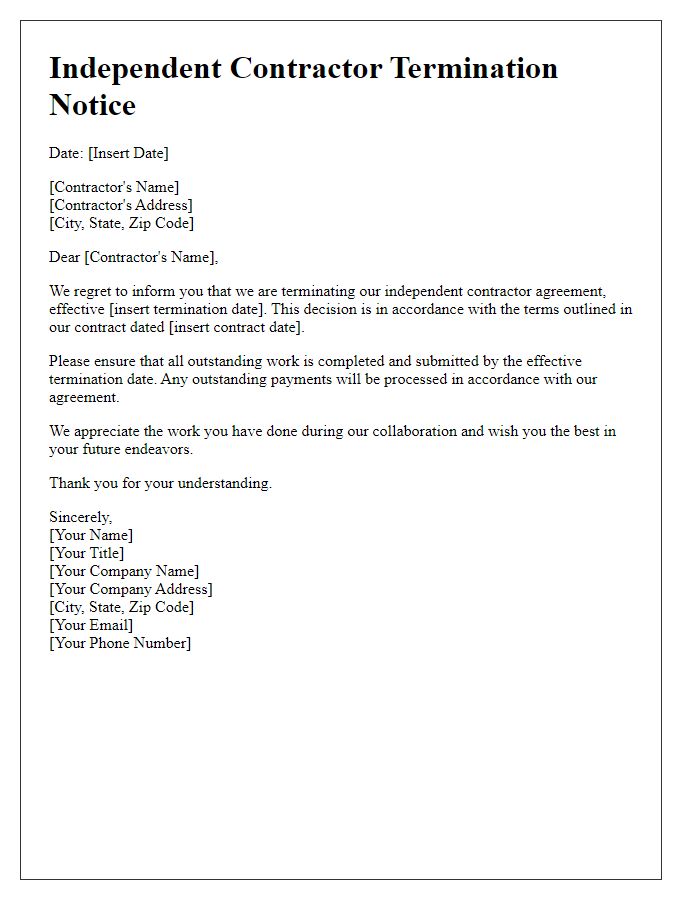

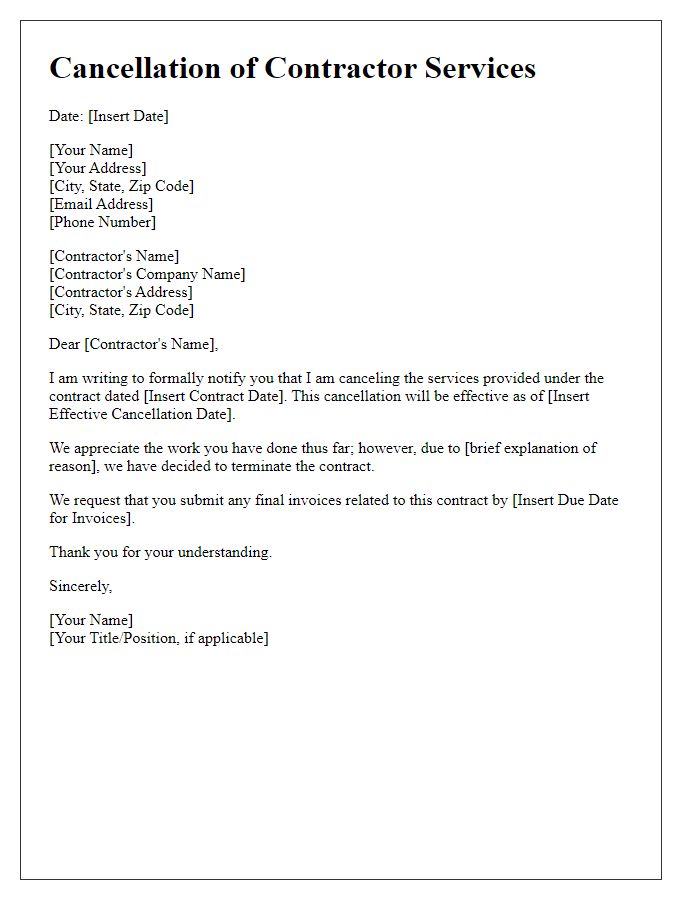

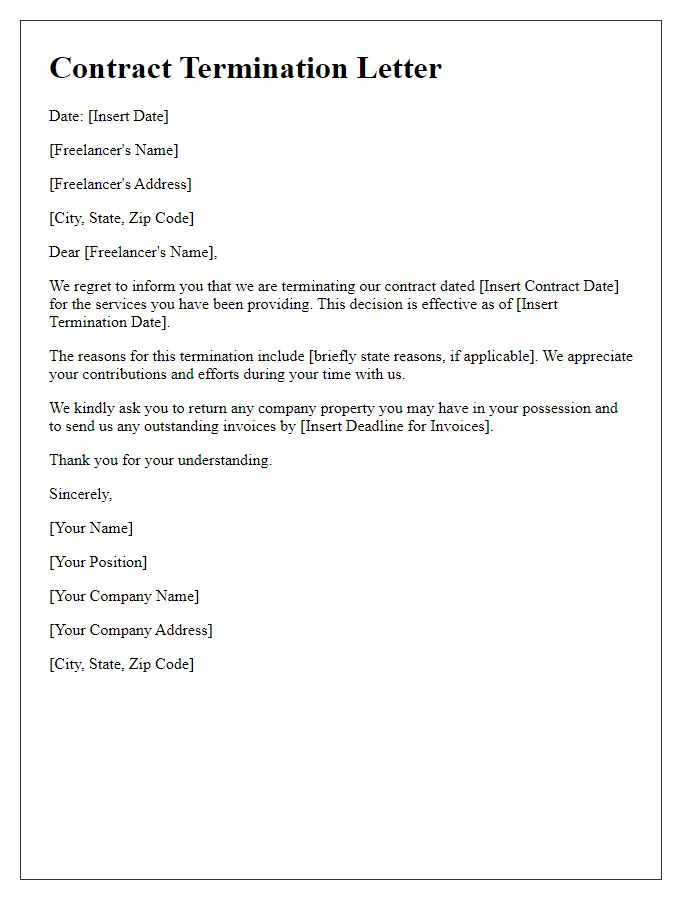

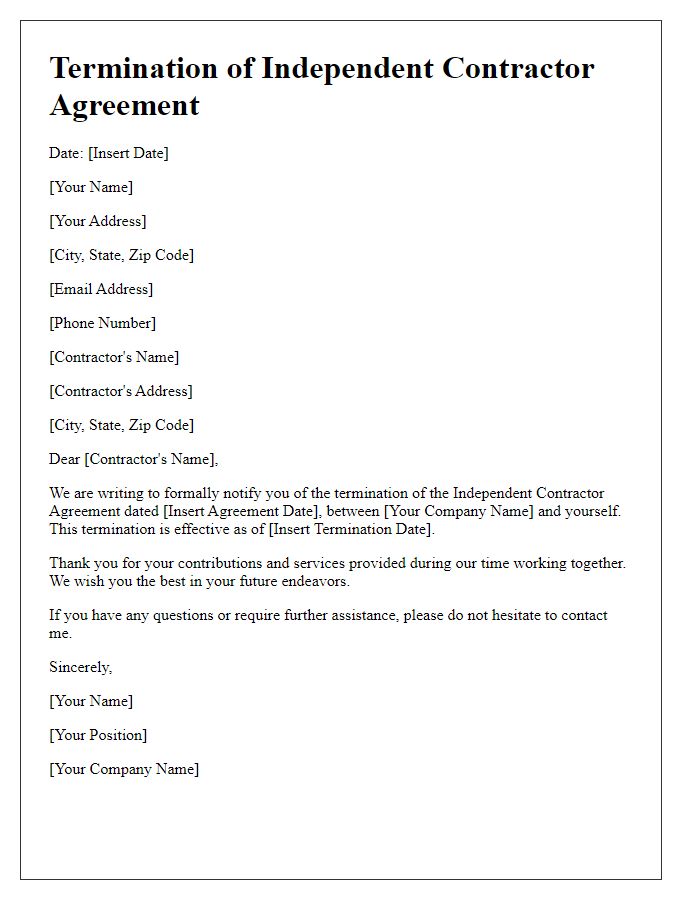

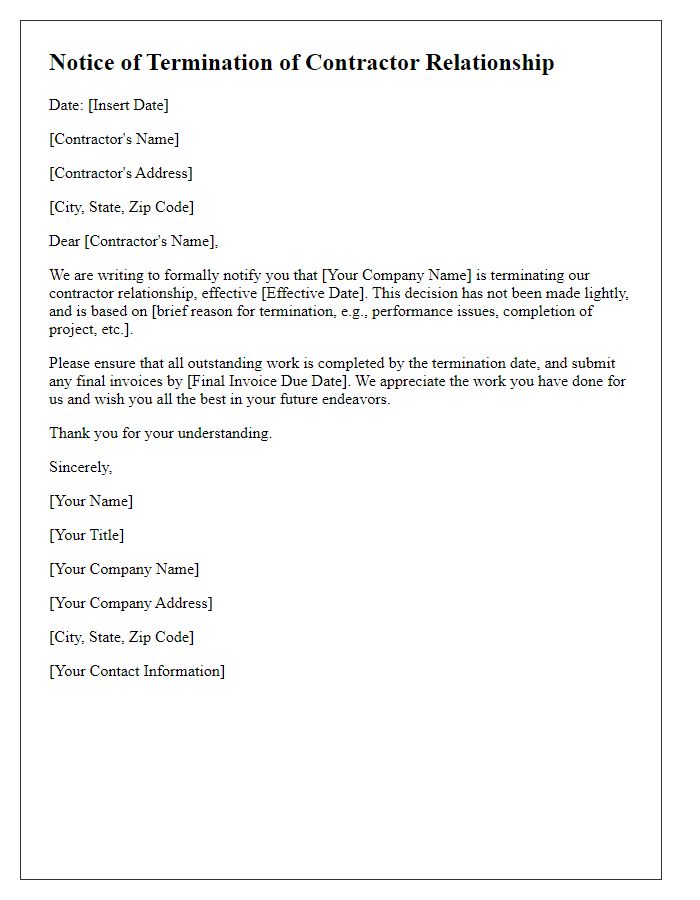

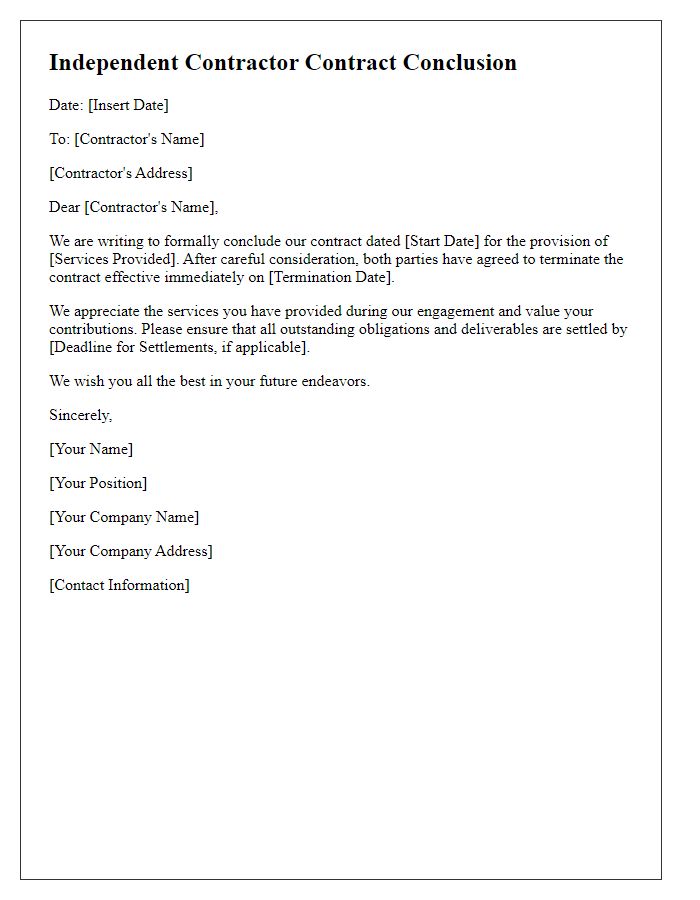

Are you facing the tough decision of terminating an independent contractor? It can certainly be a challenging situation, but having the right words can make the process smoother and more professional. In this article, we'll provide you with a letter template that ensures clarity and respect while outlining the necessary steps for this transition. So, if you want to learn how to communicate effectively during this difficult time, read on!

**Clear Identification**: Contractor's full name and business name.

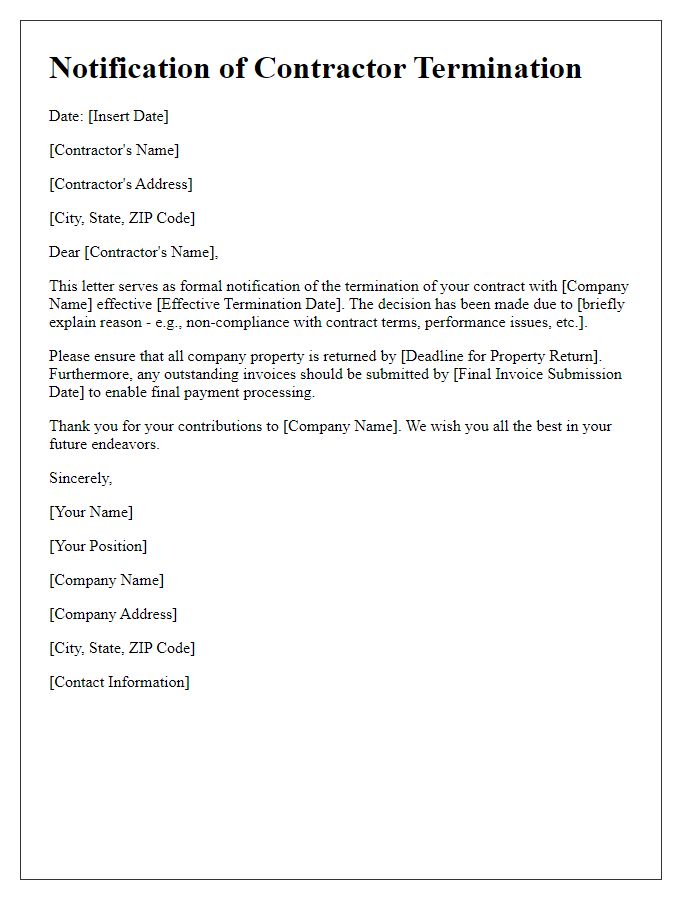

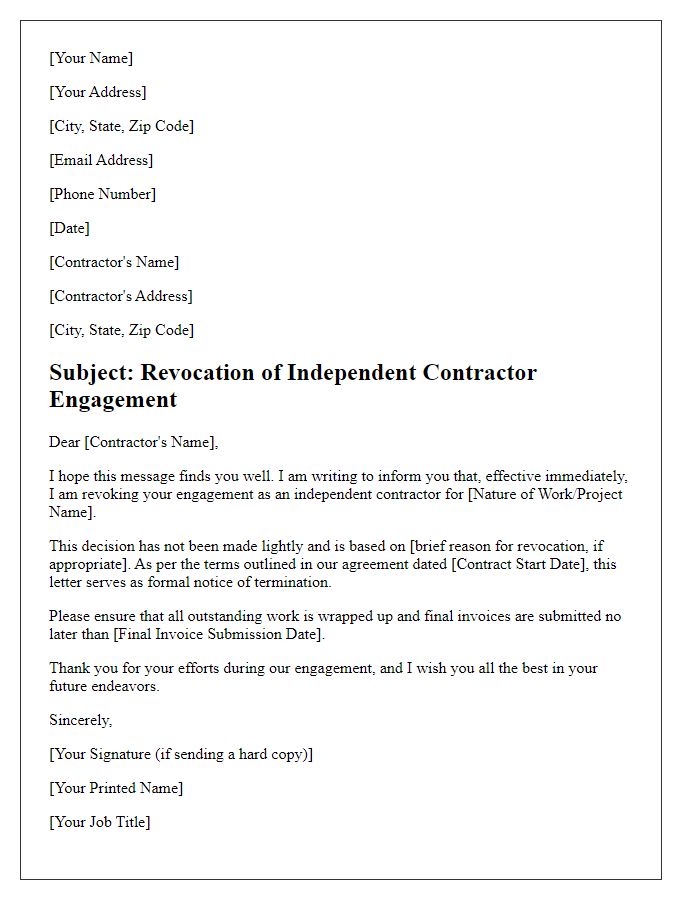

Clear identification of the independent contractor is crucial for effective termination communication. The contractor's full name, such as "John Doe," alongside their registered business name, like "Doe Consulting Services," should be explicitly stated. This ensures unmistakable recognition of the individual and their associated business entity. Additionally, including relevant information such as the contract start date (e.g., January 1, 2022) and the specific project or services provided can provide context for the termination. Accurate identification minimizes confusion and establishes a formal record of the termination proceedings.

**Termination Date**: Specific end date of the contract.

The termination of the independent contractor agreement will be effective as of **March 31, 2023**, marking the conclusion of all contractual obligations between the parties involved. Upon this date, the contractor is required to finalize all ongoing projects associated with the agreement and submit any outstanding invoices for services rendered prior to termination. The company will ensure that all payments due are processed promptly, adhering to the agreed-upon payment terms established in the initial contract. Documentation related to any previous work completed should also be returned to the company by the termination date to ensure a smooth transition and closure of the professional relationship.

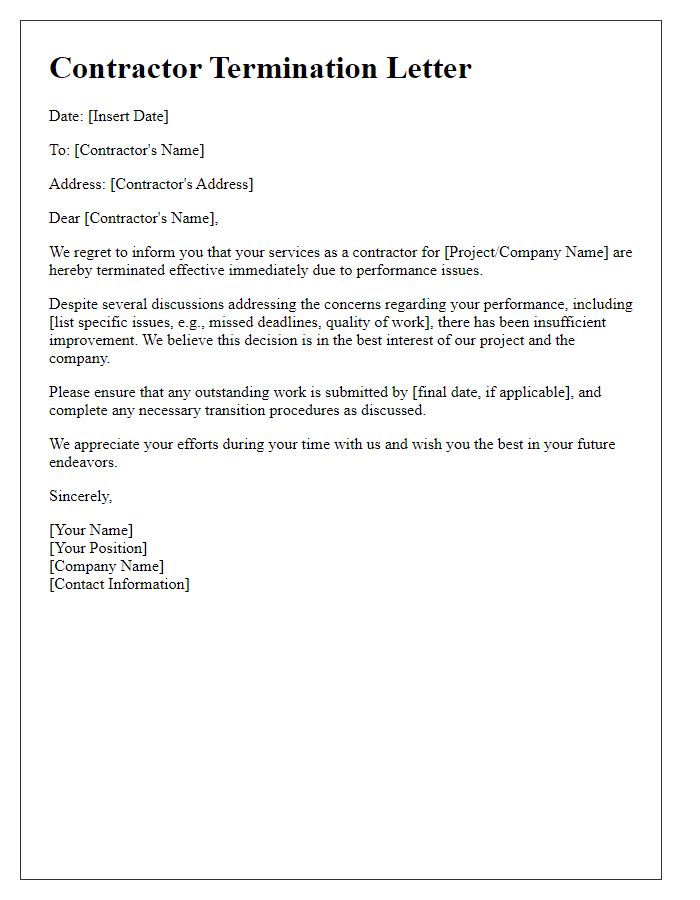

**Reason for Termination**: Brief explanation or clause invoked.

Inadequate performance from the independent contractor has necessitated the termination of the contractual agreement. Despite multiple attempts to rectify issues regarding project deliverables, quality standards remain consistently unsatisfactory. Clear expectations and deadlines, outlined in the initial contract dated January 15, 2023, have not been met over the course of the past three months. Communication failures have led to increased project delays, ultimately impacting overall project timelines and associated costs. As of October 30, 2023, the decision to terminate this agreement is in accordance with Clause 8 of the contract, which pertains to unsatisfactory service and performance.

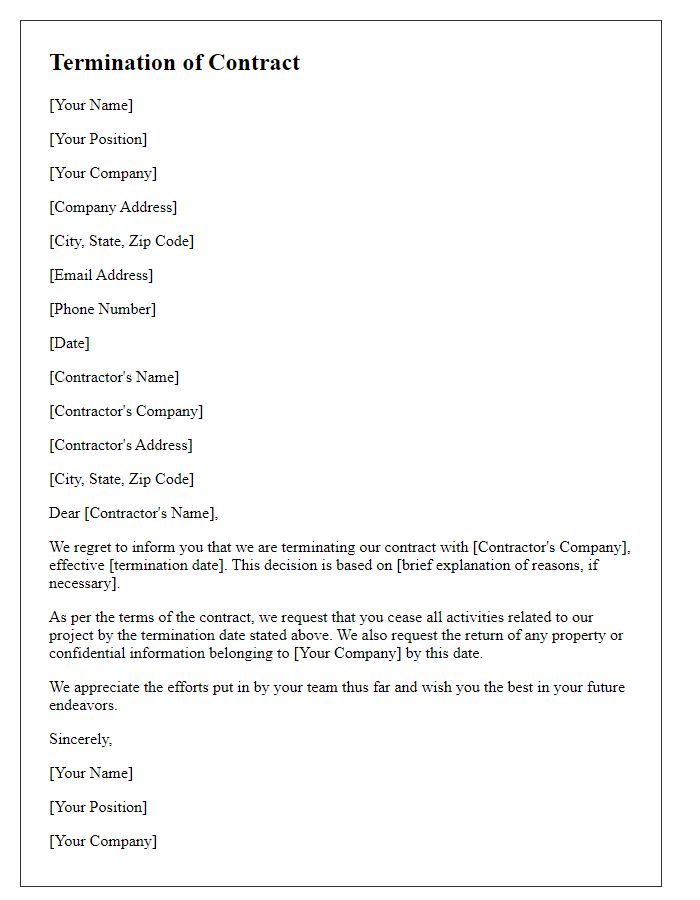

**Final Payment Details**: Outstanding payments and settlement terms.

Final payment details for independent contractors involve a comprehensive review of outstanding payments and defined settlement terms. Outstanding payments may include unpaid invoices, travel reimbursements, and any additional fees for completed tasks. An example of an unpaid invoice might be Invoice #105 from July 2023, amounting to $1,500 for consulting services rendered over a two-week period. Settlement terms should clearly state the timeline for the final payment, such as payment being issued within 30 days from the termination date, along with a breakdown of any deductions or holds related to unreturned equipment or incomplete work. It is crucial to provide contractors with a final statement that outlines all financial obligations to ensure transparency and closure on the contract.

**Return of Company Property**: Requirement for return of any assets or equipment.

Upon termination of the independent contractor agreement, the individual must return all company property, which includes items like laptops (often issued by the employer for work purposes), mobile devices (such as smartphones that may contain sensitive information), and access credentials (such as keys or keycards for company premises). Additionally, any proprietary information (including trade secrets, confidential documents, and project-related materials) must be returned in its entirety. This requirement ensures the protection of company assets and intellectual property, particularly in industries where competitive advantage relies heavily on proprietary knowledge. The return of such property must occur within a specified timeframe, frequently outlined as five business days from the termination date, to facilitate a smooth transition and maintain compliance with company policies.

Comments