices, like the Port of Los Angeles or Heathrow Airport, fostering smooth delivery and minimizing delays. Additional reference numbers associated with the shipment, such as Bill of Lading or Air Waybill numbers, enhance tracking and facilitate communication with customs authorities.

Subject line

Customs Duty Payment Notification: Urgent Action Required

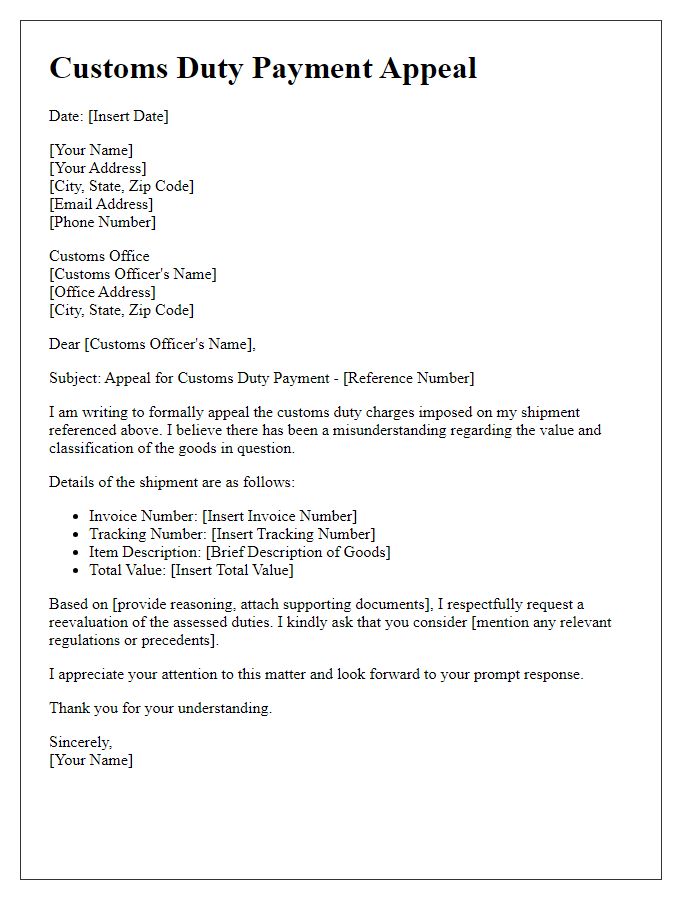

Item description and value

When importing goods, accurate item description and declared value are crucial for customs duty payment calculations. A detailed description must include specific qualities such as product type, material, brand, model number, and intended use. For example, when declaring electronics like a Samsung Galaxy smartphone, include details such as model number (SM-G991U), specifications (128GB storage, 8GB RAM), and purpose (personal use). The declared value should reflect the purchase price or fair market value, taking into account shipping costs and insurance. Accurate submissions prevent delays and ensure compliance with regulations, such as those enforced by the U.S. Customs and Border Protection (CBP), which maintains strict guidelines for ensuring all items are properly documented. Supplying precise information fosters smooth customs clearance and efficient delivery processes.

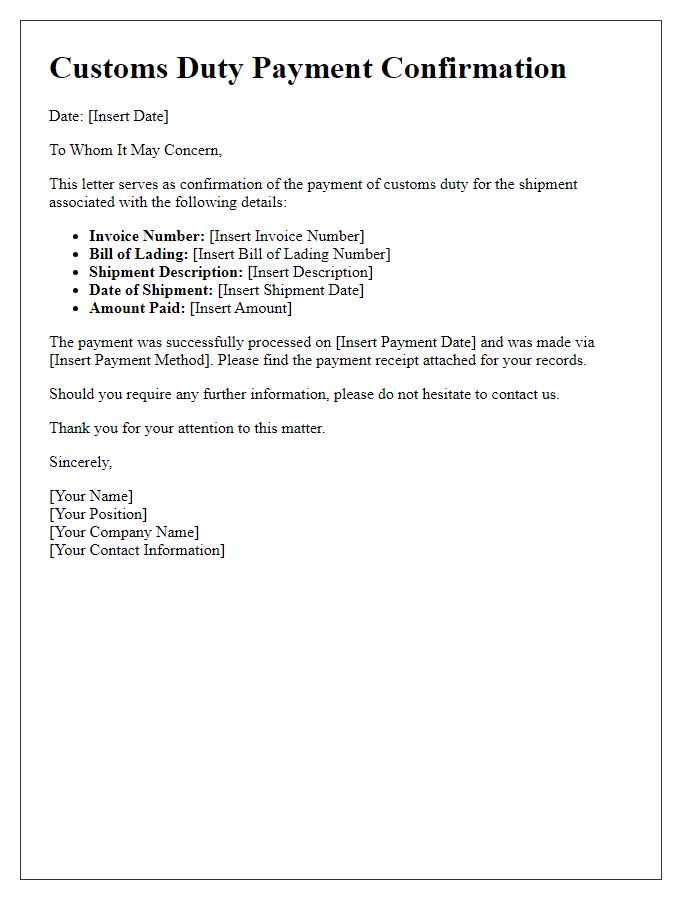

Payment method and details

Customs duty payment processes require precise steps to ensure compliance with international trade regulations. Payment methods for customs duties often include electronic funds transfer (EFT), credit card payments, or checks. For instance, using EFT allows for quicker processing and immediate confirmation. Payment details must include the invoice number (commonly a unique identifier for customs transactions), customs declaration number (specific to the imported item), and the total amount due (calculating the applicable tariffs). Accurate documentation is crucial, as discrepancies may lead to delays or penalties. Countries like the United States, Canada, or the United Kingdom have specific guidelines and forms required for customs duty payments, emphasizing adherence to local regulations to avoid complications.

Contact information for inquiries

Customs duty payments are essential for international shipments processed through customs authorities. Accurate payment of these duties can prevent delays and fines. For inquiries related to customs duty payments, it's important to have clear contact information readily available. The customs authority in the United States, Customs and Border Protection (CBP), can be reached at their official website cbp.gov, where resources and guidance are provided. International contact numbers and local offices are listed there, along with specific details for contacting the Customs Information Center. For businesses, consulting with a licensed customs broker may also streamline communication regarding customs duty obligations and procedures.

Comments