Are you navigating the challenging waters of a partial payment agreement? It can often feel overwhelming, but with the right approach and a solid letter template, you can ensure both parties are on the same page. This essential document not only protects your interests but also fosters a positive relationship between you and the other party. Curious to dive deeper into the details and get started on drafting your own agreement? Keep reading!

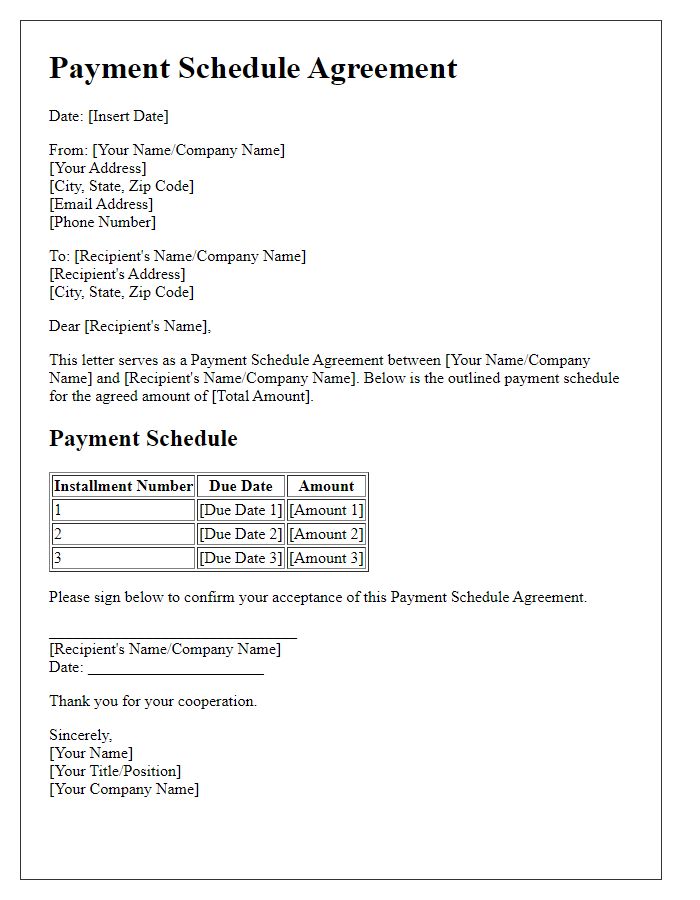

Payment Terms and Schedule

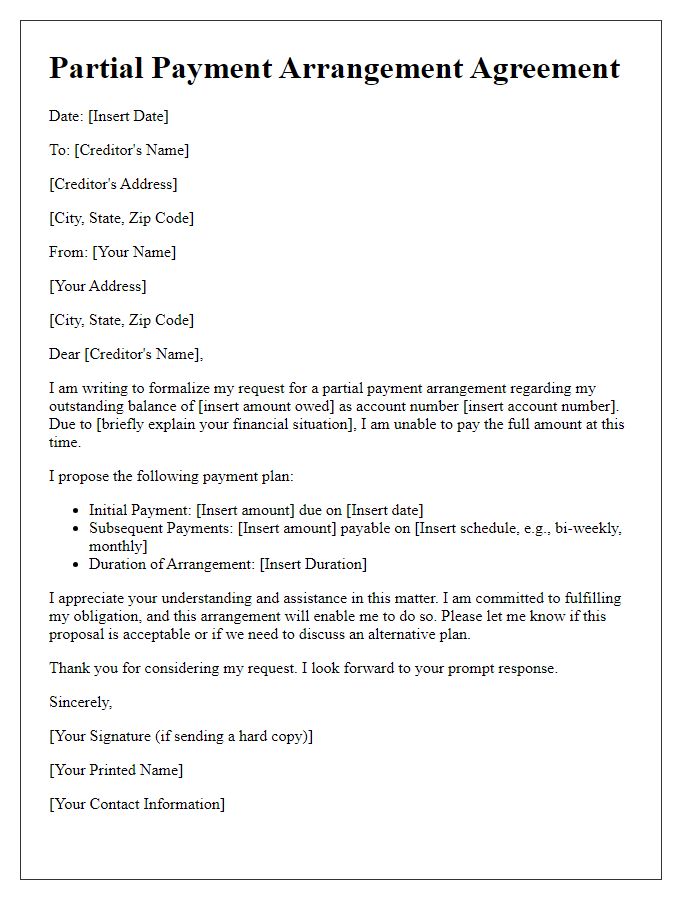

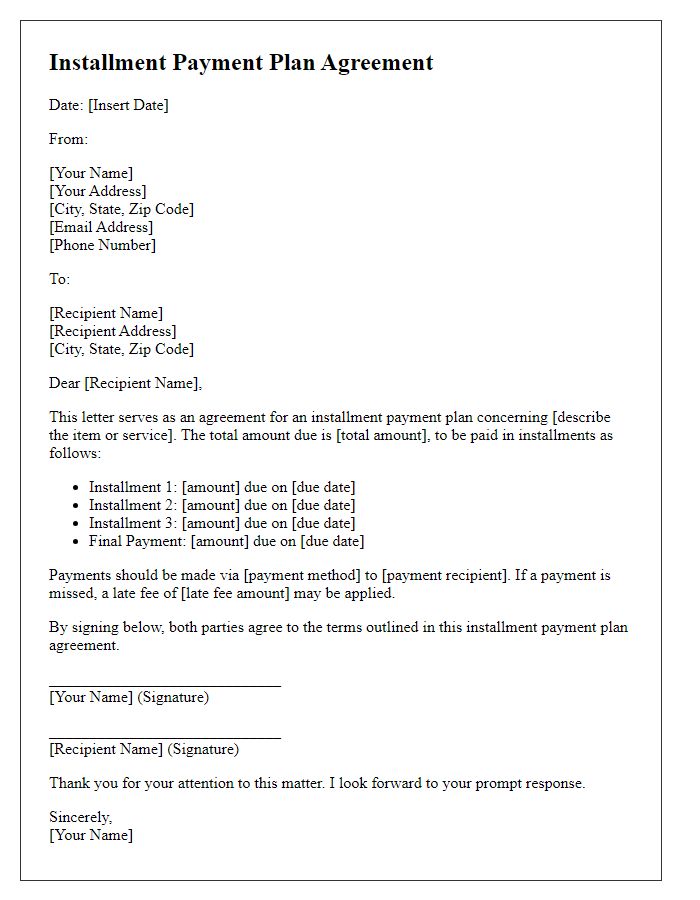

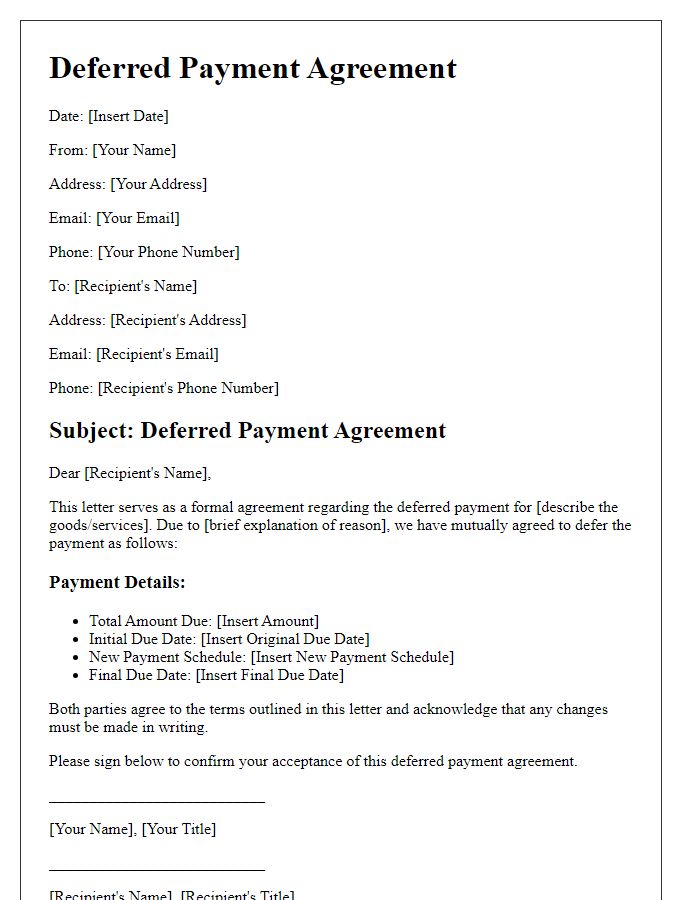

A partial payment agreement outlines the terms and schedule for settling an outstanding balance, commonly used in financial transactions. The buyer, an individual or entity, agrees to remit payments in installments rather than a lump sum. Key components of this agreement include the total amount due, typically specified in currency forms like USD or EUR, and the agreed payment schedule detailing each installment's due date. For instance, a payment plan might require monthly payments of $200 over six months for a total balance of $1,200. Interest rates, if applicable, must be clearly stated to avoid confusion. Both parties, the creditor and the debtor, must provide verifiable contact information for communication purposes. Additionally, consequences of late payments or defaults, such as fees or legal actions, should be outlined explicitly to ensure mutual understanding and compliance.

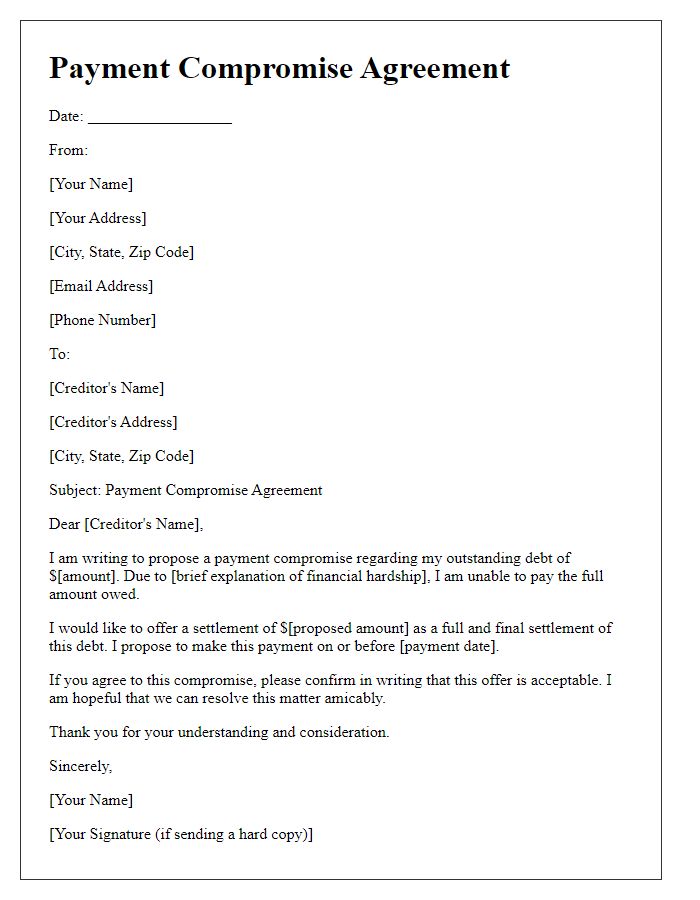

Total Amount Due and Outstanding Balance

A partial payment agreement outlines the terms for settling outstanding debts, establishing a clear framework for payments and balance management. Total amount due refers to the full sum owed by the debtor, potentially including principal, interest, and any additional fees. Outstanding balance represents the remaining unpaid amount after a partial payment has been made, indicating what is still required for complete settlement. Such agreements are crucial in financial transactions, particularly for individuals or businesses facing economic hardships, allowing for manageable and structured repayment schedules. Key elements include specified payment amounts, due dates, and consequences for missed payments, providing clarity and legal protection for both parties involved.

Late Payment Penalties

Establishing a partial payment agreement can provide relief for individuals experiencing financial difficulties while ensuring that creditors receive some level of compensation. Late payment penalties often arise from agreements involving significant amounts of debt, such as mortgages, personal loans, or credit cards. These penalties vary widely; for example, late fees can range from $25 to $50 or a percentage of the overdue amount (typically around 1%-10%). Additionally, specific terms regarding the grace period, usually 10 to 15 days post-due date, can provide borrowers with necessary flexibility. Reflection on the legal implications associated with breach of contract in states such as California or Texas, where consumer protection laws apply, can further influence the structure of the agreement. Clarity on communication channels regarding payment schedules and reminders is crucial for maintaining accountability and encouraging timely payments throughout the period of the agreement.

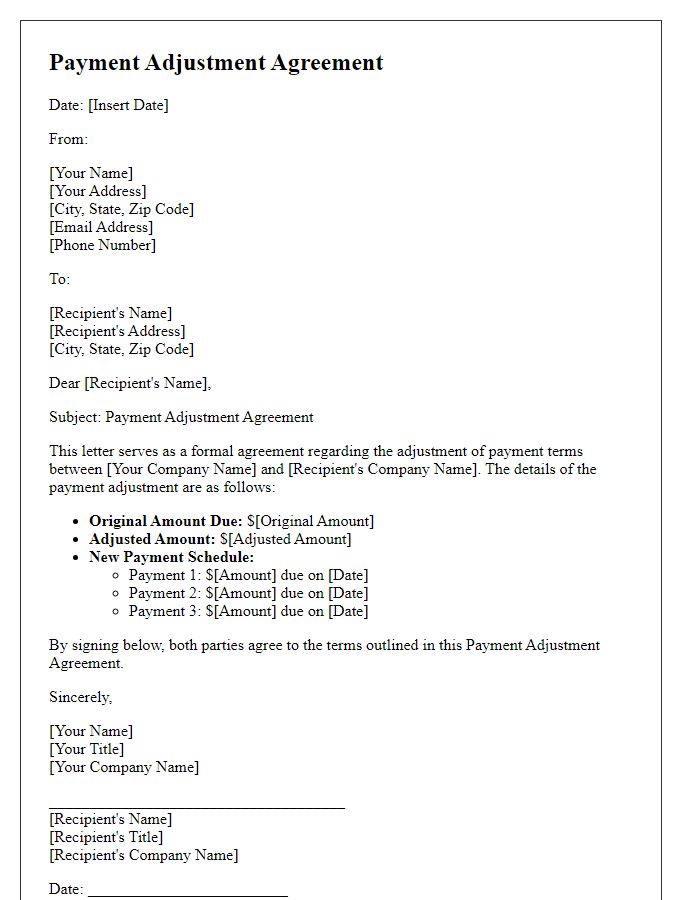

Modification and Enforcement Clauses

A partial payment agreement typically includes specific provisions detailing modification and enforcement clauses to ensure clarity and accountability. Modification clauses outline the process for amending the agreement, specifying that any changes must be documented in writing and agreed upon by both parties involved in the transaction. Enforcement clauses establish the steps necessary to enforce the terms of the agreement, such as late payment penalties and actions taken if payments are not received as agreed. For instance, interest may accrue at a predefined rate if payments are missed past a certain date. These clauses are essential in safeguarding the rights of both the creditor and debtor, ensuring that all parties understand their obligations and the consequences of non-compliance.

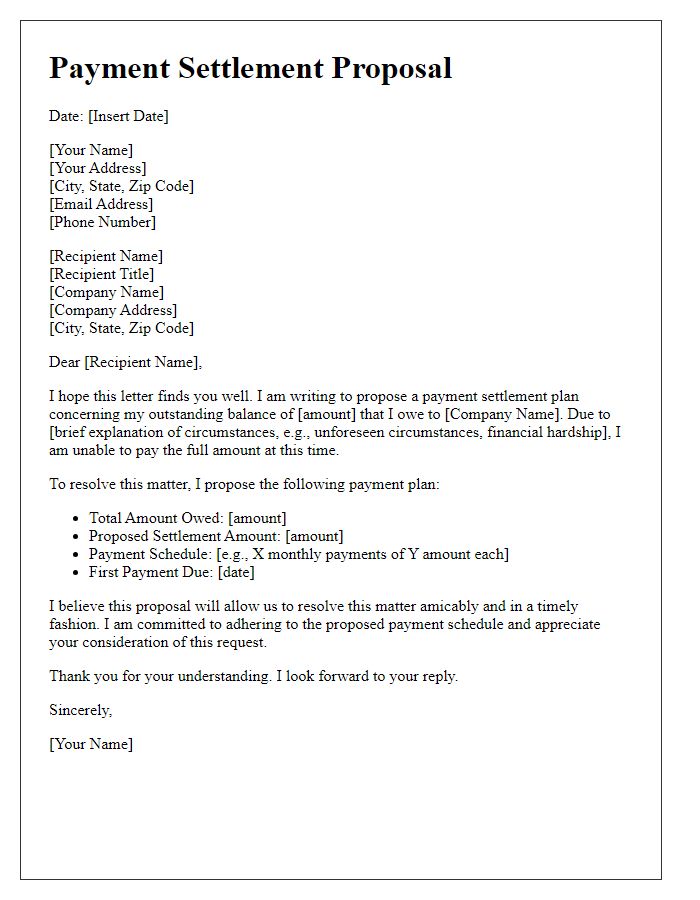

Contact Information and Signatures

Contact information for both parties in a partial payment agreement is crucial for clear communication. Include the full name, address, phone number, and email address of the debtor and creditor. The debtor may be an individual or business entity, requiring designation as such in the document. The creditor, often a financial institution or service provider, should also specify a contact person if applicable. Signatures of both parties authenticate the agreement, making it legally binding. Ensure a date is included beside each signature to confirm when the agreement was finalized. Additionally, consider adding a witness signature line for added credibility and legal protection in the event of disputes.

Comments