Are you tired of the same old billing practices that don't cater to your unique needs? Personalized billing options offer a tailored approach that can make managing your finances easier and more efficient. Imagine having a billing plan that aligns perfectly with your spending habits and preferences. If you're curious to learn how personalized billing could revolutionize your financial experience, keep reading!

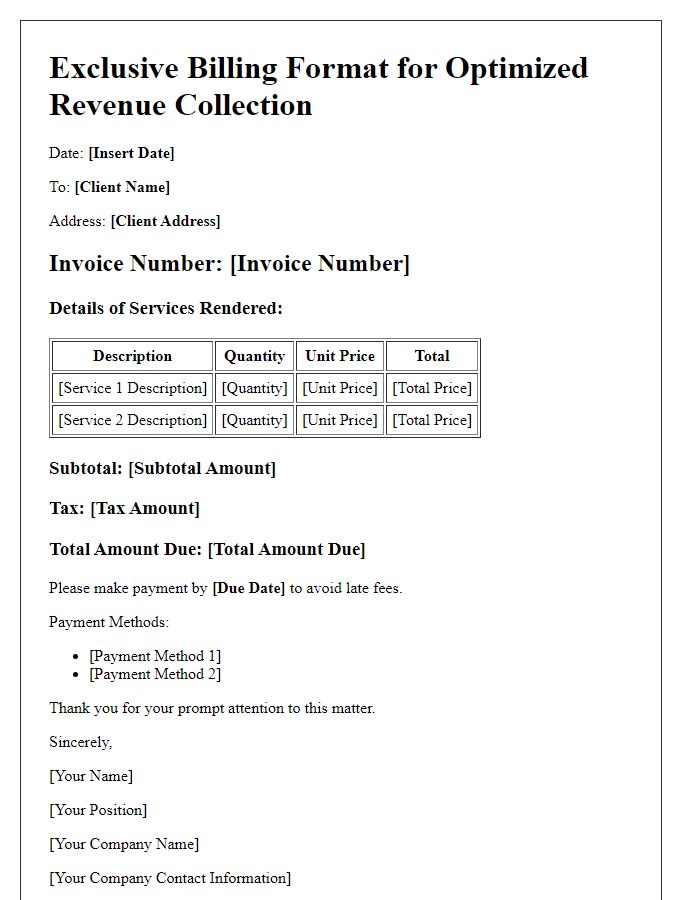

Personalization details and recipient information

Personalization of billing options enhances customer satisfaction and improves relationship management. Key aspects include customization preferences such as name (e.g., John Smith), billing address (e.g., 123 Elm Street, Springfield), and preferred billing frequency (e.g., monthly, quarterly). Incorporating delivery methods (e.g., email, postal service) ensures timely receipt of invoices. Additional personalization can involve tailoring payment methods (e.g., credit card, direct debit) to match individual preferences. Special notes regarding account history or loyalty programs can further refine the experience, increasing the likelihood of timely payments and long-term customer engagement.

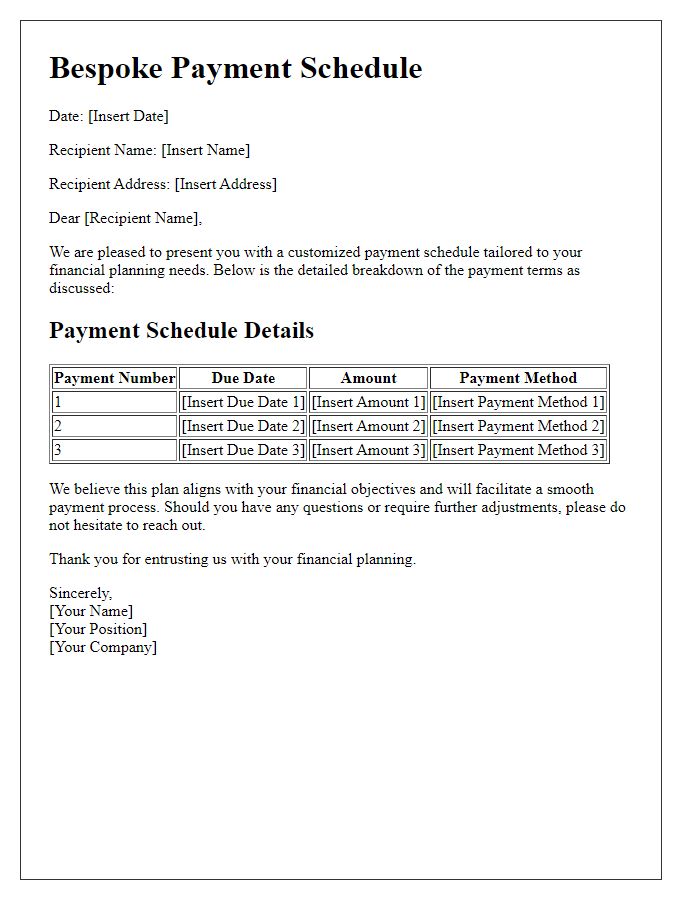

Clear billing amount and due date

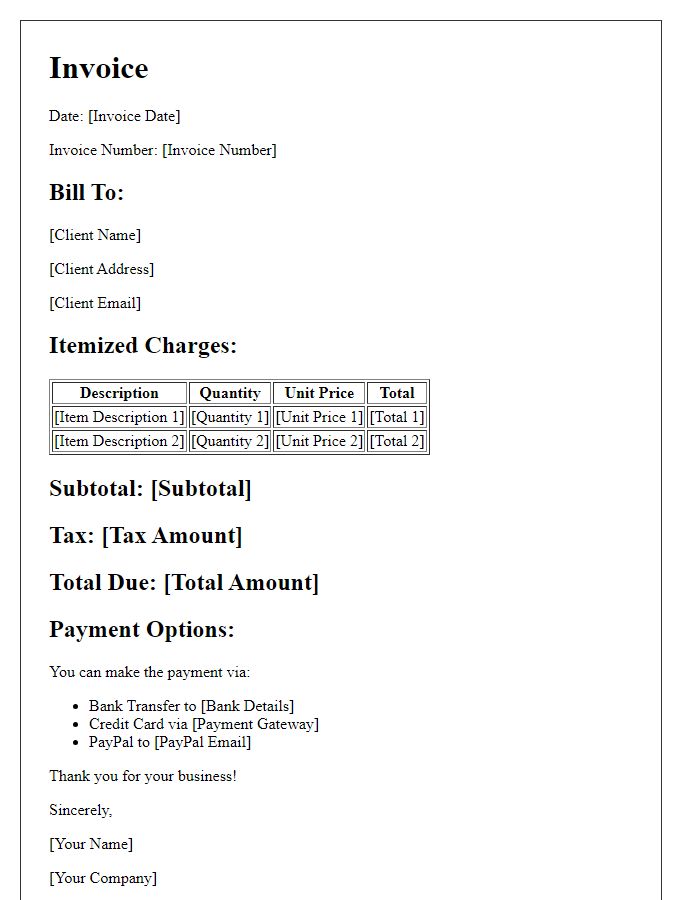

The personalized billing option allows customers to clearly understand their financial responsibilities with precision. A detailed billing amount, often outlined in dollar figures (e.g., $150.00), provides transparency regarding service costs, while a defined due date, like February 15, 2024, ensures timely payment and avoids late fees. Clear itemization of charges associated with products or services--such as subscription fees or usage charges--offers additional context for customers. Personalized notifications prior to due dates help prevent missed payments, ensuring a smooth financial relationship and enhancing customer satisfaction.

Customized payment options and instructions

Customized billing options enhance user experience, allowing flexibility in financial management. Various plans may include monthly, quarterly, or yearly payment schedules, accommodating different budgeting preferences. Specific instructions for setting up personalized billing can be provided through customer portals, accessible via secure websites like PayPal or Stripe. Additional features such as automatic payment reminders through email or SMS ensure timely payments, reducing late fees. Customers can also opt for payment methods including credit cards, debit cards, or bank transfers to meet their needs.

Contact information for assistance

Personalized billing options are designed to enhance user convenience and flexibility in managing payments. Users can access these tailored services through customer support channels, ensuring seamless communication and assistance. Various options include monthly billing cycles, automated payment reminders, and customizable payment methods. To initiate these services, users should provide essential contact information, such as phone numbers and email addresses. Direct assistance is available via dedicated support lines, with wait times often averaging under five minutes. This level of support aims to maintain customer satisfaction and to efficiently resolve any billing inquiries.

Call-to-action for prompt payment and feedback

Streamlined billing options enhance the financial management process for businesses. Timely payments are crucial, with a recommended payment window of 30 days post-invoice issuance. Prompt payments can positively impact cash flow, allowing for reinvestment into the company's growth. Regular feedback from clients can enhance service delivery, ensuring that their specific billing preferences are met. Consider creating an easy-to-use online payment portal that allows quick transactions, and implement follow-up reminders for clients who have outstanding balances. Encouraging a response to feedback requests can improve communication channels and foster stronger client relationships.

Letter Template For Personalized Billing Option Samples

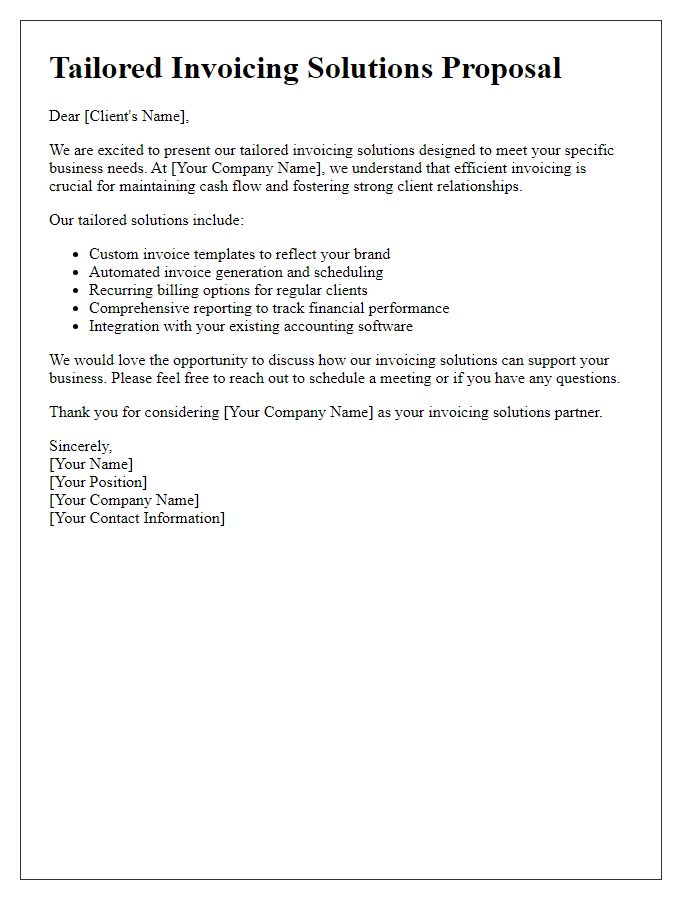

Letter template of flexible payment options for improved customer experience

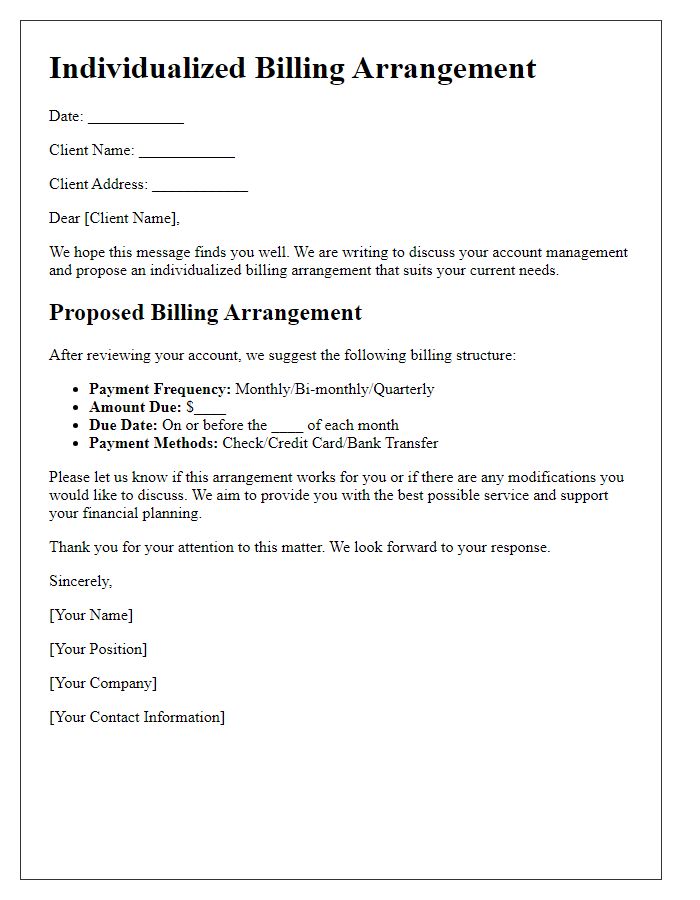

Letter template of individualized billing arrangements for account management

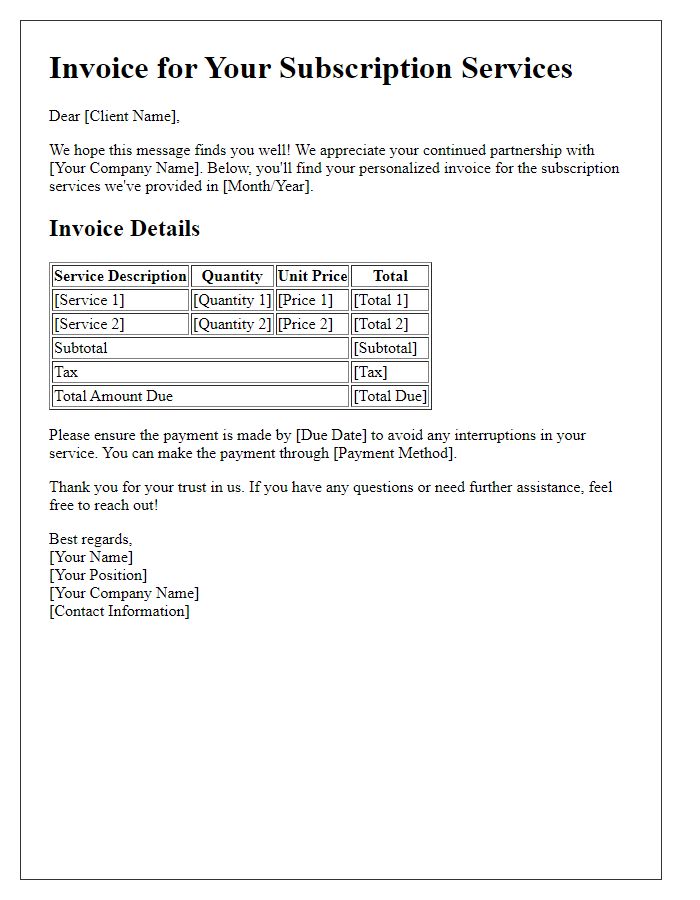

Letter template of personalized invoicing strategies for service subscriptions

Letter template of adaptive billing choices for unique client requirements

Letter template of client-specific billing modifications for enhanced convenience

Letter template of customizable invoicing options for diverse financial scenarios

Comments