When it comes to expressing gratitude for a charitable donation, crafting the perfect acknowledgment letter can make all the difference. It's essential to convey your appreciation genuinely while also highlighting the impact of their generosity. A well-written letter not only reinforces your relationship with the donor but also encourages future support for your cause. Want to learn more about how to create an effective donation acknowledgment letter? Keep reading!

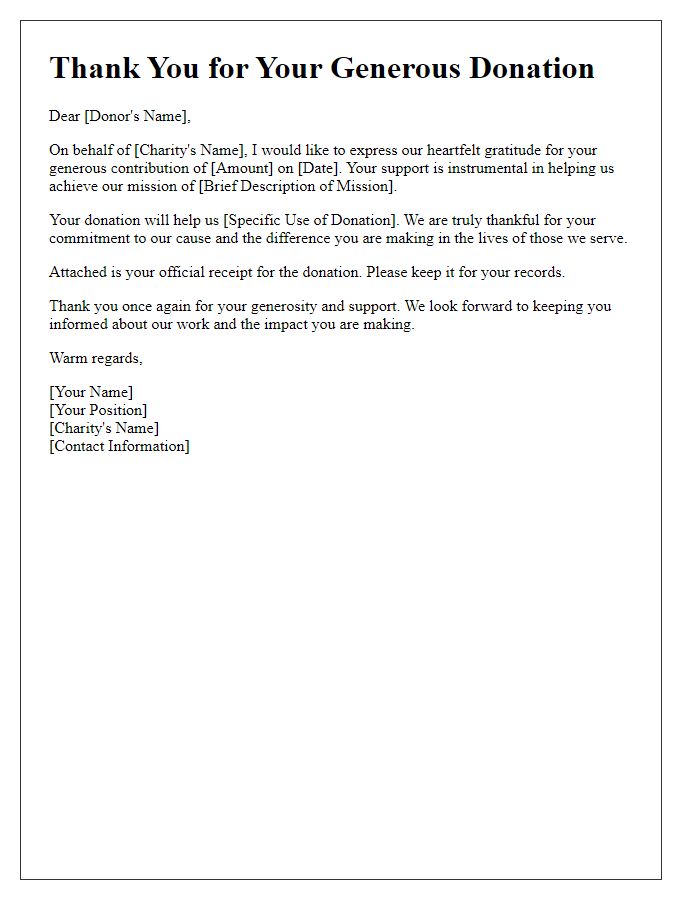

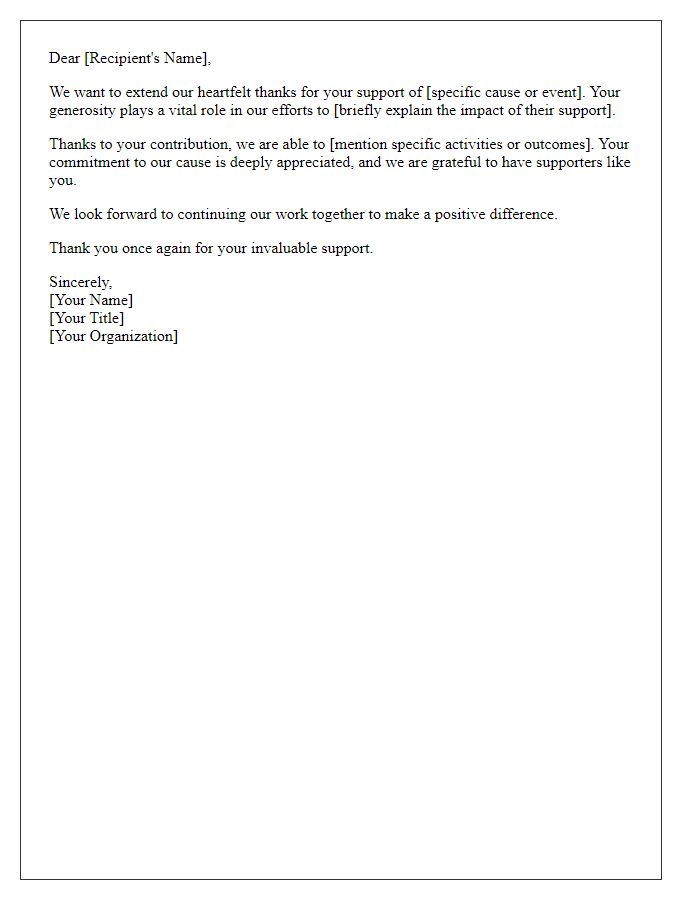

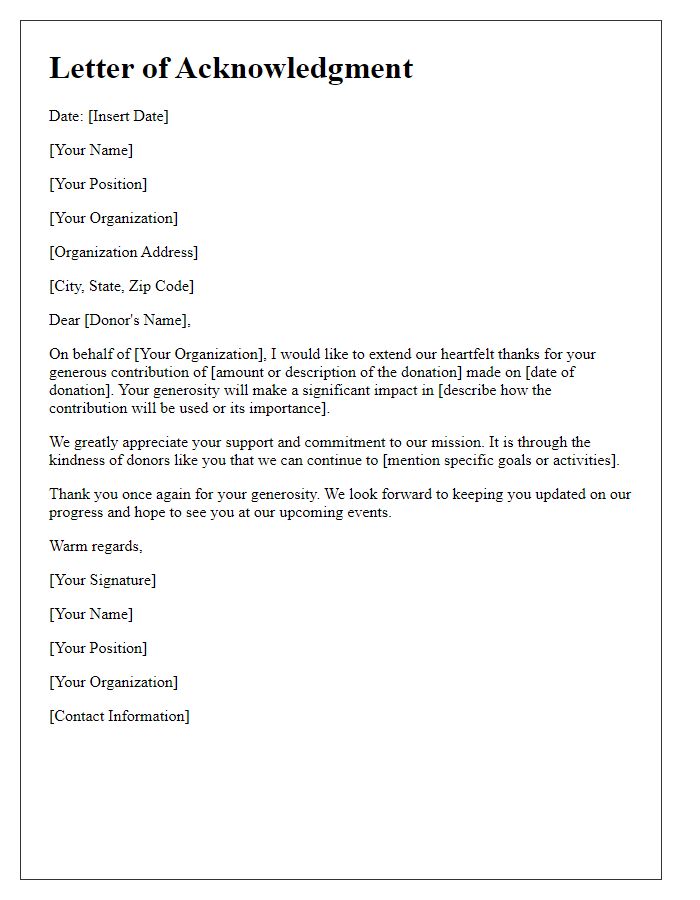

Donor's Name and Contact Information

Charitable donations play a crucial role in supporting nonprofit organizations and their missions. Recognition of donor contributions is essential for fostering ongoing relationships. Acknowledgment letters typically include the donor's name, personal contact information (address, email, phone number), and a heartfelt message of gratitude. Additional details may encompass the specific purpose of the donation, the date it was received, and any relevant tax information relating to charitable contributions. Establishing this connection can enhance donor engagement and encourage further support for community initiatives or specific projects.

Charity Organization's Name and Logo

Charitable donations play a crucial role in supporting nonprofit organizations that rely on community support to achieve their missions. For instance, contributions to organizations like Feeding America can provide meals to millions of hungry individuals across the United States. Acknowledgment letters for donations typically include essential details such as the donor's name, donation amount, and the date of the transaction, which is crucial for tax purposes. Additionally, organizations might highlight the specific programs funded by donations, such as educational scholarships or medical assistance initiatives, illustrating the direct impact that the donor's generosity has on those in need. Using the charity organization's branding, such as logos, reinforces its identity and fosters trust and transparency within the community.

Donation Details (amount, date, purpose)

The recent generous donation of $5,000 received on October 15, 2023, specifically designated for supporting educational initiatives at Springfield Community Center, plays a crucial role in enhancing learning opportunities for underprivileged children. This contribution will directly fund after-school programs, providing essential resources such as tutoring services, educational materials, and extracurricular activities. The impact of this donation is profound, as it helps bridge the educational gap and empowers local youth with skills needed for future success. The Springfield Community Center appreciates the commitment to fostering a brighter future through such charitable acts.

Expression of Gratitude and Impact Statement

A charitable donation can significantly impact community initiatives, as seen in organizations like Feeding America. A recent contribution of $5,000 facilitated the provision of over 25,000 meals to food-insecure families across the United States. This generous gift plays a crucial role in fighting hunger, demonstrating compassion and commitment to those in need. It empowers volunteers and staff members to implement programs effectively, reaching even more individuals facing challenges. Your support fuels our mission, fostering hope and strengthening communities. Every donation counts in transforming lives, making lasting change possible. Thank you for your commitment to creating a better tomorrow.

Tax Deductibility and Contact for Questions

Thanking donors for charitable contributions helps foster goodwill. Charitable organizations often send acknowledgment letters to certify the donation's value. This acknowledgment can assist in tax filing, confirming that the received amount is tax-deductible. In the United States, the IRS requires written confirmation for donations exceeding $250. The letter typically includes the charity's name, tax identification number, and a statement affirming that no goods or services were provided in exchange for the donation. Contact information should also be included for any inquiries regarding the donation or tax implications, ensuring donors feel supported and informed about their contribution's impact.

Comments