Are you feeling overwhelmed by unclear charges on your latest bill? You're not aloneâmany people find themselves grappling with unexpected fees and lack of transparency in billing statements. In this article, we'll provide a simple template for requesting a detailed breakdown of your bill, so you can navigate those confusing expenses with ease. Stick around to learn how to take control of your finances and get your questions answered!

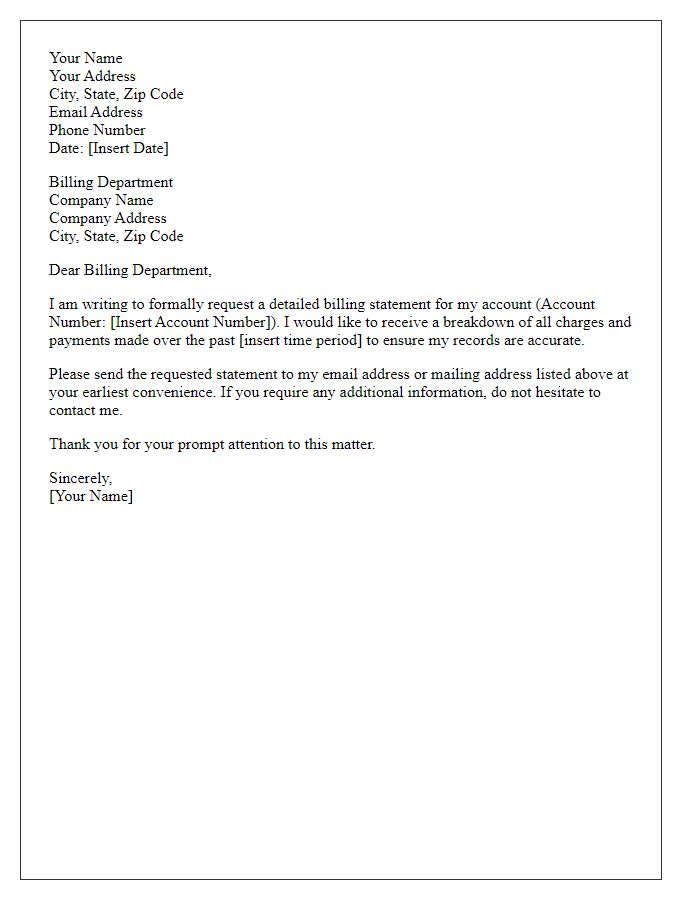

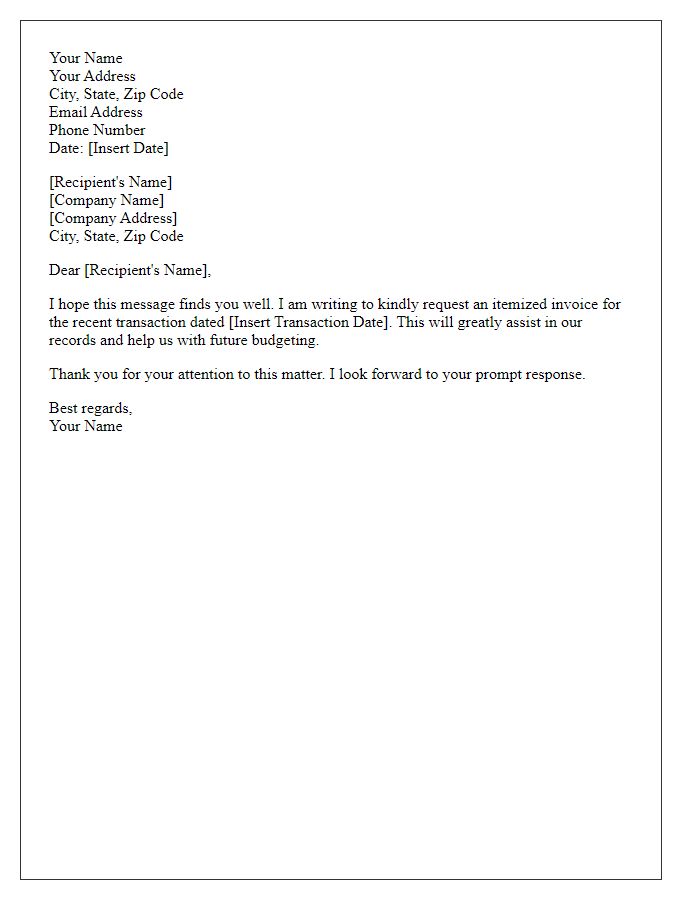

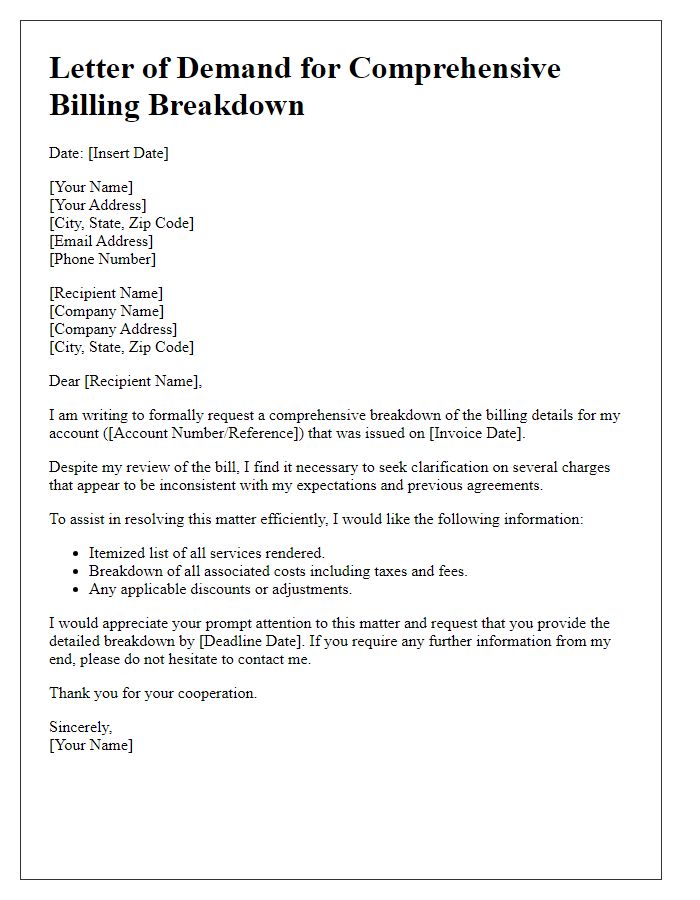

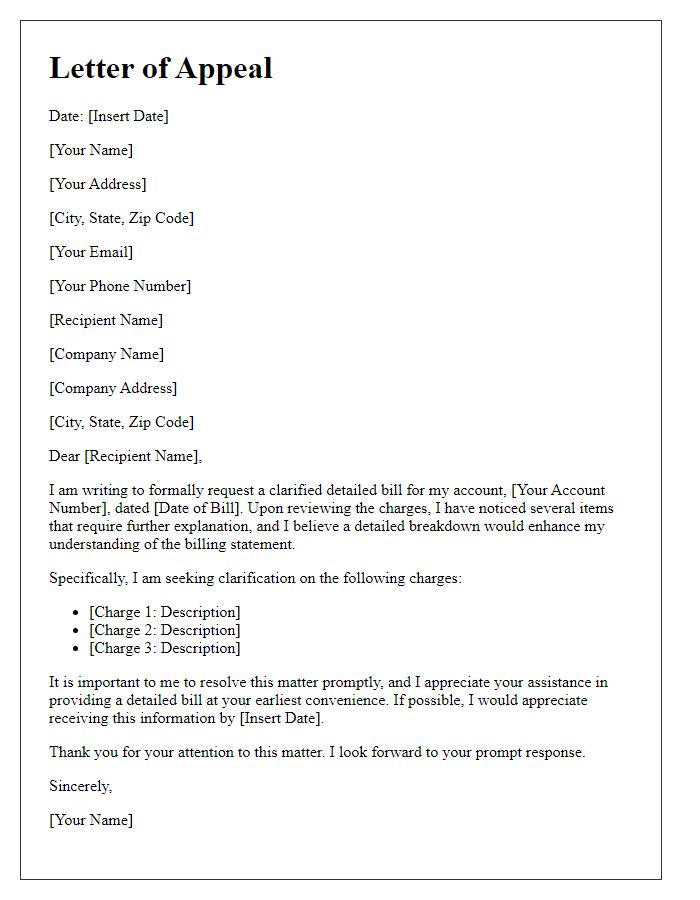

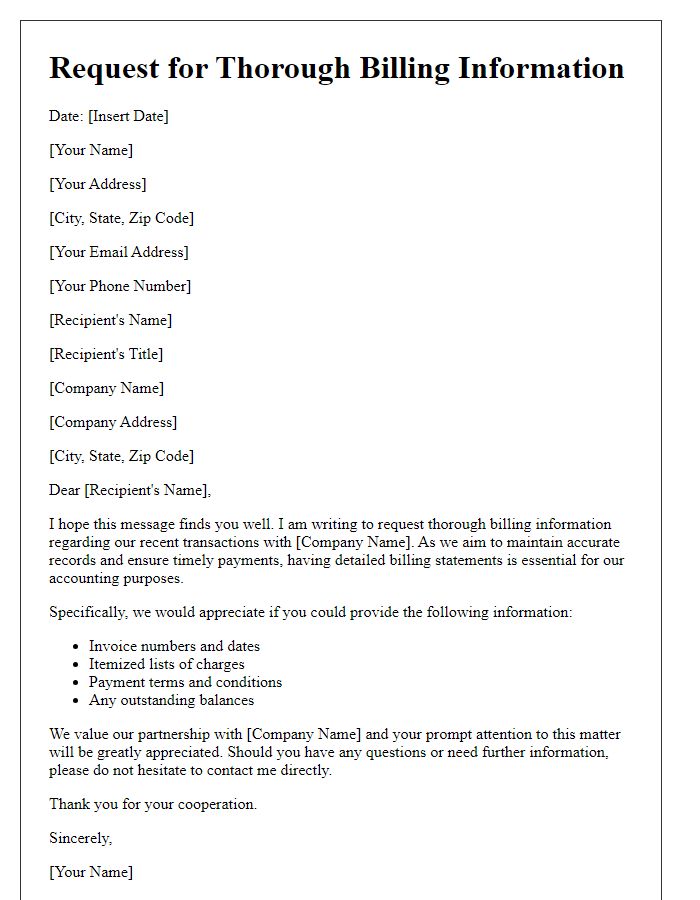

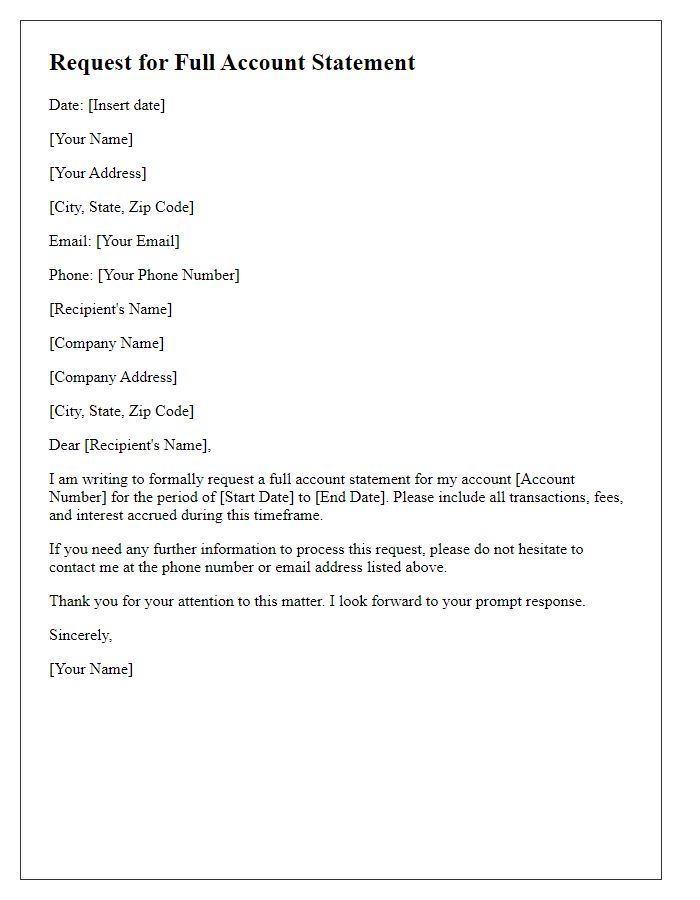

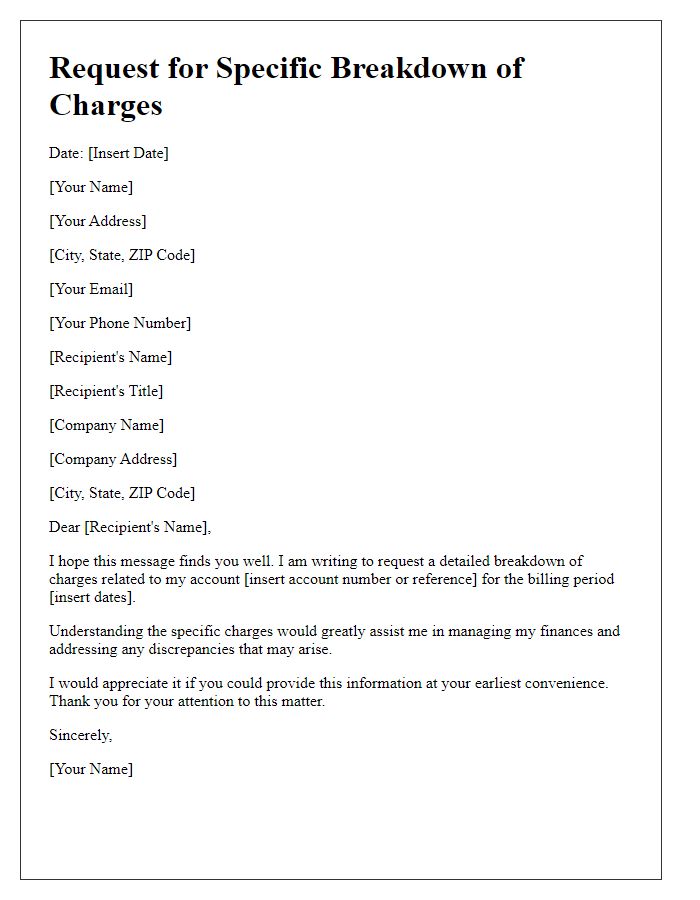

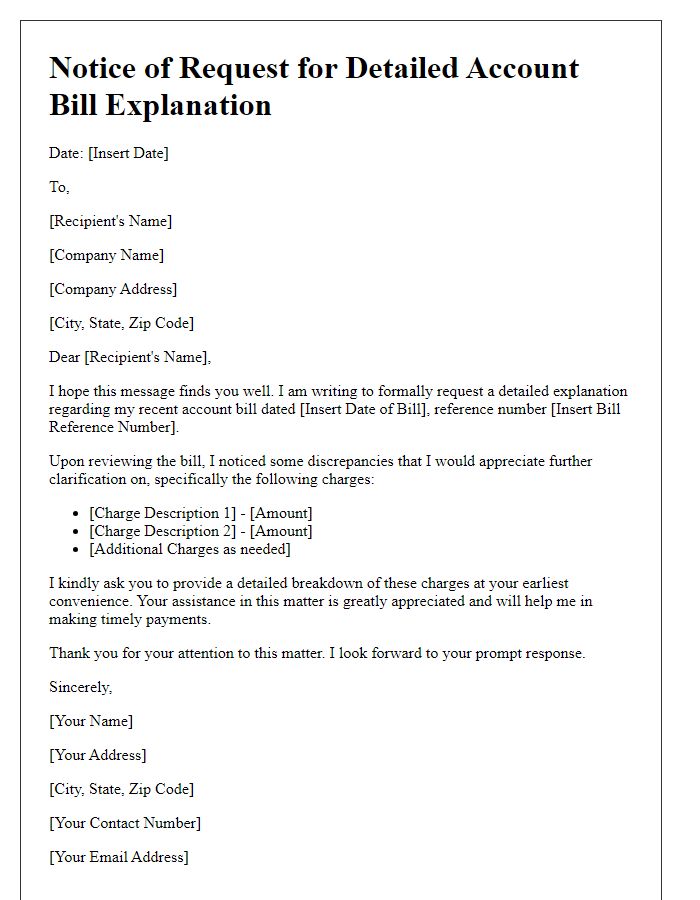

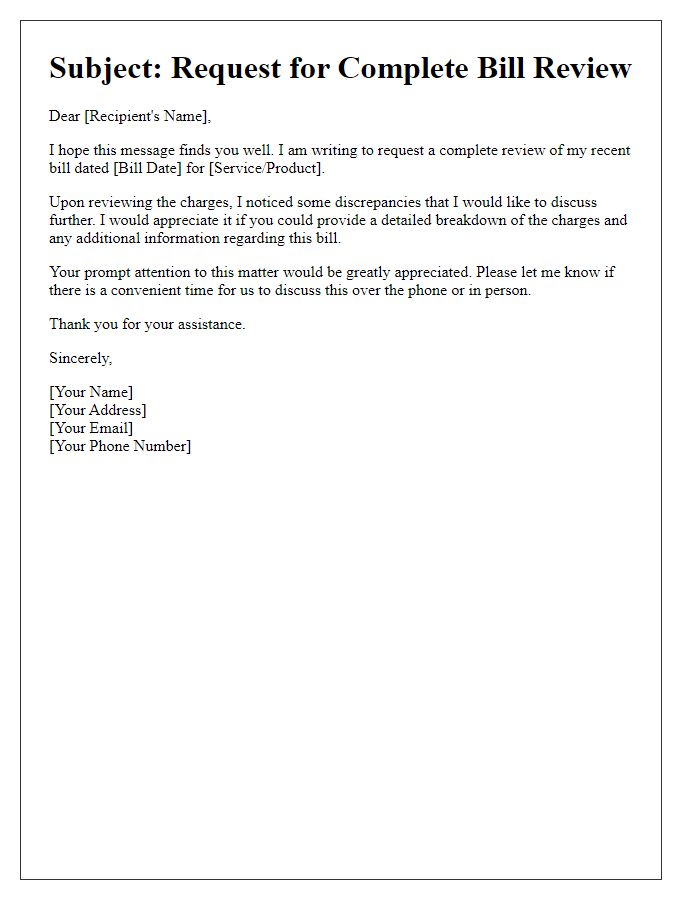

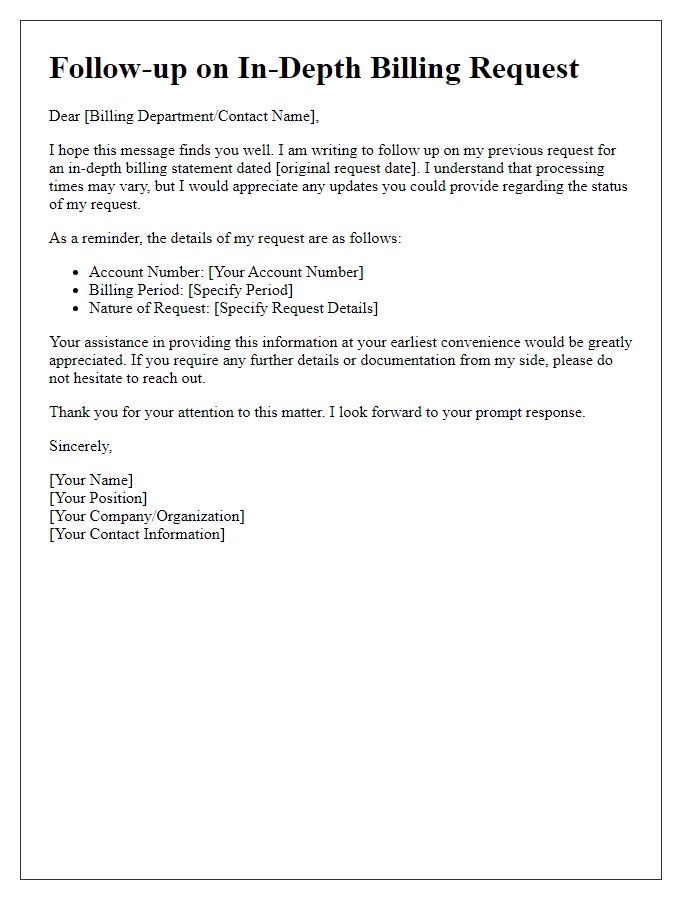

Formal salutation and recipient identification

In the heart of bustling downtown New York City, the need for detailed billing requests often arises in various sectors such as utilities, telecommunications, and healthcare services. Businesses and individuals alike require precise documentation to ensure transparency in financial transactions. A detailed bill typically includes key elements like invoice numbers, service dates, itemized charges, and total amounts due, reflecting services rendered or products purchased. Accuracy in these details is crucial for both dispute resolution and financial auditing. Additionally, the billing cycle varies by service provider, with monthly or quarterly statements commonly issued, emphasizing the importance of timely communication from clients requesting clarifications or detailed breakdowns.

Specific request for an itemized bill

An itemized bill is essential for transparency in financial transactions, especially for services rendered or products purchased at establishments such as restaurants, medical facilities, or retail stores. Such a bill breaks down individual charges into distinct categories, including but not limited to, service fees, product prices, taxes, and discounts applied. Accurate itemization assists in identifying unexpected charges or errors, ensuring accountability for both consumers and businesses. It is particularly useful during audits, expense tracking, or budget management, allowing individuals and companies to understand their spending patterns comprehensively. For instance, a medical bill may include specifics on consultation fees, lab tests, medications, and insurance adjustments, providing clarity on total costs incurred. In educational settings, an itemized tuition statement can detail charges for courses, materials, and fees, highlighting any financial aid or scholarships applied.

Clear identification of transaction or service details

A detailed bill request requires clear identification of transaction specifics, including service date, service provider name, and transaction ID for precise tracking. Service details must encompass the type of service, unit price, and quantity, ensuring the total amount reflects all items. Additional notes may include payment method used, any applicable taxes, and discounts offered, facilitating transparency. Contact information for inquiries should also be appended, ensuring effective communication for any discrepancies or clarifications needed regarding the billing statement.

Contact information for follow-up

Detailed bills play a crucial role in financial transparency. A comprehensive billing statement includes essential elements such as itemized charges, due dates, billing periods, and payment options. For instance, a utility bill from Pacific Gas and Electric Company (PG&E) outlines electricity usage in kilowatt-hours (kWh), covering the billing cycle from January 1 to January 31, with a payment due date of February 15. Key information such as customer account number and service address must be clearly indicated for accuracy. Contact details, including a dedicated customer service phone number and email address for follow-up inquiries, enhance user experience and facilitate clarification of any discrepancies or questions regarding charges.

Polite closing and expression of urgency or deadline

I appreciate your prompt attention to this matter regarding the detailed bill request. Timely access to this information is crucial for my financial planning, and I kindly request it by the end of this week to ensure all processes remain on track. Thank you for your cooperation.

Comments