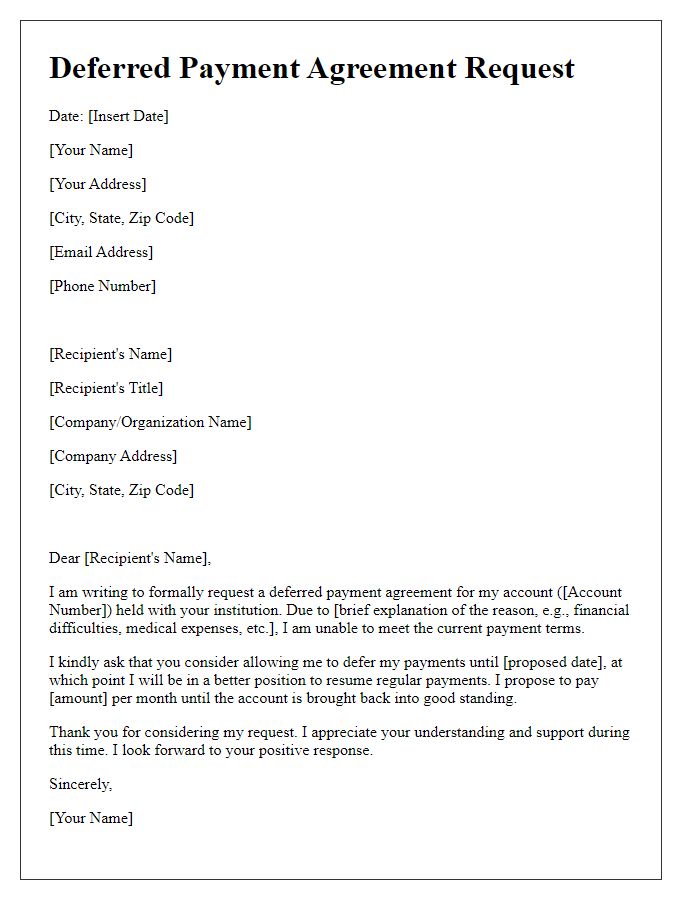

If you find yourself in a situation where meeting your financial obligations feels a bit overwhelming, a deferred payment agreement could be the perfect solution for you. This arrangement allows you to ease into your payments over time while still maintaining good relations with your creditors. It's a practical way to regain control of your finances and ensure that you're not burdened with immediate payments. Curious about how to draft one? Keep reading for a helpful template and tips!

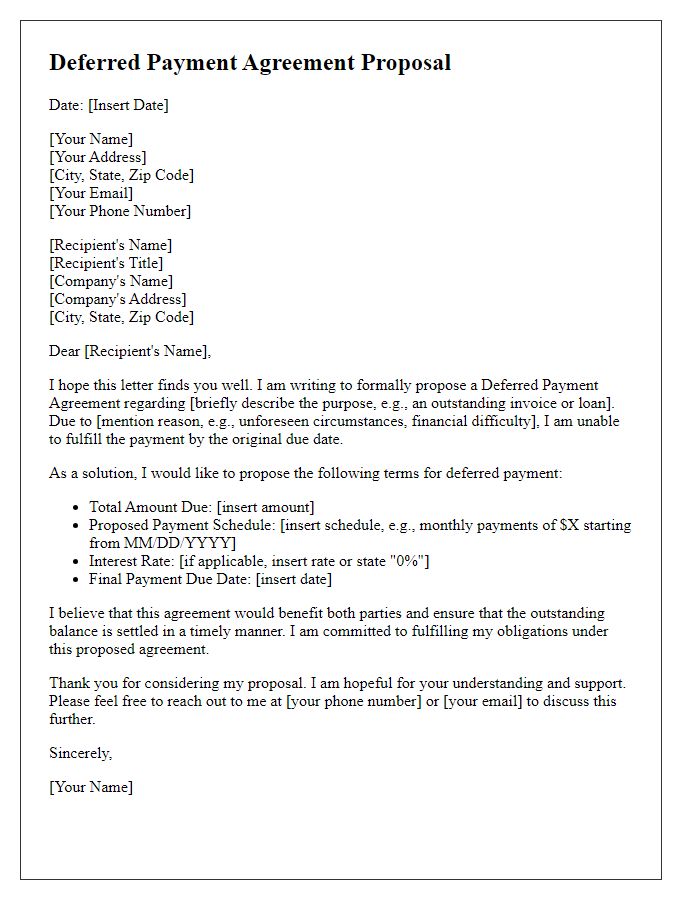

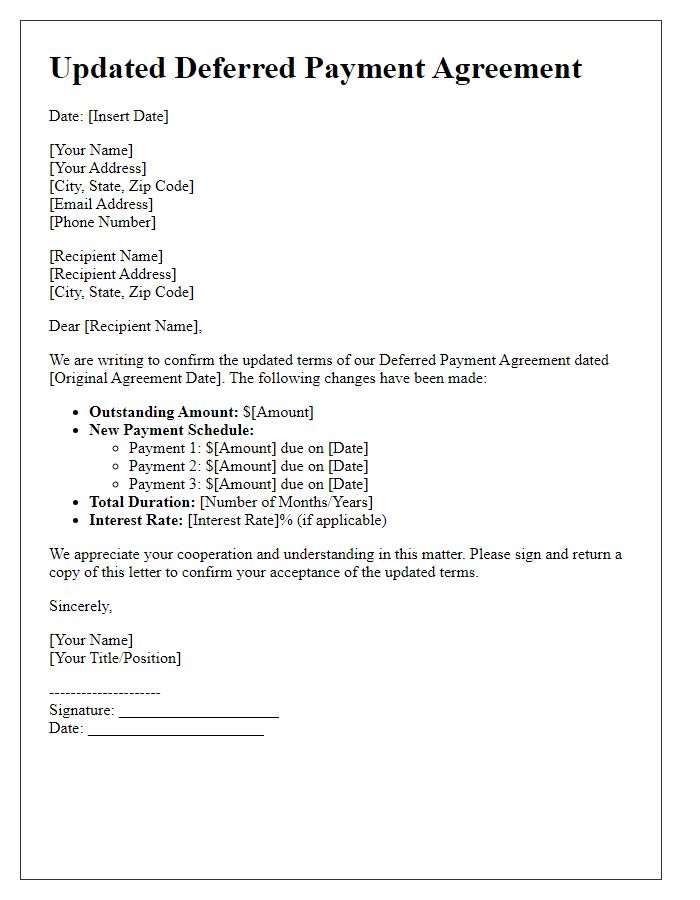

Clear payment terms

A deferred payment agreement establishes clear payment terms for the settled amount owed. The total balance, such as $5,000, must be outlined with specific deadlines to facilitate easier budgeting. For example, the customer may agree to pay $1,000 every month for five consecutive months. Each payment must be clearly detailed to include due dates, such as the 1st of each month, along with acceptable payment methods like bank transfers, checks, or credit card payments. Additionally, any late fees, such as a 5% charge after a five-day grace period, should be explicitly stated to encourage timely payments. By providing transparent and structured terms, both parties can maintain financial clarity and avoid potential disputes.

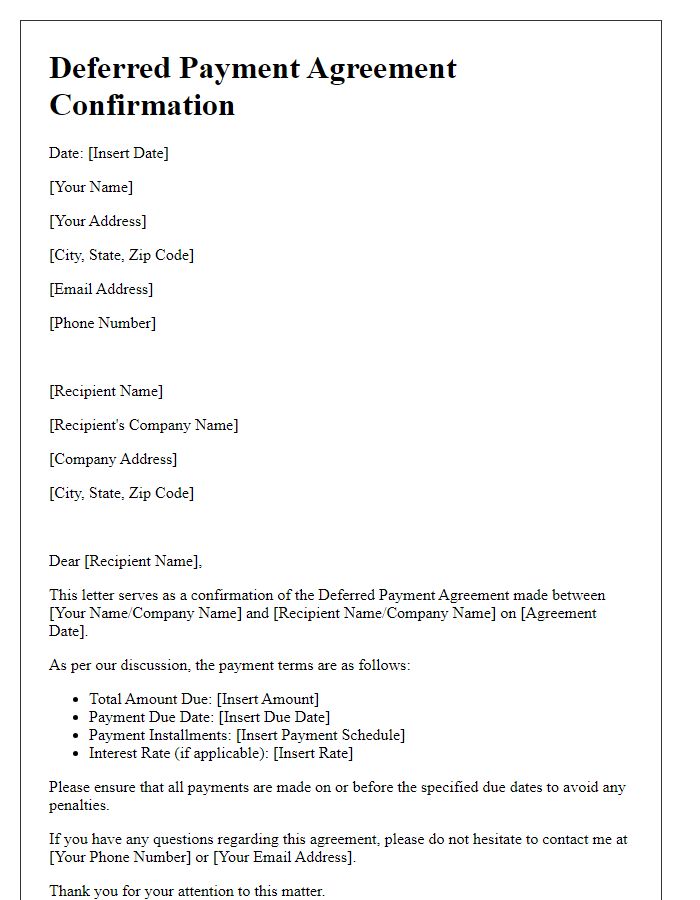

Interest and fees

Deferred payment agreements often include specific terms regarding interest and fees. Interest rates, typically ranging from 5% to 20%, depend on factors such as credit score and loan type. Additional fees might include late payment penalties, which can amount to 1% of the outstanding balance per month. For instance, a $1,000 agreement could incur a $10 late fee if payment is missed. Clear communication in the agreement regarding these charges is crucial for both parties' understanding and avoiding disputes. Always ensure terms are compliant with relevant financial regulations and local laws to protect consumer rights and uphold lending standards.

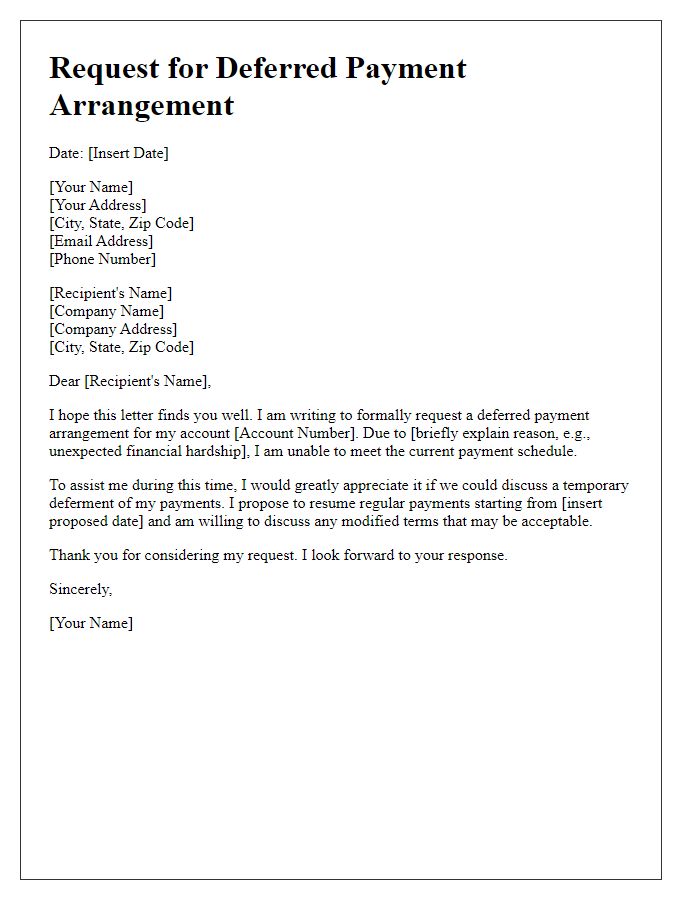

Payment schedule

A deferred payment agreement allows individuals or businesses to arrange a specific timeline for making payments. This type of agreement often details a payment schedule that outlines the amounts due, due dates, and any interest rates applicable (typically ranging from 0% to 15%). Commonly used for larger transactions such as vehicle purchases or medical procedures, the schedule may span several months or years, often requiring an initial down payment (usually between 10% to 30% of the total amount). The payments can occur monthly, quarterly, or at other agreed intervals, providing flexibility for the payer while ensuring the seller receives timely compensation. Clear communication about penalties for late payments or insufficient funds ensures both parties understand the obligations under the agreement, fostering a sense of security and trust.

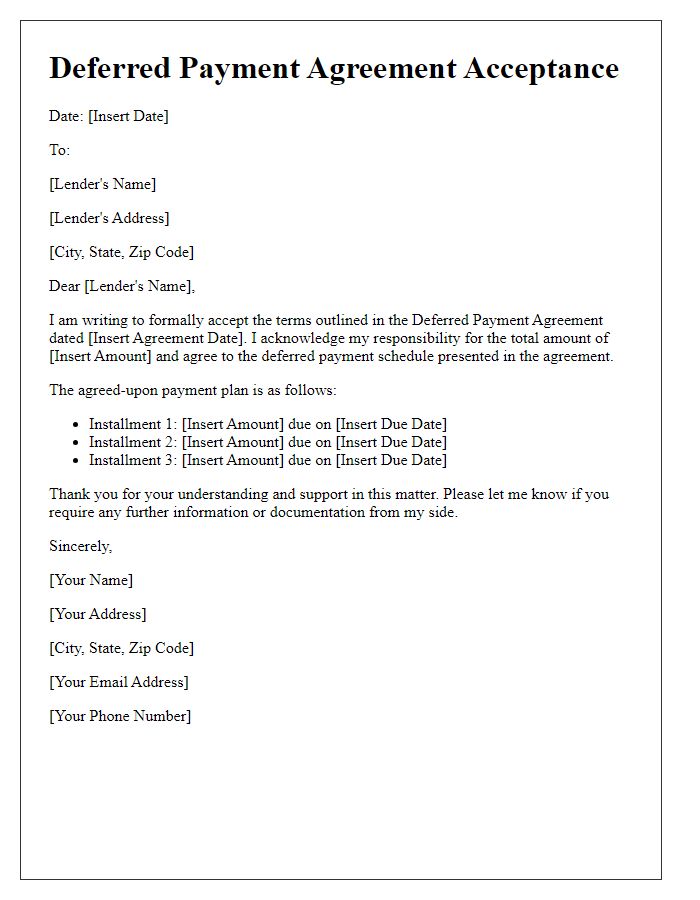

Signatures and dates

A deferred payment agreement allows a borrower to postpone their payment obligations for a specified period while formalizing the terms under which these payments will be made later. This document typically includes key elements such as identification of parties (borrower and lender), outstanding balance (the total amount owed), repayment terms (duration and payment schedule), interest rate (if applicable), and conditions for default (failure to meet the agreement terms). Signatures of both parties along with dates provide a legal acknowledgment of the terms agreed upon, essential in case of future disputes. Including notarization can enhance the document's authenticity and enforceability.

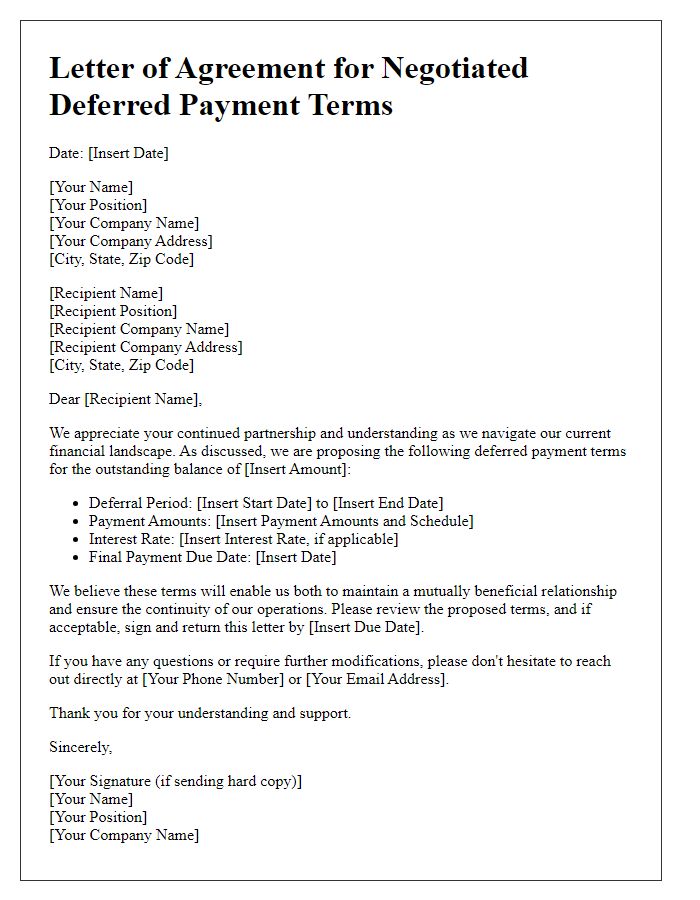

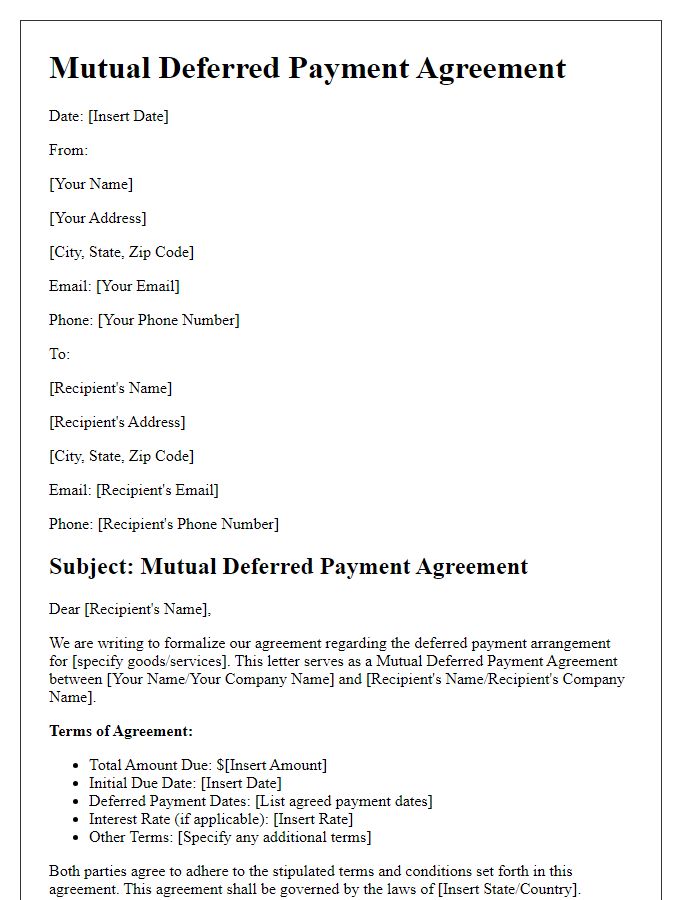

Contact information

A deferred payment agreement outlines the terms and conditions under which a debtor can postpone their payments to a creditor. This document typically includes the full legal names of the parties involved, such as the debtor and the creditor, and their complete contact information, which may include physical addresses, phone numbers, and email addresses. Additionally, important identifiers like account numbers or reference numbers should be included to ensure clarity. Dates for payment deferrals, total amounts due, and specific payment schedules are also crucial for outlining the agreed terms. This important financial document often necessitates signatures from both parties to establish legal binding obligations.

Comments