As we wrap up another quarter, it's time to take a closer look at our financial performance and key insights that shape our path forward. In this report, we'll delve into the highlights and challenges we faced, providing a transparent view of our financial health. Understanding these elements is crucial, not just for our internal stakeholders but for everyone who is invested in our journey. So, grab a cup of coffee and join me as we explore the details of our quarterly financial report!

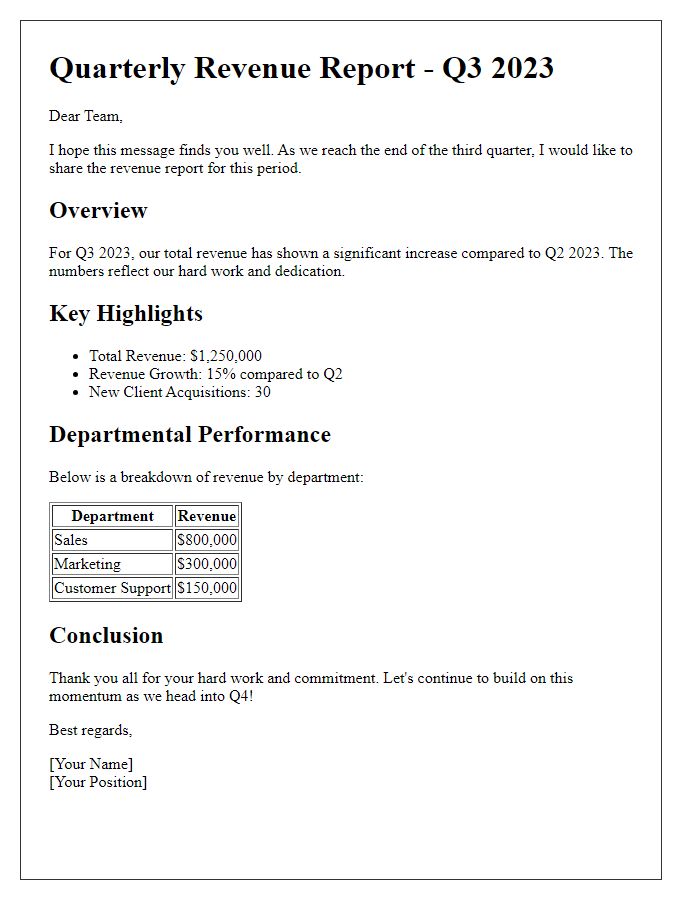

Clear Subject Line

Quarterly financial reports provide crucial insights into a company's performance, highlighting key metrics such as revenue, expenses, and profit margins. These reports typically document financial data over a three-month period, allowing stakeholders to analyze trends and make informed decisions. For example, Q2 of 2023 may reveal a 15% increase in revenue compared to Q1, while operating expenses grew by 10%, thus resulting in a net profit margin of 20%. Additionally, these reports often include comparative figures from the previous year, providing context for growth or decline. Distributing these reports timely and clearly is vital for transparency and stakeholder engagement.

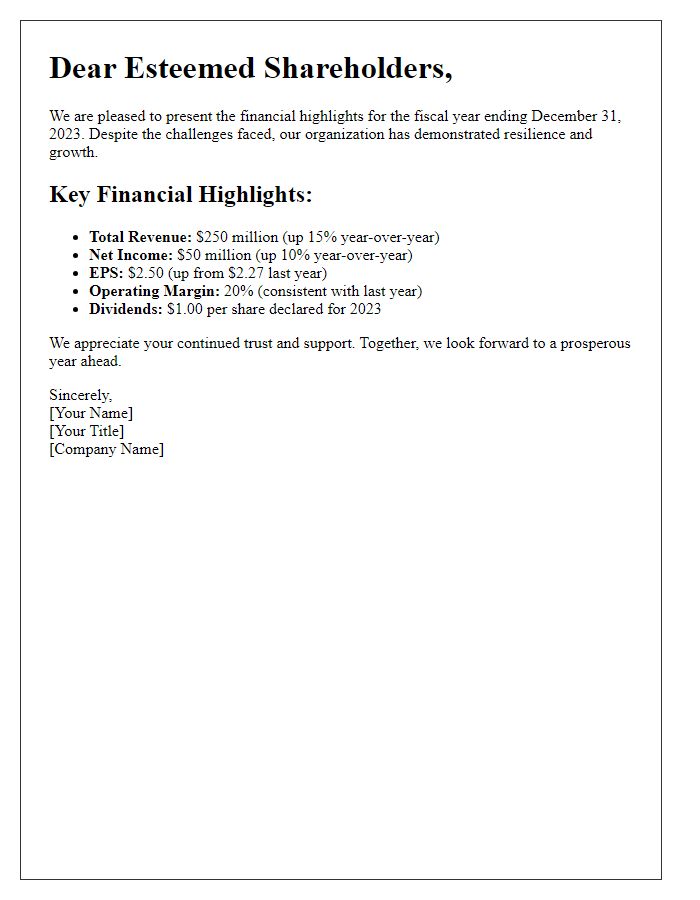

Executive Summary

The quarterly financial report for Q3 2023 provides a comprehensive overview of the company's financial health, including key performance indicators such as total revenue ($2.5 million), net profit margins (15%), and operational expenditures ($1.2 million). This period witnessed significant growth in sales, particularly in the software sector, which increased by 30% compared to Q2 2023, driven by the successful launch of Product X. Furthermore, the company expanded its market reach into Europe, with a 20% increase in international sales. The balance sheet reflects steady asset growth, with total assets valued at $10 million and a current ratio of 2.5, indicating strong liquidity. Key initiatives implemented this quarter include cost-reduction strategies that have resulted in a 10% decrease in overhead costs and investments in technology advancements aimed at enhancing operational efficiency. Overall, the Q3 metrics reveal a robust financial performance, positioning the company favorably for continued growth in the upcoming quarters.

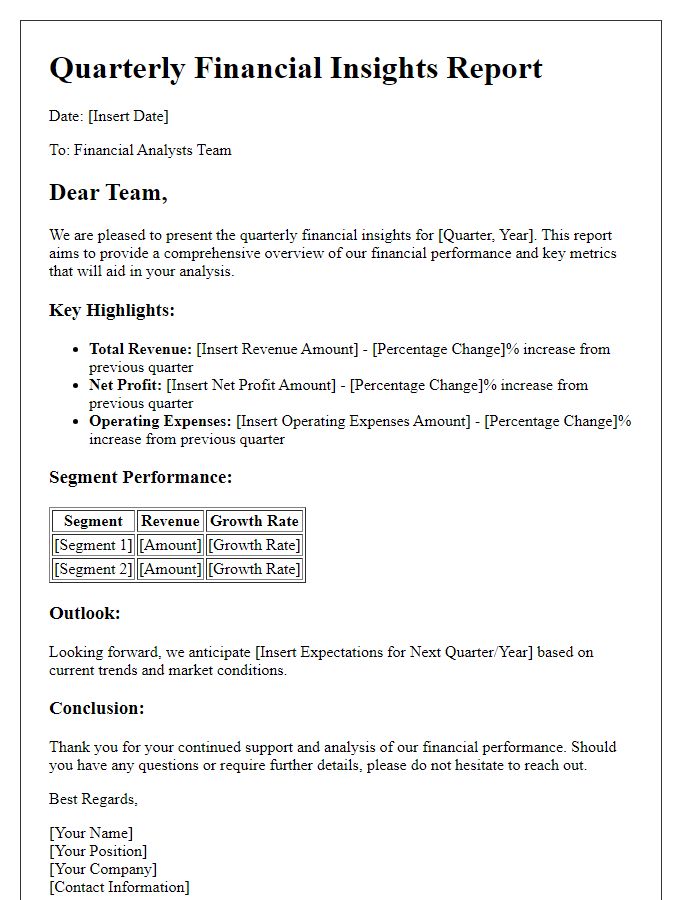

Key Financial Highlights

The quarterly financial report showcases the financial performance of the company over the past three months, highlighting key metrics such as revenue, profit margin, and year-over-year growth. For the third quarter of 2023, total revenue reached $2.5 million, an increase of 15% compared to the same period last year. The net profit margin expanded to 12%, reflecting improved cost management strategies implemented across various departments. Key drivers of this growth include an upswing in product sales in the technology sector, particularly in emerging markets like Southeast Asia, where demand surged by 20%. Additionally, operating expenses decreased by 8%, demonstrating operational efficiency and enhanced profitability. These financial highlights set a positive tone for upcoming strategic initiatives aimed at further expanding market share and enhancing shareholder value.

Detailed Financial Analysis

The quarterly financial report reveals key insights into the performance of the XYZ Corporation for Q3 2023. Total revenue reached $5.4 million, indicating a 12% increase compared to Q2 2023 figures, driven predominantly by a 15% rise in product sales, particularly in the tech division. Operating expenses rose to $3.2 million, influenced by increased investments in marketing and R&D initiatives aimed at enhancing product innovation. The gross profit margin improved to 40%, reflecting effective cost management strategies. Cash reserves, now at $1.5 million, underscore a solid liquidity position. In addition, the net profit climbed to $1 million, representing an increase of 20% year-over-year, contributing to greater shareholder value.

Future Outlook and Strategies

The future outlook for the quarterly financial report indicates promising growth potential for the upcoming fiscal period. Strong market demand forecasts for sectors such as technology and renewable energy are driving investment strategies. Key performance indicators (KPIs) show a projected revenue increase of 15% by Q4 2024. Strategic initiatives include expansion into emerging markets like Southeast Asia, focusing on countries such as Vietnam and Indonesia, which have shown robust GDP growth rates averaging 6.5% annually. Additionally, a commitment to sustainable practices will enhance corporate responsibility, attracting environmentally conscious investors. Overall, the combination of market expansion, innovative product development, and a clear sustainability focus positions the organization for long-term success.

Comments