Are you feeling overwhelmed by the complexities of technology pension plans? You're not alone! In today's fast-paced world, understanding your options for a secure retirement can be daunting, but it is essential for your financial future. Join us as we break down the key components and benefits of technology pension plans, and discover how to make the most of your retirement planning journey!

Clear Communication of Benefits

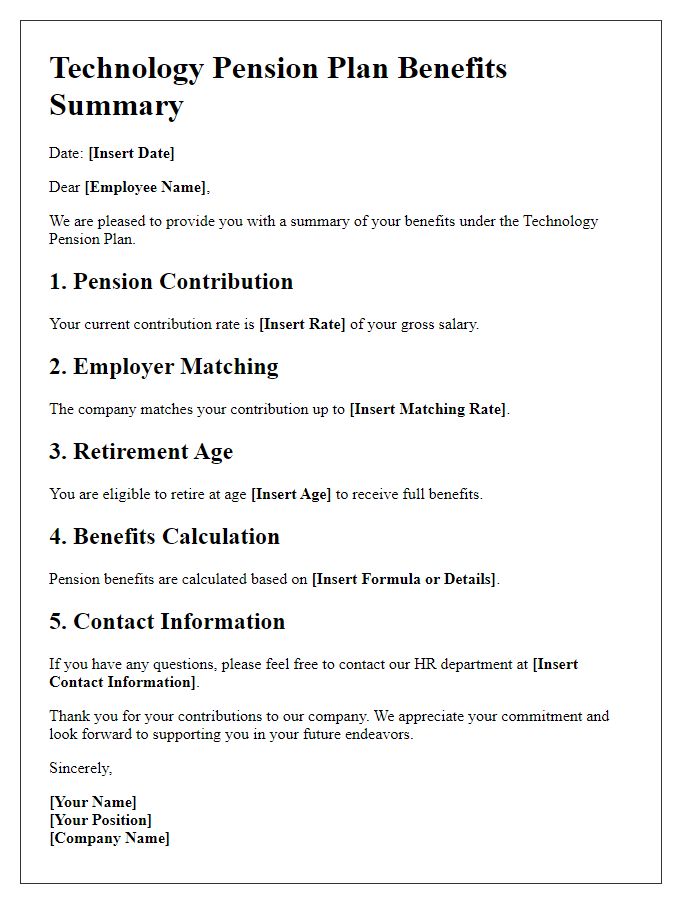

A technology pension plan offers a structured approach for employees to secure their financial future post-retirement. Key benefits include tax-deferred growth of contributions, which allows for compound investment returns over time. For example, in the United States, an employee can contribute up to $22,500 annually in 2023, leading to significant savings by retirement age. Employees can also enjoy employer matching contributions, which can amount to 6% of salary, enhancing total retirement savings. Furthermore, many technology companies, like Google and Microsoft, provide a range of investment options, such as index funds and target-date funds, allowing for tailored risk management according to individual financial goals. Regular statements (quarterly or annually) keep employees informed about their account growth and changes in benefits, fostering transparency and trust. Additionally, access to retirement planning workshops can empower employees to make informed decisions about their future.

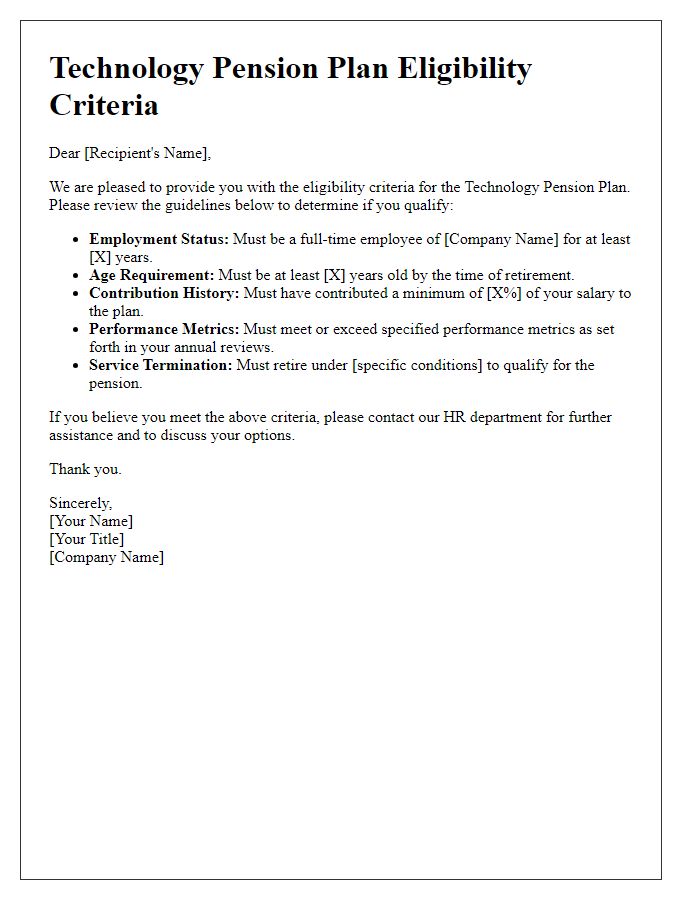

Statement of Eligibility Requirements

The technology pension plan, designed for employees in the tech sector, includes various eligibility requirements crucial for participation. Employees must typically have at least five years of service, with timeframes extending to October 2023. The plan further necessitates a minimum age of 55 years for retirement benefits to be applicable. Additionally, contributions from both employers and employees are essential, often defined as a percentage of salary. Employees typically must work a minimum of 1,000 hours per year to qualify. Communication regarding these details is often distributed via official company portals or human resources offices. Such structured eligibility promotes long-term savings and financial security for participants.

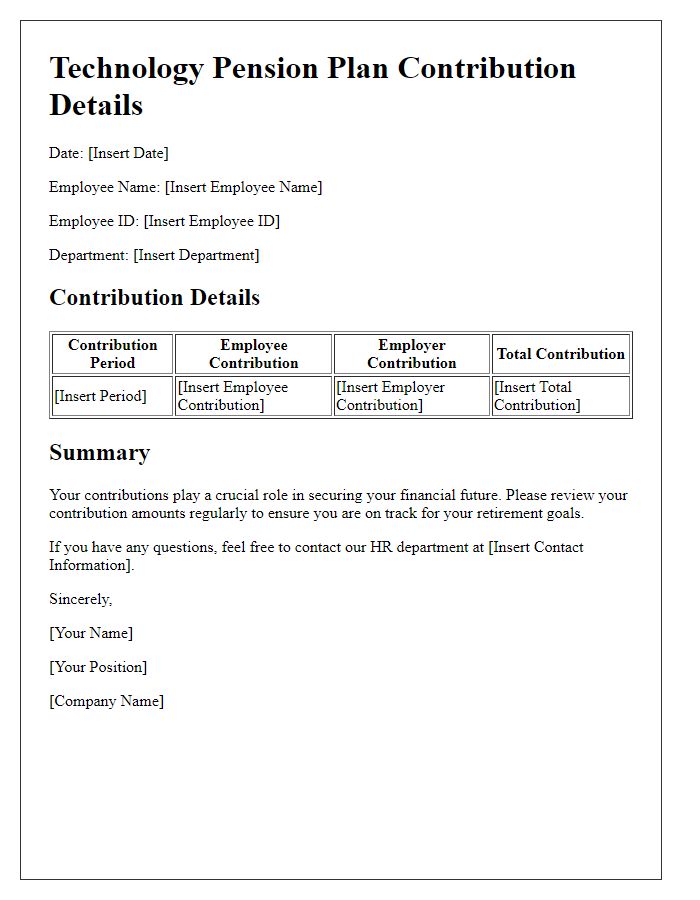

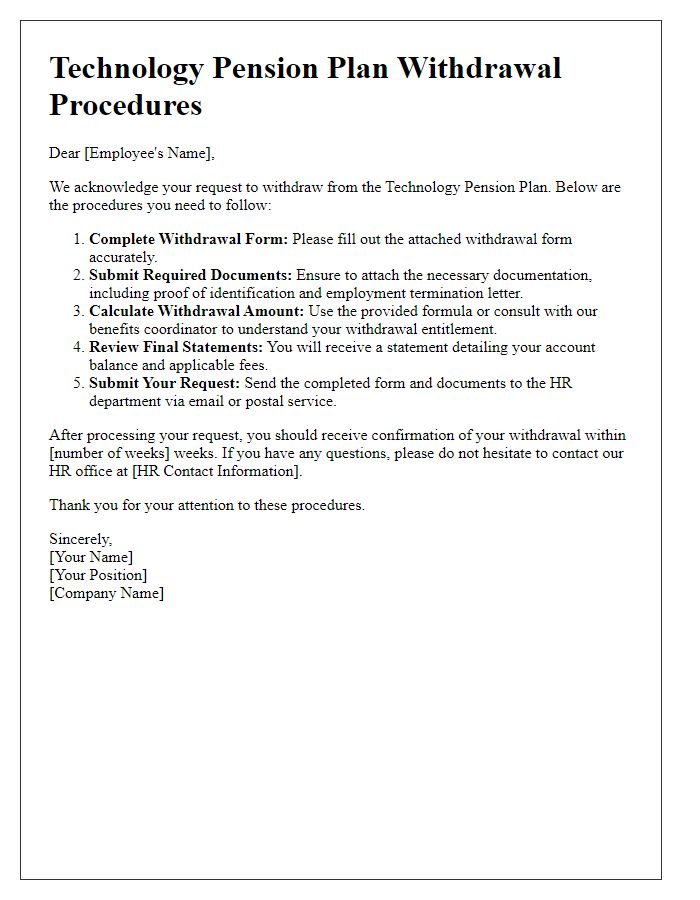

Details on Contribution and Payment Procedures

The technology pension plan involves structured contributions from both employees and employers to ensure financial security in retirement. Employees contribute a percentage of their salary, typically ranging from 3% to 6%, depending on the terms established by the plan, with an average annual salary cap of $150,000. Employers usually match employee contributions, fostering a sense of partnership in retirement savings. Payment procedures require participants to enroll through the company portal, providing necessary documentation such as Social Security numbers and bank account details for direct deposit of benefits. Contributions are automatically deducted from payroll on a bi-weekly basis, ensuring consistency and reliability in saving. Annual statements are provided, detailing growth rates and total accrued benefits, allowing for financial planning and transparency.

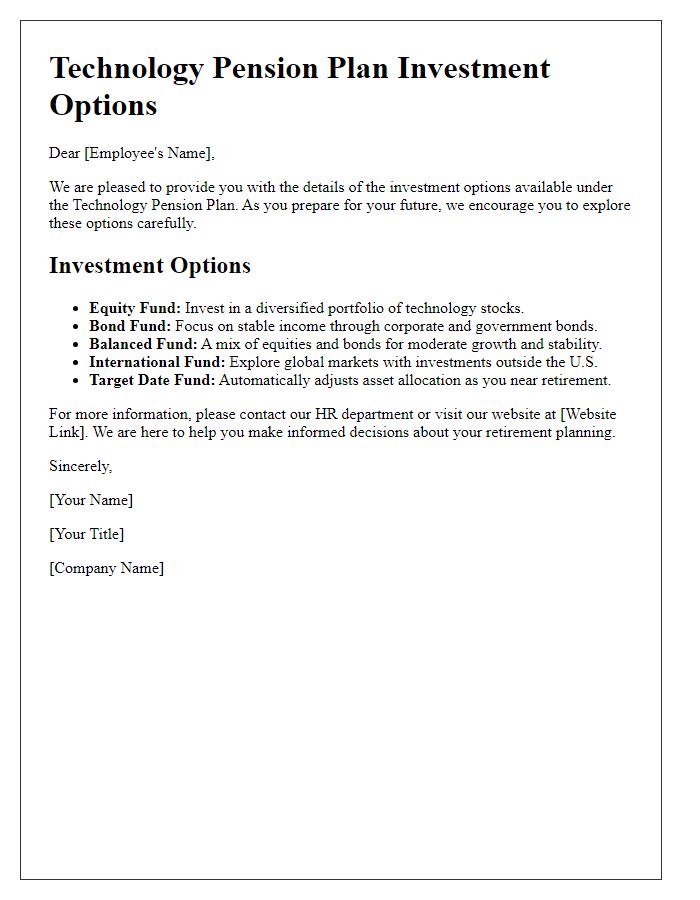

Explanation of Investment Options and Risks

Technology pension plans often include diverse investment options aimed at ensuring financial security for retirees. Common investment categories include stocks, bonds, mutual funds, and exchange-traded funds (ETFs), each with distinct risk profiles. Stocks offer potential for high returns with significant volatility, while bonds provide more stable but lower yields. Mutual funds allow broader market exposure but come with management fees, and ETFs offer flexibility with lower expense ratios. Understanding risk is crucial; market fluctuations can affect stock values, while interest rate changes can impact bond performance. Moreover, sector-specific investments, like technology funds, may expose retirees to heightened risk due to rapid industry changes. Savvy investors should evaluate their risk tolerance, investment horizon, and diversification strategies to achieve desired retirement outcomes in the dynamic tech landscape.

Contact Information for Assistance and Queries

The Technology Pension Plan provides essential information for participants, including comprehensive details on retirement benefits and eligibility criteria. Members can access their accounts online or reach out for assistance regarding specific queries. Contact points include the customer support hotline, available during business hours, and the dedicated email address for pension-related inquiries. Registering for webinars and informational sessions can deepen understanding of the plan's features and investment options. Additionally, annual statements offer updates on fund performance and personal contributions, ensuring participants remain informed about their future financial security.

Comments