Are you navigating the complex waters of changing ownership for a property or business? It can feel overwhelming, but with the right approach, the process can be smooth and efficient. This article provides a helpful letter template for requesting a change of ownership, ensuring you include all necessary details for a successful transition. So, let's dive in and simplify the steps for youâread on for the complete guide!

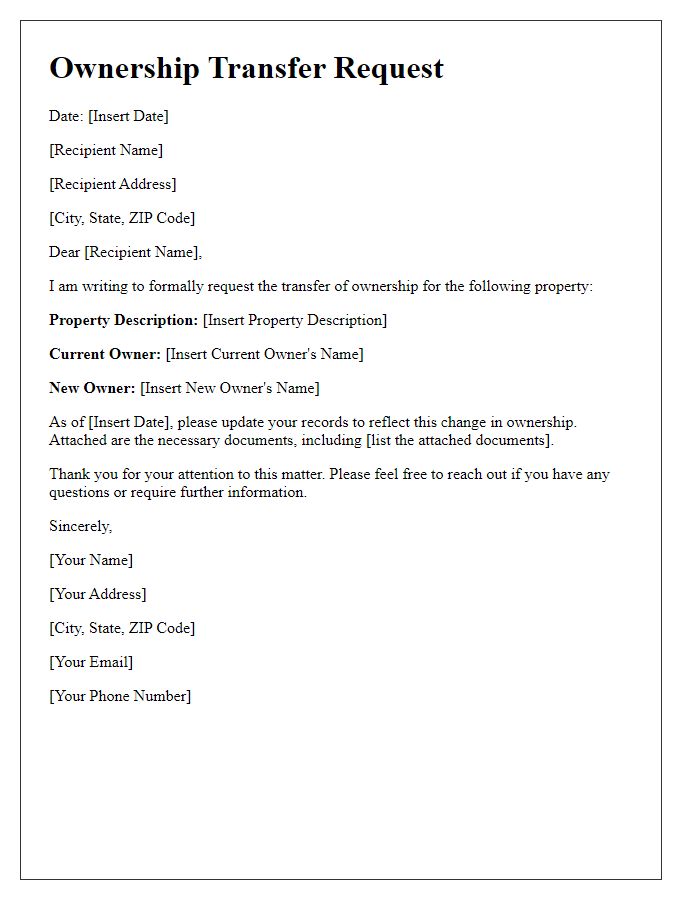

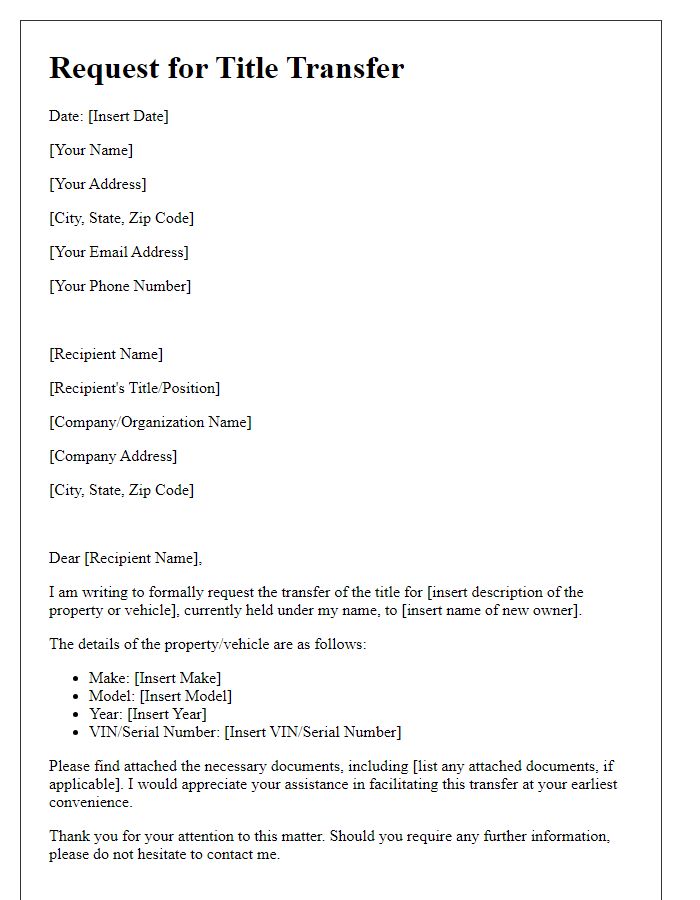

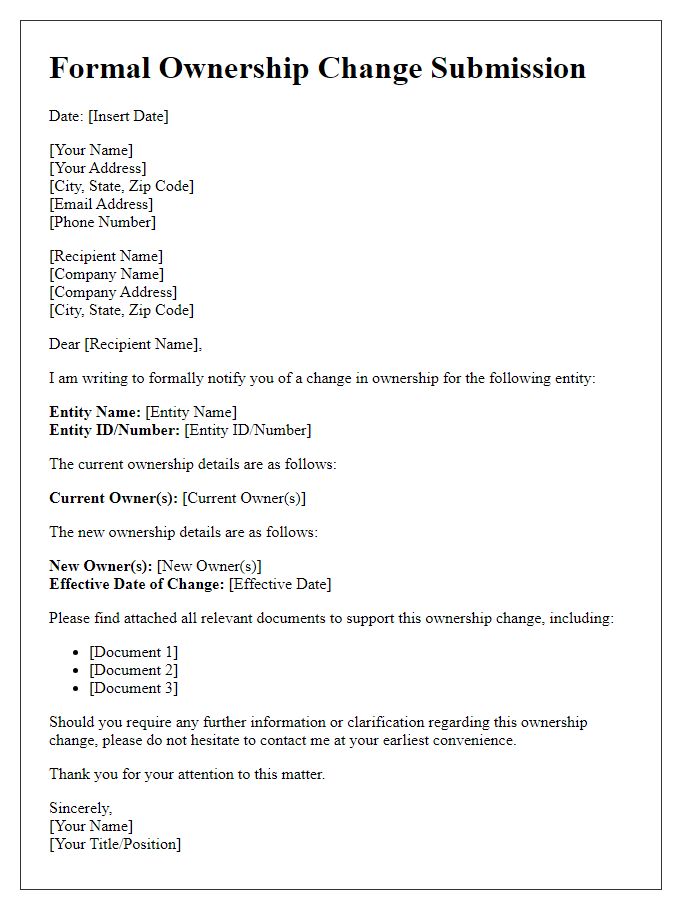

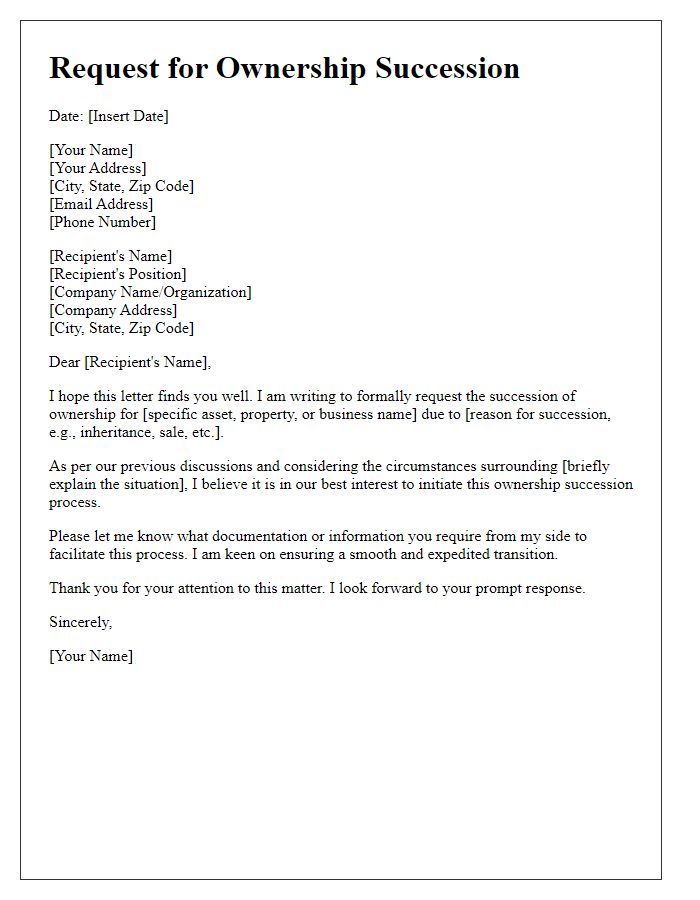

Contact Information (Buyer and Seller)

Contact information for the buyer should include full name, residential address, email address, and phone number. The seller's contact information should also encompass full name, business address (if applicable), email address, and phone number. Clarity in these details ensures proper communication during the ownership transition process. It's crucial for both parties to confirm the accuracy of this information to prevent any delays in the transfer of ownership rights, which are typically finalized through formal documentation such as a bill of sale or transfer agreement.

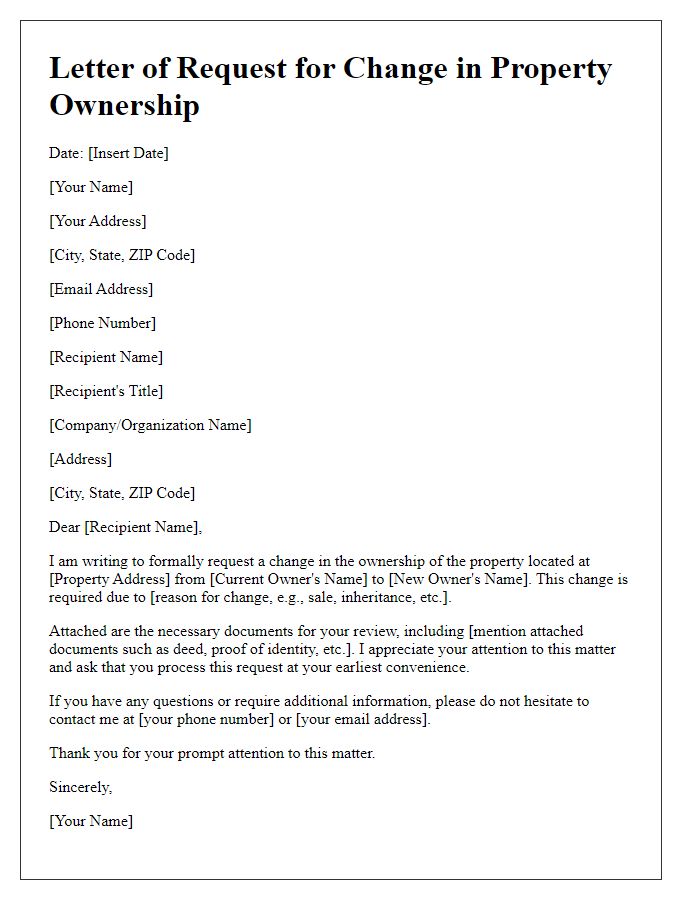

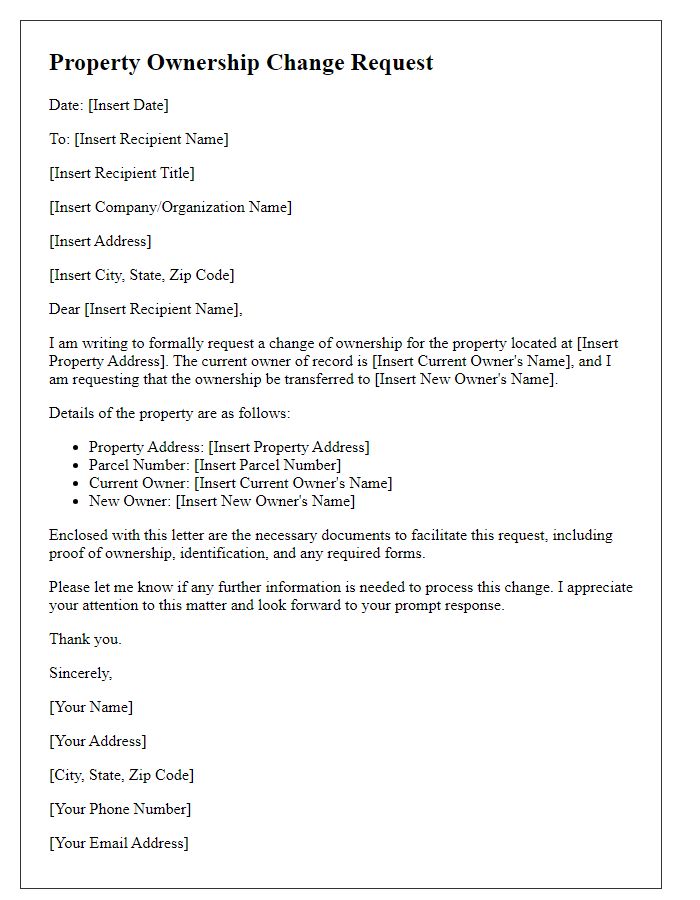

Ownership Details (Property or Asset Description)

A change of ownership request involves the transfer of rights regarding a specific property or asset, such as a residential property in San Francisco or a commercial asset like an office building. Ownership details should include the property's complete address, including the ZIP code, as well as the unique identification number, like the Assessor's Parcel Number (APN), which distinguishes it within city records. For assets, a detailed description should encompass key aspects, such as the make, model, and serial number, crucial for vehicles or machinery. Documentation, such as the current deed for real estate or the bill of sale for personal property, must accompany the request to verify ownership transfer legitimacy and initiate necessary updates in official records.

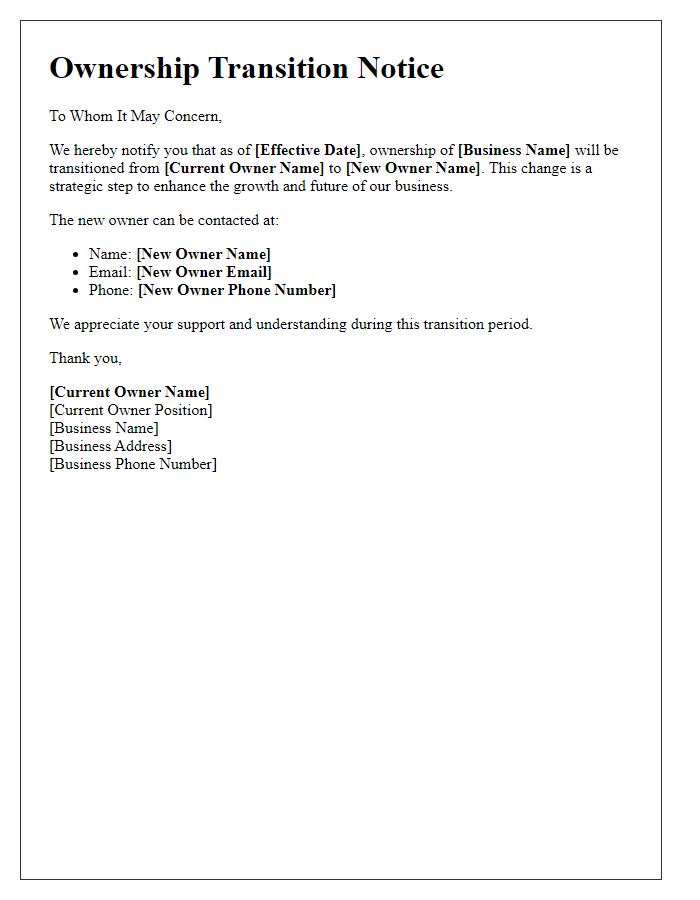

Effective Date of Ownership Change

A change of ownership request for a property asset necessitates accurate documentation to ensure a seamless transition. This request often highlights the effective date of ownership change, which can serve as a pivotal moment for financial records, legal obligations, and required notifications. For instance, if the transfer involves a residential property located at 123 Maple Street in Springfield, the ownership transition date of December 1, 2023, must be clearly stated to avoid discrepancies. Properly detailing the new owner's information, such as name and contact details, establishes clarity for all parties involved, including local government entities overseeing property records and actual tenants residing at the location. It is essential to identify any outstanding liens or mortgage agreements that may influence the transfer process, ensuring compliance with applicable state regulations governing property ownership transfers.

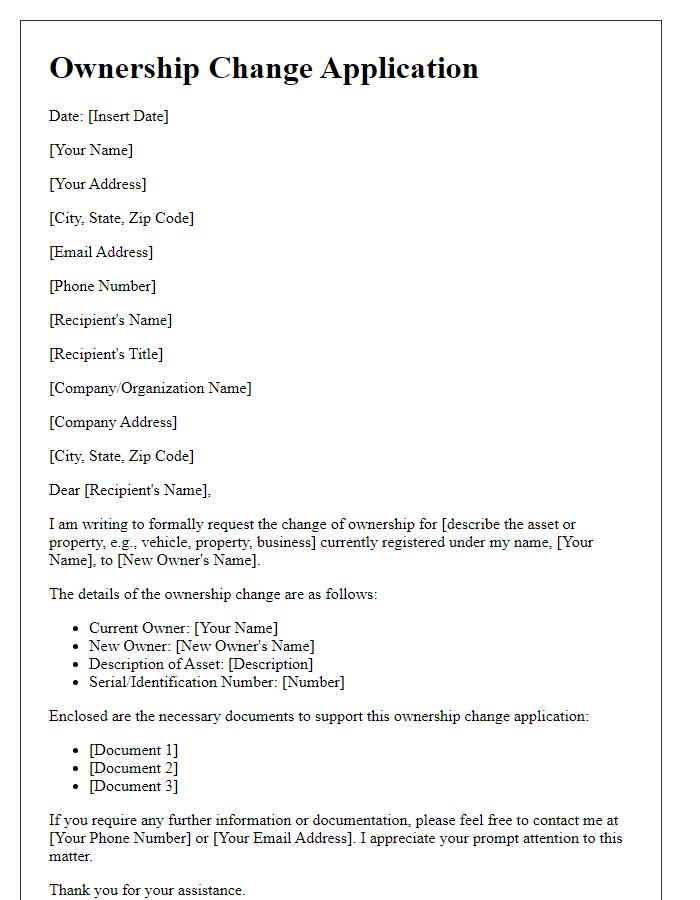

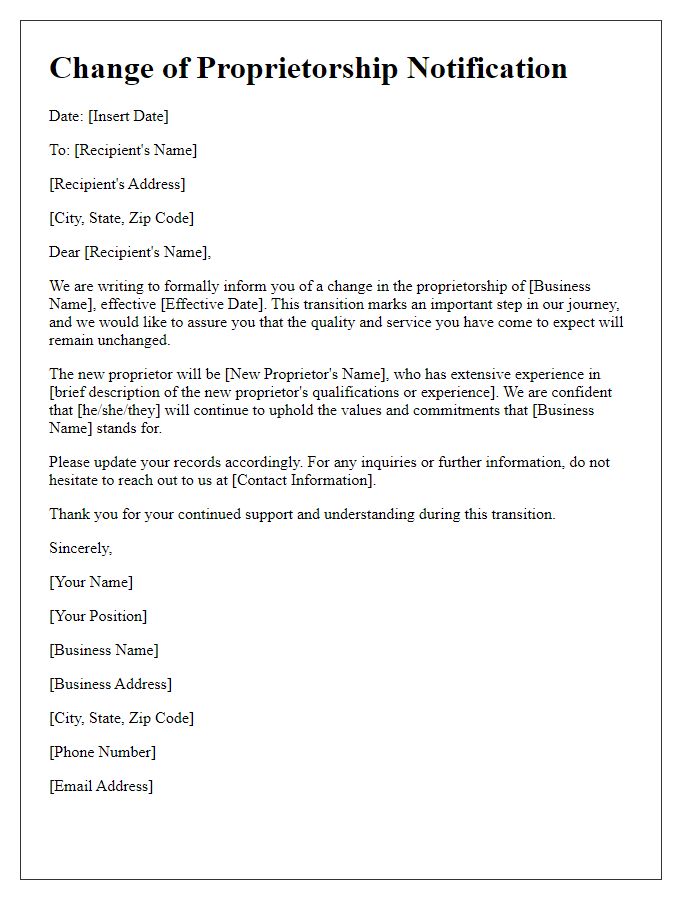

Legal and Financial Agreements

The request for a change of ownership involves the legal transfer of property rights, typically requiring formal documentation such as a deed, agreement, or contract. Upon initiating this process, both parties must adhere to local regulations within jurisdictions, such as the United States or specific states like California, which may have particular requirements for real estate transactions. This often encompasses detailed legal agreements outlining the terms of transfer, including purchase price, contingencies, and closing date, necessitating the involvement of legal professionals for accuracy and compliance. Financial agreements are also critical and may include loan assumptions or financial disclosures to prevent future disputes. Consideration of taxes, like property transfer taxes or capital gains implications, is vital when drafting these agreements, ensuring all financial obligations are clearly stated and understood.

Signatures and Notarization

A change of ownership request requires careful attention to detail, particularly regarding signatures and notarization. Essential documents such as the Bill of Sale and Transfer of Title must include the signatures of both the current owner and the new owner, indicating their agreement. Notarization is crucial, ensuring that signatures are authentic and verified by a licensed notary public, often required in states like California and Texas, where legal implications are significant. This process often involves presenting valid identification, such as a driver's license, to the notary. Additionally, specific information on the property or asset being transferred, including identification numbers and addresses, should be clearly documented to comply with local regulations. Ensuring accuracy could expedite the approval process with relevant authorities, often taking 1-2 weeks in most jurisdictions.

Comments