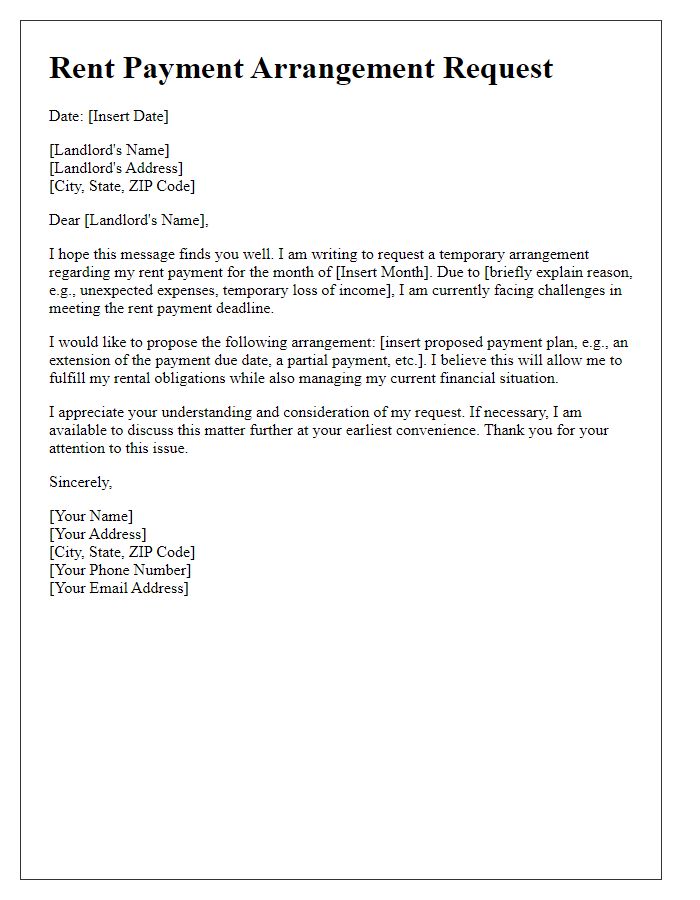

Are you struggling to keep up with rent payments? You're not alone, and this letter template can help you communicate effectively with your landlord about establishing a manageable rent payment plan. It's essential to be clear and considerate in your approach, ensuring both parties understand the situation. So, if you're ready to take the first step towards financial stability, keep reading to discover a simple yet effective way to draft your request.

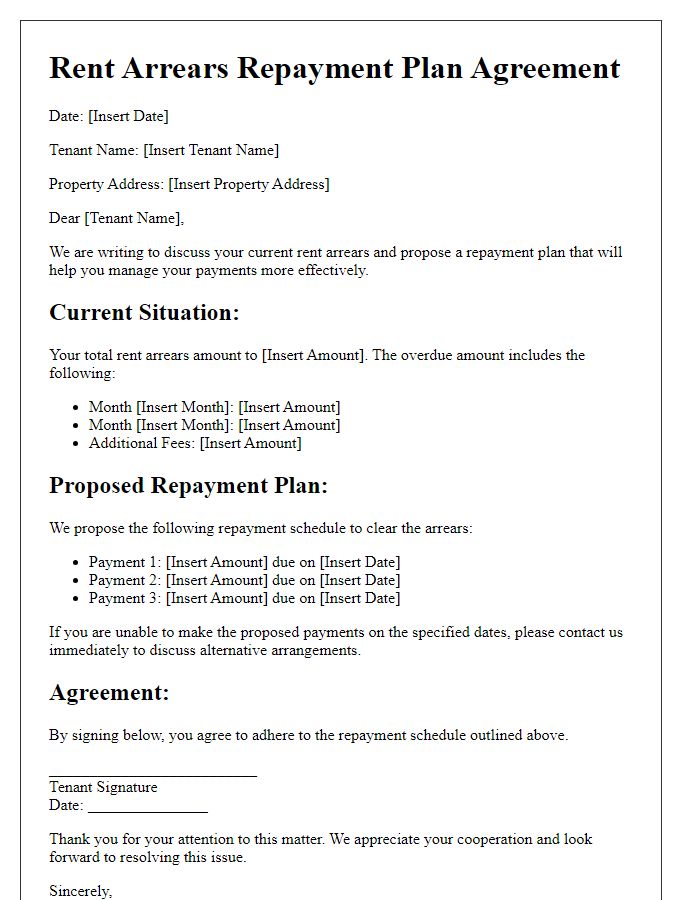

Personal Information: Tenant and Landlord details.

A tenant rent payment plan outlines a structured agreement between a tenant and landlord regarding the payment of rent, particularly in situations involving financial difficulties. Key elements include the tenant's personal information, such as full name, contact details, and rental property address. The landlord's information must include their name, company or entity (if applicable), and contact information. Specific details regarding the rent amount due, the proposed payment schedule, and any agreed-upon modifications or grace periods are critical. Additionally, the plan can encompass clauses addressing potential late fees, methods of payment (e.g., bank transfer, check), and acknowledgment of the agreement by both parties through signatures and dates. This documentation serves to protect both the tenant's and landlord's rights while fostering clear communication and expectations.

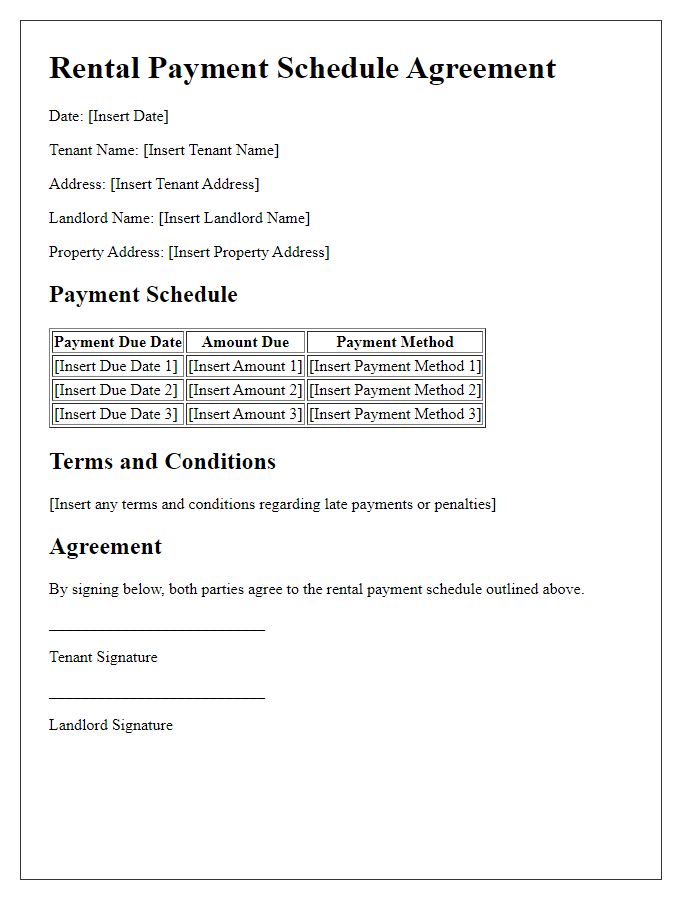

Property Details: Address and lease specifics.

Property located at 123 Maple Street, Springfield, under a lease agreement for a one-year term beginning January 1, 2023, with a monthly rent of $1,200. The property features a 2-bedroom layout covering 1,000 square feet, equipped with modern amenities, including stainless steel appliances and central heating. The lease includes clauses pertaining to late fees, payment methods, and property maintenance responsibilities. Tenants are expected to adhere to rental payment deadlines established within the lease, with considerations made for unforeseen circumstances that may necessitate a rent payment plan adjustment.

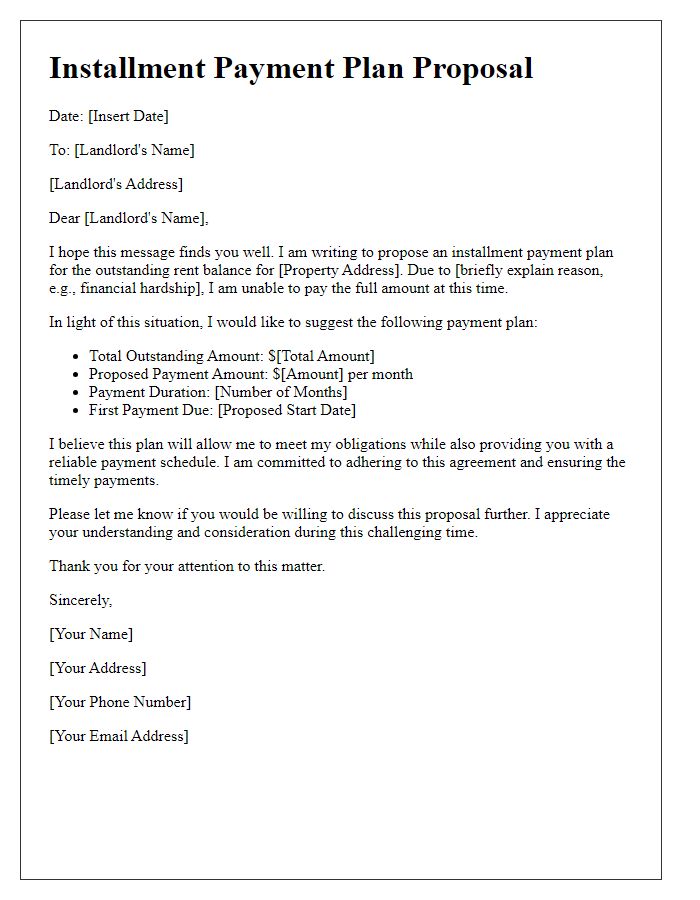

Proposed Payment Plan: Amounts and due dates.

A structured rent payment plan is crucial for maintaining financial stability, especially for tenants facing difficulties. This plan outlines specific amounts to be paid, along with their corresponding due dates. For instance, a tenant may propose a total outstanding rent of $1,500, to be divided into three installments of $500 each. The first installment could be due on the 1st of the upcoming month, the second on the 15th, and the final payment by the end of that month. Important to note, clarity in the agreement can help improve communication between landlords and tenants, facilitating smoother transactions. Additionally, establishing a mutual agreement can build trust and allow for flexibility in times of hardship.

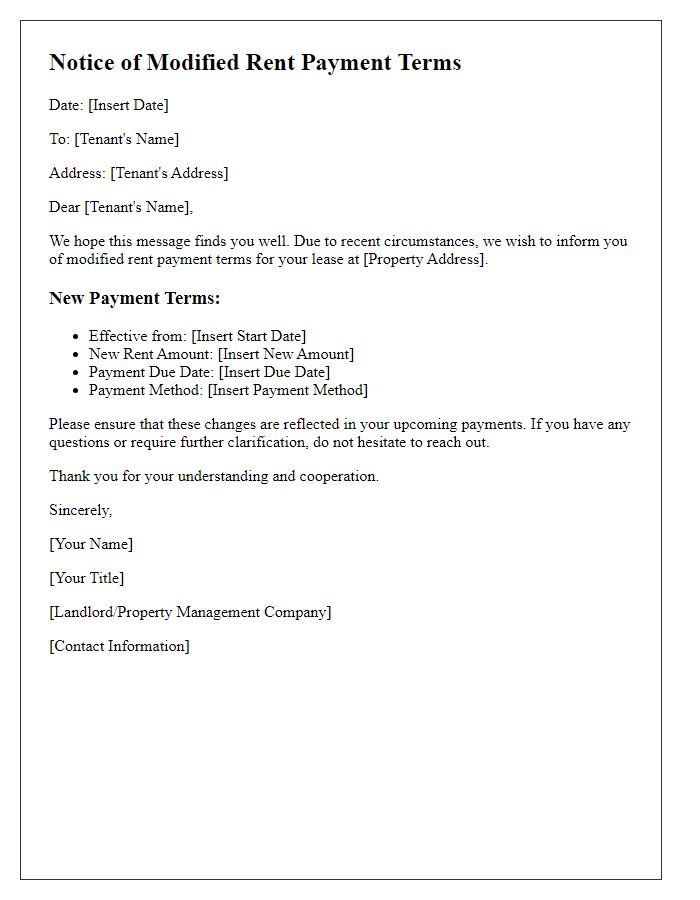

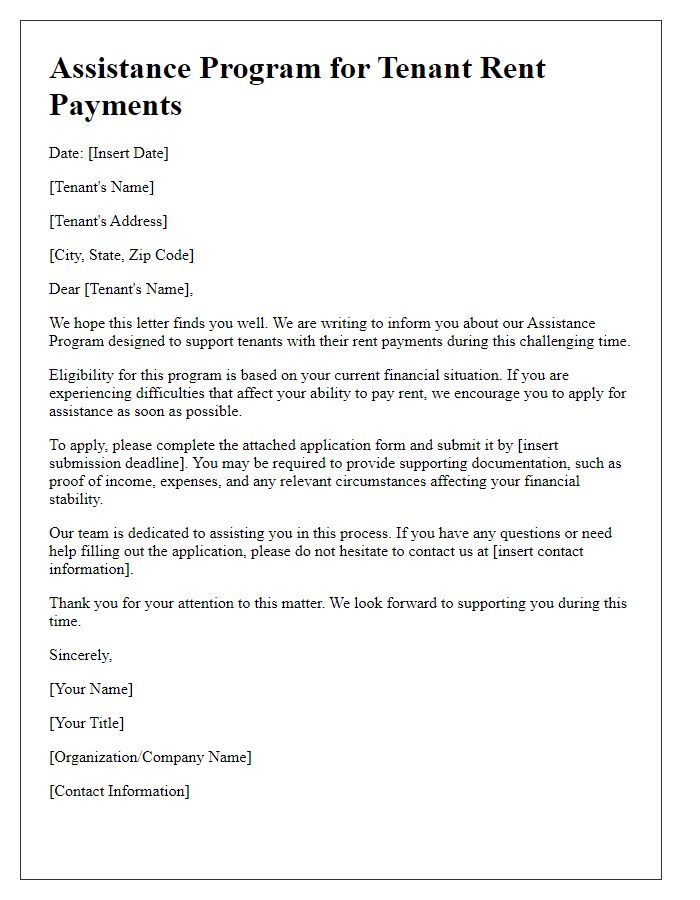

Justification: Reasons for adjustment, financial constraints.

A rent payment plan can provide tenants facing financial constraints the opportunity to manage their obligations effectively. Many tenants experience unexpected circumstances such as job loss, reduced working hours, or medical emergencies that strain their budgets. Additionally, the economic climate can impact rental markets, making it challenging for individuals to meet standard payment schedules. Implementing a payment plan may involve breaking down monthly rent into more manageable, bi-weekly or weekly installments, helping tenants avoid late fees and potential eviction. Such arrangements can promote financial stability for tenants residing in cities with high rent costs, like New York or San Francisco, where housing affordability remains a significant challenge.

Agreement Terms: Conditions, signatures, and validation.

A tenant rent payment plan outlines specific agreement terms between landlords and tenants regarding rental payments, ensuring clarity and accountability. Key details include payment amounts, due dates, and any penalties for late payments, fostering a mutual understanding of responsibilities. Each party's signature is essential for validating the agreement, emphasizing their commitment to the terms outlined. Validation may require notary services or witness signatures, enhancing the document's legitimacy and enforceability. Clear communication throughout this process helps maintain a positive landlord-tenant relationship while addressing financial challenges.

Comments