Have you ever checked your bank statement only to find an unexpected charge that makes your heart race? Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. In this article, we'll guide you through a simple letter template to help you tackle those pesky discrepancies with confidence. So, let's dive in and get you back on track to reclaiming your hard-earned money!

Account Details and Transaction Information

Unauthorized charges on bank statements can cause significant distress for account holders, particularly when transactions appear fraudulent. Account details must include the specific account number, typically a 10 to 16 digit code associated with the banking institution, revealing the relevant financial entity. Transaction information should detail the date of the transaction, ideally within the last 60 days, the merchant's name, and the disputed amount, which could range from small purchases under 50 dollars to significant sums exceeding 1000 dollars. Documentation may also reference a specific reference number provided by the bank for robust tracking during the dispute resolution process. Such disputes are often first reported to the financial institution's customer service, which may prompt an investigation into potential fraud or clerical errors.

Description and Evidence of Unauthorized Charge

Unauthorized charges on credit card statements can lead to significant financial stress for consumers. For instance, a case involving a $150 charge from an unknown online retailer can raise red flags, especially if the account holder has no recollection of any transaction on platforms like eBay or Amazon. Essential details such as transaction dates (e.g., October 5, 2023) and locations tied to fraudulent activity can provide context for the dispute. Supporting evidence might include screenshots of account statements showing the charge, an email record of communication with the credit card issuer, and any relevant identification details relating to the unauthorized transaction. Prompt reporting of such discrepancies is crucial, ensuring protection under the Fair Credit Billing Act, allowing for the investigation and potential reversal of misleading charges.

Request for Investigation and Resolution

Unauthorized charges can lead to financial stress for consumers, often involving credit card accounts like Visa or MasterCard. A federal law, the Fair Credit Billing Act, offers protections against such charges. Filing a dispute typically requires documenting the transaction details, including the transaction amount, date, merchant information, and any previous communications with the card issuer. Many financial institutions also provide specific forms or online portals for initiating disputes. Timely reporting is crucial, often within 60 days from the statement date showing the charge, to maximize protection. An investigation by the card issuer may take up to two billing cycles, giving consumers a temporary reprieve from payment obligations during this period.

Contact Information for Follow-up

Unauthorized charges on credit cards can cause significant distress for consumers. Many individuals, including those with accounts at major banks like Chase or Bank of America, have reported fraudulent transactions that range from small amounts to several hundred dollars. It's crucial for consumers to document transaction dates, amounts, and merchant names involved for effective dispute resolution. The Federal Trade Commission (FTC) emphasizes the importance of notifying the bank or credit card issuer within 60 days of the statement date to secure protections under the Fair Credit Billing Act. Furthermore, keeping a record of all communications (dates, times, and representatives contacted) can streamline the follow-up process with financial institutions.

Polite Closing and Signature

Unauthorized charges on credit card statements can lead to significant financial distress for consumers. A consumer might notice a suspicious transaction listed under a retailer, such as 'XYZ Online Shopping,' which appears to be a luxury goods store. Charges exceeding $200 can raise red flags, prompting a dispute resolution process. Cardholders should promptly contact their financial institution, such as Bank of America or Chase, to initiate the dispute. Efficient resolution may involve providing evidence such as transaction details and personal identification. Understanding consumer rights under the Fair Credit Billing Act can also empower individuals to resolve such issues effectively.

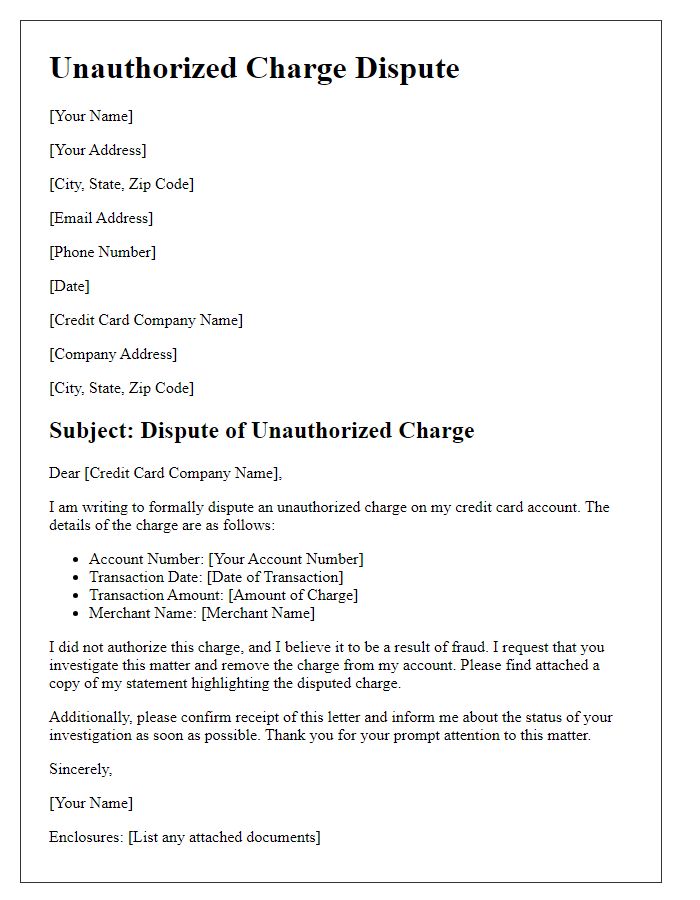

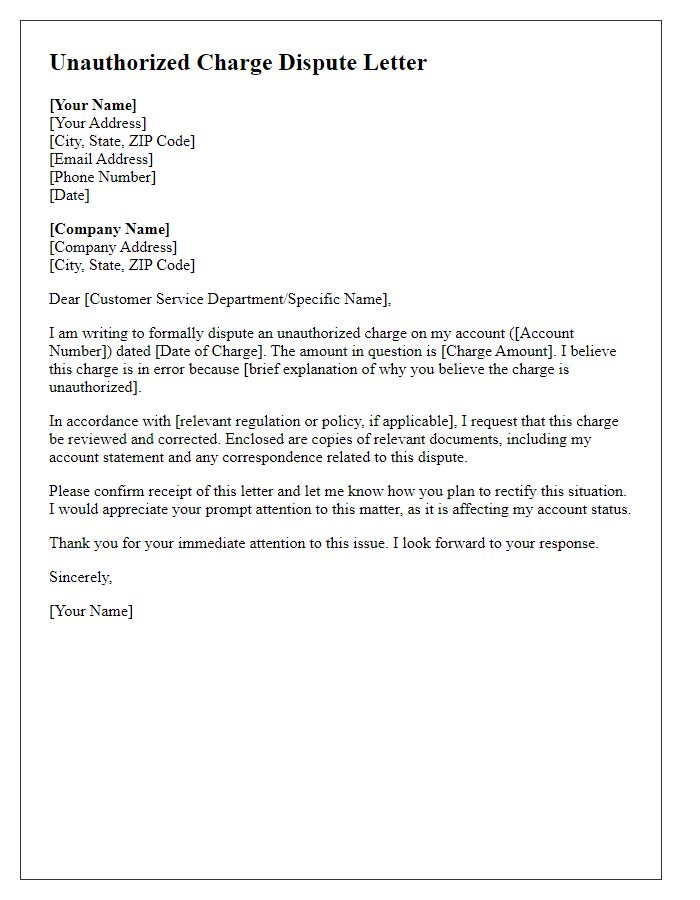

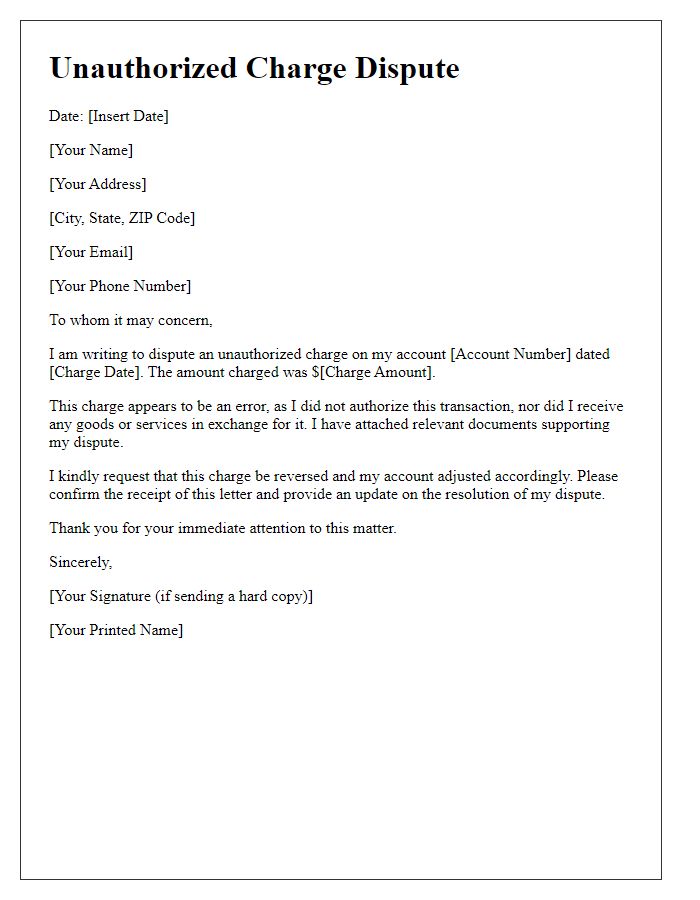

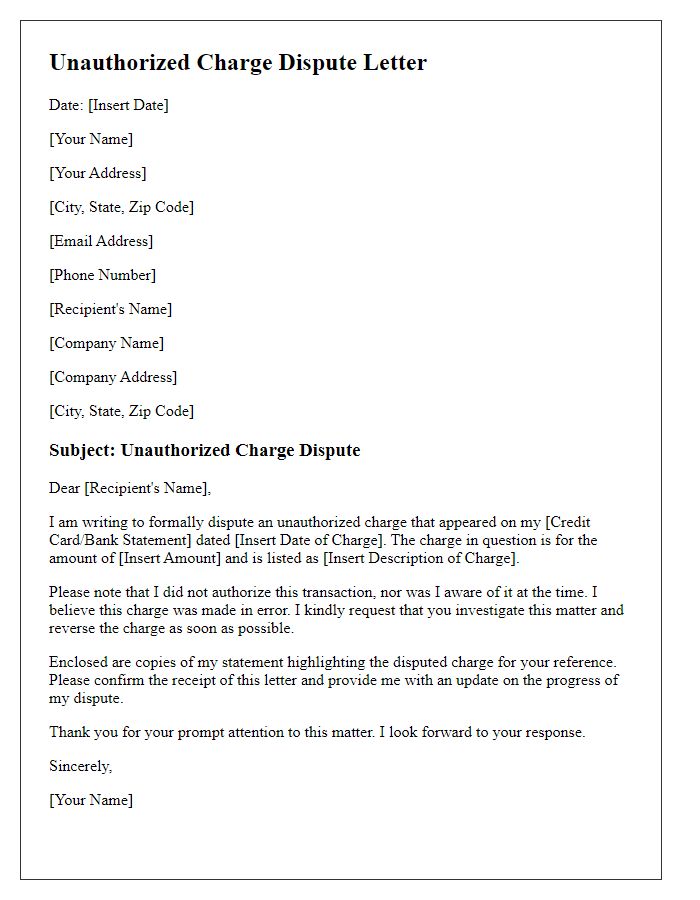

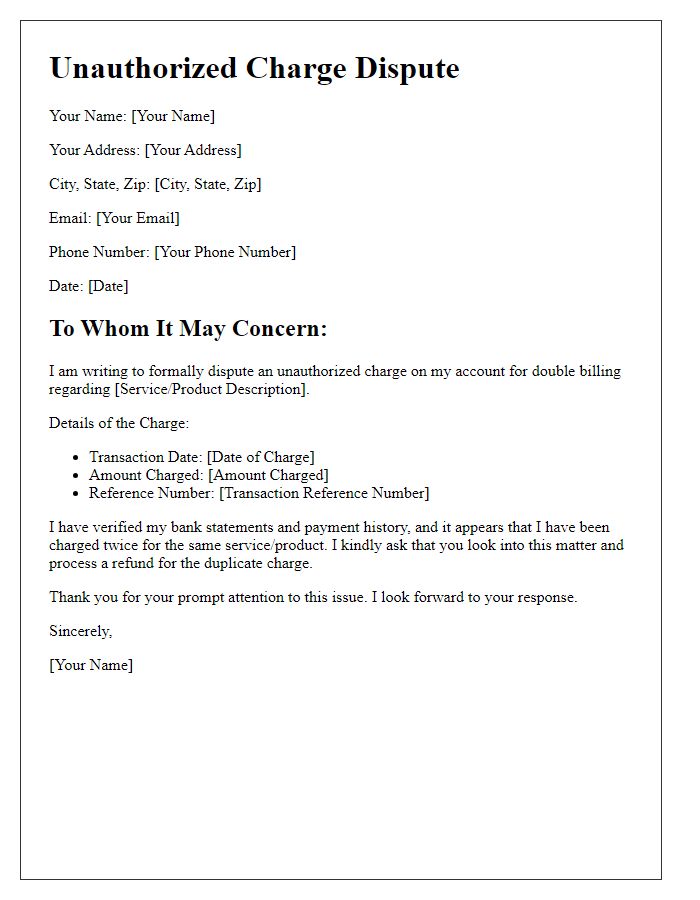

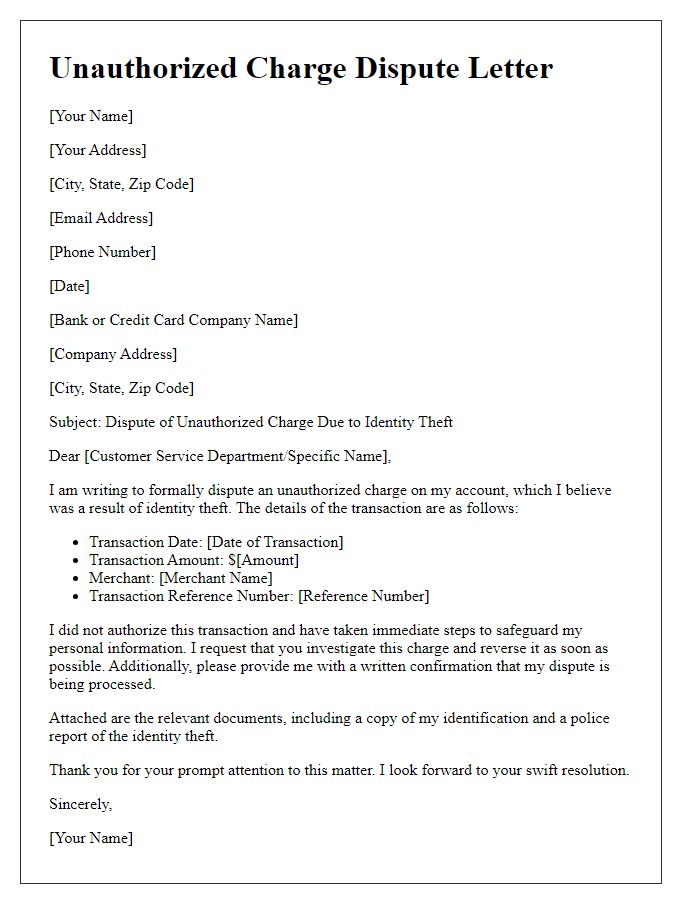

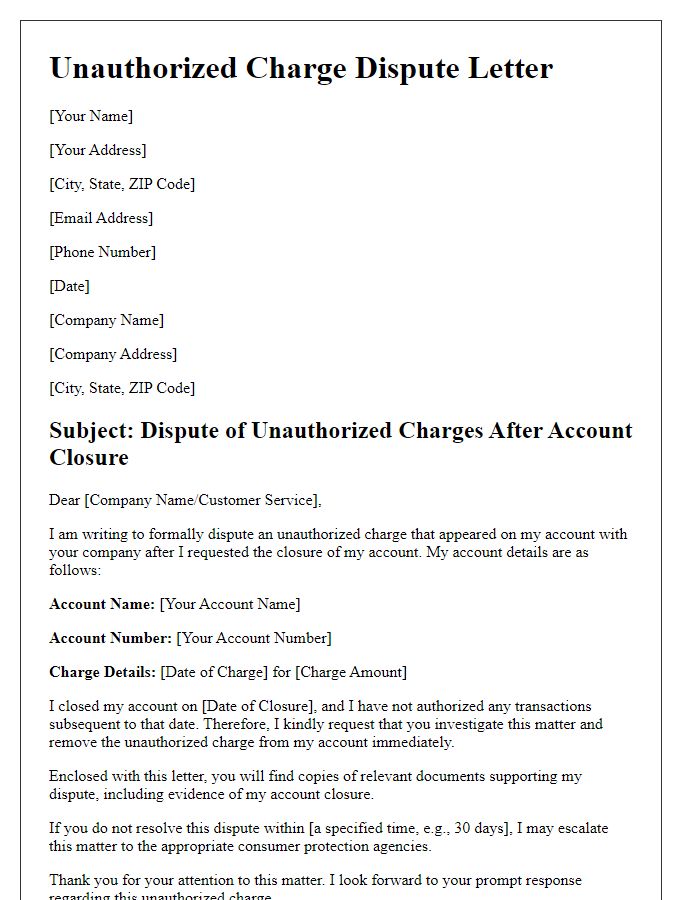

Letter Template For Unauthorized Charge Dispute Samples

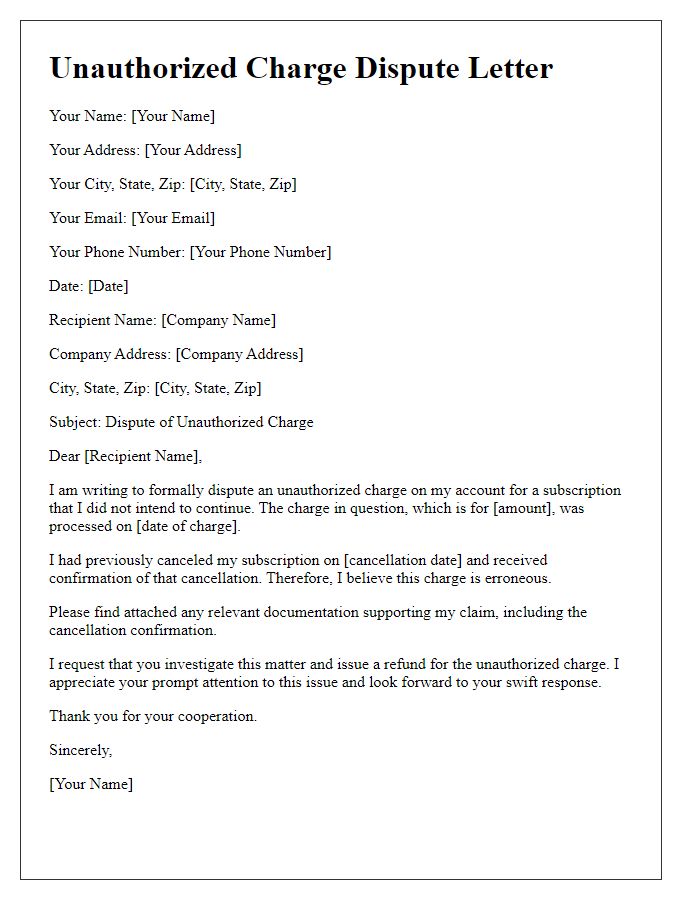

Letter template of unauthorized charge dispute for subscription cancellation.

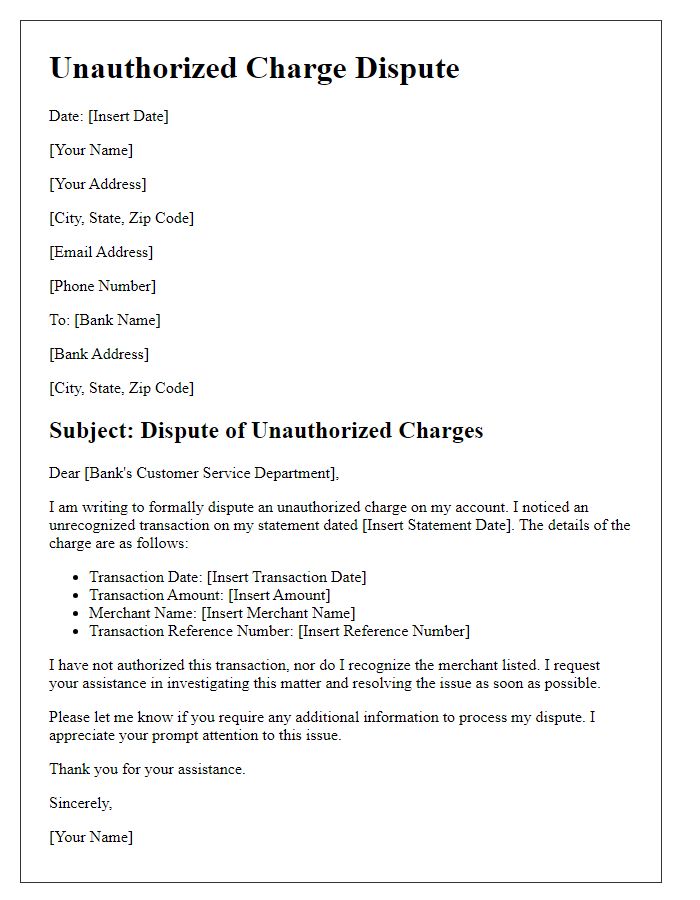

Letter template of unauthorized charge dispute for unrecognized transactions.

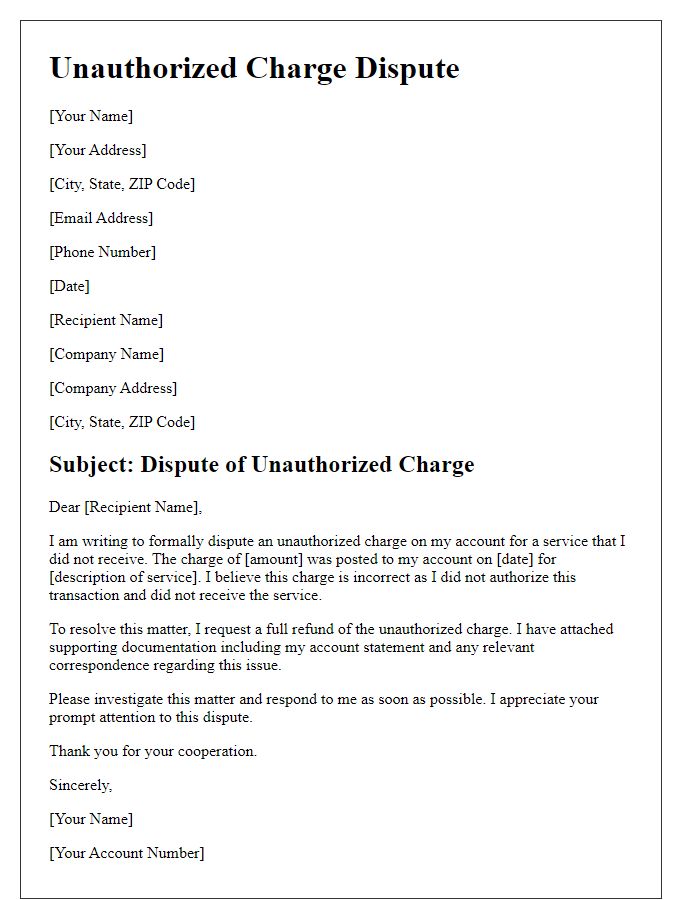

Letter template of unauthorized charge dispute for service not received.

Comments