If you find yourself in a tight spot financially, requesting a payment extension can be a practical solution. It's important to communicate your situation clearly and politely, ensuring that you provide relevant details while expressing your commitment to fulfill your obligations. A well-crafted letter can make all the difference in gaining the flexibility you need. Ready to learn how to construct the perfect request? Read on!

Polite and Respectful Tone

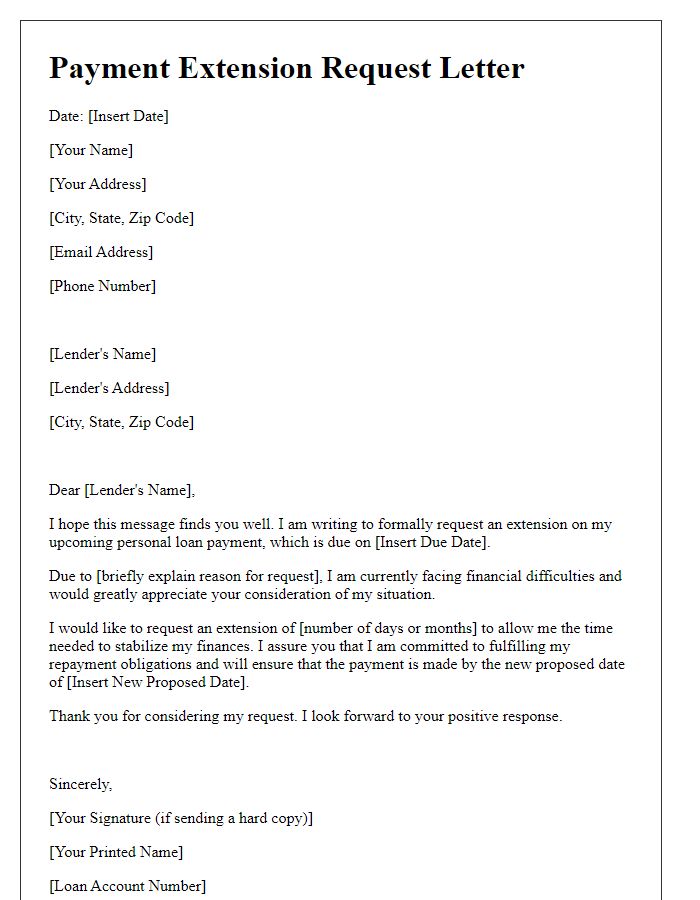

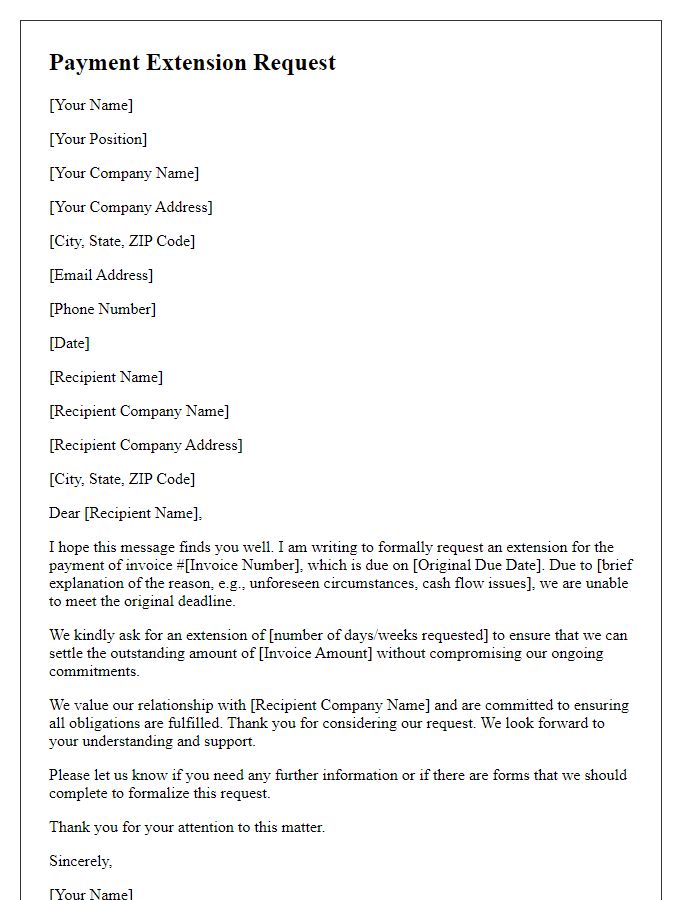

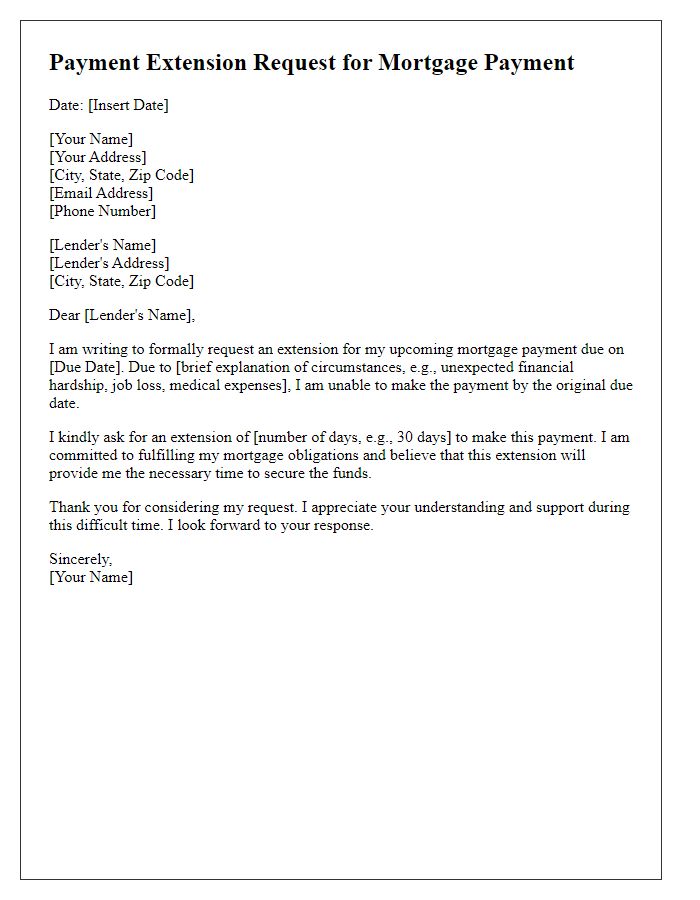

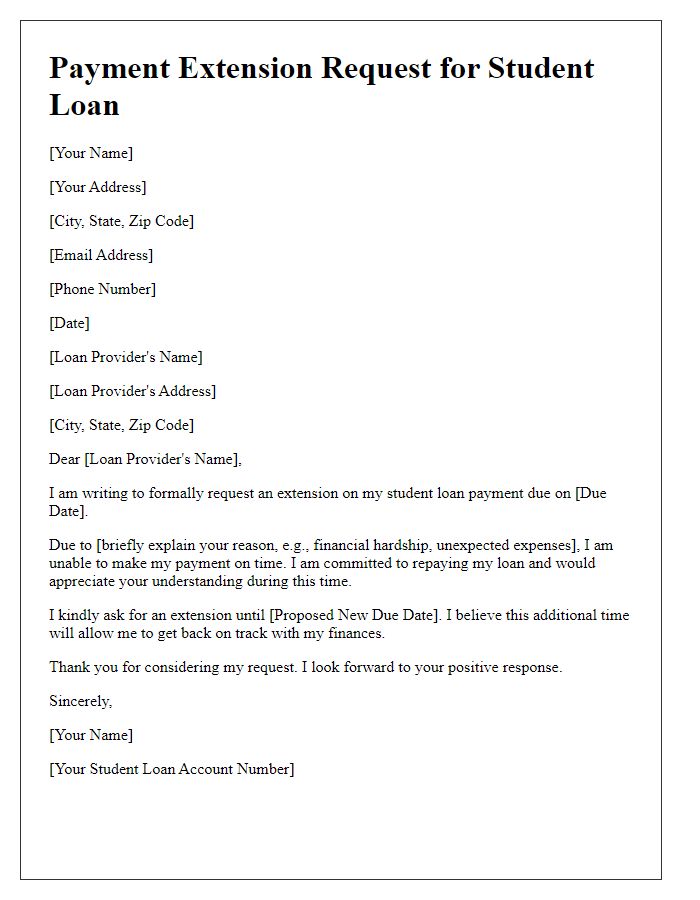

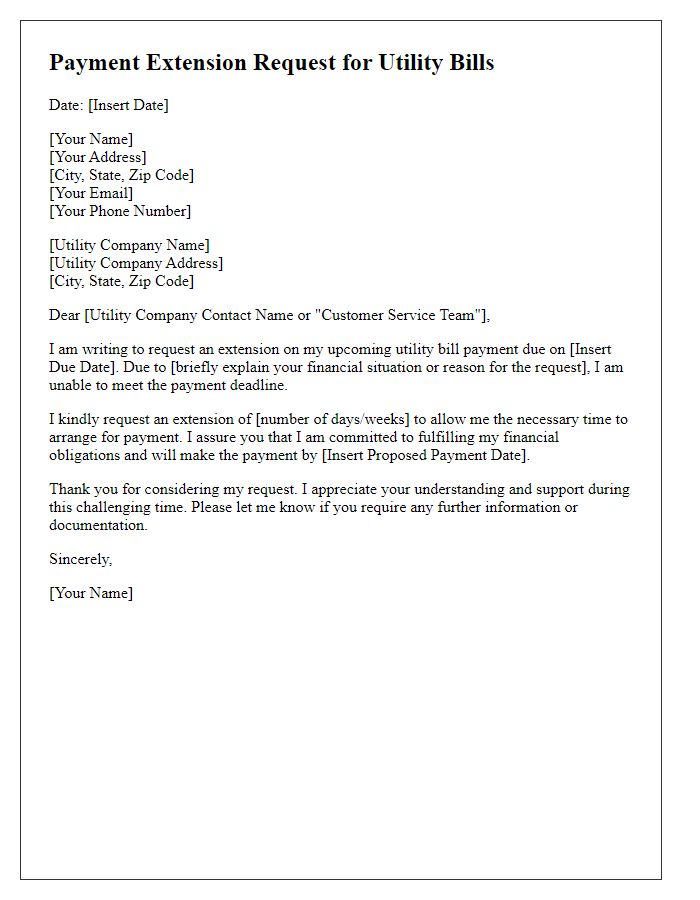

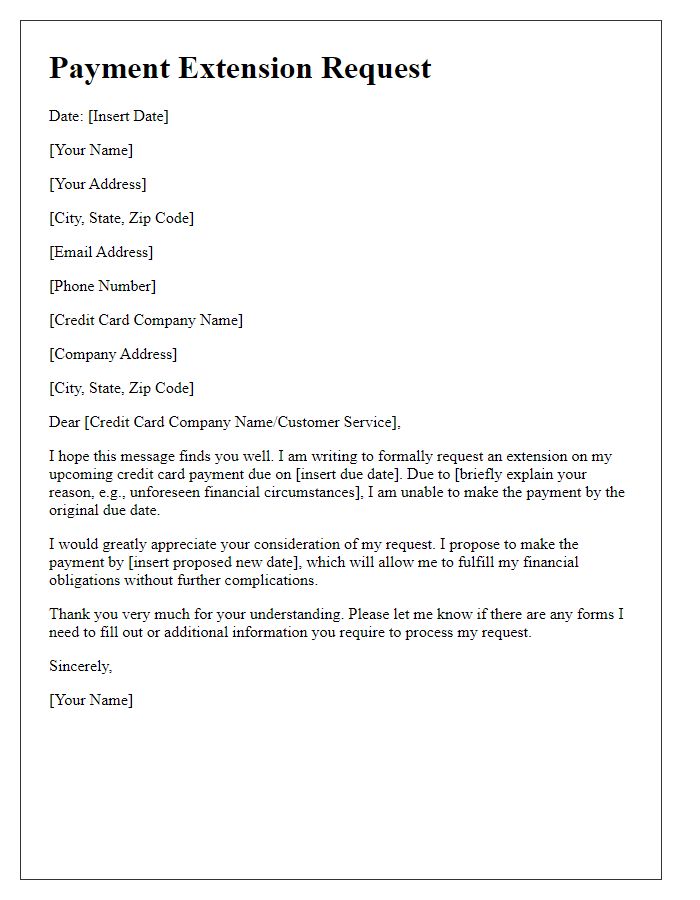

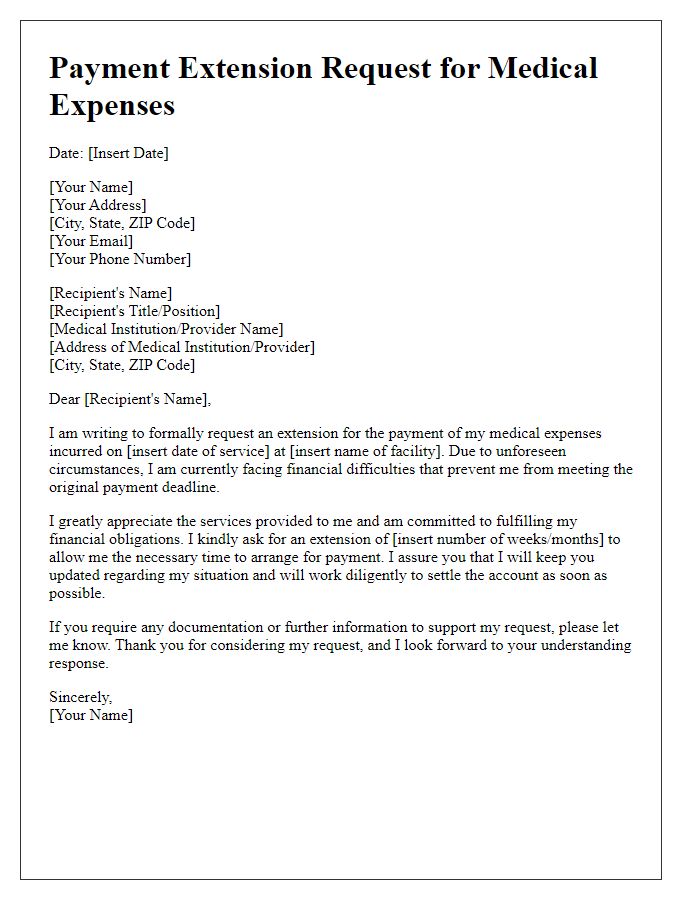

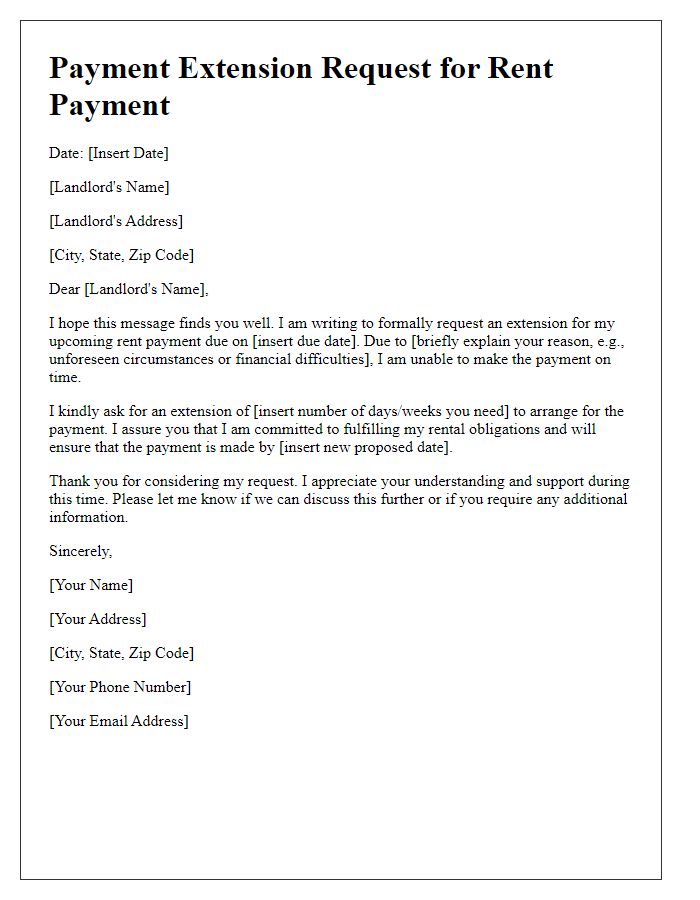

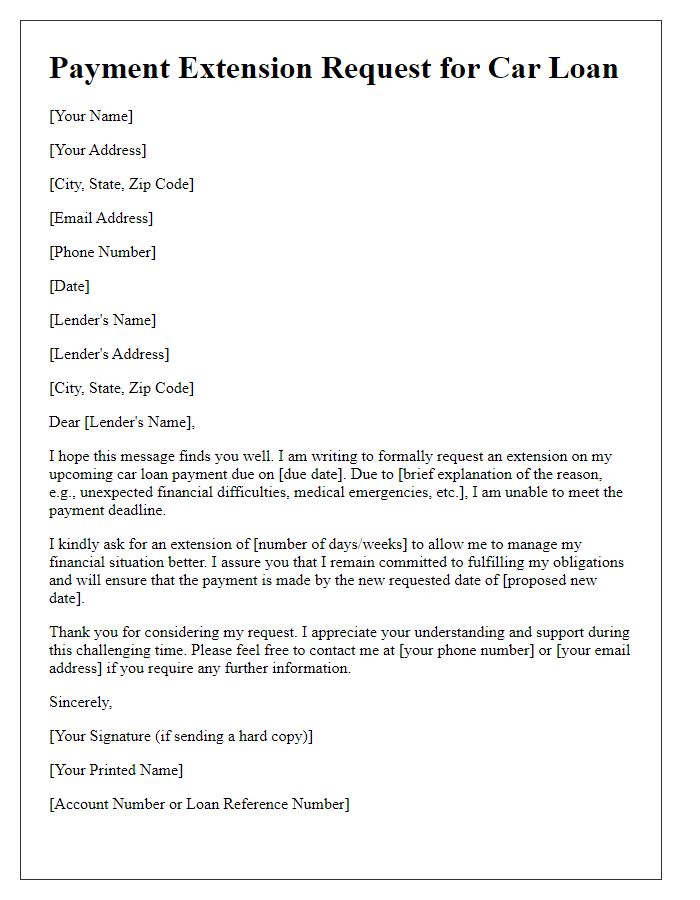

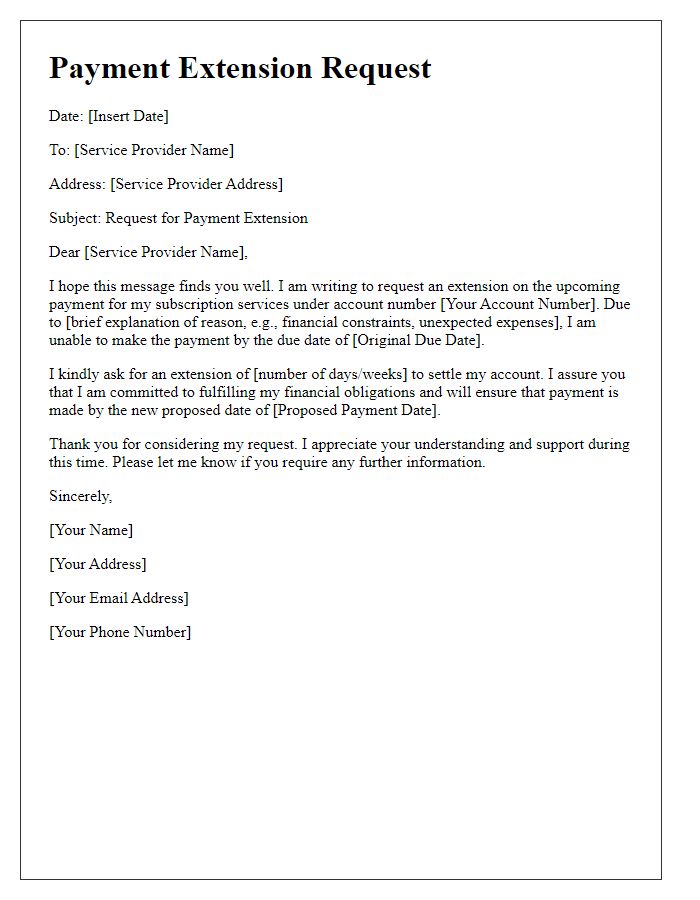

A payment extension request is often necessary during financial hardships. It is important to communicate clearly and respectfully. Affected parties should provide necessary details, such as the due amount (for instance, $500), original due date (such as June 15), and proposed new date (for example, July 15). Including a brief explanation of the circumstances, such as job loss or unexpected medical expenses, can help the recipient understand the situation. Additionally, reiterating the intent to fulfill the obligation reinforces commitment, while expressing gratitude for the consideration indicates politeness and respect. Such requests benefit from clear and concise language, avoiding unnecessary complexity to ensure the message is understood.

Clear and Specific Request

A payment extension request for outstanding debts can often arise under financial strain, such as unexpected expenses or temporary income loss. A clear and specific request typically involves detailing the debt amount, original due date, and proposed extended payment date. For instance, requesting an extension for a $2,000 bill originally due on October 15, 2023, until November 30, 2023, allows creditors to understand the urgency. Including specific reasons, such as medical emergencies or job loss, adds context, potentially increasing empathy and understanding from creditors. Furthermore, highlighting commitment to fulfilling obligations reinforces responsibility, fostering trust and goodwill in the relationship.

Justification for Extension

Facing unexpected financial challenges can hinder timely payments, especially evident during economic downturns or personal emergencies. Common reasons include medical expenses, sudden job loss, or urgent home repairs, which can drain savings intended for fixed obligations. Landlords, service providers, or lenders may consider such factors, recognizing the importance of maintaining customer relationships. Seeking an extension for payment deadlines can relieve immediate pressure, allowing individuals to stabilize their financial situation. Establishing clear communication about reasons for the request and setting a new timeline can foster cooperation and understanding with creditors.

Proposed New Payment Date

In various financial situations, individuals or businesses may require an extension on their payment deadlines. A proposed new payment date, such as March 15, 2024, can help alleviate immediate financial pressures, allowing time for funds to be secured. This request is often sent to creditors or service providers, detailing the reason for the delay, such as unexpected expenses or temporary cash flow issues. Clear communication and a sincere tone can foster understanding and maintain a positive relationship. Providing a commitment to fulfill obligations by the new date highlights responsibility and intention to settle outstanding amounts.

Assurance of Commitment

A payment extension request demonstrates a commitment to fulfilling financial obligations. Communicating with lenders or creditors involves addressing specific details, such as the original due date, the amount due, and proposed new terms. For instance, requesting an additional 30 days to settle a payment of $500 can show responsibility and intent. Including personal circumstances, such as unexpected medical expenses or temporary job loss, adds context and facilitates understanding. Maintaining a professional tone within the communication ensures respect and reinforces the commitment to honor future payments.

Comments