When it comes to navigating the complexities of cross-border shipments, having a clear and concise policy is essential for smooth operations. Many businesses face challenges related to customs regulations, tariffs, and documentation requirements, and a well-defined policy can help alleviate these concerns. By understanding the nuances of international shipping, companies can ensure compliance and maintain goodwill with their partners and customers. Want to explore more about crafting an effective cross-border shipment policy? Keep reading!

Compliance with international trade regulations

Compliance with international trade regulations is crucial for smooth cross-border shipment processes. These regulations often include tariffs, import/export restrictions, and documentation requirements imposed by organizations such as the World Trade Organization (WTO) and the International Chamber of Commerce (ICC). Proper classification of products under the Harmonized System (HS) code, which consists of over 5,000 codes to identify traded goods, is essential for determining duties and taxes. Additionally, countries may have specific licensing requirements, like the Export Administration Regulations (EAR) in the United States or dual-use regulations to prevent the shipment of sensitive technology. Accurate and timely completion of customs declarations, alongside other necessary documentation such as the bill of lading and commercial invoice, is vital to avoid penalties and delays in international logistics. Engaging with experienced customs brokers or freight forwarders can ensure adherence to these complex regulations, significantly enhancing the efficiency of the supply chain.

Accurate and comprehensive documentation

Accurate documentation plays a critical role in facilitating cross-border shipments, particularly in international logistics operations like those seen in global trade hubs. Documentation encompasses essential forms, such as the Bill of Lading (BOL), which serves as a receipt of freight services, and the Commercial Invoice, detailing transaction specifics (including quantities and pricing) required by customs authorities. In accordance with regulations set by entities like the World Customs Organization (WCO), proper documentation ensures compliance with import and export laws, minimizes the risk of delays at border crossings, and supports efficient customs clearance processes. Furthermore, maintaining records of all shipment-related documents for a minimum of five years is often mandated by customs regulations, aiding in audits and investigations. Thus, thorough and precise documentation establishes a solid foundation for successful cross-border shipments and minimizes potential legal risks.

Clear customs declaration and tariff classification

Cross-border shipments often require meticulous attention to customs declarations and tariff classifications to ensure compliance with international trade regulations. Accurate customs declarations must include detailed information about goods being transported, including product descriptions, origin countries, and declared values, to avoid delays at customs checkpoints. The Harmonized System (HS) codes, essential for tariff classification, categorize goods based on international standards, facilitating appropriate duty assessments. Incorrect declarations can lead to penalties, shipment seizures, or increased inspection rates, impacting overall delivery timelines. Moreover, familiarity with customs policies of destination countries, such as those enforced by U.S. Customs and Border Protection or the European Union Customs Union, is crucial for ensuring a smooth transit and avoiding unexpected charges or customs holds.

Risk management and insurance considerations

Cross-border shipments involve various risk management and insurance considerations critical for ensuring the safe and efficient movement of goods. Customs regulations in respective countries may impact the shipping timeline, affecting delivery schedules. Shipping insurance, often covering loss or damage during transit, typically ranges from 0.5% to 2% of the shipment value based on the coverage type selected. Additionally, understanding Incoterms (International Commercial Terms), which define responsibilities for costs and risks, is essential for both sellers and buyers. For instance, terms like CIF (Cost, Insurance, Freight) shift significant responsibilities to the seller, while DDP (Delivered Duty Paid) indicates maximum responsibility for the seller. Implementing robust risk management strategies, including choosing reputable carriers and tracking shipments using GPS technology, can mitigate potential losses during the shipping process. International shipping agreements should also consider potential liability limitations, with regulations differing greatly across jurisdictions.

Coordination with logistics and freight forwarders

Effective coordination with logistics and freight forwarders is crucial in the seamless management of cross-border shipments. This involves the strategic planning of transportation routes, including key hubs such as international ports and airports, to ensure timely delivery of goods. Understanding the intricacies of customs regulations, which vary by country, is essential for avoiding delays and additional fees. The integration of technology, like real-time tracking systems, facilitates communication between stakeholders, allowing for immediate updates on shipment status. Furthermore, establishing strong relationships with reliable freight forwarders, known for their expertise in specific regions, can greatly enhance the efficiency of the shipping process, reduce risks of damage, and optimize costs. Companies must routinely review and adapt their shipping policies to align with changing international trade regulations, ensuring compliance and maintaining a competitive edge in the global market.

Letter Template For Cross-Border Shipment Policy Samples

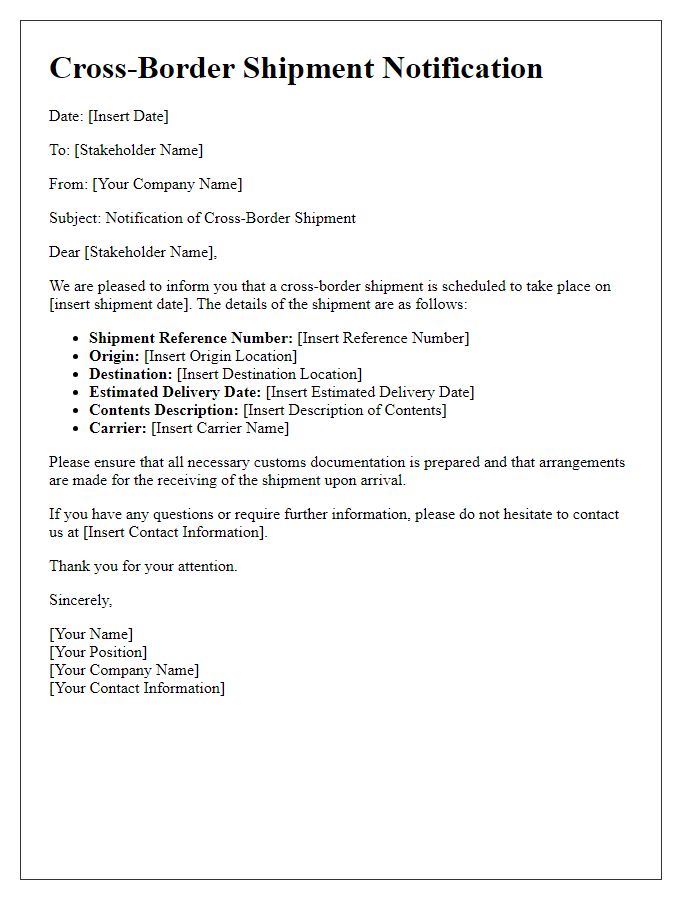

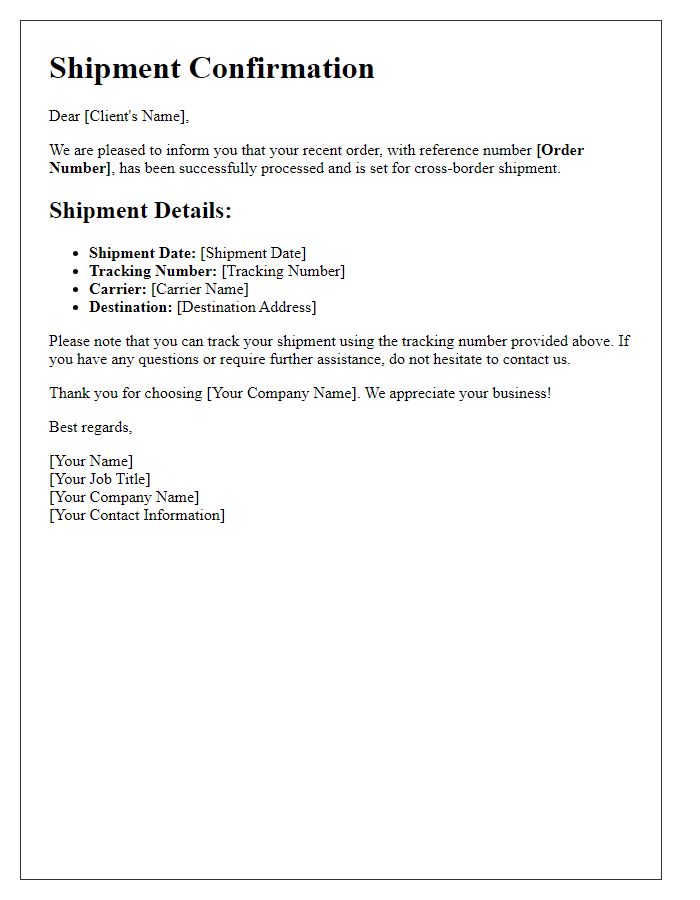

Letter template of cross-border shipment guidelines for international partners

Letter template of cross-border shipment procedures for e-commerce businesses

Letter template of cross-border shipment compliance requirements for exporters

Letter template of cross-border shipment instructions for freight forwarders

Letter template of cross-border shipment best practices for manufacturers

Comments