Navigating the difficult waters of employment termination can be challenging, especially in the retail industry where personal connections are often strong. Whether you're facing the decision for operational reasons or performance issues, it's essential to approach the situation with clarity and compassion. Termination letters should not only convey the necessary information but also maintain a level of respect for the employee's contributions. Ready to dive deeper into how to craft the perfect termination letter? Keep reading!

Employee's name and contact information

A retail employment termination involves multiple critical aspects of the employment relationship. The employee's name, prominently displayed at the top, identifies the individual affected, followed by the contact information, which may include an address, phone number, and email address, facilitating communication regarding the termination process. The termination letter itself should encompass essential details, such as the last working day, reasons for termination, and any company policies regarding the return of uniforms or equipment. Specific attention is required to ensure compliance with local labor laws, which often mandate notice periods or severance pay depending on tenure and circumstances surrounding the termination. This documentation serves not only as a formal notification but also as a legal record of the employment cessation, safeguarding both employer and employee interests.

Employer's name and contact information

Retail employment termination can occur due to various reasons, including policy violations or economic downturns that affect staffing. Proper documentation, including the employer's name and contact information, is essential for clarity. Including specific details about employee performance, tenure, and the rationale for termination can help to establish a comprehensive overview, ensuring that the information is well understood. Furthermore, following the appropriate legal guidelines during the termination process can provide protection for both the employer and the employee.

Date of termination notice

Retail employment termination involves several key elements. First, the termination notice should clearly state the **date of notice** (e.g., October 25, 2023), allowing employees to recognize the effective date of their separation. Next, outline the **reasons for termination**--common scenarios include performance issues, company downsizing, or policy violations. Additionally, include information regarding the final paycheck, addressing any accrued vacation days or severance pay. Specify the procedure for returning company property, such as uniforms and identification badges. Lastly, provide details on benefits cessation, including health insurance timelines and retirement options, ensuring that all pertinent information is accessible for employees moving forward.

Reason for termination

Retail employment termination often occurs due to various reasons, such as consistent poor performance, attendance issues, or violations of store policies. For instance, if an employee fails to meet sales targets over a period of three consecutive months, this can result in a review leading to termination. Additionally, repeated lateness or absences amounting to more than five unexcused days within a quarter can also warrant dismissal. Furthermore, breaches of conduct, such as theft or harassment, are serious violations that typically lead to immediate termination as mandated by company policy. Each of these factors plays a crucial role in maintaining a productive and respectful retail environment.

Final paycheck and benefits details

The retail employment termination process entails several key components to ensure compliance with labor laws and company policies. Final paycheck issuance must occur within the legally mandated timeframe, typically within one to two pay periods following termination, based on state regulations. This paycheck should include compensation for all hours worked, accrued vacation pay, and any applicable bonuses. Benefits details require attention to the continuation of health insurance under the Consolidated Omnibus Budget Reconciliation Act (COBRA), which allows employees to maintain coverage for up to 18 months at their own expense. Employees should receive a summary of their rights and responsibilities regarding benefits and access to retirement plans, such as 401(k) accounts, which may involve options for withdrawal or rollover. Proper documentation and communication ensure a smooth transition and adherence to all legal requirements.

Letter Template For Retail Employment Termination Samples

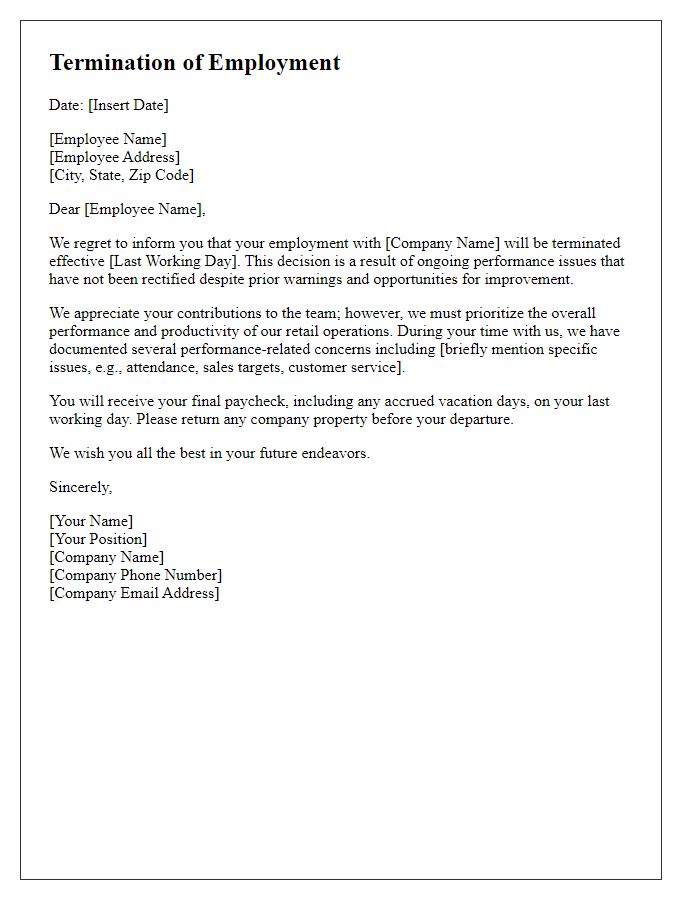

Letter template of retail employment termination due to performance issues.

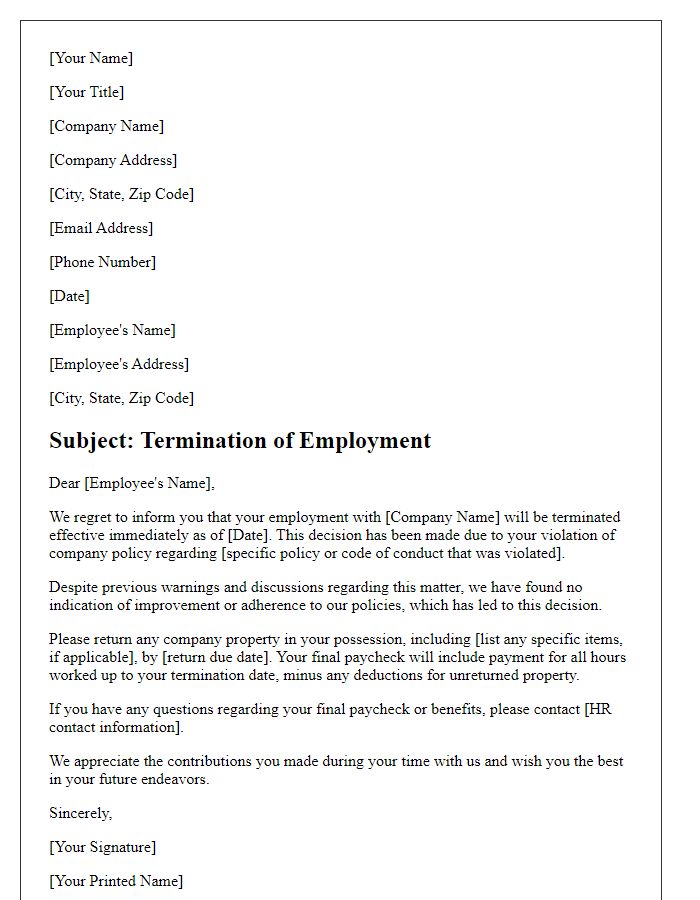

Letter template of retail employment termination for violation of company policy.

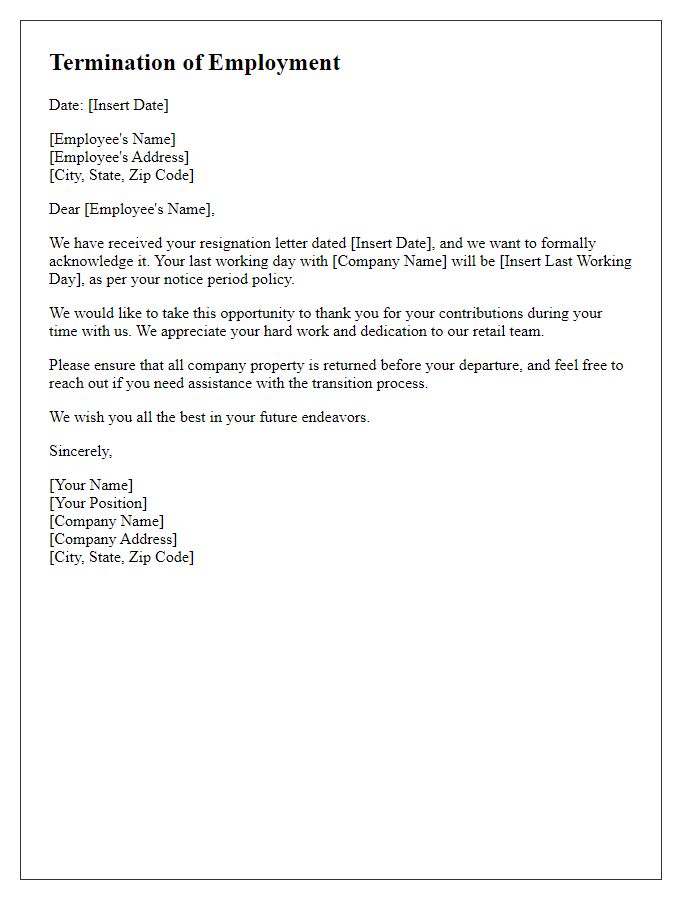

Letter template of retail employment termination in response to resignation.

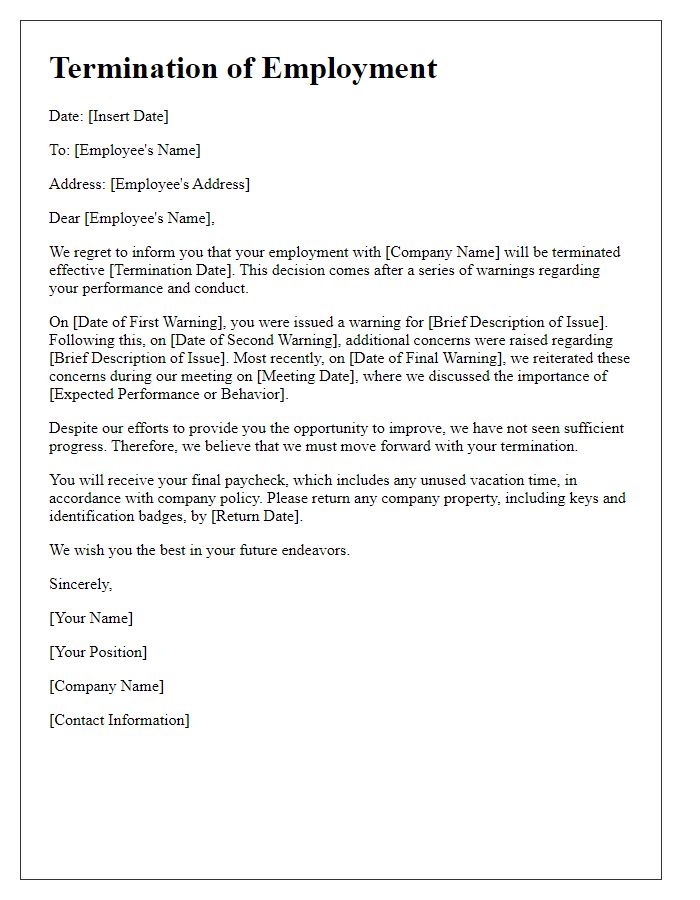

Letter template of retail employment termination following a series of warnings.

Letter template of retail employment termination due to chronic absenteeism.

Letter template of retail employment termination due to theft or dishonesty.

Letter template of retail employment termination for unsatisfactory sales performance.

Comments