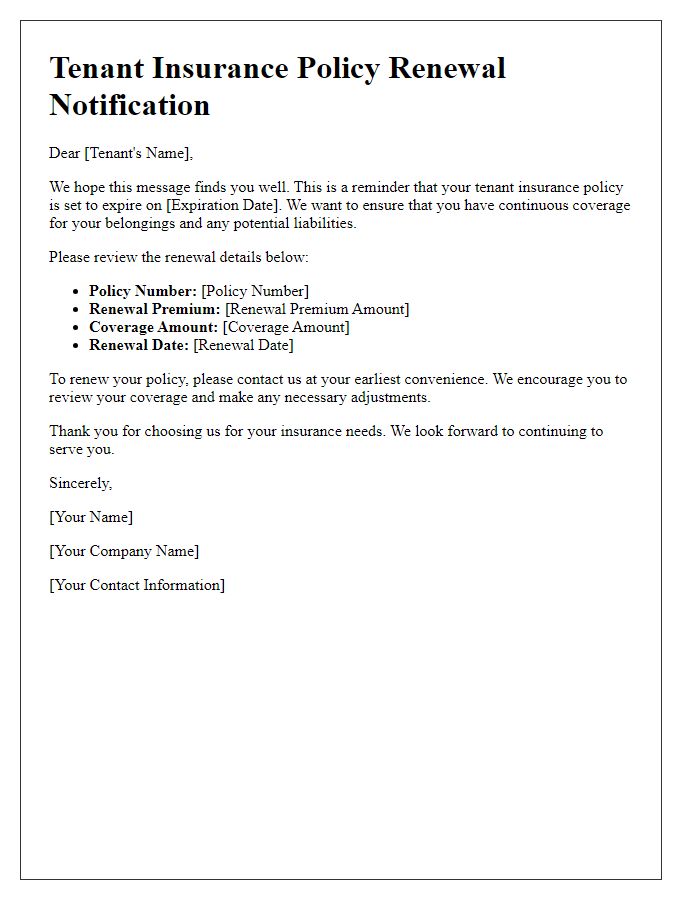

Hey there! If you're a tenant looking to stay protected, updating your insurance policy is a smart move. Knowing what coverage you need can save you a lot of hassle in the long run. Curious about the ins and outs of tenant insurance updates? Dive into our article to learn more!

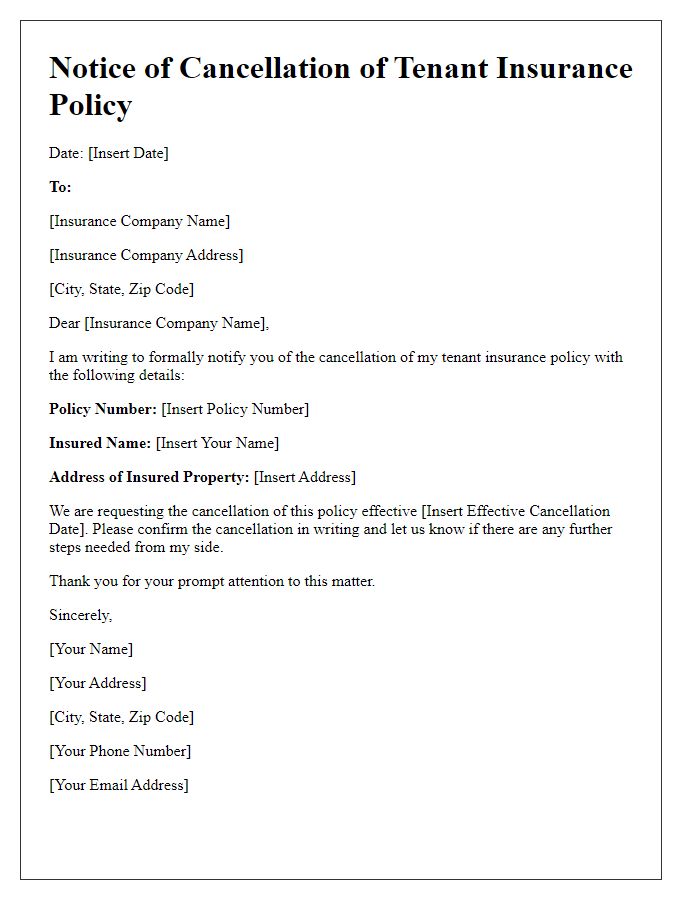

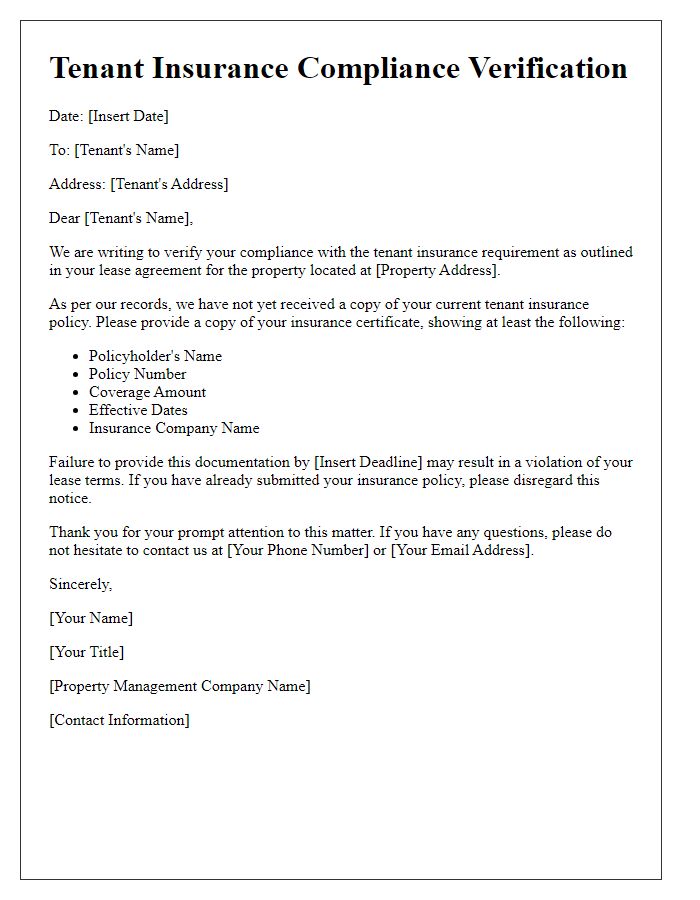

Policy Number and Customer Information

Tenant insurance policies protect renters from financial loss due to theft, damage, or liability. Key details include the policy number, a unique identifier assigned by the insurance company, and customer information, which comprises the renter's name, contact information, and address of the insured property, often a specific apartment number within a larger building. Regular updates to this information ensure coverage remains valid and tailored to the tenant's current circumstances, safeguarding personal belongings and mitigating potential legal responsibilities. Staying informed about policy adjustments can maximize protection and assist landlords in compliance with lease agreements.

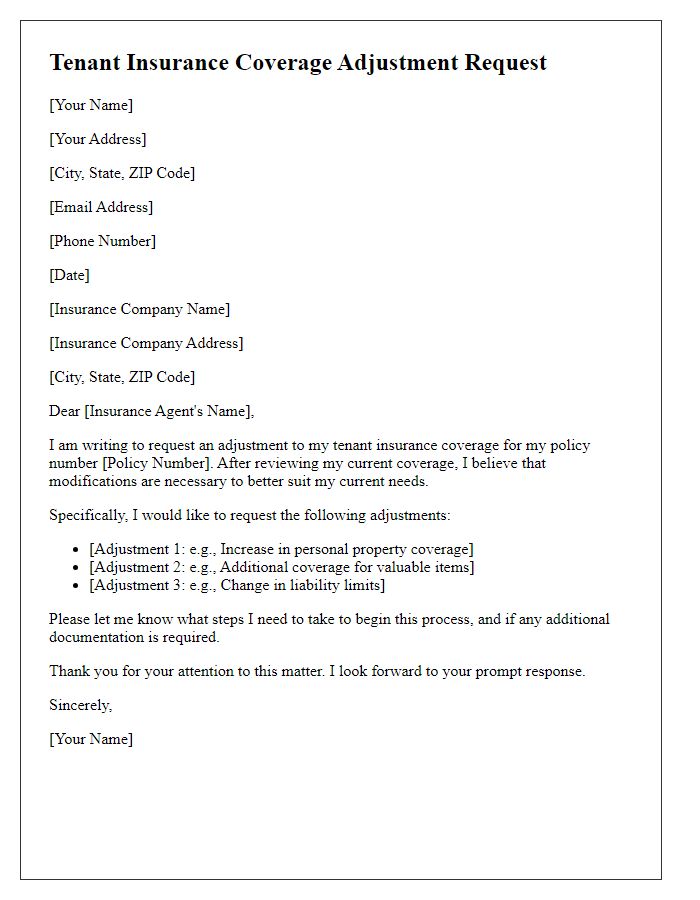

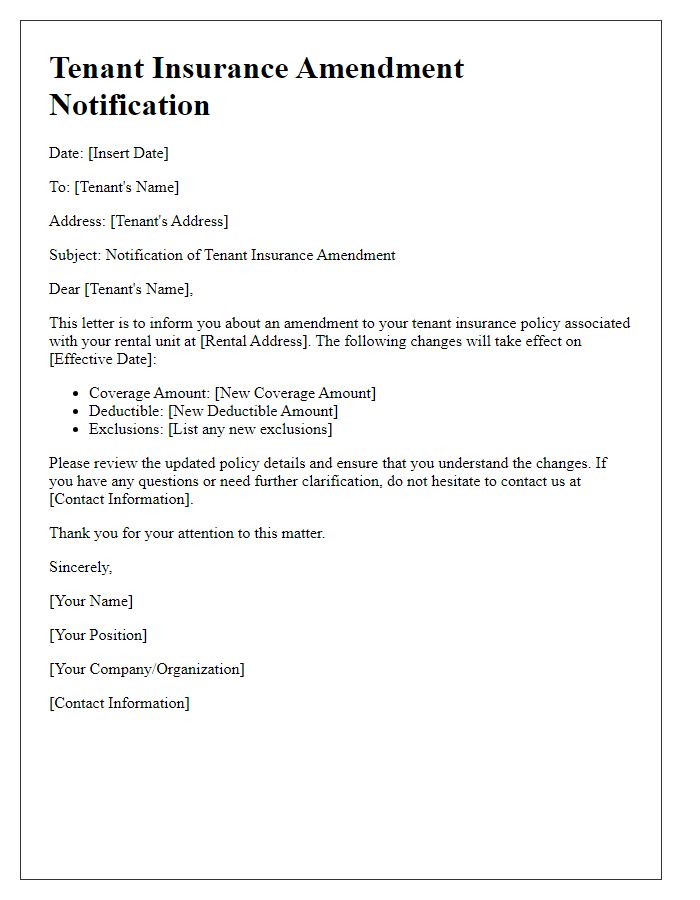

Coverage Changes and Updates

Tenant insurance policies can undergo significant changes, affecting coverage scope and terms. In 2023, policies may adjust liability limits, often raising them to $300,000 or more, to accommodate rising costs associated with potential claims. Additional coverage for personal property, specifically against theft or damage due to fire, may increase based on local crime rates, with urban areas facing higher premiums. Policyholders should pay attention to changes in exclusions, particularly regarding natural disasters, which could vary by region. Renters in locations prone to events like hurricanes or floods (e.g., Florida, Texas) might find specific endorsements necessary to maintain adequate protection. Understanding these alterations ensures proper coverage and peace of mind for tenants.

Effective Date of Changes

Tenant insurance policies offer essential coverage for personal belongings, liability, and additional living expenses in case of unexpected events such as theft, fire, or water damage. The effective date of changes to such a policy, which can range from a simple adjustment to coverage limits or the addition of new personal property, typically occurs after the policyholder completes an update request. For many insurers, the effective date may align with the policy renewal date, often occurring annually, or it may be scheduled immediately based on the insurer's policy guidelines. Ensuring that all affected parties receive timely notifications regarding these changes is crucial for maintaining adequate coverage and understanding new terms. This also protects the policyholder from lapses in essential protection, especially in high-risk environments like urban apartments or older buildings.

Premium Adjustments and Payment Details

Tenant insurance policies can vary in cost due to several factors. Premium adjustments often occur annually or when there are changes in coverage. Policyholders might experience increases or decreases based on claims history, property location such as urban versus rural settings, and risk assessments. Payment details typically include options like monthly, quarterly, or annual premiums, with varying payment methods including credit cards, electronic funds transfers, or checks. Being aware of these adjustments ensures adequate coverage and financial preparedness. It's important to review policy documents regularly to stay informed about any potential changes affecting premium rates and payment schedules.

Contact Information for Questions or Clarifications

Tenant insurance policies protect renters from personal property loss and liability claims. When updating a tenant insurance policy, including details such as policy number, coverage amount, and specific items insured is crucial. Contact information for questions or clarifications should be clear, including phone numbers (such as 1-800-555-0199) and email addresses (like support@insurancecompany.com) for the customer service department. Additionally, specifying office hours (for example, Monday through Friday, 9 AM to 5 PM EST) can help tenants reach support easily. Providing a physical address (like 123 Insurance Lane, Suite 101, Cityville, ST 12345) can also ensure that policyholders can send necessary documentation or inquiries through traditional mail if preferred.

Comments